Task Force 4: Refuelling Growth: Clean Energy and Green Transitions

In 2022, G20 leaders acknowledged the need to rapidly transform and diversify energy systems while implementing the Paris Agreement on climate change.[1] The expansion of renewable electricity generation can help address these goals but will require substantial investment. In around half of the G20’s emerging economies, state-owned electricity utilities are hampered from making such investments by crippling debt brought on by below-cost retail pricing. This policy brief provides case studies on the impact of electricity subsidies in India and South Africa, and the reforms needed to improve energy access, financial viability, and long-term sustainability. The G20 can support financially viable utilities in emerging economies and their transition to clean energy by (1) sharing best practices on reform, (2) agreeing on timelines for decarbonisation, (3) transferring technology, (4) facilitating investment, and (5) agreeing on standards for transparency.

1. The Challenge

The electricity sector is critical to energy sector decarbonisation. The electricity sector is the single largest source of CO2 emissions globally, and one of the most promising for decarbonisation, given the potential to rapidly scale up low-carbon and cost-competitive solar and wind generation.[2] Expanding renewable generation will diversify the energy supply, thereby improving energy security. Furthermore, the electrification of transport, households, and industry can help reduce emissions in those sectors.[3]3

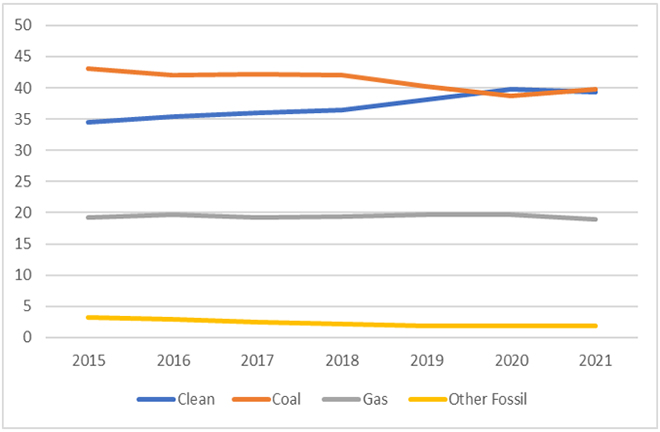

Most G20 members remain heavily dependent on fossil fuels for their electricity generation. In 2021, coal and gas accounted for nearly 60 percent of average electricity generation in the G20 countries[4] (see Figure 1).

Figure 1: Electricity generation in G20 countries by source

Source: Ember

The International Energy Agency (IEA) estimates that the fossil fuel share in the electricity mix must reduce to 26 percent by 2030 and zero by 2040 to achieve net zero emissions by 2050 (based on the IEA’s scenario to consistent with limiting the average global temperature rise to 1.5°C).[5] Nineteen of the G20 members have net zero targets, and several high energy-consuming countries have made commitments to increase renewable electricity generation; India committed to 50 percent non-fossil electricity generation capacity by 2030, the European Union (EU) plans to increase the renewable energy target to 45 percent by 2030, and China has a 33 percent renewable energy generation target by 2025.[6]

Transforming the Electricity System Will Require Major Investments

Decarbonising the electricity system will require major investments in renewable generation capacity, strengthening and expanding the grid to connect distributed renewables, and adding balancing and storage infrastructure. Power sector investments increased in emerging market and developing economies (EMDEs), excluding China, by 7 percent in 2022 with total global clean energy investment expected to reach US$1.7 trillion in 2023.[7] Most clean energy investments were concentrated in China (US$184 billion), the EU (US$154 billion), and the US (US$97 billion).[8] Clean energy investment will need to increase even more if global temperature increases are to be limited to 1.5°C. Globally, the annual investment gap for wind and solar alone will stand at US$450 billion by 2030.[9] The largest gap is for EMDCs other than China, where electricity sector investment would need to increase from the current 3 percent average annual growth rate to then 25 percent for the rest of this decade to be consistent with a net-zero by 2050 pathway.[10]

