Task Force 4: Refuelling Growth—Clean Energy and Green Transitions

Decarbonising steel can unlock sustainable and equitable economic growth pathways for G20 nations. The associated learnings can help inform multidimensional policy perspectives of the economy-wide decarbonisation of industries. Mitigating steel emissions will have a ripple effect on multiple end-use sectors such as automotive, infrastructure and buildings, leading to the decarbonisation of whole systems.

The G20 nations’ collective efforts and collaborative thinking can solve the multidimensional challenges in decarbonising hard-to-abate industries such as steel. As a way forward, this brief presents five key recommendations for G20 members to transform ambition into action:

- Scaling breakthrough technologies and solutions through dedicated research, innovation, and policy support.

- Closing the loops by mainstreaming the circular economy and industrial ecology.

- Creating markets for low-carbon products through demand-side measures and procurement policies.

- Transitioning to climate-aligned and transition-ready industries by adopting a multidimensional change model for industrial economic transformation.

- Shaping the global narrative for industrial transition beyond decarbonisation to economic transformation.

1. The Challenge

Steel is a fundamental element of our daily lives, used in nearly everything around us, from buildings and infrastructure to trains, ships, and cars. The world consumes more than 1.8 billion tonnes of steel products (World Steel Association 2022), emitting on average 1.4 tCO2 for every tonne of steel produced (IEA, 2022) and leading to nearly 8 percent of global emissions (~2.5 GtCO2). Estimates suggest that steel emissions must decline almost 30 percent by 2030 and more than 90 percent by 2050 compared to the baseline scenario (IEA, 2022a; IEA, 2022b; Wood Mackenzie, 2022) for the sector to take the net-zero pathway.

