Task Force 5: Purpose & Performance: Reassessing the Global Financial Order

This brief explores the practical implications of net-zero portfolio targets for development finance institutions (DFIs). Development finance has a critical role to play in the transition to net-zero emissions, and net-zero portfolio targets are a powerful way to align DFI activities with the objectives of the Paris Agreement. However, there are several practical challenges which prevent their successful adoption. This Policy Brief outlines plausible solutions to move development finance towards net-zero portfolio goals, including: (1) setting context-specific emissions pathways with granular bottom-up data and emphasising climate-development win-wins; (2) dealing with inertia and lumpiness in the portfolio through “when” flexibility (multi-year carbon budgets) and “where” flexibility (sharing of carbon space); (3) encouraging transition projects through future-emissions accounting and transition credits; (4) managing climate-development trade-offs with internal carbon price and ESG standards; and (5) accounting for emissions after project-end with monitoring and legal provisions.

1. The Challenge

Under Section IX. Finance (37) of the COP27 Sharm el-Sheikh Implementation Plan, multilateral development banks (MDBs) and bilateral financial institutions (collectively referred to as DFIs) are urged to reform their practices and prioritise climate finance, while also being encouraged to adopt new operational models and instruments to effectively address the global climate emergency.[1] The need to finance the international response to climate change was also the subject of French President Emanuel Macron’s June 2023 Summit on a New Global Financing Pact.[2] In this vein, DFIs are facing pressure to make their project portfolios net-zero-compatible.

While many DFIs have communicated their 2050 net-zero ambitions, set climate finance targets, and changed operational processes to align with the Paris Agreement (Article 2c), DFIs need to balance globally aligned emissions paths with their mission to advance economic development.

The concern is that too tight a constraint on the amount of carbon in their portfolio could limit their ability to meet development needs in high-carbon sectors like infrastructure, manufacturing, and agriculture in line with urgent development priorities. Further, as long-term investors, their portfolios may turn over too slowly to accommodate rapid emissions declines, and a net-zero portfolio target—with strict intermediate targets and pathways—does not reward “transition” projects aimed at decarbonising high-emissions sectors or supporting essential supply chains.[3]

DFIs have responded to the climate challenge with a combination of financial targets and operational adjustments. Practically all DFIs have set climate finance targets, which respond to the climate finance commitments of rich countries under the UN Framework Convention on Climate Change. Net-zero portfolio targets, which align all DFI activities with the objectives of the Paris Agreement, are the logical next step. They advance the debate from input targets to outcome targets.

However, only a handful of DFIs have set such targets so far. Among G20 institutions, they include British International Investment (BII), DEG of Germany, and the US Development Finance Corporation (DFC).

Net-zero portfolio targets raise important operational questions that need to be answered before portfolio targets become a practical option.

- Selecting an appropriate emissions pathway that considers the common but differentiated responsibilities of portfolio countries but also add-up to a Paris-aligned global pathway is difficult. The challenge of selecting the right emissions pathway is complicated by the fact that the declared emissions objectives of most portfolio countries (their Nationally Determined Contributions) are not yet fully Paris-aligned. Defining the right emissions pathway therefore entails careful judgement. Multiple emissions pathways are consistent with the Paris objectives, and views differ on how emissions reduction should be distributed across countries and sectors. DFIs also require granular pathways that reflect their strategic priorities, that is, the countries and sectors they are active in.

- Meeting a net-zero portfolio target in the presence of slow and lumpy projects is challenging unless additional flexibility can be provided. DFIs provide patient capital. Their portfolios turn over slowly, with project lengths that frequently exceed 10 years, and they often feature large, carbon-intensive investments in infrastructure and sectors that are not easy to decarbonise.

- Portfolio targets incentivise inherently clean projects over so-called transition projects. Transition projects are interventions in high-carbon sectors with a view to decarbonise them, as well as high-emissions projects that are important for low-carbon supply chains, such as port facilities for offshore wind. Both decarbonisation and supply chain projects are essential for net-zero and need to be rewarded.

