Task Force 1: Macroeconomics, Trade, and Livelihoods: Policy Coherence and International Coordination.

Abstract

Achieving the Sustainable Development Goals (SDGs) for a greener and more inclusive future will require vast public spending. Revenue mobilisation remains essential to many G20 economies to satisfy fiscal needs and support progress. Although the approach may vary across countries, the options holding universal promise include better use of value-added tax (VAT), rationalised tax exemptions, and appropriate taxation of the fast-growing digital economy. Strengthening personal income and property taxes can also boost their low revenue yield and make taxes more progressive. Corrective taxes can be effective to curb harmful consumptions and raise revenue for mitigating measures. Additionally, strengthening tax administration can help, and taxpayer morale can be buttressed by improving the quality of public spending.

(The views expressed in this publication are those of the authors and do not necessarily reflect the views and policies of the authors’ institutions.)

1. The Challenge

Developing economies face significant spending pressure. This includes substantial amounts required for education, health, energy, water supply and sanitation, and, in recent years, combating the consequences of climate change. The International Monetary Fund (IMF) estimates that additional annual spending needs will amount to US$ 2.1 trillion in 2030 for emerging market economies.[1] Fiscal pressure will remain beyond 2030—the target year for the SDGs. Achieving net-zero emissions by 2050 will also require massive investments in clean energy. The share of the aging population will increase rapidly in most countries, which will require higher spending on pensions and healthcare, while rising affluence may increase demand for public goods and services.[2]

The COVID-19 pandemic increased pressure on the fiscal accounts by both increasing expenditure needs and decreasing revenue. Fiscal policy needs in response to the crisis were substantial, exceeding those mustered to deal with the global financial crisis of 2008–2009. In several developing countries, the response also involved central bank asset purchase programs, as reported in ADB’s Asian Development Outlook 2022. (This policy brief draws heavily from Asian Development Outlook 2022: Mobilizing Taxes for Development.[3]),[4] Low or negative growth curtailed tax receipts in 2020. At the same time, expenditure increased significantly in most economies.[5] It is clear, therefore, that G20 economies must strengthen tax revenue mobilisation to fund the vast public spending needed to achieve the SDGs.

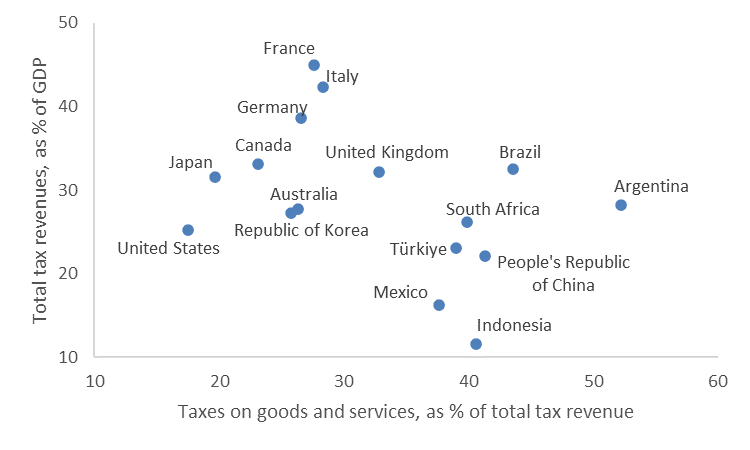

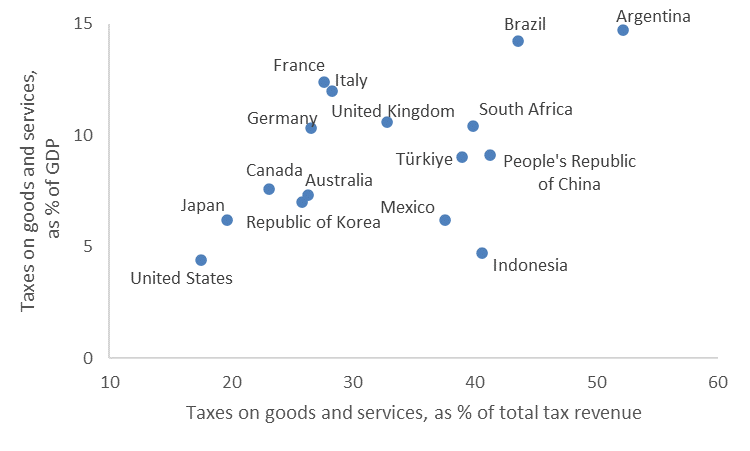

G20 economies with lower tax revenues rely more heavily on VAT and other consumption taxes (see Figure 1, panel A). For some economies such as Indonesia, Mexico, Türkiye, and People’s Republic of China (PRC), the revenue from such taxes is less than 10 percent of GDP, despite their higher reliance on the taxes (see Figure 1, panel B). Increasing tax revenue requires that governments make the most of the key revenue sources consistent with local priorities and capacities. In many countries, weak enforcement capacity can be further hamstrung by scarce third-party information on taxpayers from firms.[6],[7]

Figure 1.

