TF-2: Our Common Digital Future: Affordable, Accessible and Inclusive Digital Public Infrastructure

Financial exclusion remains one of the main challenges to eradicating poverty and enabling income equality worldwide. The G20 has shown support for new technologies in the financial domain, and in October 2020 introduced a roadmap to enhance cross-border payments and address challenges in the market.[1] Interoperability between systems is now enabled via the advance development of application programming interfaces (APIs) within payment systems. Open and harmonised APIs have allowed network-neutral and cross-technology platforms to carry out financial data exchange while tackling system sustainability issues by providing them a single, standardised set of APIs rather than customised APIs. Through open and harmonised APIs, improved and expanded financial services can be offered to the public. These financial services could enable a higher level of financial inclusion globally, thus reducing the digital access gap within and between countries.

1. The Challenge

In this age of technological advancements, digital disruptions have not only occurred in daily life, but also within financial and banking sectors. Indonesia, together with other countries, has seen an improvement of 83.6 percent in financial inclusion in 2021, largely due to advancements in financial technology.[2]

Digital disruptions push Central Banks to initiate Central Bank Digital Currency systems between countries. The issue of digital cross-border payments has been discussed and endorsed by every G20 summit since 2020, with Saudi Arabia’s presidency. The G20 leaders have, in fact, asked the Financial Stability Board (FSB) to coordinate with the stakeholders to develop cross-border payment schemes between countries. Their aim is to make digital payments and remittances fast, cheap, transparent, and accessible to citizens, while maintaining the safety and security of online transactions for businesses and economies around the world. The FSB responded by developing a global roadmap for cross-border payments enhancement.[3]

This was followed up during Indonesia’s G20 presidency in 2022, where central banks and public authorities were asked to work collaboratively with the Bank for International Settlements’ (BIS) Committee on Payments and Market Infrastructure (CPMI) to provide a joint report on interlinking payment systems and Application Programming Interfaces (APIs) specifically.[4]

The BIS has suggested that an interlinking arrangement for payment systems is critical for enhancing cross-border payments. An interlinked payment arrangement would allow banks and payment service providers (PSPs) to settle a transaction without requiring them to participating in the same payment system or even using any intermediaries. At the same time, enhancing cross-border payments is a complex challenge based on several tricky factors.

- The regulatory environment for money movement across borders can be different from one country to another.

- Transaction costs can be significant for effortless cross-border payments. Banks and other financial institutions involved can have varying transaction costs, depending on the region they are located in. This could impact the cost of digital payments.

- Transaction security has been the top concern with regard to cross-border payments. Securing financial transactions against fraud and cybercrime in correlation with anti-money laundering initiatives is key.

- Lack of standardisation and interoperability between different payment system infrastructures and protocols makes it harder to transfer funds seamlessly.

Recently, the banking industry has mobilised the adoption of digitalisation, for example through open banking initiatives. The concept of open banking entails the use of customer data, collected by banks legally, to share with third-party developers and firms to build applications that provide better services such as real-time digital payments, financial transparency options for account holders, and marketing and cross-selling opportunities.[5]

Open banking provides a system that enables users to share their financial data with third-party service providers through an open API. These open APIs have allowed more industry players to enter the financial ecosystem while giving a competitive advantage to existing banking institutions through innovation and service excellence. Far more independent financial technologies will be able to compete with banks when it comes to other services such as budgeting and investment advice, loan offers comparisons, and payment initiation.

There are both pros and cons to open banking initiatives. However, open banking initiatives may have the potential to tackle more challenges such as:

- Reducing transaction costs by reducing the need for banks to invest in expensive and proprietary information technology infrastructures and systems.

- Increasing transparency and control for customers both inside and outside of the existing financial systems. This transparency would benefit both customers and banking institutions. While banks would benefit from better customer financial behaviour analysis, customers would be enabled to take responsible financial decisions.

Some other challenges to an open banking system are:

- Ensuring customers financial data is safe and secure since it is likely to be shared widely, increasing the risk of fraud and cybercrime.

- Educating customers about their data privacy responsibilities, particularly regarding sharing their financial data with third-party entities.

