Task Force 5: Purpose & Performance: Reassessing the Global Financial Order

Steeper cuts to energy emissions will be needed to limit the average global temperature rise to 1.5˚C, and shifting public financial flows away from fossil fuels towards clean energy will be key to bridge the ‘Great Green Gap’. Greening public financial institutions (PFIs) will be critical to scaling financing for the Sustainable Development Goals (SDGs) and crowd in private capital. Through examining recent trends and select case studies on energy finance, this Policy Brief proposes solutions to improve data transparency on the portfolio emissions of PFIs, reform the international climate finance architecture, and build capacity among national and subnational PFIs through technical assistance programs to evaluate climate risks and green their portfolios. These solutions can strengthen the existing commitments of the G20 member states and inform G20 Working/Expert Groups.

1. The Challenge

a. Continued public investments in fossil fuels

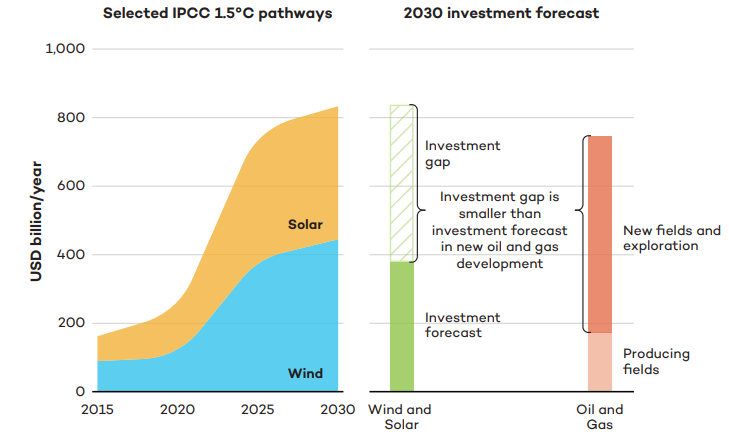

Energy-related CO2 emissions continued to grow in 2022, reaching a new high of over 36.8 Gt.[1] Limiting global warming to 1.5˚C would require steeper cuts to energy emissions by shifting financial flows away from fossil fuels and towards clean energy.

Current policies are only expected to deliver a cumulative US$380 billion in annual investments in wind and solar energy by 2030.[2] This will leave a ‘Great Green Gap’ of more than US$450 billion (Figure 1). However, this gap can be filled by shifting investments in new oil and gas development and exploration, estimated at US$570 billion annually, since new oil and gas development and exploration are incompatible with the goal of limiting warming to 1.5˚C.[3],[4]

Source: Kursk et al. (2022)

b. Limited bottom-up transparency and data reporting across energy investments to shift public financial flows

Energy investments rely heavily on scarce public sources of finance channelised by state actors—government budgets, investments by state-owned energy companies, and PFIs[a] such as Development Financial Institutions (DFIs), Export Credit Agencies (ECAs), and state-owned development banks.[5],[6],[7] Additionally, most quantified energy investments are based on top-down estimates rather than actual bottom-up financial flows.

Few financial trackers have attempted to bridge this knowledge gap in tracking the progress on Article 2.1(c) of the Paris Agreement through bottom-up exercises. These are mostly narrow in scope, resource-intensive, and track commitments rather than actual disbursements due to limited transparency, making it hard to estimate actual progress.[8] Prominently, they do not cover the full energy value chain and lack disaggregation by different state actors such as those identified above.