Multidimensional challenges in decarbonising hard-to-abate industries

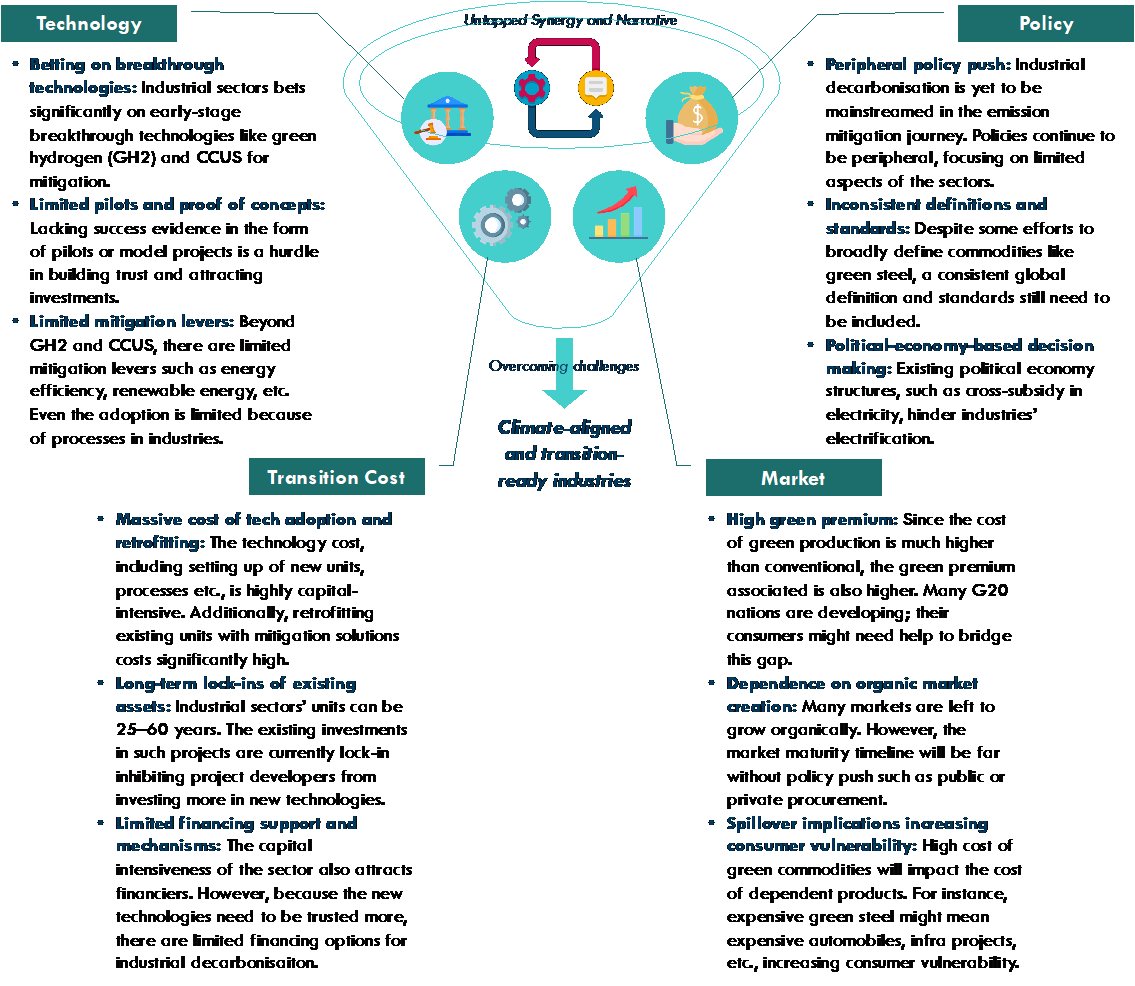

Decarbonising steel is a priority for policymakers and industrialists. However, the net-zero pathway has many multidimensional challenges slowing the global transition. These challenges are related to technology, policy, transition cost/finance and market (see Figure 1), spanning hard-to-abate industries such as steel, cement, and ammonia.

- Technology: Breakthrough technologies such as green hydrogen (GH2) and carbon capture, utilisation and storage (CCUS) are the big bets to decarbonise steel. However, both production routes are in early stages of commercial deployment. Despite the global momentum, the few available pilots and proof of concepts are not enough to build stakeholders’ trust and promote flow of investments. In addition to GH2 and CCUS, incremental mitigation levers such as renewable energy and energy efficiency can prove effective. However, there are technological thresholds to which these levers can help industrial units improve and mitigate emissions.

- Policy: Policy signals are essential to promote technology adoption and direct markets towards change. However, the policy push towards greening steel and other industrial sectors has been peripheral (McKinsey, 2022; Agha and Pujari, 2021). G20 nations have committed to net zero, but industrial decarbonisation, especially of hard-to-abate industries such as steel, is yet to be included in mainstream economy-wide mitigation efforts. Trade is at the centre of the industrial economic development of countries. However, inconsistent definitions and standards of green products make trade challenging and mitigation efforts divergent. For industrial transformation to succeed, policy decisions must overcome geo-economic and country-specific political economy challenges.

- Finance: Transitioning to green commodities such as low-carbon steel will be difficult because of the massive investment requirements in new assets and retrofitting existing production units. The existing investment lock-ins of conventional steel production routes are massive. Although the financing needs are gigantic, mechanisms for large-scale concessional funding for producers are limited. Moreover, other financing mechanisms such as carbon markets, sustainability-linked bonds and green bonds are yet to be institutionalised across nations.

- Markets: Initially evolving markets for low-carbon products require producers to have the manufacturing capacity and consumers to be willing to pay the green premium. Currently, green premium across industries is significantly high, limiting consumer demand and market creation. Higher green premium has a ripple effect on downstream sectors. For instance, expensive green steel means high-priced automobiles, infra projects, etc. affecting consumer affordability. Additionally, actions to shift markets for green commodities from growing organically to being driven by policies with an increasing focus on private and procurement push are limited. Nonetheless, the inconsistencies in definitions and standards of green products, from green hydrogen to green steel and ammonia, induce challenges in shaping domestic markets and enabling trade among nations.

Figure 1: Challenges in advancing industrial decarbonisation across G20 nations

Source: RMI India’s compilation.