Establishing hassle-free compliance from the governments and regulators of different countries, especially those that categorise financial data as private data. Based on those challenges within the industry, we can conclude that both standardisation and APIs are significant to the success of digital financial inclusion. Standardisations are important for the creation of an open and equal common system for all. Similarly, the API itself should enable the implementation of standardisation within financial systems.

Prepared by the International Standardization Organization (ISO) technical committee TC68 (financial services), ‘ISO 20022’ is an international standard for electronic data interchange between financial institutions. ISO 20022 established a messaging standard to define the structure and format of financial data messages exchanged between financial institutions. It covers a wide range of financial services such as payments, securities transactions, and trade finance.

ISO 20022 is clearly meant to improve efficiency in financial transactions. The messaging standardisation promotes automation and direct processing, reducing manual interventions and ultimately, the risk of errors. This improvement can result in a faster, reliable, and cost-effective financial transactions for customers.

2. The G20’s Role

The G20 realises the importance of an efficient, reliable, and secure payment system to provide stability and growth to the global economy. During the Saudi Arabian presidency in 2020, the G20 forum endorsed a roadmap to building and enhancing a collective payment system between countries in collaboration with FSB, BIS CPMI, and the International Organization of Securities Commissions. This roadmap defines the standards and guidelines for a payment system to be able to provide comprehensive and effective cross-border payment transactions.

The G20 has also recognised the potential of new payment system technologies such as mobile payments and distributed ledger technology to improve efficiency, effectivity, reliability, and accessibility for customers. Through the Digital Economy Task Force, the G20 has been exploring the many opportunities and challenges presented by new payment system technologies.

In 2020, the G20 endorsed the “G20 AI (Artificial Intelligence) Principles” which include a commitment to promoting a continuous development of open and interoperable APIs. Between 2021 and 2022, the G20 forum has rolled out a roadmap for enhancing cross-border payments where one of the targets is to adopt a harmonised ISO 20022 for financial services messaging formats and standardising API protocols for data exchange.

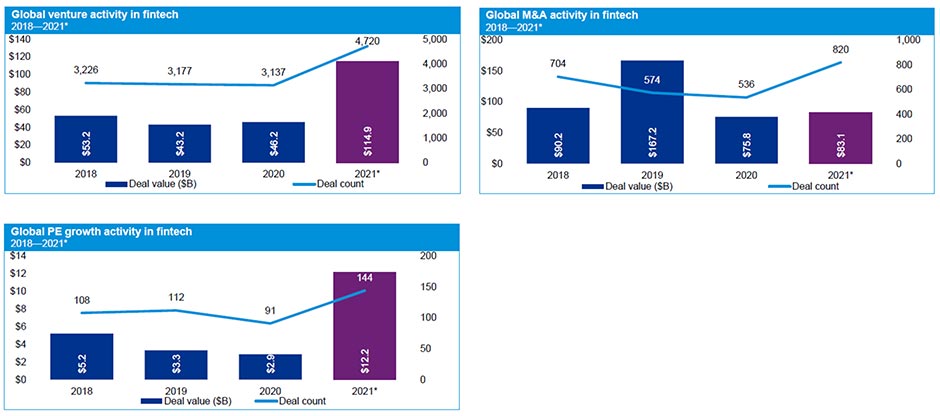

The G20 roadmap, adopted in 2021, sets out 11 targets at the global level. In addition, the FSB in October 2022 reported on the baseline estimates of key performance indicators (KPIs) to be used to monitor the progress of target achievement. In 2022, the G20 endorsed the continuation of the G20 Roadmap for Enhancing Cross-Border Payments implementation with a focus on the initial estimate of KPIs to be used for monitoring progress. The G20 also endorsed the BIS CPMI reports on interlinking payment systems and the significant role played by APIs. Now in 2023, under G20’s Indian presidency, digital technology has received a special push. Covered within the 2nd task force of Think20, ‘digital financial inclusion and social protection’ and ‘interoperability of digital services and standard setting’ are two critical workstreams. In alignment with recent global, financial, and technological trends, KPMG’s report (2022) shows a growing interest and trust in financial technology industries (see Figure 1).[6]

Figure 1: Fintech investment growth (2022)

Source: KPMG[7]