c. Greening PFIs in energy transition continue to be lacking

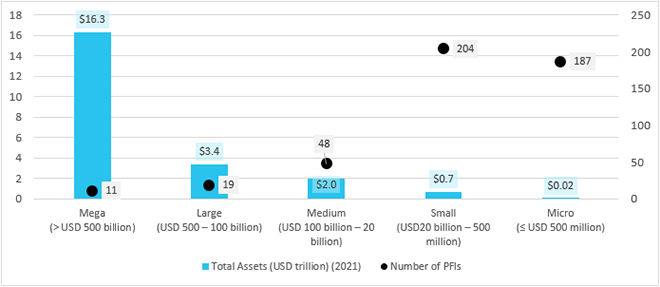

While there has been considerable effort towards reforming government budgets and designing transition pathways for state-owned energy companies, there is little research and transparency regarding energy investments by PFIs. PFIs can take many shapes and sizes, including multilateral development banks (MDBs), DFIs, ECAs, national development banks (NDBs), and sub-national development banks. However, there are no comprehensive databases of PFIs globally,[9] and till date, they remain the most under-researched state actors[10] in addressing the ‘Great Green Gap’. The only database on PFIs identified at least 528 PFIs with US$22 trillion in assets in 2021,[11] accounting for 10 percent of annual investments globally (Figure 2). Of this, at least 165 PFIs were in G20 member states, with US$19 trillion in assets, making the G20 an important grouping in energy transition.

Figure 2: Types of PFIs and Total Assets as of 2021

Note: The total assets for 59 PFIs were unavailable as of Q1, 2023, and have been excluded from the table.

Source: Authors’ own, created using data from the PDB and DFI Database, Q1 2023

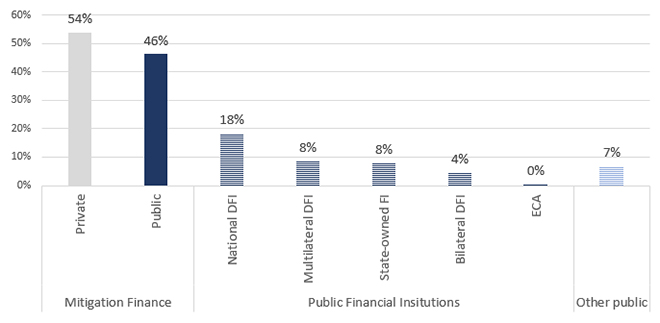

Further, of the total US$571 billion in mitigation finance in 2019-20, which mainly comprises clean energy and clean transport finance, PFIs committed 39 percent, amounting to US$224 billion—the highest among public sector sources (Figure 3).[12] Similar disaggregation and reporting data is not available for fossil fuel financing by PFIs globally, which indicates a critical gap in tracking and aligning public financial flows for energy to meet the Paris Agreement goals.

Figure 3: Mitigation Finance Provided by PFIs in 2019/20 (Percentage Share of Total)

Note: ‘Other public’ includes government budgets, multilateral climate funds, and state-owned energy companies.

Source: Authors’ own, created using data from Naran et al. (2022)

2. The G20’s Role

The G20 has led fossil-fuel subsidy reform commitments since 2009.[13] With India’s G20 presidency, the grouping must use the opportunity to extend these reform commitments to other forms of government support such as financial support provided through PFIs. For this, the G20 member states, through the G20 Data Gaps Initiative 3, should encourage their PFIs to go beyond operational net zero targets (Scope 1, 2) to reduce financing-related portfolio emissions (see Recommendation 1).

The year 2022 marked a significant milestone for India: for the first time, the G20 presidencies had three Emerging Markets and Developing Economies (EMDEs), in Indonesia, India, and Brazil.[14] With India, Brazil, and South Africa forming the next G20 Troika, this is an opportune moment for the Global South to highlight the urgency of reforming global climate financial architecture, shifting mega public financial flows away from fossil fuels and towards green PFIs to crowd in private capital. The G20 Expert Group on Strengthening MDBs constituted under India’s G20 presidency is a welcome initiative in this direction.[15] The Expert Group can draw on findings in this Policy Brief (see Recommendation 2).

Finally, the Green Development Pact proposed by India in its 2023 presidency and the G20 Sustainable Finance Working Group are both considering ways to mobilise higher climate finance for clean energy technologies. The G20 could, therefore, play a leadership role in bridging emerging knowledge gaps for national and sub-national PFIs in the Global South to scale sustainable finance through technical assistance and capacity-building programs (see Recommendations 3, 4).