Untapped synergy and narrative for climate-aligned and transition-ready industries

The multiple dimensions of the industrial sector—technology, policy, finance, and markets—are intuitively synergic but usually approached divergently. Decarbonising hard-to-abate sectors such as steel needs a whole-systems approach involving systems thinking as well as methods and practices to undertake solution-based action. Additionally, the narrative for climate-aligned and transition-ready industries must be shaped. For this, it is crucial to recognise that the industrial transition is a people-centric economic transformation beyond decarbonisation.

The expected economic growth in G20 countries such as India, Indonesia and Brazil will increase the demand for steel, cement, chemical and other sectors. Across these industries, technology, policy, financing, and market challenges are similar, consistent, and prevalent. Thus, a G20 collaboration for solutions can solve bottlenecks in the broader industrial sector, taking inspiration from the steel sector as stakeholders’ first focus in the industrial decarbonisation journey.

2. The G20’s Role

Industries contribute significantly to the economic value and emissions of G20 nations, as highlighted in Figure 2. The share of industrial emissions across G20 nations is nearly 33 percent on average. Overall, the industrial emissions intensity across these countries ranges from 0.2 to 2.0 kgCO2-e/2015 USD GVA (Climate Transparency, 2022), averaging around 0.7 kgCO2-e/2015 USD GVA. South Africa has the highest industrial emissions intensity, followed by India, Russia, and China, with European countries and the US being at the lower end. While global manufacturing is concentrated in G20 nations such as China and India, many others aspire to be emerging manufacturing hubs. Across G20 members, the average share of industries in economic value addition is approximately 27 percent (see Figure 2).

Thus, in the global pursuit of industrial sector decarbonisation, the G20 group will play a crucial role and hold significant responsibility. Most nations have committed to net-zero targets. To meet these targets, there are commitments to scale breakthrough technological solutions such as GH2 and CCUS. The current G20 positioning towards these ambitions is synergetic and can be harnessed to enhance international cooperation, harmonised engagement, and trade (IEEFA, 2022). G20’s collaborative efforts not only lay a foundation for a progressive industrial decarbonisation journey but also provide an opportunity to share learnings towards accelerating efforts.

Figure 2: Industries’ contribution to emissions and economic value across G20 nations

Source: RMI India’s compilation based on G20 country insights from Climate Transparency Report (2022).

Note: *GVA stands for Gross Value Added.

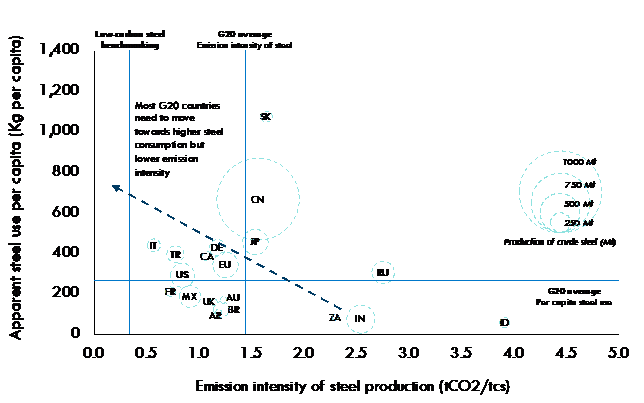

Steel is a critical sector because of its significant contribution to the economic and infrastructure growth of the countries. The steel demand will grow across developing G20 nations in the coming decades. However, the per capita steel consumption of many G20 nations is lower than the G20 and world averages. India and Indonesia’s per capita steel consumption is only 76 kg and 59 kg, respectively, compared to the G20 average of nearly 313 kg. Relative to the low-carbon steel benchmark, most G20 nations must increase their steel consumption but lower their emissions intensity. Most steel production is concentrated in China, India, Japan, and Indonesia, at about 70 percent (World Steel Association, 2022), making them the hubs of steel-linked emissions, representing nearly 75 percent of the total steel-related emissions (~2.1 GtCO2). The average emissions intensity of steel among G20 nations is around 1.5 tCO2/tcs[*] (see Figure 3a), collectively representing more than 90 percent of the production and consumption of steel (see Figure 3b) and emitting nearly 2.8 GtCO2 annually. G20 nations committing to decarbonise steel sooner will provide an opportunity to scale technological solutions, develop coherence across policies, and develop collective strategies.

