Task Force 5: Purpose and Performance: Reassessing the Global Financial Order

Cycles of monetary easing and tightening in major advanced economies (AEs) intensify their own financial cycles and, in turn, lead to abrupt ebbs and flows in movement of capital to emerging markets (EMs). This abrupt movement makes capital highly volatile and raises borrowing costs. Countercyclical macroprudential measures (MPMs) can smoothen cycles and reduce spillovers. Comparing MPMs implemented in select AEs and EMs shows that source countries mainly responsible for capital flows used MPMs less than the EMs did. Moreover, AE MPMs were more bank-based and targeted domestic credit demand rather than credit supply. As a result, cross-border flows migrated to the non-banking sector. Universalisation of a minimum set of broad-based MPMs that regulate credit-supply could reduce regulatory arbitrage across countries and financial institutions, as well as volatility and systemic risk in AE financial sectors. Greater use of broad-based regulation in EMs has improved their financial stability. G20 is the apt forum to achieve global consensus on working towards universal application of a minimum set of MPMs as in the case of minimum corporate taxation.

The Challenge

Advanced economy (AE) policies affect economic growth, financial stability and borrowing costs of emerging markets (EMs) via changes in global risk sentiments. But since EMs are now large, this creates spillovers to AEs and to global growth.

Volatility of global financial cycles entailed by movements in monetary policy making in AEs (e.g. the US) and exhibited in the behaviour of asset prices and capital flows is well-established.[1],[2],[3] Ultra-accommodative AE policies raise global liquidity and global risk appetite towards high-yielding EM assets.[4],[5] Over-leveraged large-scale capital inflows entail procyclical credit booms. Asset prices rise and domestic financial conditions ease. Busts typically follow booms. In May 2013, when the US Fed announced its intent to taper its asset purchases, asset markets in EMs witnessed risk-averse behaviour, sell-offs and instability. Another example of this were large outflows from EMs in 2022 following the steep rises in AE policy rates. The excess volatility experienced by EMs can be regarded as a negative externality emanating from AE policy actions.

According to many US macroeconomists, while monetary policy is mandated to focus on inflation and employment within countries, cross-country use of and coordination in macroprudential measures (MPMs) can reduce spillovers.[6]

MPMs aim to prevent financial instability and improve overall resilience of the financial system by reducing procyclical leverage and interconnectedness.[7],[8] Examples of such MPMs, which focus on restricting mortgage lending and credit bubbles, include capital adequacy ratios, caps on loan-to-value (LTV), and debt service-to-income (DTI) ratios. The impact of monetary policies on the financial sector can be reduced by coordinating these policies with macroprudential (MaP) regulations in an effective manner. MaP regulation can help curtail volatility of capital flows and exchange rates confronting EMs by strengthening balance sheets, preventing excessive risk-taking and limiting foreign currency exposures.[9],[10] The following few paragraphs show how this volatility raises EM borrowing costs.

1.1 Global volatility and costs of borrowing in EMs

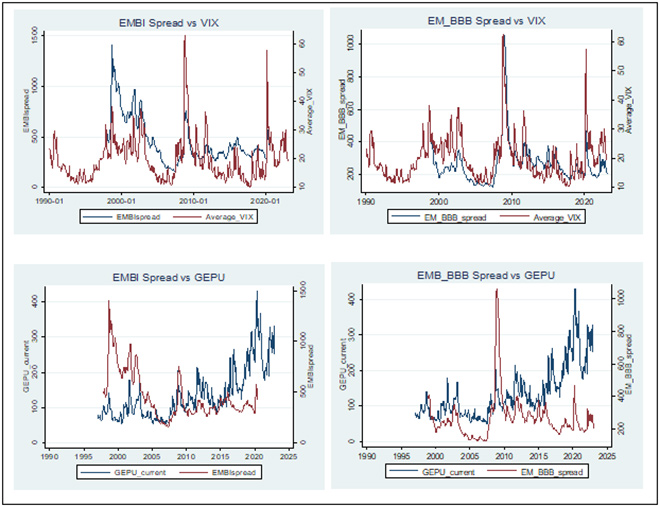

Figure 1 shows how bond spreads or cost of borrowing in a foreign currency, in EMs co-move with global uncertainty indicators. Volatility due to common external factors keeps costs of borrowing by EMs elevated and affects their access to international capital markets. Global shocks heighten risk aversion to investment in EM assets.

