Task Force 3: LiFE, Resilience and Values for Wellbeing

Abstract

There is under-investment in climate adaptation and resilience-building globally, as well as in the G20 countries. Consequently, the significant benefits of such interventions are not realised. Drivers of under-investment include lack of information on risks, the costs of addressing those risks, and the complete benefits of doing so. Climate adaptation and resilience-building interventions can enable governments, international financial institutions, and the private sector to make better investment decisions and close the financing gap. Building on work showing that the full benefits of many types of adaptation investments are far greater than often assumed and accrue even if the extreme event does not occur, this Policy Brief proposes actionable recommendations for incorporating a triple dividend approach into the economic and financial assessments of adaptation investments in a way that will facilitate their scaling up by the G20 countries as well as globally.

1. The Challenge

Globally, there is under-investment in climate change adaptation. According to the United Nations Environment Programme (UNEP), annual global financing needs for adaptation amount to US$160–340 billion by 2030 and up to US$565 billion by 2050.[1] Current levels of both domestic and international finance are inadequate to meet these needs. Under-investment is driven by incomplete information on climate risks, climate damages, and the benefits of risk reduction investments in the economy. Many investments in adaptation and resilience-building have much higher rates of return than often assumed due to the exclusion of benefits in light of projected extreme climate events. This knowledge gap also contributes to poor private sector understanding of the development benefits of adaptation investments that reduce business costs and risks. Mobilising sufficient public and private finance for climate adaptation and resilience-building therefore requires a more inclusive quantification of these benefits.

Cost-benefit analysis (CBA) is commonly defined as an economic and financial evaluation tool in which a quantitative analysis is performed to compare the costs and benefits (in monetary terms) of an intervention. CBA establishes whether the present value of the benefits of such an intervention (be it a project, programme, or policy) exceeds the present value of its costs. It is widely applied across the public and private sectors as well as by development finance institutions (DFIs) to conduct ex-ante appraisal and ex-post impact assessments of interventions. While the use of CBA had declined over the past two decades,[2] it is witnessing a resurgence due to its central role in impact assessments and in valuing externalities such as carbon emissions (using the social cost of carbon). The triple dividend of resilience (TDR) approach uses CBA to improve the benefits estimates of adaptation investments.