Figure 3a: Emissions intensity and per capita use of steel across G20 nations

Source: RMI India’s compilation based on G20 country insights from Climate Transparency Report (2022).

Figure 3b: Insights from steel production and use across G20 nations

Source: RMI India’s compilation based on data from World Steel Association (2022).

The G20 nations can create multiple viable opportunities for engagement, collaboration, and international cooperation.

- Common pursuit of industrial sector decarbonisation: Pursuing decarbonisation of steel can significantly dent a country’s industrial emissions, ensure the least long-term lock-ins of investments in emissive production routes, and avoid embodied carbon in end-use sectors such as buildings and infrastructure. Since many nations also plan to become manufacturing hubs, decarbonised steel will help lay the foundation for a green manufacturing economy.

Research and innovation for scaling technologies and solutions: To decarbonise the industrial sector, especially steel, breakthrough technologies such as GH2 and CCUS will be the way forward. Scaling these solutions will need dedicated research and innovation activities, which offers an excellent opportunity for collaboration. Collective thinking and efforts can help commercialise these technologies on time and provide prospects to many developing partners to overcome the conventional roles of being technology borrowers to be emerging co-innovators. Technology advancements for the green industry also have a cascading effect on the value chain of low-carbon technologies such as GH2, which can be instrumental in decarbonising other industrial sectors.

- Promoting trade for market creation: Trade among G20 nations will contribute substantially to the market creation of low-carbon products. Recent advancements in GH2 and its derivatives such as ammonia can be a successful model in the future. India, Saudi Arabia, Australia, and several other countries are well-positioned to offer one of the most cost-effective and dependable GH2 technologies. This advantage stems from their abundant and affordable renewable power sources, along with their significant potential for GH2 production. As a result, these countries emerge as appealing exporters in the evolving energy landscape, where renewable energy plays a crucial role. This will help initiate near-term market creation, leading to long-term commitments for the trade of green steel, ammonia, urea and much more.

- Policy learning and global ecosystem development: Finally, G20 nations can facilitate sharing knowledge and experience in policies and ecosystem developments. Initiatives ranging from documentation of best practices, policy successes and failures to case studies could help build a collective knowledge pool for effective decision making.

3. Recommendations to the G20

G20 nations’ collective efforts and collaborative thinking can solve the multidimensional challenges in decarbonising hard-to-abate industries. As a way forward, here are five key recommendations for G20 members to transform ambition into action.

Scaling breakthrough technologies and solutions through dedicated research, innovation, and policy support

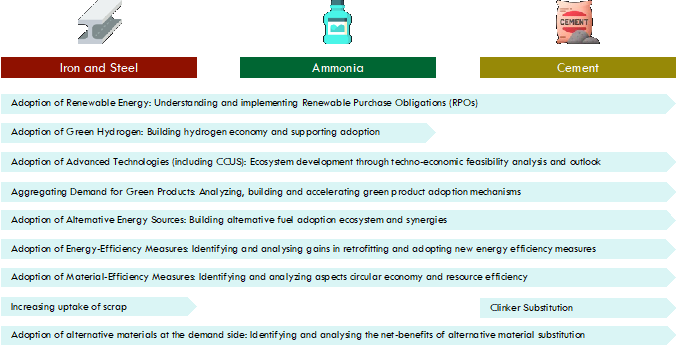

Decarbonising industries is much more challenging than perceived, necessitating breakthrough technologies and solutions going forward. Technology alternatives such as GH2, CCUS and other clean production processes need commercial scaling for wide adoption. Approaching industrial decarbonisation with a lens to prioritise mitigation levers instead of industry type can help holistically overcome challenges across sectors. Scaling levers of decarbonisation can have more economy-wide effects than targeting industries sequentially. Primary levers of decarbonisation such as renewable energy, GH2 and CCUS can be effective across most emissive industries such as steel, ammonia, and cement (see Figure 4), offering a more economy-wide decarbonisation benefit than a single sector.