Below-Cost Pricing Has Led to Mounting Utility Debt

A major hindrance to the transformation of the electricity sector in around half of the G20 EMDEs is—somewhat ironically—electricity subsidies. Government decisions to set electricity prices below the cost of supply have led to large debts for state-owned electricity providers in Argentina, China, India, Indonesia, South Korea, and South Africa. Government bailouts are needed to keep the electricity companies afloat, but transfers are often late and insufficient to cover all the costs. The resulting shortfall has reduced the capacity of some electricity SOEs to operate efficiently and invest in service delivery and the transition to clean energy.[a] Without reforms that improve utilities’ operational efficiency, the problem will only be exacerbated as electricity consumption expands with development.[11]

Consumer electricity subsidies more than doubled from US$185 billion in 2019 to US$399 billion in 2022, most of which were in EMDEs.[12] Untargeted electricity subsidies are a highly inefficient means to improve energy access for poor households. Most of the benefits are captured by the wealthiest, who consume the most energy.[13] In many countries where most households have access to electricity, subsidies frequently confer greater advantages to more affluent groups who use more electricity. In the state of Jharkhand in India, the top 40 percent of households (the wealthiest two quintiles) obtained 60 percent of the benefits from electricity subsidies, whereas the bottom 40 percent of households (the lowest two quintiles) only received 25 percent of the subsidies.[14] Subsidy reform needs to be carefully designed to prevent impacts on the poorest households, including through better targeting.

Case Studies

The India and South Africa case studies presented below illustrate the challenges of electricity utilities in EMDEs with high debt, and identify opportunities for reform. For each country, the case study describes: the finances of the electricity sector and the electricity utilities; the main drivers of debt and the main challenges preventing reform; and how this prevents the utility from investing in clean energy. Lessons are provided for both case studies at the end of the section.

South Africa

In South Africa, a major obstacle to achieving the country’s ambitious decarbonisation goals is the precarious financial position of the majority of state power generation, transmission, and distribution entities. The national electricity utility, Eskom, until recently had a monopoly on the generation and the sale of bulk electricity, owns the country’s transmission grid, and is responsible for around half of the distribution of electricity.[15] Eskom is heavily indebted[b] and has been reliant on government transfers to keep it financially viable.[c] A lack of funds has been the main reason for underinvestment in expanding the national transmission grid. Constrained transmission grid space is now the single biggest obstacle to integrating new renewable utility scale power.[16]

Local municipalities (167 in total) share electricity distribution with Eskom. They purchase power from Eskom (at a tariff determined by the national regulator) and then on-sell to their customers. The South African local government fiscal framework assumes that municipalities (which have a large development mandate, including the delivery of all basic services and local economic development) can raise most of their revenue requirements by the sale of services, and electricity sales are assumed to make the single biggest contribution to that revenue. However, municipalities are unable to charge tariffs sufficiently high to meet their requirements, leading to local government debt as well as underinvestment in electricity infrastructure.

More than 80 percent of municipalities are in financial distress. Financial constraints are the main reason for the generally poor state of local government electricity distribution,[17] which prevents grid upgrading and renewal that is necessary for the integration of renewables.

There are several reasons for the poor financial state of almost all the state entities in the electricity sector:

- Inability to implement tariffs that reflect an accurate cost of supply: Eskom’s requests for tariff increases are routinely refused by the national regulator and lower increases are implemented.

- High poverty and income inequality prevent cost recovery of tariffs: Municipalities struggle to implement cost-recovery tariffs and to collect revenue,[d] which further undermines the financial status of municipalities. The reason for both situations is the same. In the high-poverty context of South Africa,[e] full-cost recovery tariffs are simply unaffordable for a significant percentage of the population. This not only makes them politically unpalatable, but difficult to collect.[f]

- The inability to charge (particularly when those costs include the considerable leakages associated with corruption and poor financial management).