Figure 1: Global Uncertainty vs. EM Bond Spreads

Source: Authors’ own estimation using data from World Bank, Federal Reserve Economic Data (FRED) and Economic Policy Uncertainty Index

Note: Global uncertainty (VIX in top panels and GEPU in bottom panels) vs. EM bond spreads (EMBI in left panels and Option-Adjusted Spread (OAS) for the ICE BofA BBB Emerging Markets Corporate Plus Index in right panels)

Features of a global financial cycle in the movement of capital, asset prices, and credit growth, which co-moves with market risk aversion and uncertainty, are well established in the literature.[11],[12],[13] International financial leverage and volatility are mainly driven by monetary policy in source countries mainly responsible for capital flows while EM policies like exchange rate regimes have little role to play. A positive liquidity shock boosts growth, stock prices and currency appreciation, while a risk aversion shock has the opposite effect.[14] Global uncertainty exerts significant influence on cross-border flows to EMs and macroeconomic risks confronting them.[15] High volatility of net portfolio flows to EMs during periods of unconventional monetary policy-making increased their current account surpluses and precautionary reserve accumulation.[16] Thus, AE policy-making accentuated not only global risks but also disparities in balance of payments.

Experts who view that markets are efficient fear that regulation will raise costs and destroy competitive innovation. However, market-based prudential regulation that prevents overreaction and volatility in market behaviour can reduce costs. Since MPMs reduce spillovers with minimal distortions, analysis on their use in AEs and EMs is worthwhile. This analysis is presented in the upcoming section. It highlights inadequacies and asymmetries in use. Policy recommendations that address these, lead on to contributions that can be made by G20 and policy recommendations for the G20 in the sections that follow.

1.2 Understanding patterns underlying implementation of MaP regulations in AEs and EMs

While AEs rely more on credit- and borrower-based policies such as the LTV and DTI, EMs use more liquidity and foreign exchange (FX)-related policies.[17],[18] A measure most frequently deployed by EMs is that of imposing limits on FX positions.[19] MPM-CFM (MPM for capital flow management) can prevent build-up of financial imbalances that occur while facing volatile external capital flows. These include reserve requirements regulating foreign currency deposits, limits on open FX positions, and restrictions on foreign currency lending. MPM-CFM tools can be as effective as capital controls or even more in reducing the banking sector’s foreign-currency exposure and enhancing macroeconomic stability.[20],[21] Nevertheless, first best moderation in source AEs would save many recipient countries from being forced to apply them.

Since MPMs regulating credit supply could moderate over-leverage in source countries, we examine their use in AEs.

Tightening of regulations in the banking sector in the aftermath of the global financial crisis (GFC) led to AE non-bank financial institutions (NBFI) becoming the new source of cross-border flows to EMs.[22] Therefore, it is also useful to examine the implementation of MPMs that oversee NBFIs in AEs.

A new database, IMF’s Integrated MaP Policy (iMaPP),[23] enables an examination of these two issues. The database records the frequency and type of MaP policy instruments[24] used by 134 countries during the period from January 1990 to December 2020. It uses dummy-type indicators (+1 for tightening, -1 for loosening, 0 for no action) for this purpose. Initial exploratory analysis of 10 EMs and seven AEs using this database extends to cross-country comparison that addresses MPMs classified as follows:

- MPM-Domestic and MPM-CFM

- Capital, Credit Demand, Credit Supply, Liquidity, Foreign Exchange

- Bank and broad-based covering NBFIs

Classification details are reported in Tables 1, 2 and 3 and data analysis follows.

Table 1: Classification 1 – Domestic and CFM

| CFM | Includes limits on foreign exchange positions (LFX), limits on foreign currency lending (LFC) and reserve requirements regulating foreign currency deposit (RR-FCD) |

| Domestic | Includes all measures but CFM or FX-targeted measures, i.e., measures with a domestic outlook |