The G20 nations must promote government-led pilots and clusters to demonstrate the success of breakthrough solutions, build stakeholders’ trust and attract investments. Additionally, there must be forums or dialogue to share experience and knowledge of such projects with other G20 members to channelise efforts and magnify impact. To facilitate pilots and proof-of-concept activities across geographies, the G20 nations can establish a common corpus fund to undertake dedicated R&D, cluster development and pilot initiatives.

Figure 4: Decarbonisation levers across most emitting industries

Source: RMI India’s compilation.

Creating markets for low-carbon products through demand-side measures and procurement policies

Creating a market for low-carbon products is as essential as mitigation measures for production-level emissions. Embodied carbon is critical in driving mitigation actions across sectors, primarily in the built environment and infrastructure projects. For the low-carbon products market to grow and outcompete conventional commodities, an ecosystem supporting producers and bridging green premium is essential to improve consumer affordability of these products. The focus on mitigating embodied carbon across end-use sectors such as buildings, infrastructure and automobiles will induce demand for low-carbon steel and cement. The G20 nations can forge international alliances with mature markets for low-carbon products. The proposed international alliances will promote national commitments, policy actions and global accountability for the consumption, production, and market creation of green products.

Public and private commitments will be critical in creating near-term markets. Public procurement will help develop this market for low-carbon products in the near term. Additionally, initiatives such as the Government of India’s Lifestyle for Environment (Life Movement) can build community-driven demand with increasing affordability in the future. Furthermore, G20 nations proposing procurement targets for private consumer sectors such as real estate developers and automobile manufacturers can help expand market demand and signal the producing industries to move towards decarbonisation.

Closing the loops by mainstreaming circular economy and industrial ecology

Circular economy principles focusing on resource and material efficiency can help realise net-zero goals across G20 nations (McKinsey Sustainability, 2022). On the net-zero pathway, clean energy technologies will be the fastest-growing sector. Correspondingly, the energy and material demand across industries will increase exponentially. Advancing material efficiency by plugging the leakage in the system and interconnecting the flow of materials across processes and units can significantly reduce emissions from the sectors. For instance, material efficiency measures can cumulatively reduce up to 40 percent of the emissions of the steel industry between 2020 and 2050 (IEA, 2020).

Most industrial units exist in clusters, mainly medium, small, and micro enterprises. In clusters, there is a predominant opportunity to increase system efficiency by effectively implementing the concepts of industrial ecology.[c] A shared understanding of industrial material flow and better resource circularity can help the adoption of industrial ecology worldwide. The need for materials and the utilisation of by-products can also help reduce energy demand and emissions from the processes. Developing a circular economy through resource efficiency and industrial ecology must be a key focus of G20 nations. They can collectively adopt a circularity framework to improve resource efficiency and recovery across the industrial and economic demand processes. Across G20 nations, sharing of material recovery technologies and processes under R&D collaboration could help enhance system efficiency.

Shifting to climate-aligned and transition-ready industries by adopting a multidimensional change model for industrial economic transformation

The conventional industrial decarbonisation model has been primarily linear, focusing on processes, fuels and product changes leading to reduced emissions. Despite continued efforts towards energy efficiency, industries are not yet mainstreamed in the mitigation journey. This is fundamentally because of the hard-to-abate nature of industries emerging from the significant dependence on breakthrough technological solutions and transition investments.

The conversation around elements such as just transition, energy security and green procurement is gaining momentum. All these fragmented conversations must be weaved to support the change required to decarbonise industries. In this context, Figure 5 presents the framework for an innovative and effective multidimensional change model for industrial economic transformation for the G20 nations to adopt. The framework offers a structured approach for holistic industrial sector transition. It is built upon on five fundamental pillars: just, geopolitically secure, green, scalable, and affordable.

These pillars represent the five visionary pathways of climate-aligned and transition-ready industries: striving for sustainable growth, fostering globally competitive markets, spearheading sustainable businesses, establishing economic manufacturing hubs, and embracing a people-centric transition.

