Task Force 4: Refuelling Growth: Clean Energy and Green Transitions

Achieving net-zero carbon emissions by 2050 creates a US$27 trillion market for clean energy, but climate-vulnerable markets may miss out due to opaque, overly complex power project contracts. Transparent and standardised contracts can accelerate clean energy deployment by reducing information asymmetry between project developers and host governments. Addressing climate change and the energy needs of 3 billion people depends on massively scaling clean energy investment. However, success may be hindered if power project contracts are negotiated privately, hiding the true costs and risks. The G20 should commit to creating a global standard for power contract disclosure and transparency to operationalise Principle 6 of the G20’s Principles for Quality Infrastructure Investment. Governments, investors, and lenders should adopt standardised contracts and make them publicly available. This Policy Brief draws from a white paper authored by Todd Moss and Mohamed Rali Badissy, both of whom are authors of this Brief.

1. The Challenge

Energy infrastructure is an essential and costly prerequisite to development.[1] Most mature energy markets make a wealth of data about electricity contracts and pricing publicly available, which helps drive down prices, speed up procurement, and improve service quality. Yet, the status quo across many emerging markets is the opposite. In many countries, the norm is unsolicited procurement of new power generation, with the details of the underlying electricity contracts almost never disclosed. Specifically, the standard contract for developing electricity infrastructure—the power purchase agreement (PPA)—is often negotiated, signed, and implemented without any public knowledge, despite the fact that the public ultimately bears the costs in the form of higher electricity tariffs and/or increased public debt. This contract secrecy has enormous negative impacts. The following analysis relies heavily on a white paper authored by Todd Moss and Mohamed Rali Badissy, who are both authors of this Brief.[2]

First, the lack of contract transparency slows the deployment of new clean energy projects. Attracting the volume of private capital needed for the global transition to renewable energy will depend on markets that can accelerate procurement, drive down prices, and provide clarity to investors. With clear information about how electricity is produced and purchased, officials can make sound long-term decisions to accelerate clean energy and investors can react to market signals. Without that information, problematic projects often erode investor confidence and clog the project development pipeline. Thus, while mature clean energy markets are growing globally, annual energy investments in emerging markets[3] have fallen by around 20 percent since 2016.[4]

Second, the fallout from non-transparency, including contract cancellations, forced renegotiations, effective expropriations, and other legal conflicts, places a significant burden on project developers and raises the risk premium of investing in the very markets that need the most capital. In 2022, Mexico announced plans to renegotiate PPAs amidst presidential claims of paying “too much for those contracts.”[5] Kenya, Ghana, Nigeria, and other countries are also seeking to renegotiate previously agreed power contracts. This harms both investors (by eroding faith in contract sanctity) and host governments (by raising the risk-adjusted cost of capital). While PPA disclosure would not eliminate contract risk, it would substantially reduce it by increasing trust amongst all stakeholders.

Third, secret electricity contracts are costly because they lead to poor pricing. The lack of clear price discovery by comparison to market data reduces the pressures for least-cost procurement and creates a moral hazard for negotiators. While the average global costs of solar and wind are rapidly declining, emerging markets such as Kenya[6] and Bangladesh have seen renewable energy tariffs rise rather than fall as increased legal and financial costs outweigh the savings from falling technology prices.

Fourth, undisclosed contracts hinder effective power-sector planning, which leads countries to procure more power capacity than they need and undermine the financial viability of the entire market. Many power projects are financed on long-term take-or-pay contracts, which means that the offtaker (usually a utility) or government guarantor must pay for generation capacity even if it is not needed. Between 2011 and 2016, opaque electricity procurement in Ghana resulted in parallel negotiations by disparate government agencies, leading to the signing of 43 different PPAs and excess generation capacity. As a result, the government paid over US$600 million in 2019 for power it could not use.[7] Bangladesh also paid over US$1.1 billion in excess capacity charges in 2019 for idle plants.[8]

Finally, the public guarantees required to finance power projects in most emerging markets create substantial risk of ‘hidden debt’. PPAs often contain huge contingent liabilities buried inside the contracts that only come to light upon default. Without transparency, both within governments and vis-à-vis the public, the unaccountable assumption of these significant liabilities’ risks weaken sovereign finances and burden power consumers with higher prices.[9] For example, Zambia’s review of its debt stock found about US$1.2 billion in unpaid arrears from PPAs.[10] Similarly, Ghana’s energy sector debt reached US$2.8 billion in 2018, with 30 percent payable to the private sector, and is currently negotiating a US$3 billion economic bailout from the International Monetary Fund (IMF), which would require restructuring about US$1.4 billion in PPA arrears.[11]