- Corruption: Corruption and the theft of public resources have negatively impacted Eskom, in particular.

- Poor financial management and planning: This is a key factor in local municipalities and has contributed to significant underfunding of distribution grid maintenance over an extended period. South Africa’s Just Energy Transition and Investment Plan and the Presidential Climate Commission’s recommendations on the electricity sector contain several proposals to improve electricity distribution and affordability for poor households. Proposed actions include infrastructure upgrading, an increase in the free basic electricity allowance to poor households. However, to date there has been no concrete action or detailed proposals on how to implement these proposals.

India

India’s power sector has been experiencing a financial crisis for several years, primarily due to the underpricing of electricity and consequential problems with the management of the state-owned distribution companies (discoms). Electricity tariffs are politically sensitive, and governments therefore put pressure on discoms to keep tariffs constant despite rising costs. Governments also announce consumption subsidies for politically important groups of consumers to win political support. About 75 percent of the subsidy is targeted at agricultural consumers,[18] and low-income households are the other main target group.

Governments provide budgetary transfers to assist with the revenue shortfall. Electricity subsidies are the largest single energy subsidy in India, at US$20.3 billion in 2022.[19] But the transfers are often delayed, do not cover the full shortfall, or might not be paid at all.[20],[21] In addition to impacts on government revenue and discom viability, this model has deep structural flaws that have resulted in several adverse consequences.

Firstly, the monopoly status and the political importance of electricity insulate discoms from any accountability leading to poor operational efficiency. Their transmission and distribution losses are high, and billing and collection efficiency is poor. Most discoms accumulate huge losses annually, and their debts balloon to the point of bankruptcy, requiring periodic government bailouts. There have been four major rounds of discom bailout packages nationally (2003, 2012, 2015, and 2020), but the situation continues to deteriorate. In 2022, the total debts of these discoms stood at an estimated US$80.5 billion.[22]

Secondly, the subsidies are not an efficient means of assisting the poor. Similar to South Africa, India has high electricity access rates (99 percent)[23] coupled with high income inequality[g],[24] that necessitates electricity subsidies to support energy access needs. But the subsidy schemes disproportionately benefit well-off households: the top 20 percent wealthiest households harness between 28-36 percent electricity subsidies, while the bottom 20 percent households receive only between 6-14 percent.[25],[26] Subsidies for agricultural consumers also disproportionately benefit medium and large-scale farmers.

Finally, poor DISCOM finances impede power sector decarbonisation in multiple ways. Discoms:

- do not pay renewable generators on time, affecting investor sentiments. The situation has improved since the union government applied penalties. But the sustainability of the system without serious reforms is in doubt.

- need to undertake significant grid investments for higher renewable energy integration and most of are financially unable to do so.

- resist increasing rooftop solar as they will lose high-paying consumers (both households and industry) that are needed to cross-subsidise low-paying consumers. Only 7.40 GW of rooftop solar projects were installed by 2022, against the 40 GW target set in 2015.[27]

Lessons from Case Studies

Unlocking the potential for emerging economy electricity utilities to accelerate decarbonisation requires several concrete reforms.

- Ensure regular tariff revision to reflect the costs: Governments should empower electricity regulatory commissions to undertake regular tariff revision without political interference.

- Delink social transfers to support energy access from under-priced tariffs: Consumption subsidy support should not be implemented through reducing tariffs. Instead, governments should explore efficient targeting methods and direct transfer mechanisms. South Africa and India have explored pre-paid electricity metering with mixed results[28],[29] for improving utilities finances. But more research is needed to understand the welfare impacts of prepaid electricity metering and if it imposes any hidden costs on the poorest and if it improves revenue collection for utilities.

- Temporary reprieves should be linked to adherence for structural reforms: Periodic bailouts without any commitment to reforms will not work. The national government should insist on strict adherence to structural reforms and performance improvement, including corruption prevention.