A. Total Tax Revenues to GDP and Taxes on Goods and Services to Total Tax Revenue

B. Taxes on Goods and Services to Total Tax Revenue and to GDP

Notes: The members of the G20 are Argentina, Australia, Brazil, Canada, People’s Republic of China, France, Germany, Indonesia, Italy, Japan, Mexico, South Africa, Republic of Korea, Türkiye, United Kingdom, and United States. All figures are for 2019.

Sources: OECD. Global Revenue Statistics Database. https://www.oecd.org

Tax expenditures are widely used and may cause significant revenue losses. They include exemptions, deductions, credits, deferrals, and lower tax rates intended to enhance social welfare, promote development, and support other policy goals.[8] However, unlike direct expenditure, tax expenditure reductions are not typically reported in a reliable, comparable, or open manner.[9] That renders the tax system less efficient by narrowing the tax base.[10] Surveys of Asian tax authorities show the impact of tax incentives in the region, with tax holidays and tax rate reductions particularly prevalent.[11]

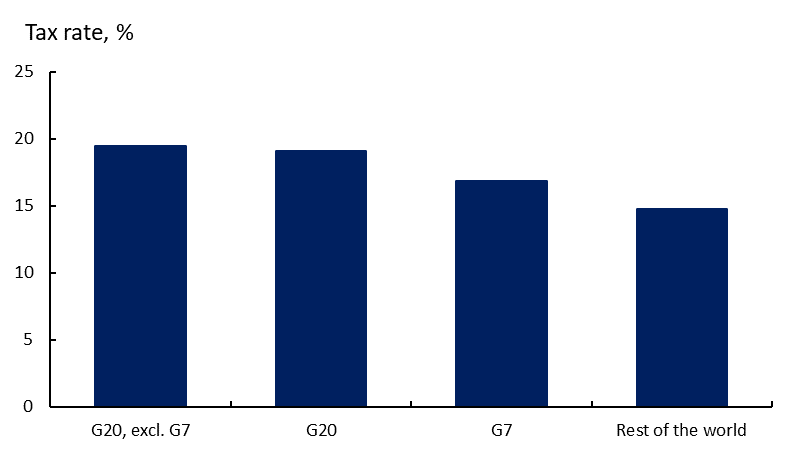

Corporate income tax (CIT) revenue faces increasing pressures of base erosion and profit shifting. Motivated by a desire to attract internationally mobile capital and maintain competitiveness, governments have steadily reduced CIT rates over the past few decades. A weak international tax framework and differences across countries in tax policy can be exploited, especially by multinational enterprises (MNEs), to reduce their tax liability. MNEs shift income and profits to lower-tax jurisdictions to minimise tax liability. Global revenue losses from tax avoidance have been estimated at 4 percent–10 percent of CIT revenue, with larger losses for developing countries.[12]

The rise of the digital economy exacerbates CIT avoidance. Digitalisation makes it hard to identify the country from which profits are derived as it happens, for example, when software sold from a platform in one country is downloaded by a user in another country.[13] Further, intangible assets such as licenses, trademarks, and data, which are easy to shift to lower-tax jurisdictions, are prevalent in the digital economy. The difficulty of determining arm’s-length prices for digital intangibles increases firms’ ability to exploit transfer pricing. It is likely that digital MNEs benefit significantly from tax planning and enjoy lower effective tax rates.[14]

Inequality in disposable income remains high in several G20 economies and has even risen recently. The dwindling labour share and the diverging wage gap between the top and bottom percentiles will likely widen inequality not only in market income but also in disposable income without strengthening progressivity. This is partly because the effective tax rate on capital income tends to be lower for the richest earners. While reducing income inequality through the expenditure side redistributive policies is feasible, taxes play a greater role in reducing inequality than social transfers.[15] Moreover, for many economies, strengthening the redistributive function in the expenditure side also requires domestic resource mobilisation, given that the current fiscal space is not enough to accommodate a significant expansion of expenditure in a sustainable manner.

