Task Force 5: Reforming the Global Financial System

It has long been clear that delivering on the SDGs and global climate goals at the necessary scale requires a large step-up in financing from private sources. Yet, despite many promising ideas, success has been modest so far. Based on consultations with official agencies and market players, this Policy Brief reviews the reasons for the disappointing performance to date and proposes measures that the G20 could promote to unblock private capital flows. It concludes that there needs to be action in five areas: reforming regulatory frameworks; improving business environments; market and project creation; blended finance; and financing channels. The G20 under India’s leadership could provide momentum by helping to consolidate and boost earlier initiatives; reviewing global financial regulation to remove unintended barriers to EMDE flows; and laying the groundwork for a Global Investment Recovery Act (G-IRA) which includes extending tax benefits to sustainable investments in EMDEs.

1. The Challenge

Emerging markets and developing economies (EMDEs) account for the majority of carbon emissions today, and their share is projected to grow further in the coming years. Consequently, these economies will require the greatest increase in investment for climate action and sustainable development. In its assessment of the need for financing the net-zero target alone, the IPCC has concluded that while annual investment flows need to increase by two to five times the current levels in developed countries, these flows need to increase by four to eight times in developing countries by 2030.[1] Yet the latter are countries with the lowest asset base, the least developed financial markets, and the highest cost of capital. This means EMDEs other than China require external finance to the tune of US$1 trillion per year.[2]

Mobilising this investment will require “a transformation of the financial system and its structures and processes,” according to the Sharm El-Sheikh Implementation Plan agreed upon at COP27.[3] Key groups such as the Coalition of Finance Ministers for Climate Action (CFMCA), the Network for Greening the Financial System (NGFS) as well as the Glasgow Financial Alliance for Net Zero (GFANZ) have recognised the need for this systemic change. At its launch in 2021, GFANZ members held assets worth over US$130 trillion. Never has so much private capital been committed to investments financing the net-zero target.

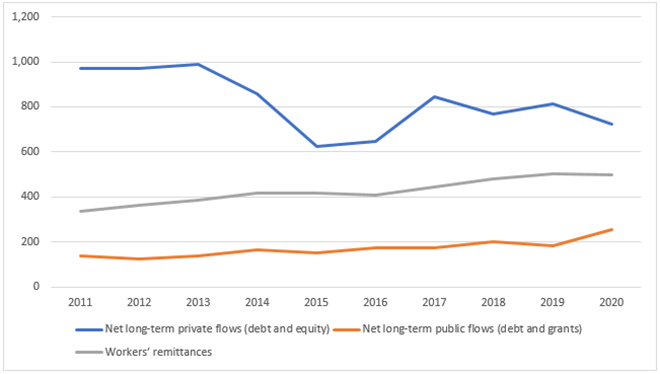

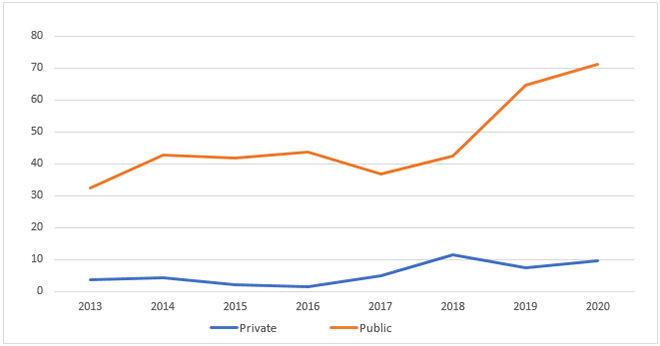

However, the actual flows to EMDEs have not met this ambition. Net annual long-term financial flows to developing countries have shrunk by more than 20 percent since the early 2010s, with private sources registering the largest contraction (see Figure 1). Though public sources of climate finance flows from developed to developing countries have grown to reach US$71 billion in 2020, private flows remain small at a mere US$9.7 billion (see Figure 2). Rising fragmentation in a post-globalisation world means that the task of increasing private capital flows to EMDEs is now going against the structural grain.[4]

This structural trend is compounded by further headwinds. The return of inflation in the wake of the COVID-19 pandemic and Russia’s invasion of Ukraine has pushed up interest rates in the US, the EU, and other major economies. Rising interest rates disproportionately impact clean technologies which tend to be capital-intensive and require upfront investment. The effect is most acutely felt in EMDEs, which are already reeling under the burden of excessive capital costs and exposure to debt instruments denominated in foreign currencies.