- Include higher renewable energy integration as a core reform agenda: Integrating renewable energy requires long-term planning and significant investments in upgrading the grid. States should consider keeping it as a core agenda in distribution reforms.

2. The G20’s Role

The G20 has made numerous statements that give it a mandate to support the development of financially viable electricity utilities to ensure a transition to clean energy in EMDEs, including commitments to:

- “Rapidly transform and diversify energy systems”.[30]

- affordable and modern energy services to the most vulnerable.

- strengthening “the full and effective implementation” of the Paris Agreement on climate change.

- Phasing out inefficient fossil fuel subsidies, reiterated every year since 2009.[31]

- identifying opportunities for investment gaps to decarbonise energy systems.

G20 members include over 85 percent of the world’s electricity demand and production. Any commitments from G20 members on decarbonising electricity systems are a powerful signal in shaping dialogue and shepherding progress. A critical prerequisite for modern energy to be accessible and affordable is the financial viability of electricity utilities. Chronic poor performance of electricity utilities from under-priced electricity, particularly in EMDEs, is the main driver of investment shortfalls, blackouts, and poor supply quality. To accelerate the energy transition, G20 needs to support all aspects of the transition, including electricity sector reform in key EMDEs of the G20.

3. Recommendations to the G20

There are at least four ways the G20 can support financially sustainable electricity utilities in EMDEs and their transition to clean energy.

- Share best practices for electricity sector reform, including:

- The gradual transition to cost-reflective tariffs.

- Policies that assist poor consumers without undermining electricity markets: in the short term, policy designs for tariffs that target subsidies to poor households and prevent well-off high electricity consumption households from benefitting; targeted end-use subsidies for the poorest drawing lessons from other energy access subsidies in India and South Africa rather than capped tariffs; and welfare systems that decouple social support from subsidised energy.

- Political economy strategies for removing universal subsidies (notably how to reduce opposition from middle- and upper-income consumers).

- Agree on timelines that “reflect equity and the principle of common but differentiated responsibilities and respective capabilities in light of different national circumstances”31 for decarbonisation of the electricity sector within a time period.

- Provide technology transfer to assist transforming the electricity grid and market to accommodate higher penetration of renewables.

- Agree standards on data disclosure and transparency:

- Accurate and detailed cost-of-supply data is essential to any sustainable financial framework. Significant leakages such as corruption and poor financial management need to be identified and removed to develop fair cost-recovery tariffs.

Attribution: Shruti Sharma, “Unlocking the Energy Transition with Financially Sustainable Electricity Utilities in Key G20 Countries,” T20 Policy Brief, July 2023.

Endnotes

[a] China is a notable exception. In 2022, more than half of state-owned coal power companies were in debt due to regulated energy prices and rising coal costs. However, subsidies for solar and wind led to a substantial investment, making China a world leader in renewable capacity. The subsidies were oversubscribed, and the government still owes around USD$60 billion to renewable energy providers. For more, see: China Dialogue, 2022, “China to Set up Special Purpose Firms to Tackle Unpaid Renewables Subsidies.” August 18, 2022, https://chinadialogue.net/en/digest/china-special-purpose-firms-to-tackle-unpaid-renewables-subsidies/

[b] R422 billion (approximately US$24 billion) as of December 2022.

[c] R136 billion (approximately US$ 8.3 billion) until the end of 2022. In the February 2023 national budget, the state announced that it would provide debt relief to Eskom of R254 billion (approximately US$ 15.3 billion), including converting a portion to sovereign debt.

[d] For FY 2022, total outstanding debt to all the local government for property rates and taxes and services (water, electricity, sanitation, waste removal) totalled some R210 billion (approximately US$ 12.8 billion), more than 50 percent of the entire debt.

[e] Around 55 percent of households live below the upper-bound poverty line, and 25 percent of households live below the food poverty line.