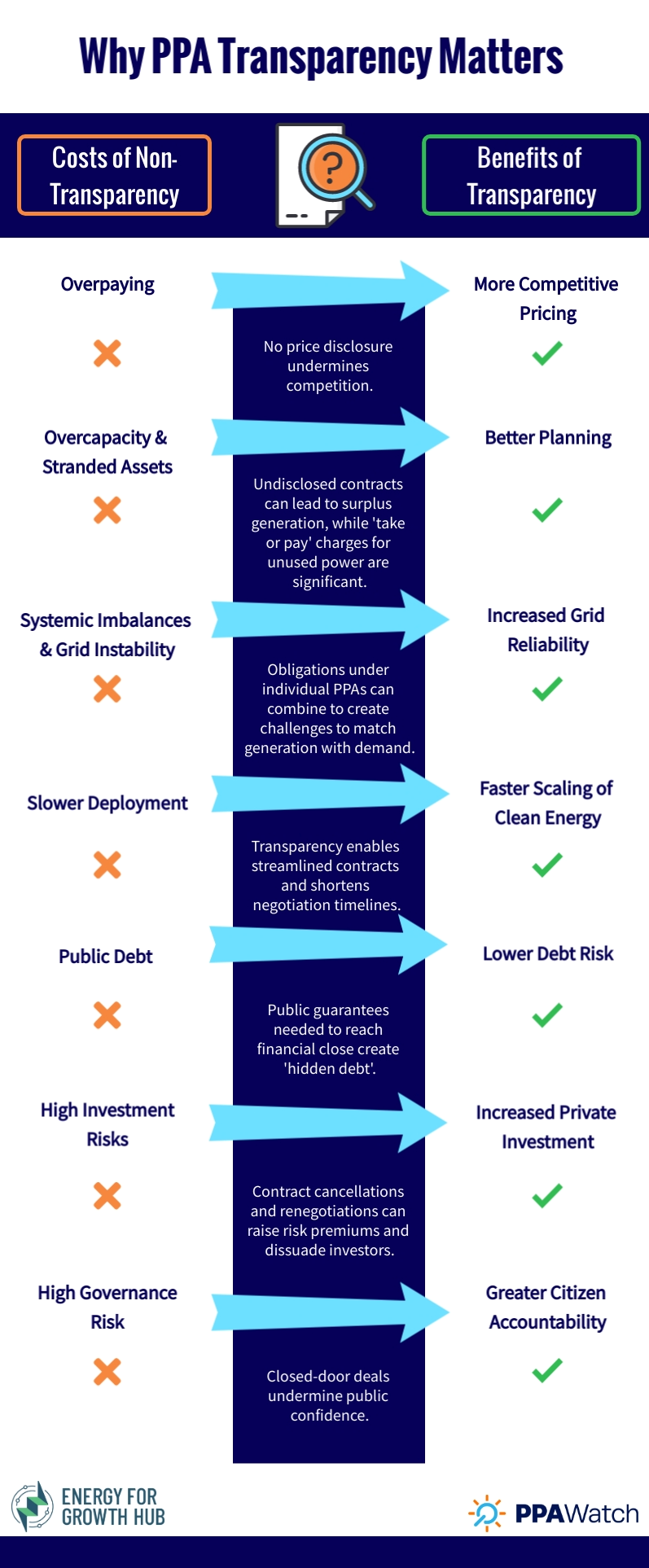

The costs and risks generated by opaque power contracts slows the pace of clean energy deployment and undermines power sector governance which, in turn, impacts economic growth, poverty reduction, and decarbonisation. Figure 1 highlights the challenges that opaque power markets face and demonstrates the benefits of contract transparency.

Figure 1: Why PPA Transparency Matters

2. The G20’s Role

Transparency of power contracts is fully aligned with the G20 Principles for Quality Infrastructure Investment, especially Principle 6: Strengthening Infrastructure Governance, which states as follows:

“Transparent, fair, informed and inclusive decision-making, bidding and execution processes are the cornerstone of good infrastructure governance. Greater transparency, including in terms of financing and official support will help ensure equal footing in the procurement process. A wide range of stakeholders such as users, local population, civil society organisations, and the private sector, should be involved.”