The G20’s role

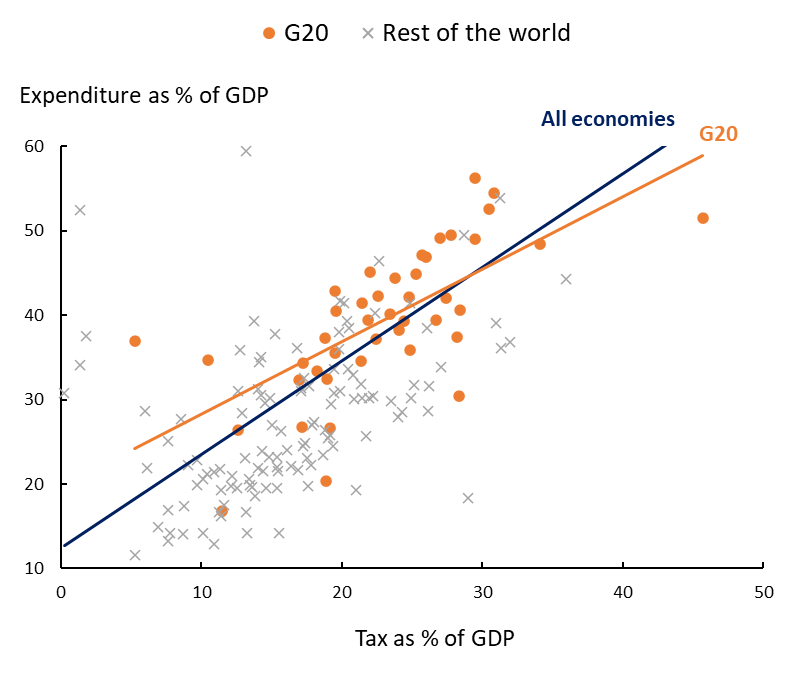

Domestic resource mobilisation—fundamentally, adequate tax revenue efficiently spent—is central to domestic and international development.[16] For most economies, taxes are the primary source of government revenue and largely define the public spending envelope over the medium and longer term. As private financial flows are not always predictable, the ability of governments to borrow varies, and revenue from state-owned operations is often uncertain. While government expenditures normally exceed tax revenues, with the balance made up of borrowing and non-tax revenue, spending rises with tax revenue (see Figure 2). As G20 accounts for around 80 percent of the global GDP and growth, raising more tax revenue in those economies is essential to satisfy the rising fiscal demand to achieve the SDGs.

Figure 2. Tax and Expenditure, Average in 2015–2019

GDP = gross domestic product

Notes: The members of the G20 are Argentina, Australia, Brazil, Canada, People’s Republic of China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, Republic of Korea, Türkiye, United Kingdom, and United States, as well as the European Union. The figure excludes Timor-Leste, Nauru, Kiribati, and Tuvalu. See Go et al. (2022) for further details.[17]

Sources: OECD. Global Revenue Statistics Database. https://www.oecd.org; IMF. Government Finance Statistics online database. https://www.imf.org; IMF. World Economic Outlook October 2021 online database. https://www.imf.org (all accessed 31 January 2022); Asian Development Bank estimates.

G20 economies should promote the use of corrective taxes to support the SDGs. Green and health taxes are levied to address negative externalities. Studies have shown that taxing pollutants can effectively reduce emissions and pollution.[18] Fossil fuel price elasticity tends to be low in the short run but higher with time.[19] Environmental taxes can cut pollution and generate significant revenues only if they hit a broad range of pollutants. Despite their widespread use, the revenue from these taxes remains low in some economies, reflecting low tax rates and patchy coverage. For example, revenue from energy, pollution, and transport taxes equaled 2.3 percent of GDP in OECD countries in 2018.[20] Increasing carbon prices can support climate change targets and lift revenue.

3. Recommendations to the G20

VAT exemptions should be reviewed and tightened to broaden the tax base and raise tax revenue (see Figure 3). They are more conducive to economic growth than increasing tax rates.[21] VAT exemptions often benefit the wealthy more because they consume more, making exemptions generally inefficient improvers of equity. A lower threshold for VAT can potentially broaden the tax base, but may also encourage firms to underreport activity or remain small.[22] Like direct expenditure, tax expenditures should have clear policy objectives and justifications and meet goals efficiently, cost-effectively, and better than policy alternatives.