- While climate action and sustainable development are well-aligned in the long term, there may be short-term trade-offs to navigate. Net-zero portfolio targets will likely not reduce DFIs’ total investment but will shift the composition of activities. This will create winners (investment areas with enhanced scope) and losers (investment areas with reduced scope).

- Accounting for emissions after a project ends is lacking. Portfolio targets encourage early exits and shorter loan tenors to time-limit the carbon impact of projects on the portfolio. However, exits reassign rather than reduce emissions. There is no impact on the real economy. While the responsibilities of DFIs end on exit, emission reductions in the real economy must continue.

The aim of this brief is to advance the debate on net-zero portfolio targets given these potential issues and to put forward potential solutions. The brief is based on a review of the academic and practical literature on the subject, as well as discussions with selected experts.[a] It summarises larger work which provides detailed proposals on actions.[4]

2. The G20’s Role

Aligning the activities of DFIs with the imperative of climate-compatible growth is central to the ongoing discussions within the G20 on economic policy coordination. The aim of this dialogue is to promote economic and equitable growth in a manner which does not contribute to climate change through efforts to reduce greenhouse gas emissions. The adoption of net-zero portfolio targets—in a pragmatic way that recognises the practical challenges they raise—is a key institutional reform for DFIs in this respect.

The G20 are influential shareholders in all MDBs, and some of them operate bilateral DFIs. They possess the power, and arguably have an obligation, to induce these institutions towards a shift in direction, embracing climate-compatible growth through the adoption of net-zero targets.

G20 leadership is particularly important in MDBs, many of which have found the adoption of net-zero portfolio targets challenging, due to their multilateral shareholdings. The G20, as the dominant shareholders in most of these institutions, have the heft to overcome institutional obstacles and promote climate-compatible strategies, targets and processes.

The proposals presented in this brief align with the concerns of developing countries, taking into consideration the principle of ‘common but differentiated responsibilities’.

3. Recommendations to the G20

Through their shareholdings in MDBs and the activities of their bilateral development institutions, G20 governments can promote net-zero portfolio targets while making sure they address the concerns of portfolio countries. To make such targets feasible in practice, the G20 should promote the following actions.

Actions to select an appropriate emissions pathway:

- Construction of bottom-up emissions pathways from global models downscaled to the country or sector level. Granular country-sector data can then be used to construct, bottom up, a DFI-specific portfolio-level emissions pathway that reflects its ex-ante strategic objectives (i.e., its expected portfolio structure, potential portfolio growth and the contexts of the countries it operates in). Granularity does not reduce the need for value judgements, but it generates pathways that can closely match the development objectives of a DFI. Once the pathway is set, DFIs can make investment decisions in the usual way, knowing that the emissions target is aligned with their strategic priorities. Disclosure and knowledge exchange on how such pathways are constructed is essential given the inherent subjectivity of the exercise. The decarbonisation trajectories must also be consistent with the DFI’s intended contribution to global net zero.

- Continued pursuit of climate-development synergies. Most DFIs already prioritise climate and development win-wins. Accelerating this can reduce the dissonance, perceived or real, between climate and development objectives (for example, through investments in energy efficiency, ecosystems that support communities, and high-growth green sectors like renewable energy, and green hydrogen). Emissions targets are not an accounting exercise; they are a strategic tool to shift the balance of investments towards those that are cleaner or can be decarbonised. They incentivise DFIs to identify where to prioritise decarbonisation and how to target capital that is aligned with development.