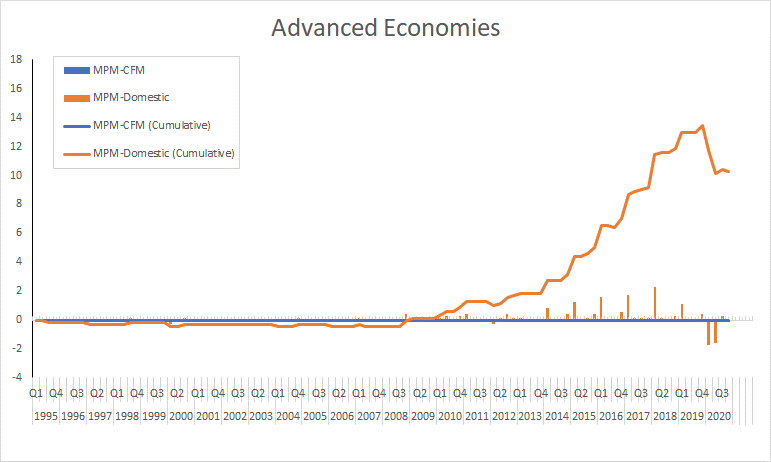

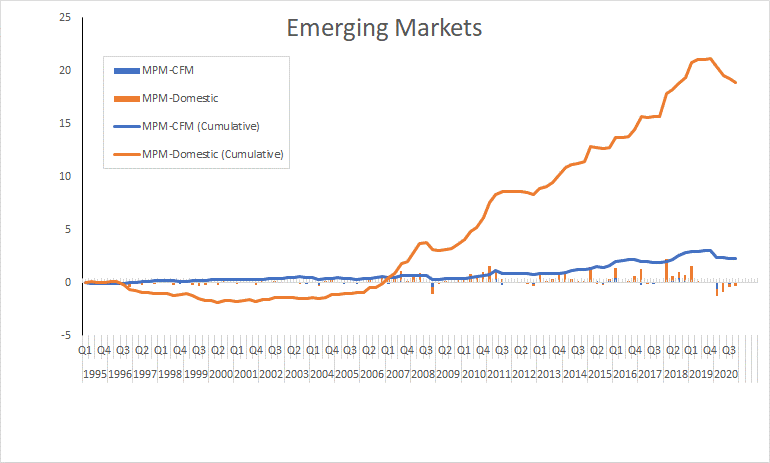

Figures 2 and 3 plot average frequency of macroprudential tightening measures classified into MPM-domestic and MPM-CFM in select EMs and AEs. The figures indicate that EMs applied both types of MPMs more frequently than AEs. The latter seldom used MPM-CFM.

Table 2: Classification 2 – FX, Credit, Capital, and Liquidity

| FX | Includes limits on net or gross open FX positions, FX exposures, foreign currency funding, and currency mismatch regulations. Also includes RR on foreign currency deposits for macroprudential purposes. |

| Credit | Includes credit-related demand and supply side measures as delineated below. |

| i) Demand | Tools that manage credit demand in the economy: a) limits on loan-to-value ratios (LTV) applied to residential, and commercial mortgages as well as other secured loans (such as for automobiles, b) limits on the debt-service-to-income ratio and the loan-to-income ratio, which restrict the size of debt service payments or that of a loan relative to income (e.g., household income, net operating income of the company etc.), and c) taxes and levies applied to specified transactions, assets, or liabilities, which include stamp duties and capital gain taxes. |

| ii) Supply | Tools that manage credit supply in the economy: a) limits on position, margin and exposure regulating the growth or volume of aggregate credit, household-sector credit, or corporate-sector credit b) penalties for high credit growth c) prohibition and limits on loan which may be conditioned on characteristics of both the loan and the lender as well as other factors. |

| Capital | Measures requiring banks to maintain a countercyclical capital buffer (CCB), including that which was established under Basel III, and other capital requirements which stipulate risk weights, systemic risk buffers, and minimum capital requirements, b) a limit on leverage of banks (LVR), calculated by dividing a measure of a bank’s capital by its non-risk-weighted exposures (e.g., Basel III leverage ratio), c) loan loss provisioning (LLP) for MaP, which includes dynamic and sectoral provisioning (e.g. housing loans), and d) measures such as capital and liquidity surcharges to mitigate risks emanating from systemically important financial institutions (SIFIs) that play a significant role in both global and domestic financial systems |

| Liquidity | Measures taken to mitigate systemic risks associated with liquidity and funding:

a) minimum requirements for liquidity coverage ratios (LCRs), liquid asset ratios, net stable funding ratios (NSFRs), core funding ratios and external debt restrictions that do not distinguish between currencies b) limits on the loan-to-deposit (LTD) ratio c) penalties for high LTD d) reserve requirements for foreign and domestic currencies. |