Figure 3. VAT Rates in G20 and Average Rates in Selected Regions

Source: PricewaterhouseCoopers. World Tax Summary. (accessed 28 March 2023).

Where the wage gap is significant, raising the marginal rates for higher earners may help strengthen the progressivity of the overall tax system. However, personal income tax (PIT) can be economically costly, especially if marginal tax rates rise steeply,[23],[24] when the economy reflects reality of self-employment, and thus a scarcity of third-party information on taxable income hinders enforcement and shrinks the tax base.[25] Higher tax rates reduce work incentives and can dampen labour supply, especially for highly skilled and internationally mobile workers.[26],[27] PIT levied on household income can discourage female labour participation, exacerbating gender inequality. By reducing lifetime earnings, progressive income tax weakens incentives to invest in human capital, compounding efficiency and output losses.[28]

Effective taxation on individuals’ capital income is vital to improving equity. Wealthy individuals own a disproportionate share of capital and must be the target of taxes. Self-employed entrepreneurs, who can shift their income from labour to capital, should also be targeted. For this reason, similar effective tax rates should be applied to capital and labour income. Many countries apply preferential tax rates to certain types of capital income, but this should be minimised because it can distort investment, erode progressivity and the tax base, and complicate enforcement. Tax breaks to encourage retirement savings, for example, may encourage taxpayers not to save more but merely to shift their savings into tax-sheltered accounts, causing revenue losses that worsen inequity.[29]

Improving property taxes can complement progressivity. In G20 economies with lower tax revenues, property tax generally raises little revenue, less than 2 percent of GDP.[30] Governments must improve property valuation to capture the rising value and enable growth in the tax base. Technology can help keep property registers and values updated in a timely and cost-effective manner.[31] Spatial data from remote imagery can be used to estimate building footprints and the built-up area and, combined with land prices, enable mass appraisal of property taxes. Where price data are scarce, prices can be estimated using models drawing on spatial data. Finally, property tax rates need to be sufficiently high and tax bases sufficiently broad. Raising low property tax rates in developing countries could yield substantial revenue gains.[32]

A comprehensive wealth tax system with a tax-exempt threshold can effectively reduce inequality. A wealth tax can be levied on transfers such as inheritance or gifts, or wealth holdings (the difference between assets and liabilities). As tax is levied regardless of asset returns, individuals may be encouraged to invest in higher-yield assets, making asset allocation more efficient.[33] Notwithstanding these advantages, a wealth tax poses considerable implementation challenges. It requires significant administrative resources for recurrent asset evaluation, made more difficult by the absence of reference prices for some asset classes.[34],[35]

Using corrective health taxes is effective in coping with the rising healthcare costs, as many G20 economies are rapidly aging. Consumption of alcohol and tobacco, and unhealthy diets generate economic costs when productivity is lost to premature death or disability, medical treatment, and other social costs. Individuals bear some of these costs as out-of-pocket medical expenses and income lost with death or disability, but other costs, such as public healthcare, are socialised. Raising corrective taxes is a highly effective way to reduce or deter the harmful consumption of alcohol, tobacco, and sugar-sweetened beverages.[36]

Raising fossil fuel taxes to curb consumption and generate revenue, if the rates are currently low. Potential revenue from carbon pricing instruments is significant in some economies, including India and PRC.[37] Fossil fuel taxes are often well-established, easy to administer, and likely to generate more revenue in the short term than carbon pricing. Direct taxation offers greater price predictability and simpler administration. A carbon tax can be imposed on a relatively small number of upstream firms, either producers or at the border, to minimise compliance costs and opportunities for evasion.[38] When implementing a carbon tax, countries must ensure that related energy taxes are not unduly cut, which can undermine revenue, as experienced in Europe.[39]

Earmarking the revenues from corrective taxes can ensure the fiscal space for SDGs-targeted expenditures. For example, Japan has used a sulfur charge to compensate air pollution victims. Such approaches can build public acceptance. Where environmental taxes have adverse distributional effects, governments can implement offsetting revenue recycling transfers or rebates. These are widely used, as in Singapore, where rebates cushion price impacts from the carbon tax and gasoline duty.