3. Recommendations to the G20

This Policy Brief proposes recommendations to the G20 based on four key pillars.

Pillar 1: Data transparency and reporting

Recommendation 1: The G20 member states and the Data Gaps Initiative 3 must ensure that they encourage PFIs to improve data transparency and climate reporting on portfolio emissions

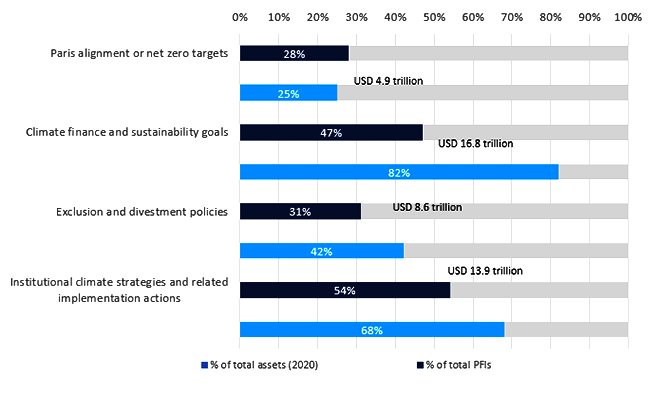

A review of the 70 largest PFIs (with US$20 trillion in assets) show that only 20 PFIs, holding 25 percent of tracked assets, have set net zero or Paris-alignment targets (see Figure 4).[16] This is significant since, on average, 97 percent of the emissions of financial institutions are in their portfolio rather than operations.[17]

Figure 4: Climate Commitments of PFIs by Percentage of Institutions Tracked and Total Assets Held (2020)

Source: Pinko et al. (2022)

Recommendation 7 of the G20 Data Gaps Initiative 3 emphasises the need to track the level of expenditures incurred by financial institutions.[18] This Brief argues that any such tracking for energy investments takes into account all expenditures across the energy value chain and includes a split for fossil fuel and clean energy financing; tracking one without adequate reporting on the other will not lead to necessary emission reduction. Such disclosures by state actors can supplement the efforts in tracking the progress of G20 member states towards Nationally Determined Contributions and enable a shift in public financial flows.

Pillar 2: Reforming international climate finance architecture

Recommendation 2: The G20 Expert Group on Strengthening Multilateral Development Banks must ensure that MDBs join the Glasgow Statement to enable mega public financial flows to shift towards clean energy

Between 2019 and 2021, MDBs[b] provided, on average, US$4.6 billion a year to fossil fuel projects (Figure 5).[19] While this is a significant decrease from previous years, continued support to fossil fuels by MDBs acts as a significant subsidy to the industry on a per-dollar basis, given the high concessionality associated with MDBs relative to other kinds of PFIs. Additionally, the absence of MDBs, except for the EIB, from the Statement on International Public Support for the Clean Energy Transition (Glasgow Statement) is also concerning.[20]

Figure 5: Fossil Fuel Versus Clean Energy Support from MDBs, Annual Average 2019-2021 (US$ million)

Source: Oil Change International (2022)

| Box 1: The ‘network effect’ of the Glasgow Statement

At the Conference of Parties (COP) 26, 34 governments[c] and five PFIs,[d] including many G20 states, signed the Glasgow Statement, committing to ending all new international financial support for unabated coal, oil, and gas by the end of 2022.[21] As the first international commitment to include not only coal, but also oil and gas, the Glasgow Statement explicitly extends to signatories’ votes and voting guidance on energy-related projects and policies through the boards of MDBs. At the European Bank for Reconstruction and Development and Inter-American Development Bank, signatories of the Statement hold over half of the voting rights, followed by 45 percent at the World Bank Group, 38 percent at the African Development Bank, and 35 percent at the Asian Development Bank (ADB).[22] This is an innovative approach to encourage dialogue with non-signatories about all fossil fuel phase-outs and shift mega public financial flows towards clean energy.[23] Therefore, the G20 Expert Group on Strengthening MDBs must encourage MDBs that have not joined the statement to shift mega public financial flows towards clean energy. Note: While aligning with the Glasgow Statement implies applying strict financing exclusions across the value chain, it allows for exceptions in “limited and clearly defined circumstances that are consistent with a 1.5˚C warming limit and the goals of the Paris Agreement.”[24] Hence, signatories can design exemptions that fit the context of their areas of intervention while aligning with the 1.5˚C ambition, if at all needed in the near term. |