Table 3: Classification 3 – Bank and Broad-based

| Bank | Includes measures imposed specifically on banks, i.e., capital and leverage-based measures on SIFI and others |

| Broad-based | Includes all measures apart from those imposed on banks, i.e., general measures to preserve financial stability |

Figure 2: Average Number and Type of MaP Policies, Select AEs (1995-2020)

Figure 3: Average Number and Type of MaP Policies, Select EMs (1995-2020)

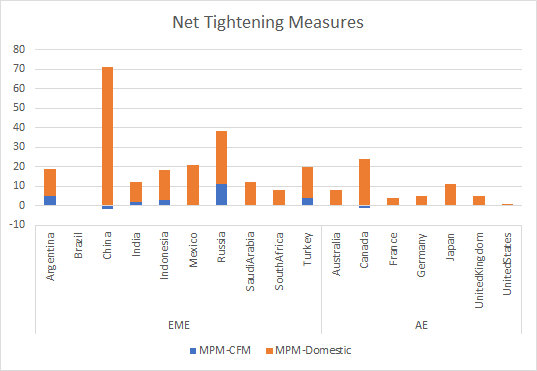

Figure 4: Net Tightening MPM, Domestic and CFM, Select AEs and EMs (1990M1-2020M12)

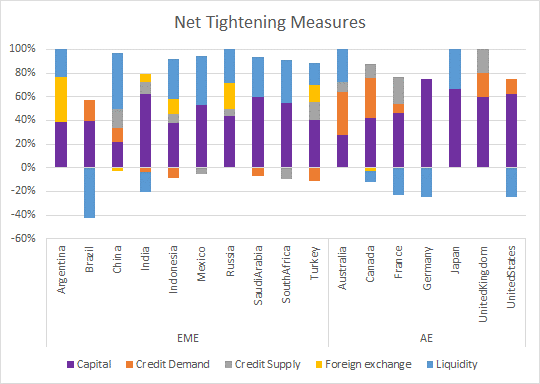

Figure 5: Net MaP Tightening, by Type, Select AEs and EMs (1990-2020)

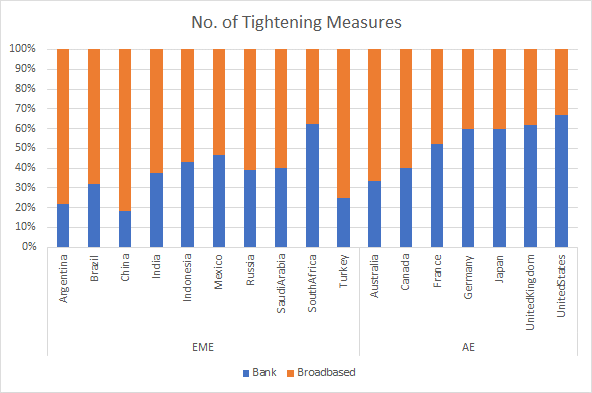

Figure 6: MaP Tightening, Select AEs and EMs, Bank vs Broad-Based, (1990M1-2020M12)

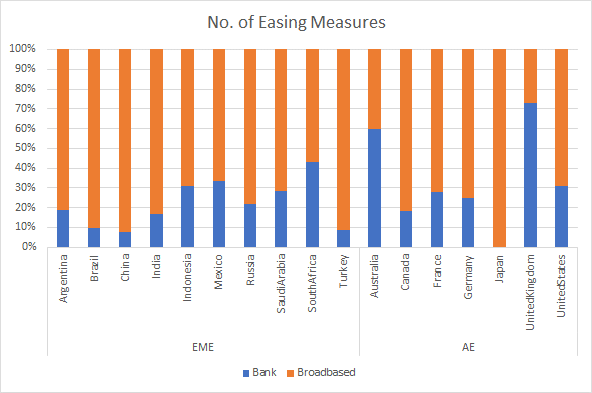

Figure 6: MaP Tightening, Select AEs and EMs, Bank vs Broad-Based, (1990M1-2020M12)

Figure 7: MaP Easing, Select AEs and EMs, Bank vs Broad-Based (1990-2020)