4. Conclusion

Developing economies face significant spending pressure for more sustainable and inclusive growth, and the COVID-19 pandemic has only worsened their fiscal space. With resilient economic growth, G20 economies will remain a driver for progressing the SDGs with their domestic resource mobilisation. Increasing tax revenue requires governments to make the most of crucial revenue sources consistent with local priorities and capacities.

For the economies currently with limited tax revenue, the reform of the existing tax expenditure and VAT exemptions may be necessary. Some G20 economies must improve the progressivity in the tax system, which can be achieved by raising the marginal PIT rate for higher earners and strengthening capital income taxes. G20 economies are expected to play a leading role in the taxation issues that have become more important in recent years. For example, advancement in digitalisation has added to the difficulties of the proper taxation on activities across borders, while acceleration in climate change and aging societies require governments to be more proactive on taxation, such as the broader utilisation of collective taxes.

The authors thank ADB consultants, Donna Faye Bajaro and Maria Hanna Concepcion P. Jaber, for their review and support.

Attribution: Yuho Myoda et al., “Mobilising Tax Revenue for Sustainable Development in Asia,” T20 Policy Brief, May 2023.

Endnotes

[1] Vitor Gaspar et al., “Fiscal Policy and Development: Human, Social, and Physical Investment for the SDGs,” Staff Discussion Notes No. 2019/003 (January 2019), Washington, DC: International Monetary Fund.

[2] Bernardin Akitoby et al., “Public Spending, Voracity, and Wagner’s Law in Developing Countries,” European Journal of Political Economy 22, no. 4 (December 2006): 908–24.

[3] ADB, Asian Development Outlook: Mobilizing Taxes for Development, (Manila: Asian Development Bank, 2021b).

[4] World Bank, “Global Economic Prospects,” World Bank Group Flagship Report (June 2021), Washington, DC: The World Bank.

[5] ADB, Asian Development Outlook: Mobilizing Taxes for Development, (Manila: Asian Development Bank, 2021b).

[6] Henrik Jacobsen Kleven, Claus Thustrup Kreiner, and Emmanuel Saez, “Why Can Modern Governments Tax So Much? An Agency Model of Firms as Fiscal Intermediaries,” Economica 83 (January 2016): 219–246. DOI:10.1111/ecca.12182.

[7] Dina Pomeranz and Jose Vila-Belda, “Taking State-Capacity Research to the Field: Insights from Collaborations with Tax Authorities,” Annual Review of Economics 11 (2019) 755–81.

[8] Christian von Haldenwang, Agustin Redonda, and Flurim Aliu, “Shedding Light on Worldwide Tax Expenditures,” GTED Flagship Report (2021), Bonn: German Development Institute.

[9] Grant Driessen, “Spending and Tax Expenditures: Distinctions and Major Programs,” CRS Report (2019), Washington, DC: Congressional Research Service.

[10] Richard Miller Bird, “Tax Challenges Facing Developing Countries,” Inaugural Lecture of the Annual Public Lecture Series of the National Institute of Public Finance and Policy (March 2008), New Delhi.

[11] ADB, A Comparative Analysis of Tax Administration in Asia and the Pacific (Manila: Asian Development Bank, 2022), 5th ed.

[12] OECD, “Examples of Successful DRM Reforms and the Role of International Co-operation,” Discussion Paper (2015), Paris: Organisation for Economic Co-operation and Development.

[13] Peter Mullins, “Taxing Developing Asia’s Digital Economy,” Asian Development Outlook 2022 Background Paper (April 2022), Manila: Asian Development Bank.

[14] Peter Mullins, “Taxing Developing Asia’s Digital Economy,” Asian Development Outlook 2022 Background Paper (April 2022), Manila: Asian Development Bank.

[15] Uma Rani and Marianne Furrer, Decomposing Income Inequality into Factor Income Components: Evidence from Selected G20 Countries (Geneva: International Labour Organization, 2016).

[16] Tony Addison, Miguel Niño-Zarazua, and Jukka Pirttila, “Fiscal Policy State Building and Economic Development,” Journal of International Development 30, no. 2 (March 2018): 161–72.

[17] Eugenia Go et al., “Developing Asia’s Fiscal Landscape and Challenges,” ADB Economics Working Paper Series No. 665 (June 2022), Manila: Asian Development Bank.

[18] Ke Wang et al., “A Cost–Benefit Analysis of the Environmental Taxation Policy in China: A Frontier Analysis-Based Environmentally Extended Input–Output Optimization Method,” Journal of Industrial Ecology 24, no. 3 (June 2020): 564–76.