EMDEs must also face capital flight induced by investment incentives offered by advanced economies. For example, while the US Inflation Reduction Act (IRA) introduces constraints on trade, it also provides generous fiscal incentives for encouraging private capital flows that can boost employment and competitiveness in the US economy. It is akin to longstanding green industrial policies existing in China and is expected to prompt a similar response from the EU. Such policies can increase the challenges faced by EMDEs in attracting green investments into their markets, which have structurally weaker risk-return profiles, especially when they lack the financial firepower to match the stimulus offered by the bigger economic blocs.

Figure 1: Net Long-Term Financial Flows to LMICs, 2011-20 (US$ billions)

Source: World Development Indicators (World Bank)

Figure 2: Climate Finance Flows, OECD to non-OECD (US$ billions)

Source: Climate Policy Initiative (CPI)

Initiatives for scaling-up private finance flows and lowering costs of capital

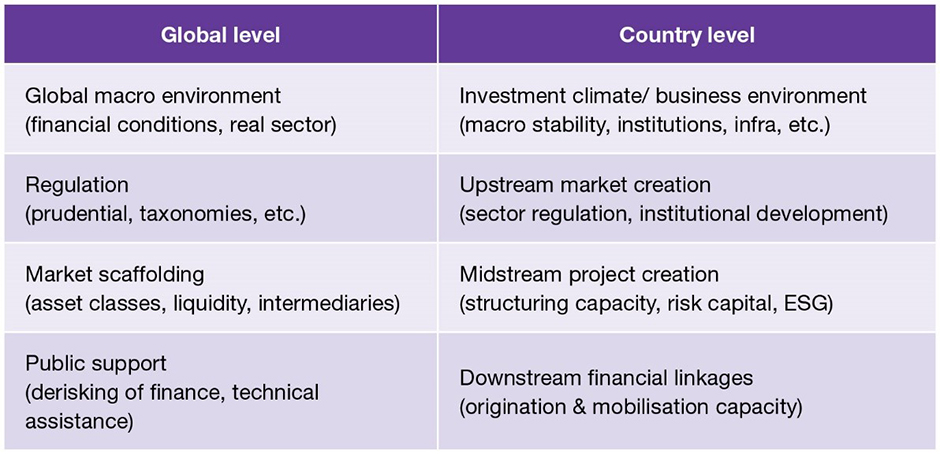

Attracting sustainable finance is then a multi-dimensional challenge. Consultations with officials, financial institutions and industry bodies highlight impediments at both the origin and destination of sustainable finance flows to EMDEs. Collectively, these impediments dampen investor interest, increase the cost of capital, and constrain the investable pipeline of projects. Issues differ across countries, sectors and investors—and thus there can be no silver bullet or a one-size-fits-all solution to the problem of scaling-up sustainable finance.

- On the supply side of cross-border finance, impediments are linked to global financial regulation and longstanding market norms (such as asset allocation and credit ratings), missing financial market infrastructure, and limited official support. Banks face large capital charges. Sustainable finance frameworks, in general, are in flux and transition finance frameworks, in particular, remain undefined. Mechanisms employed for hedging risks—markets, guarantees or blended finance—remain limited. Mobilising flows of investment capital to sustainable assets in EMDEs is far from routine.

- In the context of EMDEs as destinations of sustainable finance flows, country risk, and weak business environments and institutions assume importance. Investors are generally willing to take project risks but find it difficult to deal with changing rules of the game; and only a handful of EMDEs have an investment grade rating.

- At the sector and project levels in any country, market barriers and project development capacity become relevant: regulatory gaps or non-commercial tariffs in the case of, say, renewable energy infrastructure, and a dearth of skills to turn project opportunities into investable propositions.

- The connective tissue linking investment projects to the mobilisation of domestic or foreign finance is often weak, reflecting a lack of financial structuring abilities and aggregation into sufficient ticket sizes.

The impact of these factors has been compounded by the current polycrisis but they predate it.