Actions to deal with inertia and lumpiness in the portfolio:

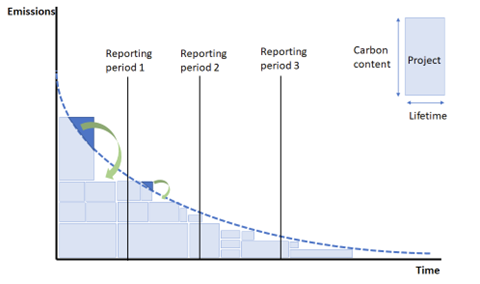

- “When” flexibility through multi-year carbon budgets: Multi-year carbon budgets provide some flexibility to allocate carbon space across time (see Figure 1). This reduces the effect of slow portfolio turnover and may help with high-carbon projects that cannot become less emissions-intensive immediately, but could feasibly do so over the longer term. However, budget periods that are too long raise concerns about intertemporal credibility (i.e., when the time comes, targets may not be honoured). To reduce moral hazard, budget periods should be relatively short, perhaps to coincide with DFI’s strategy cycle. Five-year carbon budgets have been adopted at a national level by the UK and reflect the “stock take” cycle under the Paris Agreement.

Figure 1: “When” flexibility through carbon budgets

Note: The figure shows how an emissions pathway (dotted line) constrains portfolio emissions. Portfolio emissions are the sum of project emissions. Each project is represented by a block, the height of which reflects annual emissions and the width represents project duration. Emissions may be moved between blocks within a reporting period. Note that zero-carbon projects (which will grow in number) are not visible since they have a height of zero.

- “Where” flexibility through the sharing of carbon space with institutions that have similar net-zero targets: Large projects typically require co-financing for risk management reasons. Emissions attribution rules are emerging that assign carbon emissions pro rata to financial contributions. That is, the emissions of large projects are allocated automatically across participating financial institutions, reducing the portfolio impact on individual DFIs. The need to share carbon space, as well as financial risks, could thus create an additional impetus for collaboration between DFIs. An important prerequisite is that participating DFIs must have similar net-zero targets to prevent the leakage of emissions to less ambitious institutions.

- Safeguards against carbon avoidance structures: There is a risk that the carbon impact of large projects is reduced through creative financing structures to ring-fence the carbon footprint. Clear guidelines need to be established to ensure financing structures are driven by the requirements of the project, rather than carbon accounting rules. This monitoring challenge is not dissimilar to what authorities already need to undertake to police tax avoidance.

Actions to incentivise transition projects:

- Future emissions accounting: To reward emissions reduction in high-carbon sectors, projects with high decarbonisation potential could enter the carbon account based on the expected carbon intensity at the end of the project (thus discounting temporarily higher emissions while the project decarbonises). Initially, these would be projected emissions (based on planned decarbonisation measures), but they would be replaced by actual emissions when the project ends. This forward-looking approach rewards, and creates an incentive for, future emissions reductions, but it poses risks if decarbonisation plans are uncertain. If the expected emissions cuts do not materialise, the higher actual emissions will enter the carbon account. DFIs could establish a provisioning system for carbon emissions (similar to bad debt provisioning) to prepare for this eventuality.

- Transition credits for projects with strong carbon benefits: To reward transition projects with either high emissions reductions or supply chain benefits, DFIs could introduce a system of “transition credits”, which would offer a discount on project emissions. In the case of supply chain projects, the credit would be in proportion to the expected indirect carbon benefit of an intervention. In the case of high-carbon projects, it would be proportional to the expected decarbonisation benefits, boosting the incentive already provided through future emissions accounting.

- Standards against greenwashing: The added incentives from future emissions accounting and transition credits increase the risk of greenwashing. DFIs will need to follow auditable rules and established performance standards for their use to mitigate this risk (for example, by leveraging the EU’s taxonomy of what counts as a transition activity and updating this regularly to reflect current conditions).

Actions to manage trade-offs with development objectives:

- No special treatment for high-development projects. It is tempting to make allowances for high-development projects, for example in the form of a “development credit”. In practice, this would make it easy for DFIs to avoid the carbon constraint and open the door to greenwashing. Instead, climate-development trade-offs should be addressed by choosing an emissions pathway that reflects common but differentiated responsibilities, and recognises the development need for some emissive projects. Once an appropriate pathway is defined, projects need to justify the carbon space they require.