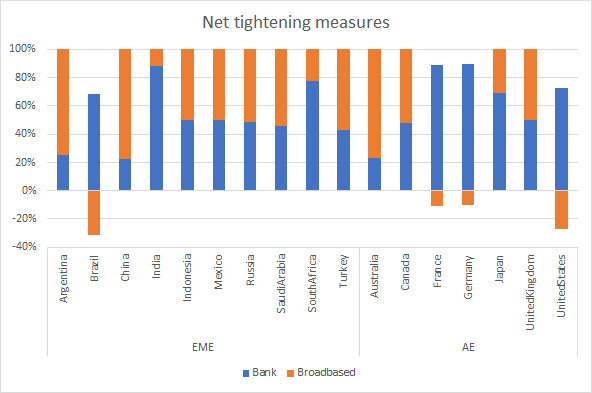

Figure 8: Net MaP Tightening, Major AEs and EMs, Bank vs Broad-Based (1990-2020)

In Figures 4-8 we plot net tightening measures, i.e., easing measures subtracted from tightening measures based on the classifications proposed in this brief. The number of tightening and easing measures classified either as bank-based or broad-based are also presented graphically.

Among countries being examined in this brief, source countries such as US, UK, and Japan implemented the least number of tightening measures. The frequency of implementing easing measures exceeded that of tightening measures in the US and UK. Figure 4 shows net tightening to be almost zero for the US.

Capital adequacy measures dominated regulatory tightening in AEs. This had the highest share at 70 percent of all regulations for the US. While the US implemented some measures that moderate credit demand, it implemented none that moderated credit supply. EMs used a mix of measures. Relaxation of capital adequacy also dominated easing measures in AEs. Nevertheless, all countries carried out, net tightening of capital adequacy. Some of them such as the US also undertook net relaxation of liquidity (Figure 5).

According to Figure 6, tightening measures in AEs were targeted more at banks while being broad-based in EMs. Moreover, greater easing for NBFIs in AEs (Figure 7) led to net easing for NBFIs in the US, France, and Germany (Figure 8).

Key facts

- On average, MaP policy instruments are used more frequently in EMs than AEs (Figures 2 and 3).

- None of the AEs but Canada implemented MPM-CFMs in the entire period under study (Figure 2) (Figure 4).

- Since 2007, EMs, on average, employed MPM-CFMs as a tightening measure. Before 2007, although leaning towards being a tightening measure, MFM-CFMs remained neutral.

- Russia, Turkey, Indonesia, India, and Argentina undertook a net tightening of FX-based regulations over the entire period under study.

- All AEs and EMs carried out net tightening of capital-based MPMs.

- All EMs but Brazil and India carried out net tightening of liquidity-based measures. Among AEs, only Australia and Japan tightened liquidity measures while Canada, France, Germany, and US eased them.

- Credit-demand saw greater net tightening than credit-supply in most AEs, and vice-versa in most EMs. US implemented some measures moderating credit demand but none moderating credit supply. MaP policy tightening in AEs was largely in the banking sector—five out of seven AEs in the sample used for the analysis employed more than 50 percent of their total MPMs on banks, On the contrary, nine out of 10 EMs in the sample used for the analysis employed more broad-based measures (Figure 6).

Source countries used less of MPMs and credit-supply measures than EMs and had less tightening with net easing for NBFIs and of liquidity measures. Instead of responding to quantitative easing (QE) by tightening MPMs, these economies eased some MPMs thus encouraging financial leverage. For example, since the 2000 US Commodity Futures Modernisation Act eased limits on position, among other deregulations for swap dealers, the volatility of international crude oil prices increased sharply. This hurt both oil producing and consuming countries.[25]

The MaP tightening sought by US macroeconomists as a means of reducing QE-induced risks was not implemented. Following the GFC, former Chair of the United States Federal Reserve, Janet Yellen had called for minimum margin requirements on a market wide basis. In a 2019 talk with fellow economist Paul Krugman, she regretted the continuing lack of tools to prevent risky lending.[26]

2. The G20’s Role

EMs had to deal with destabilising fluctuations in capital flows that resulted from continuous switching between periods when global capital was more and less willing to take risks during QE and the tightening that followed.[27] While bank capital buffers did improve after the GFC, relying solely on them was inadequate. Lobbying against these buffers led to a reduction in 2018 of the requirements for small banks in the US. This was responsible for the Silicon Valley Bank crisis with global spillovers. In its report reviewing the crisis, the Fed stated that 2018 onwards, supervisors were expected to accumulate more evidence before taking action. This pressure on them to reduce burdens on firms and to follow due process lowered the quality of regulation.