Endorsing minimum contract disclosure standards for PPAs would support the efforts of the G20 government policymakers and planners, investors, and development finance institutions to accelerate energy market development and reap the benefits of open competition. Access to information and data is necessary to enhance cost and benefit analyses and improve government decision-making and policy monitoring.[12] The objective is to create positive incentives, improve governance, accelerate project development, reduce transaction costs, and ultimately, deliver cheaper and more reliable power for people and businesses.

Transparency can help. Contract disclosure is a straightforward, zero-cost way to help make energy markets work better.

- Transparency will make clean energy cheaper and help markets scale faster. Reaping the benefits of competition requires prices to be known, not kept secret. Deployment cannot happen quickly if every contract is negotiated over years behind closed doors. Greater disclosure would help the market work more efficiently by establishing standards and encouraging countries to utilise proven contract models. There is growing evidence that open contracting in other sectors has revolutionised public procurement, resulting in huge savings and improving market competition.[13] The same benefits should occur in clean energy.

- Transparency will clear the pipeline for new and better projects. Secret contracts often clog the system with projects that are poorly conceived, overpriced, or that never get built. This backlog increases both costs and risks for developers and shuts many of them out of the market entirely. Even when renewable projects are procured with some degree of transparency, they often compete against others that are not procured with the same level of transparency. Cleaner power projects cannot scale in such a market despite their cost advantage. Commonly agreed transparency norms would raise the bar for all projects and help governments distinguish high-quality investors from investors that prefer to operate in opaque, closed environments.

- Transparency will help countries plan for a low-carbon energy system. Without clear information about how electricity is being produced and purchased, officials cannot make sound long-term decisions required to end energy poverty and combat climate change.

Electricity production uses similar technologies worldwide, so data on contract models and costing from analogous negotiations elsewhere can help spread better practice and help set expectations regarding reasonable costs and terms. These benefits of transparency are also reflected in the global effort to standardise PPAs to expedite contract negotiations and ensure the inclusion of critical terms based on recent growth in areas such as renewable energy and battery storage.[a]

Enhancing contract transparency in the power sector also aligns with the recommendations of the Independent Review of Multilateral Development Banks’ Capital Adequacy Frameworks. Specifically, Recommendation 5 calls for increased access to MDB data and analysis and the creation of “an enabling environment for reform through greater transparency and information.”[14] The G20 has already recognised how transparency of information will make MDBs more effective and increase shareholders; a similar level of transparency on how MDBs are structuring the money they lend (to power projects) should be prioritised.

Greater disclosure will help improve future negotiations both by strengthening contract structuring and by setting the expectations of firms, investors, citizens, and governments to uphold market norms for power projects.[15] The more information that is known about an individual project, the more benefit it will provide for comparison. In an open, competitive market, independent power producer (IPP) costs (and the terms included in any related PPA) would allow for clearer benchmarking. At the sectoral level, transparency regarding system capacity and pricing models will allow outside parties to reconcile predicted energy demand with the pipeline of power projects, thus reducing the risks of overcapacity and focusing utilities’ negotiations on value rather than volume.

Contract disclosure has proven to be hugely beneficial in the extractives sector[16] and in public procurement. Power contracts are just another form of procurement, so why not expect the same level of transparency and accountability in the electricity sector? Governments, investors, and civil society already recognise the importance of contract disclosure in other sectors, especially extractives. Investors, development finance institutions, and regional banks should aim to apply the same standards to the power sector. This scrutiny is critical, especially now, when the way in which power plants are developed will determine so much about our collective future.

3. Recommendations to the G20

The G20 should create and endorse new disclosure norms for PPAs and related power contracts.

In emerging and developing markets, PPA disclosure will compress negotiation timelines and generate information and insights that enhance governance outcomes.

There is no best practice in competitive power procurement and contract disclosure practices, as markets at different levels of development require specific procurement processes that are better suited to them. The core principle is that all contracts should be publicly available; basic project information would be released when the contract becomes effective, followed by publication of the PPA (redacted where absolutely necessary) within one year of financial close (Appendix 1).