The proposed framework can help harness the multidimensional opportunities offered by the transition to low-carbon technologies such as GH2 and CCUS. For instance, the global community considers GH2 a reliable common commodity to ensure the world meets the climate goals. If the cost of GH2 reaches US$1/kg by 2030, its use in the steel industry can help produce competitive, low-carbon steel. Similarly, green ammonia can take advantage of low-cost GH2 and help decarbonise urea and shipping. Cheaper green urea can help reduce the burden of subsidies and overcome the deficit, ensuring the economic transformation of industry and farmers. Many countries and communities run their economies with fossil fuel revenue. However, while advancing GH2 can transform these countries into green economies, adopting other low-carbon technologies such as CCUS can provide an additional lifetime to fossil fuel players to aid a smooth transition.

Figure 5: Innovative and multidimensional change model for industrial economic transformation

Source: RMI India’s compilation.

Shaping the global narrative for industrial transition beyond decarbonisation to economic transformation

Industries are economically, environmentally, and socially critical, affecting the local environment and global climate, economic growth and lives and livelihood of people across value chains. Recognising that “industrial transition beyond decarbonisation is a story of people-centric economic transformation” is crucial for G20 nations in the new climate paradigm. Conventionally, industries have been approached with the decarbonisation lens by primarily focusing on changing processes and production units, adopting alternative energy sources, etc., which are all inevitable. However, there is an also opportunity to shape the narrative from decarbonisation to economic transformation. Shaping this narrative can help recognise the multidimensional benefits of industrial economic transformation beyond decarbonisation.

Going forward, the people-centric economic transformation of industries needs to be mainstreamed for the world to meet the climate ambition of 1.5 °C. The proposed recommendations to the G20 can help decarbonise hard-to-abate industries via a whole-systems’ approach involving systems thinking, methods and practices to undertake solution-focused actions. The role of international cooperation and collaboration will be more crucial than ever. The G20’s leadership will be instrumental in scaling breakthrough solutions, creating markets for low-carbon products, promoting a circular economy and industrial ecology, shaping global narratives, and adopting an innovative change model. The actions of the G20 can lay a green industrial growth pathway for the world, especially for the developing countries that are yet to start their economic development and transition journey.

Attribution: Akshima Ghate et al., “Multidimensional Policy Perspectives for Industrial Decarbonisation,” T20 Policy Brief, June 2023.

Bibliography

Agha, Zainab, and Rana Pujari. “Decarbonizing Heavy Industry in India: What Will it Take to Bring Down Emissions in the Coming Decade,” ETEnergyWorld, June 29, 2021.

Climate Transparency. “Climate Transparency Report 2022: G20 Response to the Energy Crisis: Critical for 1.5 Deg C,” (2022).

Garner, Andy, and Gregory A. Keoleian. Industrial Ecology: An Introduction. National Pollution Prevention Center for Higher Education, PPIE, 1995.

IEA. “Direct CO2 Intensity of Steel Production in the Net Zero Scenario, 2018-2030.” Last modified November 2021.

IEA. “Iron and Steel Technology Roadmap.” Last modified October 2020.

IEA. “The Role of Critical Minerals in Clean Energy Transitions.” Last modified May 2021.

IEA. “World Energy Outlook 2022.” Last modified November 2022.

IEEFA. “India’s G20 Presidency is an Opportunity for Green Hydrogen Leadership.” Last modified December 2022.

McKinsey Sustainability. “How a ‘Materials Transition’ Can Support the Net-Zero Agenda.” Last modified July 20, 2022.

McKinsey Sustainability. “COP27: Accelerating Decarbonization.” Last modified November 16, 2022.

Wood Mackenzie. “Steel Industry Emissions to Decline 30% by 2050.” Last modified May 17, 2022.

World Economic Forum. “The Great Minerals Scramble: How Can We Provide the Materials Needed for the Energy Transition?.” Last modified January 18, 2023.

World Steel Association. “Climate Change and the Production of Iron and Steel,” 2021, Accessed March 18, 2023.

World Steel Association. “World Steel in Figures 2022,” 2022, Accessed March 18, 2023.

[*] tcs stands for tonnes of crude steel.

[c] Industrial ecology explores industry as an ecosystem, such as natural systems, where the unwanted materials or by-products of one process or unit are used as an input in another process or unit. Industrial ecology interactions attempt to move from a linear to a closed loop system (Garner and Keoleian, 1995).