Task Force 1: Macroeconomics, Trade, and Livelihoods: Policy Coherence and International Coordination

Abstract

The economic logic of globalisation resulted in a redistribution of global wealth but also led to an overconcentration of supply chains in particular geographies, as is the case with Rare Earth (RE) supply chains. Supply chain monopolies are valuable instruments to exploit the one-sided dependence of the international economy in a state in pursuance of their political and military goals. The overconcentration of RE supply chain has also been weaponised and used for both benign political influence and coercive political leverage. RE are concentrated in specific states. This Brief addresses the problem of preventing RE monopolisation by any state for the G20. RE is not merely an issue of control of a critical resource; it is equally concerned with creating resilient supply chains that enable shared benefits for the world and are indispensable to the G20’s agenda.

1. The Challenge

The monopoly problem

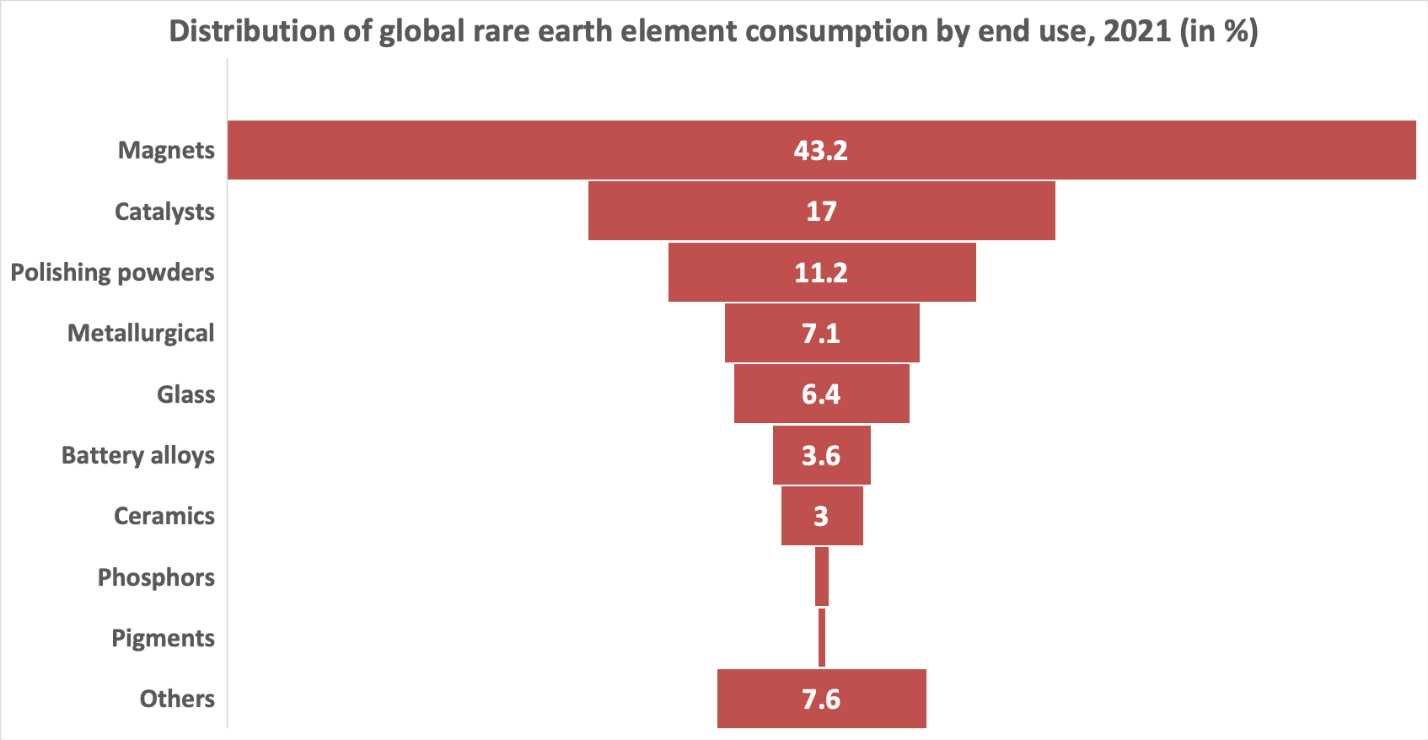

Rare Earth Elements (REEs) are 17 elements on the periodic table, its “largest chemically coherent group”, exhibiting a range of “electronic, magnetic, optical and catalytic properties.”[1] Technologically, to use the words of the former Vice Minister of China’s Ministry of Land and Resources, REEs are the “vitamins” of the fourth industrial revolution.[2] From magnets and batteries used in windmills and electric vehicles, to the coating of silicon wafers used for producing semiconductor chips and solar cells, to increasing the efficiency of light bulbs and precision-guided munitions, REEs are enablers of modern technology. Their contribution to the global economy is enormous, with over US$7 trillion worth of high-technology finished products requiring REEs.[3]

Figure 1: Distribution of Global RE Consumption by End Use, 2021 (In Percentage)

Source: Statista, Adamas Intelligence, NRCan, Roskill (2021)

An unhindered, efficient, and viable REE supply is critical for a state’s economic growth, technological transformation, and national security, but it is equally crucial for addressing some of the most pressing problems in the world, such as climate change and renewable energy. Prima facie, this should not be a significant concern. Unlike other raw materials, such as oil, which are mainly concentrated among the OPEC countries, REEs are found in mineral deposits such as Bastnaesite and Monazite, which are relatively more geographically dispersed.

Figure 2: Reserves of RE Worldwide as of 2022, by Country (in 1,000 Metric Tons REO) 2022

Source: Statista, US Geological Survey (2023)