All these factors, which are listed in Table 1, influence availability and cost of capital. Since some of these are long-standing, bringing about change will be complex and slow-moving. The challenge lies in the way in which fundamental policy and market constraints are overcome—making substantive progress on the ground and not waiting for a perfect system solution.

Table 1: Challenges to Scaling Up Private Finance for Climate and Development

Efforts by multilateral development banks (MDBs), development finance institutions (DFIs), public policymakers, and market coalitions to overcome these gaps are underway.[5] These efforts are recent and it is difficult to gauge their impact. According to our consultations, while there is need to step up the size and ambition of these efforts, it is also important to formulate a more integrated and systematic agenda across five items: reforming regulatory frameworks, improving business environments, market and project creation, blended finance, and financing channels.

Reforming regulatory frameworks as a means to drive sustainable finance

To divert capital from unsustainable activities to sustainable ones, the rules and incentives governing the financial system must be transformed across two intersecting axes.

The first involves ensuring consistent definitions and disclosures for climate and sustainable finance across the financial system so that transaction costs are minimised, markets have the data to drive decisions and risks of ‘greenwashing’ are contained. Substantial progress has been made on reporting frameworks for climate and nature, notably through the Task Forces on Climate-Related and Nature-Related Disclosures (TCFD and TNFD). These two have provided the foundation for the International Sustainability Standards Board (ISSB), which released its first overall sustainability (S1) and climate (S2) standards in June 2023. Taxonomies are also under development in 30 markets[6] with a large degree of convergence on what constitutes ‘green.’

Nevertheless, gaps remain in both advanced economies and EMDEs, one of them being the lack of credible frameworks for ‘transition’ activities—for example activities in the energy sector which while being ‘brown’ are on a credible decarbonisation trajectory. A current priority is to agree on internationally consistent frameworks for net-zero transition plans, both by real economy actors as well as financial institutions. It is important to ensure that the realities of EMDEs are incorporated into the design of these taxonomies and frameworks for disclosure and planning. Furthermore, they have to be adopted into routine business and financing practices.

The second axis involves reforming the existing architecture of prudential regulations and monetary policy regimes by hard-wiring them to account for climate and sustainability risks and requirements. This means incorporating climate, nature and other sustainability factors to the supervisory frameworks of the banking sector for the purpose of ensuring price, monetary and institutional stability. The NGFS and others have made considerable headway in demonstrating how climate and nature can be made a core part of prudential supervision, scenario planning and stress-testing while being consistent with and reinforcing central bank’s mandates for stability. What has not yet taken place is a review of how aligned existing financial rules are—such as Basel III or AML-CFT rules for banking, and the EU’s Solvency II for insurance—to ensure that they are not inadvertently obstructing scaled-up flows of finance for sustainable assets in EMDEs. Some efforts were made after the global financial crisis to address concerns about possible downside impacts of financial rules on SMEs and trade finance.[7] A similar investigation in the context of sustainable finance is now called for.

Continuing to improve the business environment

Improving the quality of the investment climate in EMDEs remains foundational to raising levels of private investment and finance. For example, an unstable macro environment or unpredictable government regulation will be detrimental to efforts for attracting investors. Governments that are serious about achieving the SDGs must tackle these issues, and seek recourse to external support from, for example, the MDBs.

The investment climate has improved overall in EMDEs. Between 1997 and 2018, OECD’s FDI Restrictiveness Index declined from 0.367 to 0.128 in non-OECD countries, though it did see a moderate increase during the pandemic.[8] However, further improvement in the index remains crucial to scale up private investment. Apart from the need for a clear, consistent, long-term commitment from governments, the international community should ensure that technical support is available to countries that require help.

Enhancing markets

Many of the impediments to the functioning of markets are found “upstream” of investment decisions—conditions that should be in place to allow investors to make decisions without having to deal with avoidable risks.