The World Bank’s Framework for Disclosure in Public-Private Contracts[17] already provides a detailed list of recommended disclosures for all public-private partnerships, including PPAs, from pre-tender documents that incorporate project pipeline details, tenders and requests for proposals, and draft contracts and project reports, to aspects of the contract covering financial information, government support, tariffs, performance metrics, termination, and renegotiation.

Specific information to be disclosed

The basic principle for contract disclosure norms should be maximum transparency in the maximum number of circumstances. Transparency should be the norm any time a proposed project has a public financial obligation or substantial implications for public services, particularly in emerging markets where utilities remain (at least partially) state-owned or their financial obligations are state-guaranteed.

Disclosure would occur on a mutual basis, with governments agreeing to publish PPAs through their regulatory authorities and funders of private generation projects, waiving any confidentiality concerns.

The foundational principle of PPA transparency is that independent observers should be able to understand and verify who is being paid how much and for which services. This should apply both ex-ante according to contract details (what is in the contract itself) and ex-post during the actual life of the contract (how the project is performing against the contract).

Disclosure should ideally include putting into the public domain the entire power purchase agreement, subsequent amendments/addendums, and related ‘direct agreements’ between producers, offtakers, lenders, and host governments. These documents can be redacted where absolutely necessary for commercial confidentiality, but the default should be maximum disclosure.

In addition to contract disclosure, publicly available data should be made available and cover the following critical information (Appendix 1):

- Basic information released upon signing, including project location, effective dates, signatories to the PPA, award process, technology, installed capacity and expected generation capacity factor, and agreed project milestones.

- Contract terms released within one year of financial close, including payments such as signature bonuses, fixed and variable payment formulas, tax and public-sector finance provisions, government and international financing, public guarantees, performance and related penalties, and termination, force majeure, and decommissioning.

Appendix 1: Proposed Project Disclosure and Contract Terms At the Time of Signing: Basic Project Information

- Project name & location: ______________________________________

- Status: ❑ Operating ❑ Under construction ❑ Signed ❑ Proposed ❑ Other_________

- Award process: ❑ Competitively bid ❑ Directly negotiated ❑ Other ______________

- Signatories: Generator: ❑ Known _______________________________ ❑ Unknown

Offtaker: ❑ Known _______________________________ ❑ Unknown

- Dates: PPA signing __________ Commissioning ___________ Term ____________

- Technology: ❑ Hydro ❑ Solar ❑ Wind ❑ Geothermal ❑ HFO ❑ Diesel ❑ Gas ❑ Coal

❑ Hybrid ____________________ ❑ Other ____________________

- Installed capacity _____ MW and projected average capacity factor ________%

- Government guarantees ❑ None ❑ Direct ❑ Via utility ❑ Other _______________

Within one year of financial close, publish the PPA in full (redacted where necessary) or at least disclose core terms, including:

- Government financing: Amount US$______________ Terms: ❑ Grant ❑ Loan.

If loan, Term ______ Rate _______ Grace period_________

- Official international financing: Amount total US$______________

Number of agencies: ___

Each agency: Name: _______________

Type: ❑ Grant ❑ Loan ❑ Equity ❑ Guarantee

Financing terms: ____________________________________

- Ownership: government_____ %, firms _________% Names of all owners with % _________________________________________

- Special terms: ❑ Tax holidays __________ ❑ Accelerated depreciation __________

- Inclusion of specific clauses related to

❑ Arbitration ___________________

❑ Governing jurisdiction _________________________

❑ Limits on transfer of interest ____________________

❑ Disclosure of transfer of interest required? ❑ Yes ❑ No

❑ Restrictions on future changes to taxes? ❑ Yes ❑ No ______________________

❑ Restrictions on future changes to regulations? ❑ Yes ❑ No_____________________

- Payment obligations for the offtaker

❑ Take-or-pay ❑ Peaker ❑ Alternative ___________________________________

Pricing formula ❑ Undisclosed ❑ Disclosed _______________________________

- Termination costs (force majeure or breach of contract) _____________________________________________________________

- Other payment obligations resulting from disruption of project operations ________________________________________________

Additional data for disclosure: Market environment information

- Legal obligation to disclose any PPA information

❑ Law to disclose

❑ Policy to disclose

❑ Parliamentary oversight

❑ Parliamentary approval of guarantees

❑ Securities filings

❑ Other_____________________________________________

- Public availability of any market information:

❑ National demand forecasts

❑ Sector planning documents

❑ IPP selection process

❑ Related procurement plans

❑ Other_____________________________________________

- Public disclosure of any relevant surrounding agreements:

❑ Construction contracts

❑ Concession agreements

❑ Grid connection agreements

❑ Fuel contracts

❑ Government financing agreements

❑ Sovereign support/other credit support agreements

❑ Other_____________________________________________

- Clarity on payment obligations for the offtaker Hypothetical prices paid per available kWh if:

(a) zero power is supplied to the offtaker_________ $/kWh

(b) all power is supplied to the offtaker _________ $/kWh

Attribution: Mohamed Rali Badissy et al., “Harnessing the Power of Transparency: G20 Global Disclosure Standards for Power Sector Contracts,” T20 Policy Brief, July 2023.

Endnote

[a] A sample of PPA standardisation efforts include Power Africa’s Understanding handbooks series.; Open Solar Contracts ; and Scaling Solar.

[1] Anton Eberhard et al., Independent Power Projects in Sub-Saharan Africa: Lessons from Five Key Countries (Washington DC: The World Bank, 2016).

[2] Mohamed Rali Badissy, Charles Kenny, and Todd Moss, “The Case for Transparency in Power Project Contracts: A Proposal for the Creation of Global Disclosure Standards and PPA Watch (Revised Version),” Energy for Growth Hub; Centre for Global Development, August 17, 2022.

[3] Ashoka Mody, “What is an Emerging Market?,” IMF Working Papers, 2004.

[4] International Energy Agency, Financing Clean Energy Transitions in Emerging and Developing Economies (IEA, June 2021).

[5] Reuters and Dave Graham, “Mexican President Plans Renegotiation of Power Industry Contracts,” Reuters, March 3, 2021.

[6] EED Advisory & Energy for Growth Hub, “Enhancing Public Participation in Kenya’s Power Purchase Agreement Process,” Energy for Growth Hub, 2021.

[7] Ishmael Ackah et al., “A Case Study of Ghana’s Power Purchase Agreements,” Energy for Growth Hub and Institute of Economic Affairs, 2021.

[8] Simon Nicholas and Sarah Jane Ahmed, “Bangladesh Power Review: Overcapacity, Capacity Payments, Subsidies and Tariffs Are Set to Rise Even Faster,” Institute for Energy Economics and Financial Analysis, May 19, 2020.

[9] Todd Moss and Rushaiya Ibrahim-Tanko, “The Other Hidden Debt – How Power Contract Transparency Can Help Prevent Future Debt Risk,” IMF (blog), June 21, 2022.

[10] International Monetary Fund, Request For An Arrangement Under The Extended Credit Facility—Press Release; Staff Report; Staff Supplement; Staff Statement; And Statement By The Executive Director For Zambia, Country Report No. 22/292, IMF, September 6, 2022.

[11] Moses Mozart Dzawu, “Ghana Power Firms Reject Move to Restructure $1.4 Billion Debt,” Bloomberg, March 23, 2023, https://www.bloomberg.com/news/articles/2023-03-23/ghana-power-firms-reject-move-to-restructure-1-4-billion-debt.

[12] “Open Contracting: Impact and Evidence,” Open Contracting Partnership (OCP), accessed April 2023.

[13] Centre for Global Development (CGD), Publishing Government Contracts: Addressing Concerns and Easing Implementation (Centre for Global Development, November 10, 2014).

[14] Independent Expert Panel convened by the G20, Boosting MDBs’ Investing Capacity – An Independent Review of Multilateral Development Banks’ Capital Adequacy Frameworks (Global Infrastructure Hub, October 1, 2022).

[15] Amanda Peterson Corio and Donna Calderon, “One Small Step for RFPs, One Giant Leap for Clean Energy,” Google Cloud [blog], March 15, 2023.

[16] Extractives Industries Transparency Initiative (EITI).

[17] World Bank, A Framework for Disclosure in Public-Private Partnerships: Technical Guidance for Systematic, Proactive, Pre -& Post Procurement Disclosure of Information in Public-Private Partnership Programs, (Washington DC: World Bank, March 30, 2022, updated July 14, 2022).