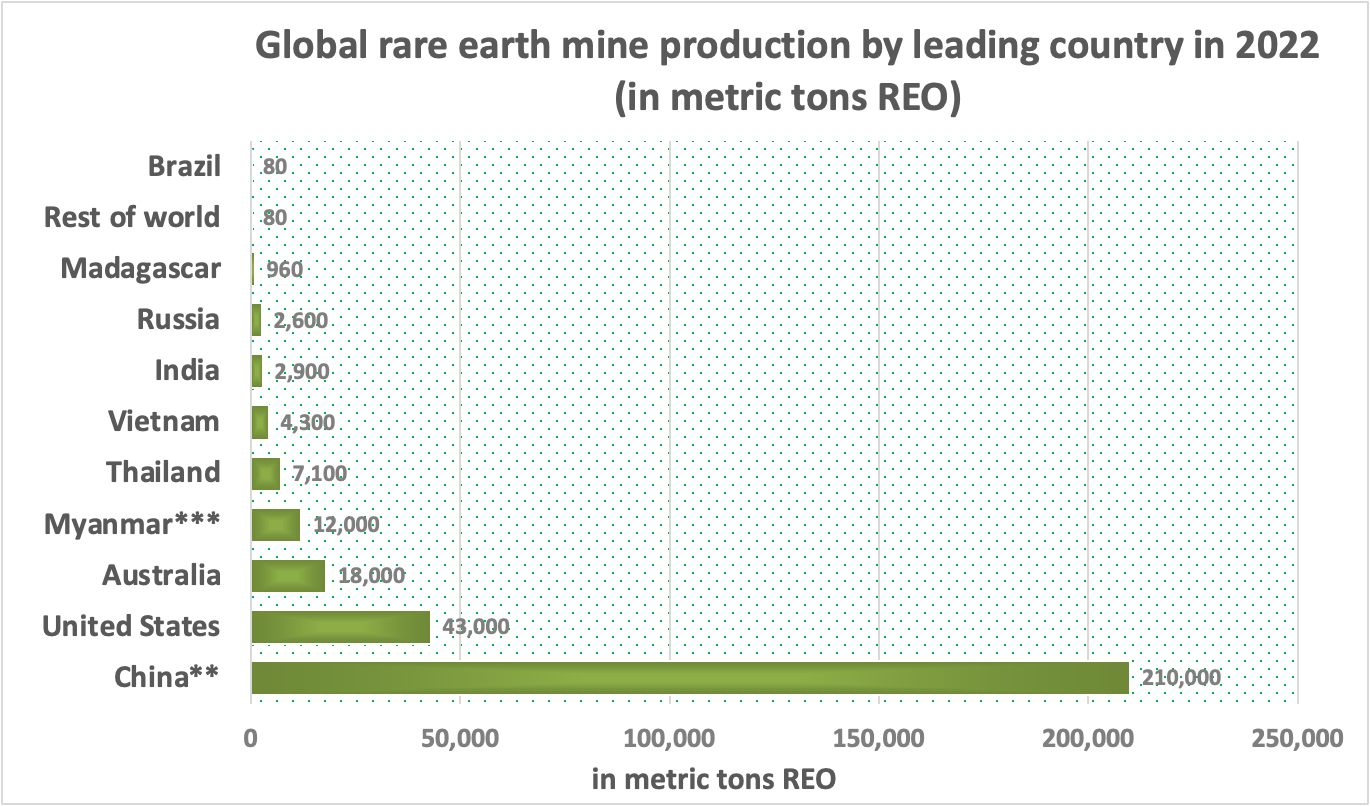

Yet, REE supply chains are highly geographically concentrated, mainly in China.[4] From mine to metal, Beijing dominates the REE supply chain.[5] In 2022, China mined only 70 percent of the world’s RE deposits, down from more than 90 percent in 2010. Yet, it refined more than 80 percent of RE into mixed oxides and 90 percent of the separation of oxides into metals.[6] RE extraction, refinement into oxides, and separation into metals also require vast amounts of seed capital and very high turnover time for new mines, and accompany severe environmental hazards during mining and processing. These unique characteristics of REE supply chains render them susceptible to monopolies rather than market competition.[7]

Such overconcentration of REE supply chains has remained a prominent concern for the G20 since 2010. In October 2010, during the buildup to the fifth G20 meeting in Seoul, a large but diverse group of businesses and corporate entities across America, Europe, and Asia appealed to the world’s most prominent multilateral grouping to address the bottlenecks in the supply of rare earth minerals.[8] The appeal came in the wake of the export embargo imposed by China after the September 2010 Senkaku Island crisis with Japan. Beijing then controlled almost 97 percent of the world’s REE production.[9]

Figure 3: Global RE Mine Production by Leading Country in 2022 (in Metric Tons REO)

Note: **Production quota, excluding undocumented production. ***Referred to as Burma by the Source

Source: Statista, US Geological Survey (January 2023), Argus Media

Monopoly over REE supply chains is highly problematic for several reasons. First, this exorbitant dependence on a single source of REE does not bode well for supply chain resilience. Over-concentration of supply chains in particular geographies was one of the defining features of post-Cold War globalisation, where states readily agreed to a division of labour and manufacturing based on economic efficiency and in the quest for economic interdependence.[10] External shocks like the COVID-19 pandemic have laid bare the low resilience of such crowded value chains.[11]