A skewed focus on banking regulation raised the share of cross-border capital flows from NBFIs. Regulatory arbitrage also increased risk exposure of NBFIs such as hedge funds, pension funds, insurance companies and securitisation vehicles in AEs. Regulating these markets using MaP instruments could reduce excessive risk-taking and curtail AE exposure to financial vulnerabilities. Financial stability has improved in EMs as a result of more broad-based regulation. Moreover, since the growth of EMs is now essential to driving and sustaining global demand and trade, global volatility ends up creating direct and indirect[28] negative spillovers for AEs themselves.

Financial stability remained an important part of G20 agenda until 2016 when it was decided that enough had been done to achieve it. However, recent recurrence of episodes that threaten financial stability indicate that more needs to be done. Universal implementation of a minimum set of MPMs on credit-supply is necessary to reduce regulatory arbitrage, instability, and spillovers. But this requires agreement among countries. One of the areas G20 can be most effective is in coordinating between countries and achieving consensus among them. It can build on its success in achieving global consensus on the minimum corporate tax. Global regulatory norms can insulate domestic regulators from the lobbying that weakens reform. A common set of minimum global regulatory standards can reduce the need for defensive controls in EMs.

3. Recommendations to the G20

-

- To work for global consensus on universal implementation across countries and different types of financial institutions of a minimum set of MPMs relating to credit-supply. This would reduce arbitrage, excessive risk-taking and volatility not only in cross-border capital flows but also in domestic financial sectors of AEs.

- Examples of prudential regulations that reduce risk-taking by financial firms and are amenable to universal application are position and exposure limits, and margin requirements.

- The G20 can support the development of more broad-based uniform standards that regulate auditing, disclosure, and supervision in capital and derivative markets, just as after the GFC it supported the reform of Basel norms for banks.

- The idea of levying some form of a Tobin tax on cross border flows or financial transactions has been revived as part of an ongoing effort to generate adequate finance for climate risk mitigation. This would also curtail excess financial volatility and could be designed as a counter-cyclical measure. The success achieved in the implementation of the corporate minimum tax can act as a template for direction and guidance.

- While the process of working out a detailed plan of action and reaching the required global consensus will take time, the Indian presidency would be making a significant contribution even by merely bringing attention to the issue and initiating a discussion to address it. Future presidencies of other EMs could take this process forward.

If regulations improve, reducing excess financial volatility, spillovers and the frequency of crises, the cost of capital will fall, enabling steady cross-border financing of development needs with sustainable debt.

The authors thank the anonymous referees for very useful comments.

Attribution: Ashima Goyal and Sritama Ray, “The Pattern of Global Macroprudential Regulations and its Impact on Borrowing Costs,” T20 Policy Brief, June 2023.

Endnotes

[1] Silvia Miranda-Agrippino and Hélène Rey, “World Asset Markets and the Global Financial Cycle,” CEPR Discussion Paper no. 10936 (November 2015).

[2] Ashima Goyal and Akhilesh Verma, “Emerging markets perspectives on G-20 led financial reforms,” in 20 years of G20, ed. Rajat Kathuria and Prateek Kukreja (Singapore: Springer, 2019), 19-36.

[3] Beatrice Scheubel, Livio Stracca, and Cédric Tille, “The global financial cycle and capital flow episodes: a wobbly link?” European Central Bank Working Paper 2337 (December 2019): 1-49.

[4] Woon Gyu Choi, Taesu Kang, Geun-Young Kim, and Byongju Lee, “Global liquidity transmission to emerging market economies, and their policy responses,” Journal of International Economics 109 (November 2017): 153–166.

[5] Alice Y. Ouyang and Shen Guo, “Macro-prudential policies, the global financial cycle and the real exchange rate,” Journal of International Money and Finance 96 (September 2019): 147–167.

[6] Ben S. Bernanke, “Federal reserve policy in an international context,” Paper presented at 16th Jacques Polak Annual Research Conference of the IMF, Washington DC (November 5-6, 2015): 1-53.