While overall energy finance by MDBs has gradually increased on the clean energy side, in 2021, 58 percent of the financing was committed to EU countries (mainly driven by EIB due to its higher asset base) (Figure 6),[25] with the most financing taking the form of investment loans. Additionally, the co-finance multiplier for MDB climate finance in low and middle-income countries (LMICs) is only 0.86, compared to 1.83 in high-income economies.

Figure 6: MDB Energy Finance Commitments Across Regions (as a Percentage Share of Total Clean Energy Finance in 2021)

Source: Authors’ analysis, created using data from European Investment Bank (2022)

Such findings partly represent the geographical imbalance in broader MDB climate finance, raise concerns on the mandates of MDBs, and highlight the unmet financial needs of LMICs. This shows that the G20 Expert Group on Strengthening MDBs must recommend MDBs to enable market creation and plan green financial sector initiatives in LMICs to crowd in private capital for clean energy. It is vital that higher clean energy finance channelised through MDBs does not lead to debt sustainability concerns and unintended effects on macroeconomic and financial stability for LMICs.

Pillar 3: Scaling clean energy finance

Recommendation 3: The Green Development Pact should evaluate the higher use of transaction-enabling mechanisms to scale clean energy finance

Transaction-enabling mechanisms (TEMs) are interventions by a public entity that do not finance a project directly or put public funds at risk but facilitate investment from other actors, private or public.[26] Transaction enablers are purely catalytic, and no contingent liability is assumed by public funds. Typical instruments include warehousing and pooling, offtake agreements, blending, and syndication.

TEMs are typically more complex (as shown in Box 2) than risk mitigation mechanisms (RMMs) where PFIs make direct use of public finance. Given the rising debt sustainability concerns in EMDEs, this Brief argues that the Green Development Pact must focus on developing more transaction enablers such as country platforms and blended finance facilities to scale green finance in EMDEs.

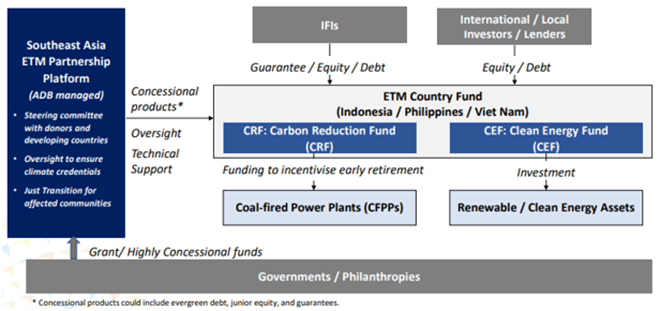

| Box 2: Energy Transition Mechanism (ETM), ADB

In November 2021, the ADB launched the ETM on the sidelines of COP26 in Glasgow to accelerate Southeast Asia’s clean energy transition.[27] ETM is a market-based, blended finance approach. As the nodal administrative agency for ETM, ADB is responsible for (i) conducting pre-feasibility studies to identify coal plants to be prioritised for early retirement or repurposing, (ii) estimating the size of the ETM, and (iii) conducting an initial policy/regulatory analysis, to be followed by a full feasibility study for assets. Different financial institutions such as multilateral banks, private sector institutional investors, philanthropic organisations, and long-term investors are, in turn, expected to provide capital for ETM. Figure 7: ETM and the Role of ADB  Source: ADB (2022) Within two years of its conception, ADB signed a Memorandum of Understanding with Cirebon Electric Power, PT Perusahaan Listrik Negara, and Indonesian Investment Authority at the G20 Leaders’ Summit in Bali in 2022 to begin discussions on the retirement of Cirebon-1, a 660-megawatt coal-fired power plant in West Java, enabling its transition from coal to clean energy. Note: It is a common practice for a deal to employ both RMMs and TEMs. While ADB uses both in ETM, only its transaction-enabling role has been highlighted here to specify the kind of role that PFIs, especially multilaterals, can play in their country of operation to crowd in investments for energy transition. |