- Internal carbon price: A shadow price of carbon that is consistent with the chosen emissions pathway can help inform climate-development trade-offs. It allows an explicit comparison of the carbon costs and development benefits of a project. Shadow pricing is particularly suitable in organisations that calculate social returns on investment in addition to financial returns. If the benefits of a project far outweigh its costs after accounting for the carbon price, then space should be made for it. An internal carbon price that is aligned with the emissions pathway thus helps to prioritise the most impactful projects which deserve carbon space.

Actions to account for emissions after a project ends:

- Monitoring the emissions of completed projects: DFIs and their clients should commit to continue reporting emissions beyond project-end, taking advantage of the monitoring systems that were put in place during the project. The reporting of post-completion emissions would be a separate, perhaps less frequent process and happen outside the formal portfolio target. It would encourage responsible exits (to investors committed to net-zero) and increase the likelihood that emissions management continues. While the commitment would be difficult to enforce legally, carbon reporting requirements are fast evolving (e.g., through the International Sustainability Standards Board) and the public reporting of carbon performance is becoming increasingly standard. Environmental lawyers are also exploring the legal feasibility of exit covenants on carbon performance (for equity investments only).

These recommendations need to be debated further, refined and tested in a practical context. The aim of this brief is to advance this debate among the G20. It is a critical one to ensure net-zero portfolio standards move closer to operational reality. Whilst the direction of travel is clear, solutions will have to account for the varying capacities, resources, strategies and organisational cultures of each DFI, as this ultimately underpins their ability to move towards a net-zero investment portfolio.

Attribution: Sam Fankhauser et al., “Net-Zero Portfolio Targets for DFIs: Challenges and Solutions,” T20 Policy Brief, July 2023.

Acknowledgements

The background research for this brief was funded by British International Investment (BII). Further financial support was provided by the UK Foreign, Commonwealth and Development Office through the Climate Compatible Growth programme and the University of Oxford’s Strategic Research Fund through Oxford Net Zero. The authors are grateful to Amal-Lee Amin, Paddy Carter, Alaa Al Khourdajie, Alzbeta Klein, Ingrid Holmes, Mark Howells, Hans Peter Lankes, Malcolm McCulloch, Nicola Mustetea, Shibao Pek, Olivia Prentice, Steve Pye, Lily Ryan Collins, Josue Tanaka and John Ward for their input. Editorial and design support was provided by Simon Patterson and Sarel Greyling. The views expressed are those of the authors and do not necessarily reflect those of BII or the UK government’s official policies.

*We conducted five semi-structured interviews with senior sector experts from development finance, development economics and the financial sectors. To support key findings, anonymous quotes are inserted throughout the text. These quotes are labelled I1 to I4 for each interviewee. A risk and ethics assessment following the Medical Sciences Interdivisional Research Ethics Committee at the University of Oxford was completed and approved with reference: R74082/RE001.

References

[1] United Nations Framework Convention on Climate Change (UNFCCC), Sharm el-Sheikh Implementation Plan: Non-official session documents (Sharm el-Sheikh: UNFCCC, 2022).

[2] “International solidarity – Website for the Summit on a New Global Financing Pact goes live (25 May 2023),” French Ministry for Europe and Foreign Affairs, last modified May 25, 2023.

[3] British International Investment, Transition Finance for Africa Accelerating decarbonisation efforts in sectors critical to economic development, (London: British International Investment, 2022).

[4] Sam Fankhauser, Sugandha Srivastav, Ingrid Sundvor, Stephanie Hirmer and Gireesh Shrimali, Net zero portfolio targets for development finance institutions: Challenges and solutions (Oxford: Smith School of Enterprise and the Environment, 2022).