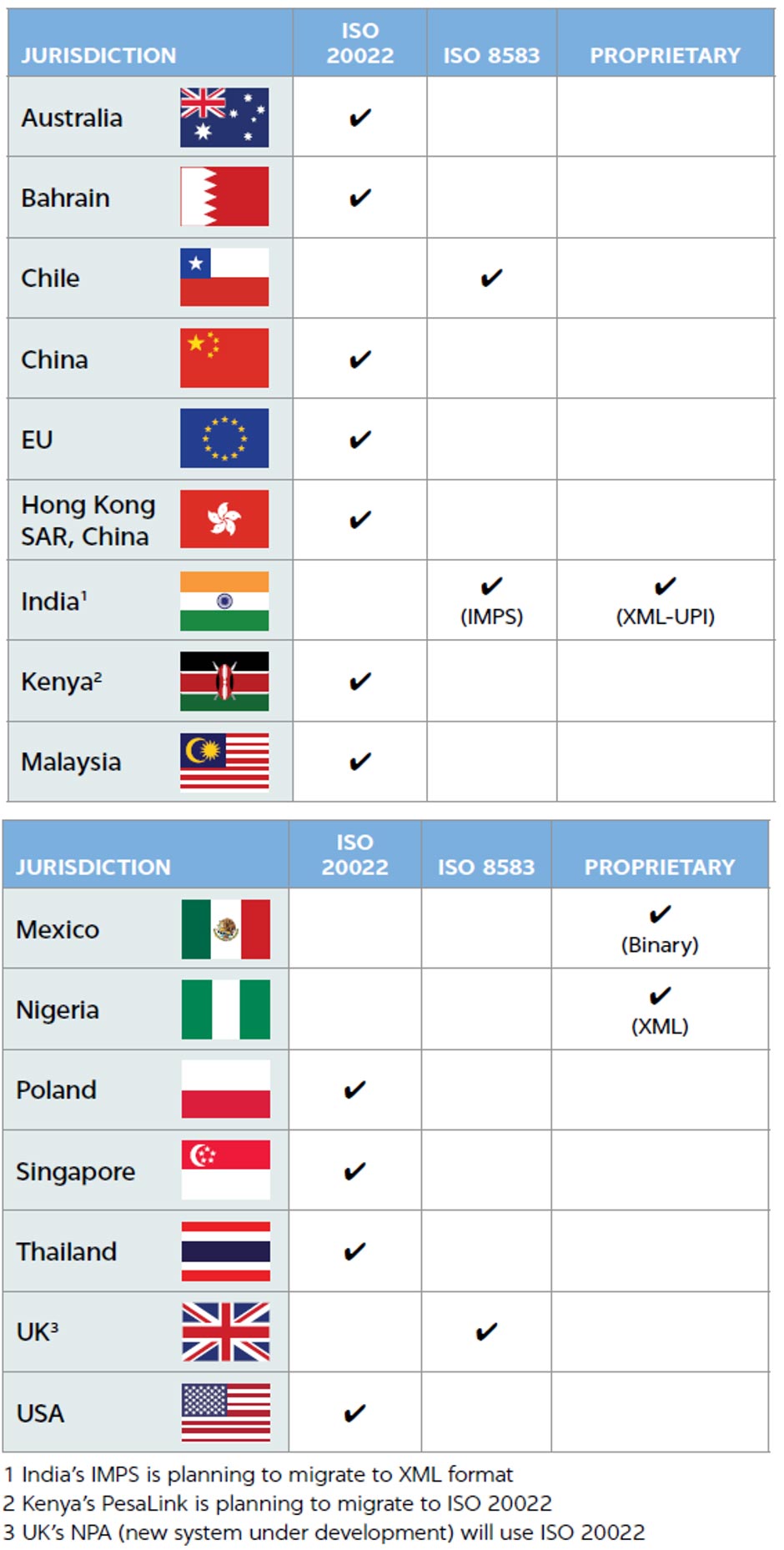

The World Bank, in their report on Fast Payment Systems (2021),[8] have laid out some considerations and lessons for developing and implementing fast payment systems. As part of the fast payment system infrastructure, standard messaging formats and structures for payment and financial transactions adopted by every country can still vary. Some messaging standards adopted by the countries are as below:

Figure 2: Financial messaging standards adoption

Source: International Bank for Reconstruction and Development[9]

A CPMI report in 2022 showed that at least three API interlinking schemes for cross-payments have been tested. India (UPI or Unified Payments Interface) and Singapore (PayNow) have implemented APIs with a bilateral link scheme to enable cross-border payment services, while Eastern and Southern Africa have implemented a hub and spoke scheme for their Regional Payment and Settlement System through APIs. Another interlinked arrangement scheme which uses a common platform model has been tested for multicurrency payment settlement within a Europe-wide area on their Target Instant Payment Settlement (TIPS) service. Interlinked arrangement schemes provide opportunities for many countries to extend their financial services, but at the same time, without any standardisation implementation between countries and regions, integration will likely remain a dream.

3. Recommendations to the G20

Interlinking payment systems between countries can be done in various ways. As the BIS suggested,[10] there are two types of links that can be initiated, they are:

- Interlinking payment system

- Currency arrangement

A framework for interlinking arrangements is needed as every country may need a different scheme and technologies. Adoption of an API can be done once the interlinking arrangement between countries has been defined. A standardised API is a must for cross-border payment integration.

Research into interlinking arrangements, such as the Bilateral Link arrangement between India (UPI) and Singapore (PayNow), launched in February 2023, show both countries implementing regulatory guidelines and an extensive use of APIs to implement interlinking arrangements.

Another type of interlinking arrangement is the currency arrangement. As discussed above, TIPS is a service that aims to provide a Europe-wide solution for the settlement of instant payments in central banks. By design the TIPS system is a multicurrency settlement platform, capable of processing the Euro and other currencies. This interlinking arrangement is made possible through the many PSPs participating in each of the countries involved. TIPS has exceeded its users’ expectations to provide multi-country fast-payment services, with large scale volume capacity (reaching more than 43 million transactions daily), instant payment execution (less than 5 seconds payment process), and fixed low-cost at 0.002 euros per transaction.

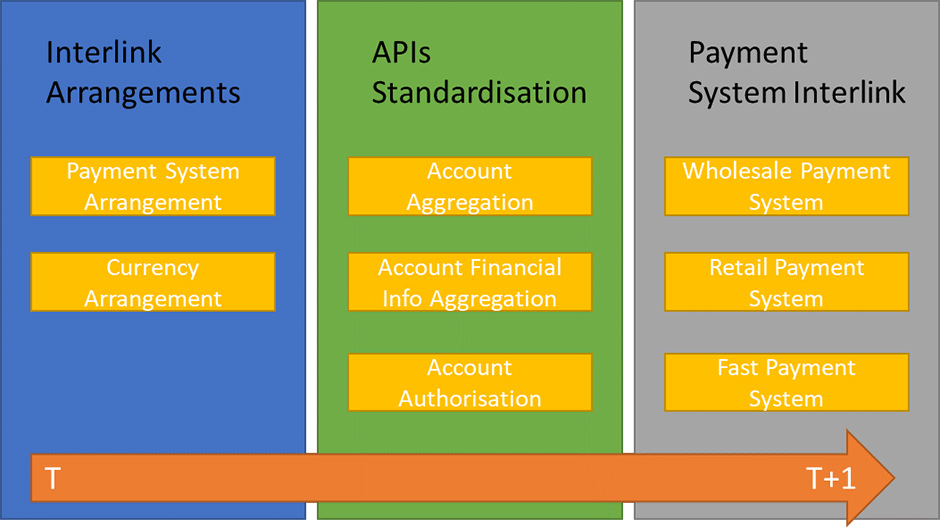

Based on these examples, it is clear to see that establishing an interlinking payment system is a very complex task. As a recommendation to the G20 to tackle this complicated task, we propose a framework that consists of three main parts: forming link types, APIs standardisation, and payment system interlinking (see Figure 3).

Figure 3: Detailed framework for Interlinking Payment Systems

Source: Authors’ own

The framework should be implemented in a timely manner, beginning with establishing interlink arrangements between participating countries. An arrangement between participant countries would be determined based on whether they choose a payment system or a currency arrangement.