[19] Toshi Arimura, Maosheng Duan, and Hyungna Oh, “EEPS Special Issue on ‘Carbon Pricing in East Asia’,” Environmental Economics and Policy Studies 23 (June 2021): 495–500.

[20] ADB, Asian Development Outlook: Financing a Green and Inclusive Recovery. (Manila: Asian Development Bank, 2021a).

[21] Santiago Acosta-Ormaechea and Atsuyoshi Morozumi, “The Value-Added Tax and Growth. Design Matters,” International Tax and Public Finance 28 (July 2021): 1211–41.

[22] Li Liu et al., “VAT Notches, Voluntary Registration, and Bunching: Theory and UK Evidence,” Review of Economics and Statistics 103, no. 1 (2021): 151–64.

[23] Richard Blundell, Labor Supply and Taxation, edited by Andreas Peichl and Klaus Zimmerman (Oxford: Oxford University Press, 2016).

[24] Brian Wheaton, “The Macroeconomic Effects of Flat Taxation: Evidence from a Panel of Transition Economies,” (2022).

[25] Anders Jensen, “Employment Structure and the Rise of Modern Tax System,” American Economic Review 112, no. 1 (January 2022): 213–34, DOI:10.1257/aer.20191528.

[26] Ufuk Akcigit, Salome Baslandze, and Stefanie Stantcheva, “Taxation and the International Mobility of Inventors,” American Economic Review 106, no. 10 (October 2016): 2930–81, DOI:10.1257/aer.20150237.

[27] Henrik Kleven et al., “Taxation and Migration: Evidence and Policy Implications,” The Journal of Economic Perspectives 34, no. 2 (Spring 2020), 119-142.

[28] Fatih Guvenen, Burhanettin Kuruscu, and Serdar Ozkan, “Taxation of Human Capital and Wage Inequality: A Cross-Country Analysis,” The Review of Economic Studies 81, no. 2 (April 2014): 818–50.

[29] Raj Chetty et al., “Active vs. Passive Decisions and Crowd-Out in Retirement Savings Accounts: Evidence from Denmark,” The Quarterly Journal of Economics 129, no. 3 (May 2014): 1141–219.

[30] Roy Bahl, William McCluskey, and Riel Franzsen, “Strengthening Property Taxation within Developing Asia,” Asian Development Outlook 2022 Background Paper (April 2022). Manila: Asian Development Bank.

[31] Daniel Ayalew Ali, Klaus Deininger, and Michael Wild, “Using Satellite Imagery to Revolutionize Creations of Tax Maps and Local Revenue Collection,” Policy Research Working Paper 8437 (May 2018), Washington, DC: The World Bank.

[32] Matthias Kalkuhl et al., “Can Land Taxes Foster Sustainable Development? An Assessment of Fiscal, Distributional and Implementation Issues,” Land Use Policy 78 (November 2018): 338–352.

[33] Faith Guvenen et al., “Use It or Lose It: Efficiency Gains from Wealth Taxation,” Working Paper No. 26284 (September 2019), Cambridge, MA: National Bureau of Economic Research.

[34] IMF, “Fiscal Policy and Long-Term Growth,” Policy Papers 2015/023, (April 2015), Washington, DC: International Monetary Fund.

[35] OECD, “The Role and Design of Net Wealth Taxes in the OECD,” OECD Tax Policy Studies No. 26 (2018), Paris: Organisation for Economic Co-operation and Development.

[36] Christopher Lane, “Meeting Health Challenges in Developing Asia with Corrective Taxes on Alcohol, Tobacco, and Unhealthy Foods,” Asian Development Outlook 2022 Background Paper (April 2022), Manila: Asian Development Bank.

[37] Melanie Martin and Kurt van Dender, “The Use of Revenues from Carbon Pricing,” OECD Taxation Working Papers No. 43 (2019), Paris: Organisation for Economic Co-operation and Development.

[38] Stephen Stretton, “A Simple Methodology for Calculating the Impact of a Carbon Tax,” MTI Global Practice Discussion Paper No. 23 (August 2020), Washington, DC: World Bank.

[39] Erik Haites, “Carbon Taxes and Greenhouse Gas Emissions Trading Systems: What Have We Learned?” Climate Policy 18, no. 8 (April 2018): 955–66.