Pillar 4: Capacity building of national and sub-national PFIs

Recommendation 4: The G20 Sustainable Finance Technical Assistance Action Plan must include capacity-building programs at national and sub-national PFIs to align their portfolio to climate commitments

National and sub-national DFIs provide important experience-based inputs to national policymakers, promote stewardship among local financial institutions, and direct resources according to regional or local contexts, thereby implementing the 2030 SDGs agenda on the ground.[28] However, national and sub-national PFIs have claimed limited capacity to translate their “high-level commitment” into “true ownership” of implementing the 2030 SDGs agenda.[29] Most of these national and sub-national PFIs are in the initial phase of alignment, but the learning has been gradual and fragmented. There is increasing recognition that such commitments will need to be followed up with profound governance and business model restructuring, which is a broader concern for financial institutions in EMDEs.

Further, the growing importance of innovative sustainable finance instruments in mobilising clean energy finance will need capabilities to develop green lending operations and products. This will require specialised skills and forward-looking climate data—capabilities that are often missing in EMDEs. Given that MDBs have global reach, access to financial resources, and wide technical expertise in project development, they must support national and sub-national PFIs with technical assistance programs on climate risks and sustainable finance, alongside concessional finance, which can build internal capacity to better evaluate their physical and transition risks and align their portfolio-linked emissions to the Paris Agreement goals (Box 3).

| Box 3: Capacity building of national and sub-national financial institutions in emerging economies to improve climate governance

The Green for Growth Fund (GGF) is an investment fund that mitigates climate change and promotes sustainable economic growth by investing in measures that reduce energy consumption, resource use, and CO2 emissions.[30] The GGF was established by the EIB and the German development bank Kreditanstalt für Wiederaufbau (KfW). A dedicated Technical Assistance Facility (TAF), among other things, provides knowledge and technical expertise to national financial institutions in developing their green-lending operations on a sustainable basis by creating suitable lending products and procedures with corresponding marketing strategies. Through the GGF Green Academy, it also helps partners engage in relevant training programs. As of the first half of 2022, there were seven national financial institutions and one non-financial institution in Turkey benefitting from the TAF. |

Attribution: Swasti Raizada and Natalie Jones, “Greening Public Financial Institutions: Lessons from the G20,” T20 Policy Brief, June 2023.

Endnote

[a] PFI here stands for financial institutions that: (i) are owned, controlled, or supported by governments; (ii) execute a public, development-oriented mandate addressing market inconsistencies; and (iii) enjoy independent legal status and financial autonomy.

[b] Includes nine MDBs, namely, the African Development Bank (AfDB), the Asian Development Bank (ADB), the Asian Infrastructure Investment Bank (AIIB), the European Bank for Reconstruction and Development (EBRD), the European Investment Bank (EIB), the Inter-American Development Bank (IADB), the Islamic Development Bank (IsDB), the New Development Bank (NDB), and the World Bank Group (WBG).

[c] Albania, Belgium, Burkina Faso, Canada, Costa Rica, Denmark, El Salvador, Ethiopia, Fiji, Finland, France, Gabon, The Gambia, Germany, Ireland, The Holy See, Iceland, Italy, Jordan, Mali, Marshall Islands, Moldova, The Netherlands, New Zealand, Portugal, Slovenia, Spain, South Sudan, Sri Lanka, Sweden, Switzerland, the United Kingdom, the United States, and Zambia

[d] Agence Francaise de Développement (AFD), Banco de Desenvolvimento de Minas Gerais (BDMG), the East African Development Bank (EADB), the European Investment Bank (EIB), and Financierings-Maatschappij voor Ontwikkelingslanden N.V. (FMO)

[1] International Energy Agency (IEA), “CO2 Emissions in 2022 – Analysis,” accessed May 17, 2023.