Second, and more importantly, economic globalisation occurred under the shadow of extreme global military and economic power concentration, i.e., US unipolarity. The Washington consensus was underpinned by a liberal political transformation across the world, where states embraced an ‘outward-oriented model’ emphasising “access to global markets, capital, and technology” that global supply chains were “well suited to deliver.”[12] As Etel Solingen explains, the model required domestic stability, regional cooperation, and “minimizing, to the extent possible, external geopolitical and geo-economic tensions that compromise those synergies.”[13]

2. The G20’s Role

REE monopoly and its geoeconomic and geopolitical implications

The largest known reserves of the REE ore are found in the People’s Republic of China (PRC).[14] However, rather than just the ‘geography of reserves’, several other factors are responsible for why REE supply chains came to be dominated by Beijing.[15]

First, until the 1950s, India, Brazil, and South Africa were the top producers of rare earth minerals.[16] However, the Indian and Brazilian REE minerals were Monazite deposits, containing large concentrations of radioactive Thorium. Even though the fraction of more useful Heavy Rare Earth Elements (HREE) is two to three times higher in Monazite than in Bastnaesite, the question around the use of Thorium extracted during the process and the dispersal of radioactive waste rendered it economically unviable and environmentally more hazardous. As interest in Thorium as a nuclear fuel waned, along with increased scrutiny of nuclear waste management in the 1960s, China’s rich reserves in Bastnaesite deposits gained more traction in the global REE ore industry. Second, the growing environmental concerns and labour costs in the USA led to the closure of the Mountain Pass mine in California—one of the largest deposits of Bastnaesite—which, until the 1980s, was the largest producer of global REE.[17]