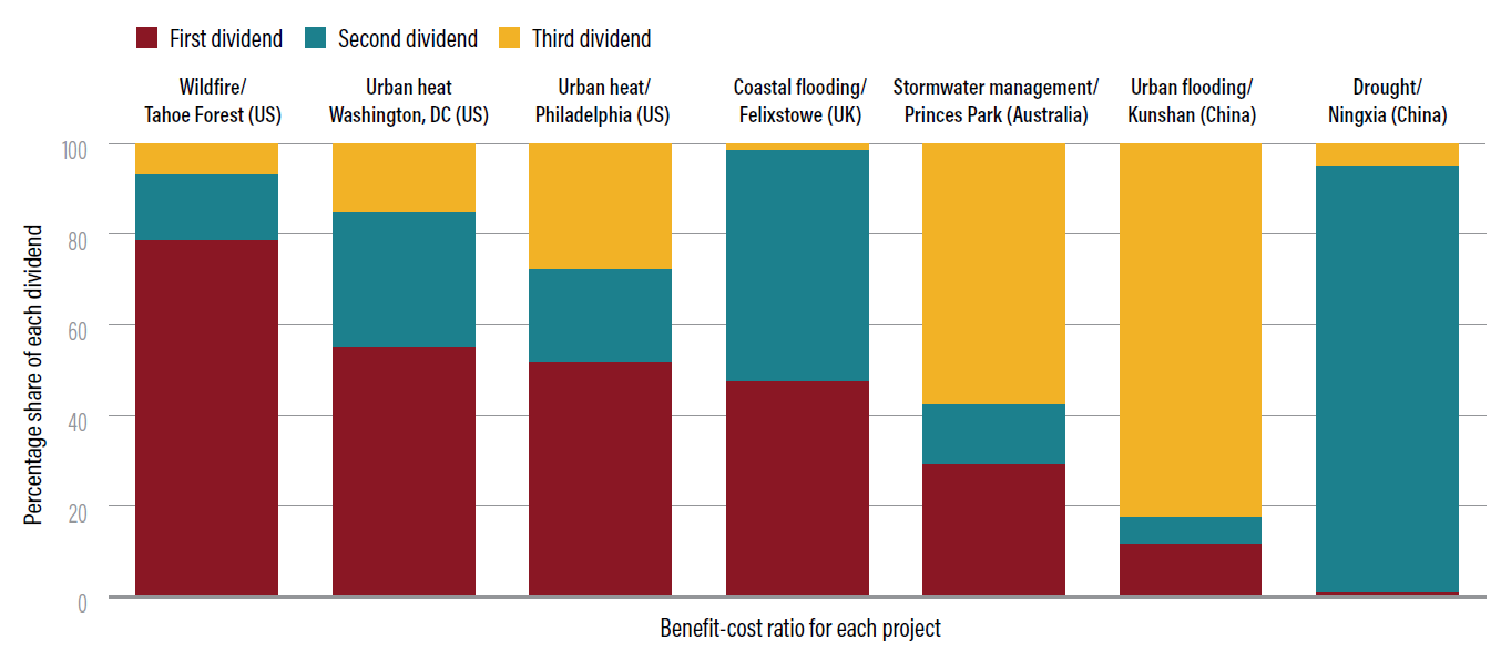

The TDR captures and quantifies the full economic, environmental, and social benefits of climate change adaptation interventions. It groups benefits along three dividends: avoided losses (first dividend), induced economic or development benefits (second dividend), and additional social and environmental benefits (third dividend) of adaptation actions.[3] The second and third dividends are especially important since they accrue regardless of whether the actual climate risk materialises.

Figure 1: Each dividend as a share of total project benefits

Source: Harald Heubaum et al., “The Triple Dividend of Building Climate Resilience: Taking Stock, Moving Forward,” Working Paper, World Resources Institute, 2022.

Application of the TDR approach across a number of cases has found that accounting for the full range of benefits across all three dividends can yield higher benefit-cost ratios (BCRs) for adaptation investments.[4] Traditionally unquantified second and third dividend benefits (including the distributional equity of projects and programmes) are often equal to or even greater than the avoided loss (first dividend) benefits (see Figure 1), generating BCRs greater than 1 even without considering the first dividend.[5] By revealing economic, environmental, and social benefits that are traditionally excluded, the triple dividend approach can help governments, DFIs, and the private sector address information market failures and catalyse the higher level of investing required to adapt at the necessary scale.

2. G20’s Role

Countries around the world are increasingly affected by the impacts of climate change. This is especially the case for vulnerable, low-income countries that are least able to deal with climate events due to a lack of institutional and financial capacities, but it also disproportionately affects middle- and lower-middle income G20 members. According to the Notre Dame Global Adaptation Initiative (ND GAIN) Index, India, Indonesia, South Africa, Mexico, and Brazil are the five most vulnerable G20 countries.[6] Successive G20 presidencies have consequently devoted more attention to adaptation and resilience-building as key concerns. For example, during Argentina’s 2018 G20 presidency, the Climate Sustainability Working Group (CSWG) emphasised the need for enhanced national adaptive capacity, better adaptation research, and improved adaptation and resilience investment planning.[7] The 2022 G20 Bali Leaders’ Declaration called for greater parity between climate adaptation and mitigation investments and better alignment of private and public financial flows, with a number of resilience objectives, including nature and biodiversity.[8] It further emphasised the need to identify cost-optimal interventions and capitalise on the varied co-benefits of adaptation actions, acknowledging that the understanding of such benefits needs to be improved at both a project and sectoral level.