[7] Stijn Claessens, “An overview of macroprudential policy tools,” IMF Working Paper no. WP/14/214 (December 2014): 1-38.

[8] Gabriele Galati and Richhild Moessner, “What do we know about the effects of macroprudential policy?” Economica 85, no. 340 (March 2017): 735-770, https://doi.org/10.1111/ecca.12229.

[9] Alice Y. Ouyang and Shen Guo, “Macro-prudential policies,” 147-167.

[10] Athanasios Andrikopoulos, Zhongfei Chen, Georgios Chortareas, and Kexin Li, “Global economic policy uncertainty, gross capital inflows, and the mitigating role of macroprudential policies,” Journal of International Money and Finance 131, no. 102793 (March 2023).

[11] Hélène Rey, “Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence,” Proceedings of the 2013 Jackson Hole Symposium (2013): 285-333.

[12] Hélène Rey, “International channels of transmission of monetary policy and the Mundellian trilemma.” IMF Economic Review 64, no.1 (May 2016): 6–35.

[13] Silvia Miranda-Agrippino and Hélène Rey, “World Asset Markets,” 10936.

[14] Choi, Kang, and Lee, “Global liquidity,” 153–166.

[15] Ashima Goyal, Akhilesh K. Verma, and Rajeswari Sengupta, “External shocks, cross-border flows and macroeconomic risks in emerging market economies,” Empirical Economics (2021): 2111-2148.

[16] Krittika Banerjee and Ashima Goyal, “Current account imbalances: exploring role of domestic and external factors for large emerging markets,” IGIDR Working Paper no. WP-2021-001 (2021): 1-40.

[17] Claessens, “An overview of macroprudential,” 1-38.

[18] Eugenio Cerutti, Stijn Claessens, and Luc Laeven, “The use and effectiveness of macroprudential policies: new evidence,” IMF Working Paper no. WP/15/61 (March 2015): 1-43.

[19] Zohair Alam, Adrian Alter, Jesse Eiseman, Gaston Gelos, Heedon Kang, Machiko Narita, Erlend Nier, and Naixi Wang, “Digging Deeper–Evidence on the Effects of Macroprudential Policies from a New Database,” IMF Working Paper no. 2019/66 (March 2019).

[20] Toni Ahnert, Kristin Forbes, Christian Friedrich, and Dennis Reinhardt, “Macroprudential FX regulations: shifting the snowbanks of FX vulnerability?” Journal of Financial Economics 140 no. 1 (2021): 145-174.

[21] Katharina Bergant, Francesco Grigoli, Niels-Jakob H Hansen, and Damiano Sandri, “Dampening Global Financial Shocks: Can Macroprudential Regulation Help (More than Capital Controls)?” IMF Working Paper no. WP/20/106 (June 2020): 1-41.

[22] Goyal, Verma, and Sengupta, “External shocks,” 2111–2148.

[23] The IMF’s Integrated Macroprudential Policy (iMaPP) database has been compiled by Zohair Alam and others in their 2019 IMF working paper titled “Digging deeper–evidence on the effects of macroprudential policies from a new database”. This database has been used to derive and plot Figures 2-8 in the current policy brief.

[24] The instruments covered in this database are limits on the loan-to-value (LTV) ratio, limits on the debt-service-to-income (DSTI)ratio, loan loss provisions (LLP), limits on credit growth (LCG), loan restrictions (loan), limits on foreign currency (LFC), limits on the loan-to-deposit ratio (LTD), liquidity requirements (liquidity), limits on foreign exchange positions (LFX), reserve requirements (RR), countercyclical buffers (CCB), conservation, capital requirements, leverage limits (LVR), tax measures, measures taken to mitigate risks from global and domestic systemically important financial institutions (SIFIs), and others.

[25] Ashima Goyal and Rupayan Pal, “Global shocks and international policy coordination.” Global Policy 13, no. 4 (August 2022): 458-468.

[26] “Janet Yellen in Convesation with Paul Krugman,” YouTube, January 23, 2019.

[27] Ricardo J. Caballero and Gunes Kamber, “On the global impact of risk-off shocks and policy-put frameworks.” NBER Working Paper no. 26031 (July 2019): 1-55, 10.3386/w26031.

[28] Goyal and Pal, “Global shocks,” 458-468.