Beijing, however, used this opportunity to strengthen its hold on the REE market. The abundance of Bastnaesite ore was only advantageous to the extent of the availability of cheap labour, non-existent environmental standards, and non-acceptance of International Atomic Energy Agency (IAEA) regulations. In the 1980s and 1990s, Beijing nearly dumped REEs by driving down their prices.[18] In 1990, China declared REEs to be a “protected and strategic mineral”.[19] China’s public enterprises controlled the entire REE mining industry, and foreign firms could operate only under joint ventures with public enterprises for processing and metallurgy. Such joint ventures allowed public firms to get necessary technology and patents on REE metallurgy from foreign firms. In 1983, China filed its first RE patent; by 2019, it registered over 25,000 patents, compared to 9,810 in the US.[20] American liberalism is entirely responsible for China’s current technological dominance, such as the US Congress granting “…China most favoured nation trading status,…opening…the door for the exchange of goods, knowledge, and technology between the two nations…” and between China and other industrialised countries.[21] What distinguishes China’s dominance of REE supply chain compared to the oil market is the control of refinement and separation of REEs.

Monopolies are built on consolidation and centralisation. Public enterprises in RE business in China have seen greater integration in the last couple of decades. In 2015, China restructured its rare earth industry into six public firms; by 2016, these six firms were responsible for 99.9 percent of RE production in the country. Beijing further consolidated its rare earth industry by establishing the China Rare Earth Group, combining the assets of Aluminum Corp. of China, China Minmetals, and Ganzhou Rare Earth Group.[22] The new entity controls 70 percent of all RE production in the country, helping stabilise production and supply chains as well as influencing prices.[23] Only national security considerations in the US and Australia have stifled China’s efforts.[24]

However, China’s economic statecraft around its rare earth dominance does not end with the production of RE oxides and metals; it has also actively leveraged its RE monopoly to control the production of their applications.[25] Developing downstream industries based on REEs is a primary strategic goal which dovetails with the 2025 Made in China programme. Constant supply of REEs has been leveraged to relocate the foreign high-technology industry into China.[26] For example, REEs are a crucial component of permanent magnets which use traces of REEs, such as Samarium and Neodymium. These magnets are superlight and more efficient compared to non-REE magnets and have multiple applications, ranging from electric vehicles and wind turbines, to precision-guided munitions, guided missile systems, and radars. The most prominent case of coercive disruption of supply chains in REEs was the Chinese embargo in the supply of REEs against Japan following the Japan Coast Guard’s (JCG) seizure of Chinese fishing trawlers and the latter’s collision with a JCG vessel in September 2010. Consequently, China’s government halted supplies of REMs to Japanese industry. At the time of the China-Japan fishing incident in 2010, which occurred around Japanese control but the Chinese-claimed Senkaku islands in the East China Sea (ECS), China controlled over 95 percent of the world’s REE production[27] and Beijing enforced an embargo against Tokyo.[28] This episode provided a taste of things to come, i.e., the growing weaponisation of trade by a significant power such as China. It brought home to Japan their real vulnerability to China’s coercion in the area of REEs, which is crucial to the performance of their industry, especially in the robotics and semi-conductor sectors.[29]

| Table 1: Rare Earth Elements and their Applications | |||

| Element | Symbol | Atomic number | Example applications |

| Lanthanum | La | 57 | Optical glass, nickel-metal-hydride batteries |

| Cerium | Ce | 58 | Colored glass (flat-panel displays), automobile catalytic converters |

| Praseodymium | Pr | 59 | Super-strong magnets, metal alloys, specialty glass, lasers |

| Neodymium | Nd | 60 | Permanent magnets |

| Samarium | Sm | 62 | Permanent magnets, nuclear reactor control rods, lasers |

| Europium | Eu | 63 | Optical fibers, visual displays, lighting |

| Gadolinium | Gd | 64 | Shielding in nuclear reactors, X-ray and magnetic resonance imaging scanning systems |