In the energy sector, countries can strengthen investment signals by creating transparent and reliable regulatory frameworks. For instance, in half of the emerging markets surveyed by Bloomberg NEF, standardised power purchase agreements (PPAs) which would help to lower transaction costs for offtake contracts were absent. Just half of the emerging markets tracked allow power generators to charge cost-reflective energy tariffs, and only 16 percent allow power generators to supply electricity directly at cost, compared with 52 percent of OECD markets.[9]

In sectors with sizable investment potential but unfinished or imperfect markets, obstacles upstream of investment should be identified and systematically tackled as part of public-private strategies. Apart from energy, these areas might include digitalisation, commercial transport or WASH infrastructure, agribusiness supply chains, or certain segments of the education and health sectors. The IFC/World Bank Group have made laudable efforts in building upstream advisory capacity but these efforts should be scaled up massively across the development finance system.[10]

Boosting the supply of bankable projects

In many countries, the lack of ‘bankable projects’ is a key concern. The issue is not the absence of project opportunities per se. It is a capacity issue deriving, for instance, from lack of skills or execution capacity. Addressing these bottlenecks would unlock financiers’ confidence to fund the projects.

Building local capacity is critical to developing the many projects essential for achieving the requisite scale. This might involve: (i) partnership between MDBs and developers or utilities that bring project development expertise into emerging and frontier markets; (ii) development of project portfolios through the agency of local financial intermediaries such as National Development Banks[11] (combined with technical assistance for these institutions); and (iii) assistance to project developers with replicable templates for tendering, financing, insurance and risk management—such as the IFC’s Scaling Solar initiative.[12]

It would also be important to combine the existing patchwork of technical assistance facilities governed by different mandates and requirements[13] into a flexible, harmonised system of support. One scalable option is the Global Infrastructure Facility (GIF), which was created in 2014 as a G20 initiative precisely to enable end-to-end advisory services for building bankable pipelines of infrastructure projects.

Addressing risks and risk perceptions

Many projects in EMDEs do not move forward because either the risk—real or perceived—is too high or the return is too low.[14] This has led to the development of de-risking approaches which include those using guarantees and blended finance.

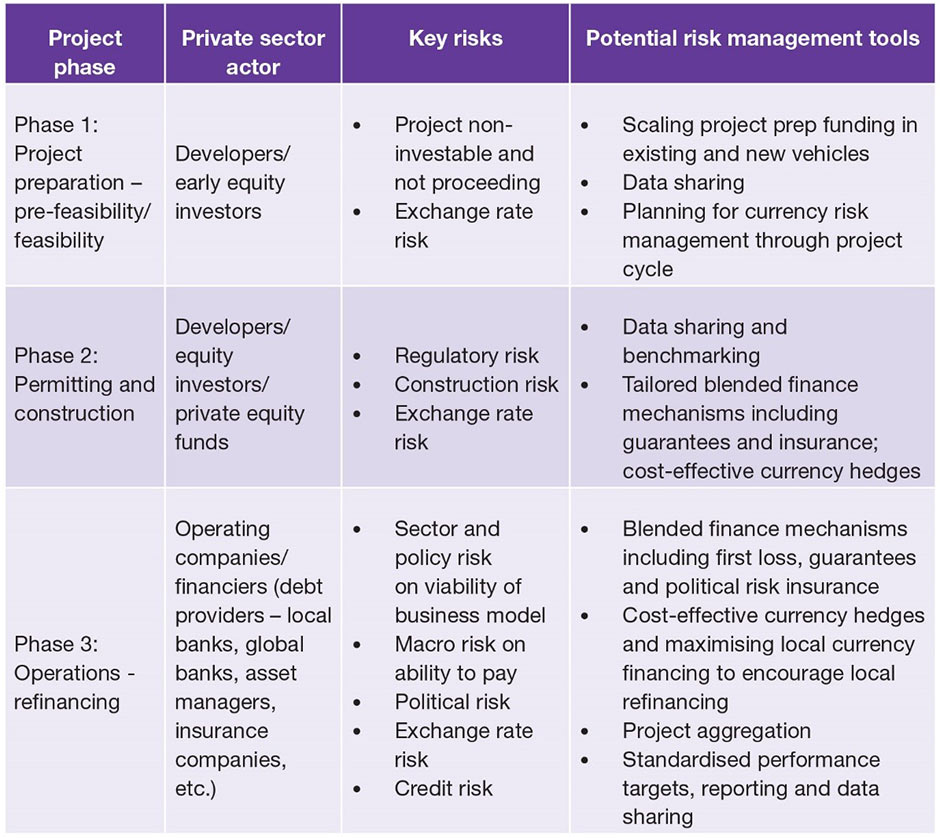

In addition to reassuring private investors through solid macroeconomic management, improving the business environment and unblocking markets, blending and guarantees offer a complementary approach by helping in matching risk and return profiles to investor requirements. This can be justified if markets fail to align risk-adjusted returns with social preferences. Investments in EMDEs are rife with risks that would be absent or could be mitigated in well-functioning markets. An economic case can also be made for de-risking innovation finance if the broader economic benefits realised by early movers are large. Table 2 provides an overview of project stages, related risks, and the potential targeting of guarantees, blending, and other risk management tools in infrastructure projects.