The implications of the G20’s increasing prioritisation of adaptation and resilience extend beyond member countries. The G20 countries have significant influence over, and responsibility for, the terms and scale of international climate finance for adaptation. The G20 has been increasingly called out by the vulnerable 20 (V20) group of countries (which now numbers 58 countries) and others for large increases in available adaptation finance.[9] The G20 countries contribute to climate finance flows via several channels, including bilateral and multilateral DFIs as well as international funds. A recent review shows that there are 81 active climate funds, mostly G20-financed.[10] As of 2023, the top five contributors to the Green Climate Fund (GCF) are the United States, Japan, the United Kingdom, France, and Germany.[11]

3. Recommendations to the G20

Application of the TDR in the evaluation of adaptation interventions can help governments, DFIs, and a range of other financial actors: (i) identify and finance more cost-effective interventions for building resilience at home and abroad through improved project design and appraisal; and (ii) generate greater financial and political support for adaptation and resilience-building investments by mapping out their full range of public and private benefits. The five actionable recommendations below aim to increase the uptake of the TDR approach and guide its operationalisation during the life cycle of adaptation interventions:

- Require development banks and government ministries to use the TDR approach during project appraisals to more accurately reflect the various climate and development benefits of adaptation interventions.

The scope of economic and financial analyses conducted for adaptation and resilience-building interventions needs to be broadened to reflect all types of benefits more accurately and holistically. Both the public and private sectors can better guide their investment choices by considering economic, environmental, and social benefits in addition to potential losses avoided through adaptation interventions.

- Require the use of the TDR approach as a framework for interim and ex-post assessments to monitor and evaluate investment impacts and improve data availability.

While this would help governments monitor and evaluate investment impacts more holistically, it would also help improve the availability of data to implement the TDR approach in future projects.

- Build the capacities needed for government and donor institutions to undertake the TDR approach for improved investment decision-making and to impact evaluation.

To better achieve the first two recommendations, the G20 governments can work with multiple organisations that help build capacity and provide a project pipeline for adaptation investments, such as the Coalition for Disaster Resilient Infrastructure (CDRI), the Institutional Investors Group on Climate Change (IIGCC), and the UNEP Finance Initiative (UNEP-FI). - Raise awareness on the full benefits of adaptation investments, including those materialising in the absence of projected climate impacts.

Large, induced development benefits (the second dividend) are particularly important for attracting private-sector investment. Green infrastructure and resilience-building through nature-based solutions also generate high third dividends. The G20 governments should shift the debate towards this broader adaptation framework to help make the development case for scaling up adaptation-related investments.

- Use the TDR methodology to better distinguish between private and public benefits as a basis for designing blended finance approaches to adaptation investments.

TDR shows high rates of economic return on many adaptation investments but also shows high induced development benefits that can create financial returns to private-sector investors. Such mapping of economic and financial benefits can form the basis for increasing private participation in adaptation investments.

Each of these recommendations is elaborated below.

First, require the use of the TDR approach during project appraisals to more accurately reflect the various climate and development benefits of adaptation interventions.

While conducting CBAs is routine for assessing public investment projects, a more comprehensive assessment of costs and benefits attributable to adaptation and resilience-building interventions is not. The lack of useful data is an oft-cited reason,[12] as is the fact that forecasting multiple types of benefit streams over at least two decades is trickier than forecasting costs.[13] Gathering data where it does not yet exist can be a costly and time-consuming process. Another reason is the difficulty of estimating the full scope of all three dividends, including estimating induced development benefits under different economic growth scenarios, and non-market social and environmental benefits valued in monetary terms. Examples include estimating the value of the ecological benefits of a restored natural flood plain or the social benefits of evacuation centres that double as community centers. Such intangible, non-monetary benefits are often not captured by traditional CBA. However, data assessment and valuation tools have become increasingly sophisticated in recent years and more evidence from cases is publicly available. Researchers can not only learn about this newly available evidence but about its political and economic context.[14]

Encouraging the use of a TDR approach in CBA would provide useful guidance for data collection and simplify analysis along several well-defined indicators. The suggested improvements in CBA can be easily incorporated into the existing regulations of G20 governments’ and guidance concerning the type of analysis required during the design and appraisal of public investment projects.