| Heavy rare earth elements | |||

| Terbium | Tb | 65 | Visual displays, fuel cells, lighting |

| Dysprosium | Dy | 66 | Permanent magnets, lighting |

| Holmium | Ho | 67 | Lasers, high-strength magnets, glass coloring |

| Erbium | Er | 68 | Glass coloring, fiber optic cables |

| Thulium | Tm | 69 | Lasers, portable X-ray machines |

| Ytterbium | Yb | 70 | Stainless steel, lasers |

| Lutetium | Lu | 71 | Petroleum refining |

| Yttrium | Y | 39 | Metal alloys, visual displays, lasers, lighting |

| Source: U.S. Geological Survey (April 2019) | |||

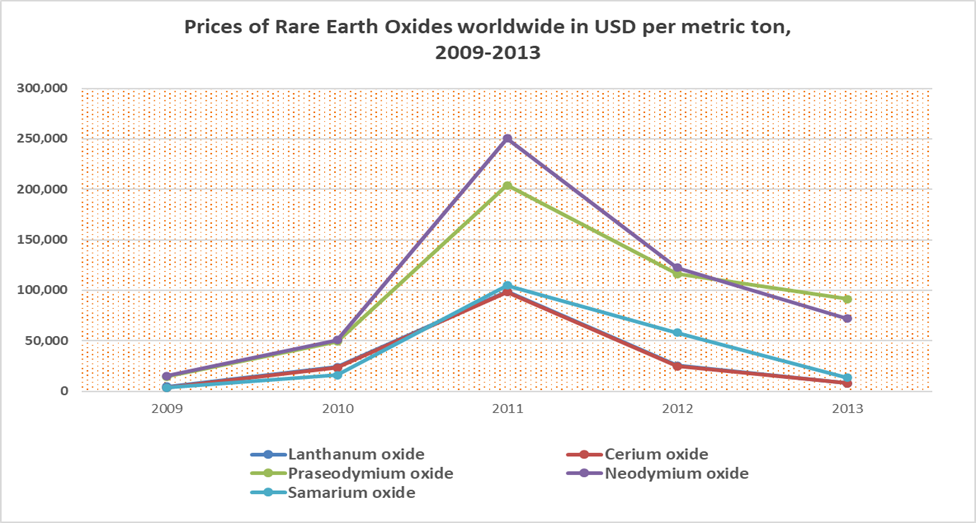

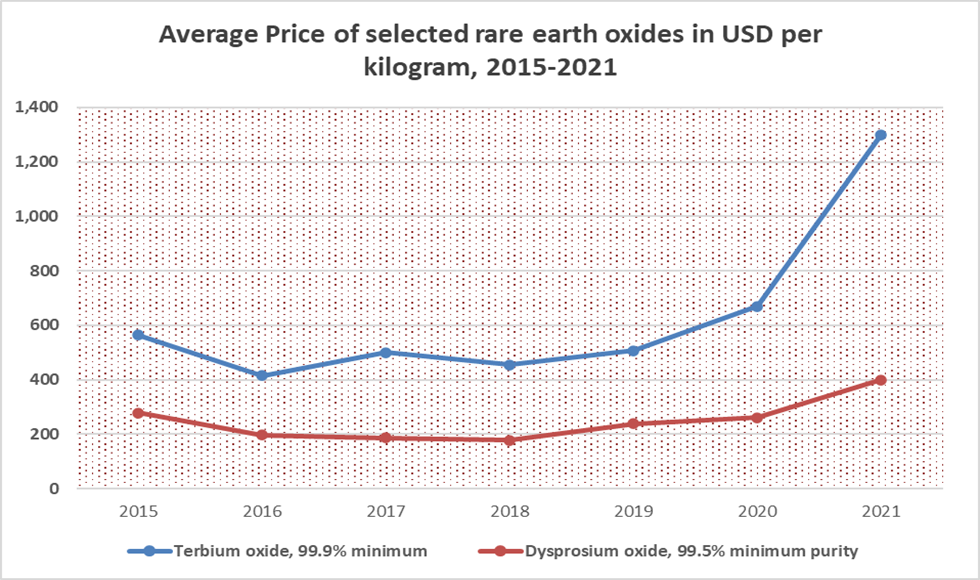

3. Recommendations to the G20

In the last decade, REEs have acquired a strategic dimension for most G20 countries, and their continuous supply has become a matter of economic survival and national security. However, even with a slew of national, regional, and multilateral initiatives, the problem of geographical overconcentration and the accompanying geopolitics of supply chains remains unresolved.[30] An overconcentration in a particular geography not only renders supply chains susceptible to exogenous shocks, as was the case during the pandemic, but also opens up possibilities for deliberate manipulation, such as through embargoes for geopolitical purposes. The price fluctuations between 2010 and 2013 attest to such monopoly problems. Beijing’s REE embargo ratcheted REE prices in 2010-11. As Western countries plan to invest in alternative sources, Beijing has once again opened supplies and manipulated prices down, thereby neutralising any market alternatives to or from consolidation.

Figure 4: Selected Rare Earth Prices Between 2009 and 2013 (Embargo)

Source: Statista, Stormcrow (2015)

Figure 5: Selected Rare Earth Prices 2018-2022 (Pandemic)

Source: Statista, US Geological Survey (January 2023), Argus Media (Argus Metals)

Over the past decade, many bilateral or plurilateral initiatives have emerged with the aim of diversifying and reforming global supply chains in critical minerals. The existing initiatives, however, need to become inclusive in their quest for an alternate vertically integrated structure of rare-earth mining to manufacturing. Any move to reconfigure the global supply chains also entails significant planning, coordination, and redressal of cost and efficiency concerns on the part of the world’s preeminent economies, i.e., the G20 states. The existing China versus the rest (mainly OECD members) narrative can hardly contribute to making rare-earth supplies more robust, resilient, and, more importantly, predictable. In this regard, the G20’s intervention and leadership can go a long way in addressing current supply chain woes and forging trust to revitalise international cooperation.