[f] Adopting an approach of cutting supply to non-payers will effectively remove access to electricity from a large part of the population.

[g] In 2021, bottom 50 percent of the population was estimated to have 3 percent of the total wealth, while the top 1 percent owned 40 percent wealth.

[1] “G20 Bali Leaders’ Declaration,” White House, last modified November 16, 2022.

[2] IEA, Electricity Market Report 2023 (Paris: IEA, 2023).

[3] IEA, Electricity Market Report 2023.

[4] “Electricity Data Explorer,” Ember, accessed 2023.

[5] IEA, Electricity Sector (Paris: IEA, 2022).

[6] IEA, Electricity Sector.

[7]IEA, World Energy Investment 2023 (Paris: IEA, 2023).

[8] IEA, World Energy Investment 2023.

[9] Olivier Bois von Kursk et al., Navigating Energy Transitions: Mapping the Road to 1.5°C (International Institute for Sustainable Development, 2022).

[10] IEA, World Energy Investment 2022 (Paris: IEA 2022).

[11] Prateek Aggarwal, Siddharth Goel et al., Mapping India’s Energy Policy 2022 (IISD & CEEW, 2022).

[12] IEA, Fossil Fuels Consumption Subsidies 2022 (Paris: IEA, February 2023).

[13] D. Coady, V. Flamini, and L. Sears, “The Unequal Benefits of Fuel Subsidies Revisited: Evidence for Developing Countries,” IMF Working Paper No. 2015/250 (International Monetary Fund, 2015).

[14] Shruti Sharma, Tom Moerenhout, and Michaël Aklin, How to Target Residential Electricity Subsidies in India (Geneva: International Institute for Sustainable Development, 2020).

[15] Republic of South Africa, South Africa’s Just Energy Transition Investment Plan (JET IP) (The Presidency, 2022).

[16] Republic of South Africa, South Africa’s Just Energy Transition Investment Plan.

[17] SAICE, SAICE 2017 Infrastructure Report Card for South Africa (Midrand: South African Institute of Civil Engineers, 2017).

[18] Prateek Aggarwal et al., Mapping India’s Energy Policy 2022.

[19] Swasti Raizada et al., “Mapping India’s Energy Policy 2022: December 2022 Update,” International Institute for Sustainable Development, December 2022.

[20] Prateek Aggarwal et al., Mapping India’s Energy Policy 2022.

[21] Sabyasachi Majumdar et al., Indian Power Sector- Electricity Distribution: Distribution Sector Reforms Imminent with Rising Discom Debt and Dues to Gencos (ICRA, 2021).

[22] IEA et al., Tracking SDG 7: The Energy Progress Report (Washington D.C.: World Bank, 2022): 7.

[23] Apoorva Mahendru et al., Survival of the Richest: The India Story (New Delhi: Oxfam India, 2023).

[24] Shruti Sharma et al., How to Target Residential Electricity Subsidies in India.

[25] Shruti Sharma et al., How to Target Electricity and LPG Subsidies in India. Step 1. Identifying Policy Options (Winnipeg: International Institute for Sustainable Development, 2019).

[26] PTI, “India Misses RE Capacity Target Due to Low Solar Rooftop, Wind Energy Project Installations: Parliamentary Panel,” The Hindu, March 21, 2023.

[27] Jack Kelsey, Kathryn McDermott, and Anja Sautmann, “Pre-Paid Electricity Metering and Its Effects on the Poor,” International Growth Centre (blog), September 11, 2019.

[28] Ashwini Swain, “Prepaid Power Is Not the Silver Bullet to Solve Problem of Discom Finances,” The Indian Express, March 19, 2020.

[29] White House, “Bali Leaders’ Declaration.”

[30] “Leaders’ Statement, The Pittsburgh Summit, September 24-25 2009,” US Department of the Treasury, last modified 2009.

[31] White House, “Bali Leaders’ Declaration.”