Table 2: Addressing Risks in Infrastructure Finance: The Role of Guarantees and Blending

Source: Adapted from Independent High-Level Expert Group on Climate Finance; November 2022

Nevertheless, despite considerable international discussion and growing expectations around de-risking strategies, the share of aid allocations to these forms of support remains small. The grant element involved in blended finance, for instance, represented US$3.2 billion or less than two percent of total overseas development aid in 2019.[15] The DFIs report using US$1.4 billion of concessional funding in 2019 for a total project volume of US$10.4 billion.

Strengthening financing channels for capital mobilisation

In the context of capital mobilisation, the challenge is to achieve scale by shifting from tailored and ad hoc finance towards portfolio and market-based solutions. The focus should be on institutional investors, both international and domestic, who represent the largest untapped source of funds for projects in EMDEs. The constraint here is not the availability of potentially willing sources of funds, but how to connect them to investments.[16]

Institutional investors exhibit conservative investment behaviour, which may be yielding slowly to a quest for diversification and higher returns.[17] They tend to seek transparency of terms (standardised documentation), liquidity (achieved most easily via listed and rated securities), relatively large ticket sizes, and they prefer operating assets while avoiding early-stage and construction risk.[18] These conditions are met by few EMDE assets directly.

To tap the institutional investment market at scale, EMDEs need to create portfolios of investment opportunities and set up intermediaries that can aggregate, securitise, diversify, label/certify, and if necessary de-risk such assets. Market scale can be achieved through blended fund structures, development of markets for themed bonds and creation of a sustainable infrastructure asset class.[19] Each of these approaches would give investors access to EMDE assets in a more standardised and scalable format.

2. The G20’s Role

The G20 members have a direct interest, as potential sources and recipients of finance, in acting to boost private capital flows for climate and development. The G20 is also the group which is best placed to agree and drive action, through coordinated fiscal measures. The G20 members play host to key players in the global financial system, are dominant shareholders of MDBs, and enjoy a decisive voice in global financial regulation.

Mobilising private sources of sustainable finance is a broad agenda and action on all fronts will be necessary.

3. Recommendations to the G20

The following points outline the opportunities for the G20 to provide momentum to further the agenda of mobilising private sources for climate action:

- Consolidate efforts to get the basics of private flows of climate finance right:

- Accelerate work on the creation of asset classes (especially Emerging Market infrastructure bonds and loans).

- Commit to scaling up concessional finance for blending, underpinned by the principle of value-for-money and steered by the OECD and Sharm-el-Sheikh Guidebooks.

- Boost support for project preparation, for example by organising a donor conference for the GIF, and seek to consolidate existing technical assistance facilities. Identify and replicate initiatives that are successful in scaling-up private capital despite systemic

- Review the global financial architecture to remove barriers to flows into EMDEs: The rules that govern the financial system have been established to achieve the vital goals of stability and soundness. Key regimes include the Basel banking rules, AML-CFT regulations as well as the solvency regime for insurance. Yet it may have created unintended barriers to flows of long-term private capital into EMDEs. To understand its extent and ways to improve it, the G20 could commission a High-Level Expert Group that assesses key financial regulations on three points: 1) Does it promote (or at least not prevent) long-term investment? 2) Are these investments directed to EMDEs? 3) Are these investments sustainable?

- Identify the key features of a Global Investment Recovery Act (GIRA): The green industrial policies being pursued by China, the EU and the US combine national goals of employment generation and competitiveness with the pursuit of net-zero emissions. Their impact on investment flows into EMDEs must be examined in relation to the following two questions. First, what problems do these policies cause in terms of access to capital and markets? Second, what opportunities are available to reformulate and/or complement these policies and programmes for incentivising private capital flows into EMDEs? The JET-P that has been initiated with several countries could be an appropriate starting point, to the extent that this platform allows defining eligibility of investments and monitoring of support. Nevertheless, a broader approach across EMDEs would be needed to ensure that any new measures that complement incentives akin to the US IRA be accessible by all of them.