The G20 should collectively address the problem of REE monopoly and resultant supply chain disruptions. The G20 countries should take the following initiatives to build resilient REE supply chains.

- A G20 REE Fund: The immense consolidation of REE production capacity and market capitalisation in one particular geography and a few state-owned firms has practically rendered any new mining investments worldwide economically unsustainable. REE mining requires substantial capital investments and long threshold periods, which can be quickly scuttled through price manipulation. Several new mining projects worldwide have fallen prey to such predatory policies. The G20, or at least a coalition of like-minded countries within this group, should establish a resource pool for capital investments in promising alternate mineral sites worldwide. Japan’s contribution to this effort needs to be acknowledged and followed. Japan Oil, Gas and Metals National Corporation’s (JOGMEC) investment of US$250 million was critical for the operational viability of Australia’s Lynas Corporation.[31] JOGMEC and Toyota Tsuho Corporation have partnered with Indian public sector enterprises to mine and process India’s REE deposits. The Minerals Security Initiative (MSI), established by ten Western states and the EU in June 2022, must take the lead in establishing such a fund.

- Create an international REE bank: To guard against geopolitical and geoeconomic coercion through trade embargoes of REEs, the G20 countries should work together to create an international REE bank from which countries can draw emergency supplies in case of trade blockades. Such an REE bank can build upon the historical experiences of establishing a nuclear fuel bank by the IAEA and would help immensely reduce the effect of any REE supply blockades on the targeted state. It would also disincentivise the imposition of embargoes and blockades, given that the effect of such measures could be countered in the short term. This should also be unobjectionable to the PRC, as an REE bank enables a more consensual and cooperative multilateral mechanism that addresses China’s concerns as much as other G20 states and beyond to resolve or mitigate supply-related problems. In the long term, market forces do not allow the continuous imposition of sanctions, as was evident during the 2010 incident. Strategic stockpiling of REEs should occur not just at the national level, and the G20 should offer a more multilateral response to the threat of economic and political coercion through deliberate disruption of REE supply chains.