Once the arrangement has been decided, a standardisation of APIs needs to be defined. When it comes to open banking schemes there are 3 data types critical to processing a payment interlink, including account aggregation, financial information aggregation, and account authorisation. There are a few considerations to be mindful of in API design, they are:

- Service API pattern: The API pattern designed based on the interactions between stakeholders, infrastructure, and the API itself (i.e., Service Agent, Service Façade, API Proxy, and API Gateway.)

- API protocols: API protocols cover the style used by the developer to establish the API’s communication protocols (i.e., SOAP, REST, gRPC, graphQL, and Falcor)

- API access level: API access level includes considerations regarding data sharing as regulated by regulatory authorities. This access can be categorised into:public, private and partner.

- Security considerations: API security mechanisms consist of:

- Authentication

- Access control

- Encryption

- Audit logging

Finally, a payment system interlink can be formed if implementation to wholesale, retail, or fast payment systems can be done in parallel or in stages. Using this framework of an interlinking arrangement, a country can decide it wants to integrate with other payment systems for both local and cross-border payments.

Interlinking payment systems using API may enhance cross-border payment system effectivity and efficiency. Digital technology innovations and improvements, alongside API standardisation will enable countries to plan their financial services expansion and create unique roadmaps, effectively disrupting globalisation within cross-border payments.

The impact of API standardisation on financial inclusion can be summarised as below:

- API standardisation enables interoperability, with various PSPs able to exchange data easily and seamlessly.

- It also promotes innovation. The developer may introduce innovative payment applications and services that promote new ideas in financial services. This includes innovation competition in financial services which in turn lowers costs and provides better services.

- Using standardised API, financial service providers ensure its compliance twith the regulations mandated.API standardisation enables data sharing. A common and standardised API can facilitate data sharing across different payment system platforms which also improves other associated financial services.

- Enabling competition between financial service providers also promotes more access to remote and undeserved areas.

Some examples of how API standardisation boost financial inclusion are:

- UPI by the Indian government: Since its launch in 2016, UPI has functioned as an open-source platform for peer-to-peer payments and money transfers between bank accounts using mobile phone numbers and virtual payment addresses. It has recorded more than 74.09 billion transactions in volume in 2022 (about a 91 percent rise compared to 2021) and has enabled small businesses to accept digital payment options including cross-country remittances.

- QRIS (Quick Response Code Indonesian Standard) by the Indonesian government: Preceded byi the penetration of QR payments by e-wallet service providers, a central-bank backed QRIS payment service provider has enabled small and medium enterprises to accept payments using QR code scanning. QRIS transactions has accounted for more than 1 billion transactions reaching 99.98 trillion Rupiah in 2022 alone.[11]

Based on these success stories, it is clear that API standardisation can promote greater financial inclusivity and prosperity for every country implementing it.

Attribution: Andi Nugroho and Suhono Harso Supangkat, “Improving Global Financial Inclusion: Implementing Open and Standardised API for Cross-Border Payments,” T20 Policy Briefs, July 2023.

[1] Bank for International Settlements, “Interlinking Payment Systems and the Role of Application Programming Interfaces: A Framework for Cross-Border Payments-Report to the G20,” BIS, 2022.

[3] Bank for International Settlements, “Enhancing Cross-Border Payments: Building Blocks of a Global Roadmap: Stage 2 Report to the G20,” BIS, 2020.

[4] G20 Indonesia, “G20 Bali Leaders’ Declaration,” November 2022.

[5] Financial Stability Board, “G20 Roadmap for Enhancing Cross-Border Payments: Priority Actions for Achieving the G20 Targets,” FSB, 2023.

[6] KPMG, “Pulse of Fintech H2 2021,” KMPG, 2022.

[7] KPMG, “Pulse of Fintech H2 2021”

[8] International Bank for Reconstruction and Development, “Considerations and Lessons for the Development and Implementation of Fast Payment Systems,” World Bank, 2021.

[9] International Bank for Reconstruction and Development, “Considerations and Lessons”

[10] BIS, “Interlinking Payment Systems”

[11] Adi Ahdiat, “QRIS Transactions Increase, Reach a New Record at the End of 2022,” Databoks, July 5, 2023.