Attribution: Hans Peter Lankes and Nick Robins, “Mobilising Private Capital for Climate Action and Growth in the Global South,” T20 Policy Brief, July 2023.

The authors benefited from in-depth consultations with senior interlocutors at Convergence, G20 SFWG, GFANZ, GISD, HSBC, NGFS, Standard Chartered Bank, and insights from Sharing Strategies. Many thanks to Baysa Naran at the Climate Policy Initiative and Alex Wollenweber at GRI for their assistance.

Endnotes

[1] Intergovernmental Panel on Climate Change, Working Group III, Sixth Assessment Report, Climate Change 2022: Mitigation of Climate Change (Cambridge: Cambridge University Press, 2022).

[2] Songwe, Vera, Nicholas Stern and Amar Bhattacharya, Finance for Climate Action (London: Grantham Research Institute, 2022).

[3] UNFCCC, Sharm-el-Sheikh Implementation Plan (New York, NY: UNFCCC, 2022).

[4] Kristalina Georgieva, “Confronting Fragmentation where it Matters Most: Trade, Debt, and Climate Action”, IMF Blog, January 16, 2023.

[5] This includes initiatives such as the CoFM, the NGFS, the G20 Sustainable Finance Working Group (SFWG), and on the private side the GFANZ, the Sustainable Markets Initiative (SMI), Global Investors for Sustainable Development Alliance (GISD) and the Climate Finance Leadership Initiative (CFLI). There are also initiatives to mobilize and strengthen coordination among the development banks, including the MDB Infrastructure Cooperation Platform, the MDB climate leaders’ group, the International Development Finance Club (IDFC) and the Finance in Common Initiative, which seeks to bring together all public development banks. The Just Energy Transition Partnerships (JET-Ps) starting with South Africa, Egypt, Indonesia, and Vietnam, offer a novel way of organizing climate financing efforts across public and private parties at the country level.

[6] Notably ASEAN, Brazil, China, the EU, India, Mexico and South Africa.

[7] T. Beck and L. Rojas-Suarez: Making Basel III work for Emerging Markets and Developing Countries: A CGD Task Force Report (Washington: Center for Global Development, 2019); and WTO and IFC, Trade Finance and the Compliance Challenge (Geneva & Washington: WTO and IFC, 2019).

[8] OECD, FDI Regulatory Restrictiveness Index (Paris: OECD, undated).

[9] Climate Finance Leadership Initiative et al., Unlocking Private Climate Finance in Emerging Markets (New York: CFLI, 2021).

[10] IFC, Annual Report (Washington: IFC, 2020).

[11] OECD, Blended Finance in the Least Developed Countries (Paris: OECD, 2020).

[12] World Bank Group, Scaling Solar (Washington: World Bank, undated). Along similar lines, IRENA has developed an ‘Open Solar Contracts’ initiative.

[13] ODI, Clean energy project preparation facilities-mapping the global landscape (London: ODI, 2018).

[14] There is a debate about whether African credit ratings, for instance, are painting too negative a picture of the actual risks (see e.g., M. Kotecha ).

[15] OECD DAC, Official Development Assistance report (Paris: OECD, 2020).

[16] Amer Bisat and Karen Leiton, Investors are underinvested in EM, no matter how you cut it (London: BlackRock, 2022).

[17] IRENA, Mobilizing Institutional Capital for Renewable Energy (Abu Dhabi: IRENA, 2020).

[18] IRENA, Mobilizing Institutional Capital for Renewable Energy. Over 75% of all direct investments made by institutional investors in renewable energy projects over the 2009 to Q2 2019 period were in secondary-stage transactions, i.e. investments in already operating assets that do not require further funding.

[19] A key initiative in this context is the FAST-Infra program, which is developing a sustainable infrastructure label and was launched under the auspices of the OnePlanet Summit as a joint venture by HSBC, IFC, OECD, GIF, and CPI. See “Finance to Accelerate the Sustainable Transition-Infrastructure (FAST-Infra),” Climate Policy Initiative.