Recent comparative analyses of adaptation and resilience interventions across sectors have revealed different assessment frameworks and methodologies to produce substantially different net present values (NPVs) and BCRs. This can complicate effective comparisons of policy and investment options and make it difficult for governments to decide between necessary trade-offs. Both the public and private sectors therefore need better guidance on appropriate methodologies. As the private sector currently accounts for less than 2 percent of tracked adaptation finance globally,[15] a TDR approach would help governments avoid bias in the selection of benefits for inclusion in the CBA as well as avoid a potential under- or over-evaluation of these benefits,[16] facilitating more effective use of government resources in catalysing private-sector investment in adaptation and resilience, both at home and abroad.

Second, require the TDR approach as a framework for interim and ex-post assessments to more comprehensively monitor and evaluate investment impacts and improve data availability.

Using the TDR approach for interim and ex-post project evaluations can help assess full project impacts across all categories of benefits, regardless of whether the anticipated climate events actually occur. While ex-ante CBAs of policy or investment projects and programmes are the norm, ex-post and interim assessments showing concrete impacts are still relatively uncommon. G20 and non-G20 governments can change this by requesting more ex-post and interim assessments (in the case of projects running for 20 years or more) of adaptation and resilience interventions.

Whenever possible, actual developments should be compared to the initial assumptions underpinning project appraisals. Such comparisons may find the latter to have been either too conservative or too ambitious. This is not only important to monitor and evaluate whether the intervention has produced actual value for money,[17] it can also help improve the following: (i) future ex-ante CBAs; (ii) national monitoring, reporting, and evaluation capacities, which can help improve communication and transparency on the sustainability and resilience benefits of investments in adaptation and resilience-building; and (iii) facilitate the use of performance-based or performance-linked financial instruments.

Third, build the capacities needed for government and donor institutions to undertake the TDR approach for improved investment decision-making and impact evaluation.

To support better decision-making, the G20 countries and others seeking to close the adaptation finance gap should build the necessary institutional capacities and capabilities to conduct and critically assess more comprehensive CBAs, as described in the first two recommendations. Doing so requires resources, for example to train officials on an ongoing basis and develop institutional guidelines or standards. To better achieve this, the G20 governments can work with multiple organisations that help build capacity and a project pipeline for adaptation investments, such as the CDRI, IIGCC, and UNEP-FI.

Capacity-building will also need to be complemented by the development of high-quality and up-to-date datasets relevant for effectively valuing benefits across the three dividends. Investments in such datasets and training officials to use and understand them will not only facilitate improved CBA and application of the TDR approach but also enhance the overall institutional capacity to monitor and report on social, economic, and environmental data, which is critical for attracting private investment, accessing public climate funds, and streamlining data for other reporting requirements such as progress on national development goals and the SDGs.

Fourth, raise awareness on the full benefits of adaptation investments, including those materialising in the absence of projected climate impacts.

Large, induced development benefits (the second dividend) are particularly important for attracting private-sector investment, since they show projected increases in productivity and jobs as well as lower costs of capital and insurance. Separately, green infrastructure and resilience-building through nature-based solutions also generate high third dividends. The G20 governments should help shift the debate towards this broader adaptation framework by helping populate reference materials on the full development benefits of climate adaptation investments, incorporating full benefits accounting into the deliberations of the G20 Infrastructure Working Group (IWG) and the Sustainable Finance Working Group (SFWG), and communicating the extent of those benefits across their climate stakeholders. This would help address the current problem of under-investment in climate adaptation, both within G20 countries and across the most vulnerable countries globally. The added value of the TDR approach flows from its ability to make visible many often unrecognised and under-researched benefits of adaptation and resilience-building interventions.

While decisions on which interventions to pursue require more work than identifying the presence of multiple dividends or, indeed, their quantification, the TDR approach contributes to a more rigorous and convincing evidence base for the value of adaptation and resilience investments. Policymaking is a complex political process involving a wide variety of stakeholders and requiring trade-offs between different goals. Increasing spending on certain budget items will usually require spending cuts elsewhere.[18] Such decisions are rarely purely evidence-based, but good economic and financial analysis is a critical element in helping officials make the right policy and investment choices. Evidence of the presence and size of multiple dividends of resilience interventions can help policymakers more effectively advocate for adaptation investments, as is often necessary within a context of scarce public resources.