[2] Olivier Bois von Kursk et al., “Navigating Energy Transitions: Mapping the Road to 1.5°C,” International Institute for Sustainable Development (IISD), October 21, 2022.

[3] Kursk et al., “Navigating Energy Transitions”

[4] IEA, “World Energy Outlook 2022,” 2022.

[5] IEA, “Financing Clean Energy Transitions in Emerging and Developing Economies,” 2021.

[6] Anna Geddes et al., “Doubling Back and Doubling Down: G20 Scorecard on Fossil Fuel Funding,” IISD, November 9, 2020.

[7] Baysa Naran et al. “Global Landscape of Climate Finance: A Decade of Data: 2011-2020,” Climate Policy Initiative, October 27, 2022.

[8] Nicole Pinko et al., “Public Financial Institutions’ Climate Commitments,” Climate Policy Initiative, October 13, 2022.

[9] Jiajun Xu et al., “What are Public Development Banks and Development Financing Institutions? ——Qualification Criteria, Stylized Facts and Development Trends,” China Economic Quarterly International 1, no. 4 (December 1, 2021): 271–94.

[10] Pinko et al., “Public Financial Institutions”

[11] Xu et al., “What are Public Development Banks”

[12] Barbara Buchner et al., “Global Landscape of Climate Finance 2021,” Climate Policy Initiative, December 14, 2021.

[13] G20, “G20 Bali Leaders’ Declaration,” 2022.

[14] Press Information Bureau, “G20 India Presidency: 1st G20 Health Working Group Meeting to Commence from 18-20 January at Thiruvananthapuram, Kerala”, January 16, 2023.

[15] Press Information Bureau, “G20 Expert Group on Strengthening Multilateral Development Banks,” March 28, 2023.

[16] Pinko et al., “Public Financial Institutions”

[17] Katharina Lütkehermöller et al., “Unpacking the Finance Sector’s Climate-Related Investment Commitments,” New Climate Institute, August 2020.

[18] International Monetary Fund, “G20 DGI Recommendations,” 2023.

[19] Oil Change International, “At A Crossroads: Assessing G20 and MDB International Energy Finance Ahead of Stop Funding Fossils Pledge Deadline,: November 2022.

[20] Lucile Dufour et al., “Turning Pledges Into Action: How Glasgow Statement Signatories Can Meet Their Commitment to Shift International Public Finance out of Fossil Fuels and into Clean Energy by the End of 2022,” IISD, June 2022.

[21] COP26, “Statement on International Public Support for the Clean Energy Transition,” UN Climate Change Conference (COP26), November 4, 2021.

[22] Anja C. Gebel et al., “From Glasgow to Guiding Action,” Germanwatch, December 2022.

[23] Gebel et al., “From Glasgow to Guiding Action”

[24] Dufour et al., “Turning Pledges”

[25] European Investment Bank, “2021 Joint Report on Multilateral Development Banks’ Climate Finance,” October 3, 2022.

[26] Dirk Röttgers, Aayush Tandon, and Christopher Kaminker, “OECD Progress Update on Approaches to Mobilising Institutional Investment for Sustainable Infrastructure,” OECD, November 30, 2018.

[27] Asian Development Bank, “Establishment of the Energy Transition Mechanism Partnership Trust Fund under the Clean Energy Financing Partnership Facility,” August 2022.

[28] Sergio Gusmão Suchodolski et al., “From Global to Local: Subnational Development Banks in the Era of Sustainable Development Goals,” Working Paper No. 172, AFD, October 2020.

[29] Maria Alejandra Riaño et al., “Scaling Up Public Development Banks’ Transformative Alignment with the 2030 Agenda for Sustainable Development,” Working Paper No. 1, Peking University, November 2020.

[30] Green for Growth Fund, “Technical Assistance – Green for Growth Fund,” accessed April 7, 2023.