- Developing affordable and sustainable technology for REE extraction from Monazite ore: Monazite ores are abundant in India, Australia, and Brazil. Their HREE content is also significantly higher than Bastnaesite ores. Yet, the use of accumulated Thorium and the management of radioactive waste has not allowed for the significant exploitation of Monazite ores for REE production. The G20 countries, along with the IAEA, must cooperate to fund research and find avenues for the use of Thorium, including in nuclear energy production. Colorado-based Energy Fuel Inc. has started mining Monazite ores, and REE separation will take place at the European facility of Neo Performance Materials.[32] Interested G20 countries such as India and Australia, which have large Monazite deposits, as well as the US, France, and Japan, which have been historically involved with Thorium nuclear energy research, should collaborate to exploit the REE deposits in Monazite ores.

- Strengthen market mechanisms and standards: The G20 should emphasise a market-based global trade in critical raw materials based on the WTO’s free-trade norms and avid exceptions to the extent possible. A G20-led technological alliance must coordinate research for new process innovations to boost refining capacities and diversify mineral demand. The G20, in this way, can address potential misgivings about supply-chain weaponisation and set the model for international cooperation and stability. By creating ‘many roads and many belts’ of collaboration, the G20 must lead by example and serve the purpose for its existence. The 1973 oil crisis holds a vital lesson for the current situation, requiring the G20 to set up a rare-earth institute along the lines of the International Energy Agency (IEA). Such an institute can present timely demand-and-supply forecasts for critical raw materials.[33] Like IEA members’ emergency oil holdings (90 days), the G20 should provide for holdings of strategically important raw materials. The G20 should consider developing product and process standards, including extraction and refining of materials and sustainable, ethical mining codes.

- Develop technological alternatives for replacement and recycling: Technological solutions for long-term resilience and sustainability should target the replacement or substitution of REE and their recycling. Both replacement and recycling were prominently discussed during the trilateral workshops between the EU, US, and Japan in the aftermath of the 2010 embargo by China on exports of REEs. Though direct substitution (element-for-element substitution) of REEs is still not technologically feasible, reducing the amount of REEs used in a particular application through the use of innovative technology (also called technology-for-element substitution), use of alternate categories of materials (grade-for-grade substitution), and designing new systems to perform at the same level as REE systems (systems-for-systems substitution) substitution has shown some progress.[34] Even today, only 1 percent of REE is being recycled.[35] However, material scientists are hopeful that, in the next decade, almost a quarter of the world’s REE needs may be served through recycling.[36] The G20 countries should collectivise their efforts to promote the recycling of REEs.

The authors thank Satish Tezaa for data-related research assistance.

Attribution: Yogesh Joshi, Kapil Patil, and Kartik Bommakanti, “Resilient Rare Earths: Pathways for the G20,” T20 Policy Brief, June 2023.

Endnotes

[1] United States Geological Survey, “Rare Earth Elements—Critical Resources for High Technology,” Fact Sheet 087-02.

[2] Sophia Kalantzakos, China and the Geopolitics of Rare Earths (New York: Oxford University Press, 2018), 117.

[3] Jakie Northam, “COVID-19 Pandemic Highlights U.S. Reliance On China’s Rare Earth Metals,” NPR, July 17, 2020.

[4] “Abundance, Occurrence, and Reserves,” in Encyclopedia Britannica.

[5] “Abundance, Occurrence, and Reserves”

[6] Jamil Hijazi and James Kennedy, “How the United States Handed China Its Rare-Earth Monopoly,” Foreign Policy, October 27, 2020.

[7] Gustavo Ferriera and Jamie Critelli, “China’s Global Monopoly on Rare-Earth Elements,” US Army War College Quarterly: Parameters 52, no. 1 (2022): 57-72.

[8] Keith Bradsher, “Rare Earths Stand is Asked of G-20,” New York Times, November 5, 2010.

[9] Laurie Ure, “China Mineral Dominance Concerns U.S.,” CNN, April 16, 2010.

[10] Michael Keaney, “One World, No Longer: The Past, the Present, and the Future of Global Value Chains,” NAR 3, no. 1 (2021): 1-49.

[11] Rakesh Chaddha, “Skewed Critical Minerals Global Supply Chains Post COVID-19,” Brookings Institution, June 10, 2020.