Fifth, use the TDR methodology to better distinguish between private and public benefits as a basis for designing blended finance approaches to adaptation investments.

Due to its growing number of applications, the TDR approach can help the G20 countries and donors consider the paradox of high projected BCRs for multiple types of climate adaptation interventions but low levels of investment, particularly by the private sector. Deeper analysis would lead to a better understanding of how high induced development benefits (the second dividend) in particular can create financial returns for private-sector investors. Such mapping of private costs and benefits can form the basis for increasing the level of private participation in adaptation investments through appropriate blended finance and de-risking mechanisms.

Given the current under-investment in climate change adaptation, there are strong market barriers that constrain the understanding and planning of adaptation projects, including the lack of adequate information, capacity, incentives, and/or finance. Scaling up the TDR approach can help address the first three dimensions of these market barriers (information, capacity, incentives) and, in so doing, help attract increased levels of finance. Since there are many types of potential adaptation investments in every sector of the economy, there is no ‘one size fits all’. Nevertheless, TDR can help test ways to incentivise increased private investment in at least five different investment areas: infrastructure, cities, agriculture, nature, and financial services.

Attribution: Harald Heubaum, Carter Brandon, and Bradley Kratzer, “Improving Cost-Benefit Analysis to Catalyse Finance for Climate Adaptation and Resilience,” T20 Policy Brief, May 2023.

[1] UN Environment Programme, “Adaptation Gap Report 2022,” 2022.

[2] World Bank Group, “Cost-Benefit Analysis in World Bank Projects (English),” IEG Fast Track Brief, 2010.

[3] “Adapt Now: A Global Call for Leadership on Climate Resilience,” Global Commission on Adaptation, 2019.

[4] Harald Heubaum et al., “The Triple Dividend of Building Climate Resilience: Taking Stock, Moving Forward,” Working Paper, World Resources Institute, 2022.

[5] Harald Heubaum et al., “The Triple Dividend of Building Climate Resilience: Taking Stock, Moving Forward”

[6] “ND-Gain Country Index,” 2020. The Index defines vulnerability as a combination of exposure to climate hazards, the sensitivity of sectors and the population to these hazards, and a country’s adaptive capacity.

[7] “G20 Climate Sustainability Working Group Adaptation Work Program (2018-2019),” G20 Argentina, 2018.

[8] “G20 Bali Leaders’ Declaration,” G20 Indonesia, 2022.

[9] “V20 Ministerial Communique,” 2022.

[10] Philippe Le Houérou, “Climate Funds: Time to Clean Up,” Working Paper, Fondation pour les Études et Recherches sur le Développement International, 2023.

[11] “Status of Pledges and Contributions (Initial Resource Mobilization),” Operational Document, Green Climate Fund, 2023.

[12] Vinod Thomas and Namrata Chindarkar, Economic Evaluation of Sustainable Development (Singapore: Palgrave Macmillan, 2019).

[13] Jon Stern, “Cost-Benefit Analysis: Past, Present and Future,” Bennett Institute for Public Policy (blog), November 1, 2022.

[14] Thomas Tanner et al., “Influencing Resilience: The Role of Policy Entrepreneurs in Mainstreaming Climate Adaptation,” Disasters 43, no. S3 (2019): S388–411.

[15] Barbara Buchner et al., “Global Landscape of Climate Finance 2021,” Climate Policy Initiative, 2021.

[16] Harald Heubaum et al., “The Triple Dividend of Building Climate Resilience: Taking Stock, Moving Forward”

[17] See, e.g., “Green Book Supplementary Guidance: Value for Money,” HM Treasury, 2022.

[18] Christopher Adolph, Christian Breunig, and Chris Koski, “The Political Economy of Budget Trade-Offs,” Journal of Public Policy 40, no. 1 (2020): 25–50.