[12] Etel Solingen, “Introduction: Geopolitical Shocks and Global Supply Chains,” in Geopolitics, Supply Chains, and International Relations in East Asia, edited by Etel Solingen (Cambridge: Cambridge University Press, 2021), 1-20.

[13] Etel Solingen, “On Covid-19, Global Supply Chains, and Geopolitics,” in Geopolitics, Supply Chains, and International Relations in East Asia, edited by Etel Solingen (Cambridge: Cambridge University Press), 229–50.

[14] Julian Turner, “Is China Using Rare Earth Metals as a Geopolitical Weapon?,” Mining Technology, November 23, 2020.

[15] National Bureau of Asian Research, “China’s Control of Rare Earth Metals: Interview with Kristin Vekasi,” August 13, 2019.

[16] Kalantzakos, China and the Geopolitics of Rare Earths, 56.

[17] J. Goldman, “The U.S. Rare Earth Industry: Its Growth and Decline,” Journal of Policy History 26, no. 2 (2014): 139-166. 10.1017/S0898030614000013.

[18] Kalantzakos, China and the Geopolitics of Rare Earths, 61.

[19] Yuzhou Shen, Ruthann Moomy, and Roderick G. Eggert, “China’s Public Policies Toward Rare Earths, 1975–2018,” Mineral Economics 33 (2020), 127–151.

[20]Eric Ng, “China’s War Chest of Rare Earth Patents Give an Insight into Total Domination of the Industry,” South China Morning Post, July 20, 2019.

[21] Jamil Hijazi and James Kennedy, “How the United States Handed China its Rare-Earth Monopoly,” Foreign Policy, October 27, 2020.

[22] Annie Fixler and Louis Gilbertson, “China Consolidates Rare Earth Supply Chain,” Foundation for Defense of Democracies, November 5, 2021.

[23] Felix K. Chang, “China’s Rare Earth Metals Consolidation and Market Power,” Foreign Policy Research Institute, March 2, 2022.

[24] Kalantzakos, China and the Geopolitics of Rare Earths, 8.

[25] Wayne M. Morrison and Rachel Tang, “China’s Rare Earth Industry and Export Regime: Economic and Trade Implications for the United States,” Congressional Research Service, April 30, 2012.

[26] Kalantzakos, China and the Geopolitics of Rare Earths, 120.

[27] Pui Kwan Tse, “China’s Rare-Earth Industry,” United States Geological Survey (USGS), 2011.

[28] Keith Bradsher, “Amid Tension, China Blocks Vital Export to Japan,” New York Times, September 22, 2012.

[29] Marc Schmid, “Mitigating Supply Risks Through Involvement in Rare Earth Projects: Japan’s Strategies and What the US Can Learn”, Resources Policy 63 (October 2019).

[30] Sophia Kalantzakos, “The Race for Critical Minerals in an Era of Geopolitical Realignments,” The International Spectator 55, no. 3 (2020): 1-16.

[31] “Inquiry into the Joint Standing Committee on Australia’s Foreign Affairs, Defence and Trade into Australia’s Investment Relationship with Japan and the Republic of Korea”, Submission No. 16, Department of Resources, Energy and Tourism, Australian Government, August 2011, pp. 17-18.

[32] “Energy Fuels Receives First Shipments of Natural Monazite Ore; Commercial Recovery of Rare Earths Expected to Begin in U.S. in Coming Weeks,” Energy Fuels, March 9, 2021.

[33] Svendstorp, M. 2022. The West Needs an Energy and Resource Alliance, Project Syndicate, October 28, 2022.

[34] Linda Omodara et al., “Recycling and Substitution of Light Rare Earth Elements, Cerium, Lanthanum, Neodymium, and Praseodymium from End-of-Life Applications – A Review,” Journal of Cleaner Production 236, no. 1 (2019).

[35] Y. Fujita, S. McCall, and D. Ginosar, “Recycling Rare Earths: Perspectives and Recent Advances,” Mineral Resource Bulletin 47 (2022): 283-88.

[36] Eric Wayman, “Recycling Rare-Earth Elements is Hard — But Worth It,” ScienceNews Explores, May 4 2023.