Trade and investment underpin the remarkable development story of many G20 economies, but this progress has come with environmental costs that contribute to climate change. Many developing economies of the G20, especially those in Asia, are net exporters of carbon emissions to developed economies. However, with the right mix of policies, trade and investment could be part of the climate solution. For this to happen, priority should be given to promoting freer trade in environmental goods and services; putting in place appropriate regulations, standards, and certification schemes to incentivise green investment; strengthening international and regional cooperation including through climate commitments in trade agreements and investment treaties; and utilising market-based approaches such as carbon pricing mechanisms. This brief draws heavily from the analyses and discussions contained in the Asian Development Bank’s Asian Economic Integration Report 2023, of which the authors of this brief were part.[1]

Attribution: Albert F. Park and Jong Woo Kang, “Greening International Trade and Investment,” T20 Issue Brief, July 2023.

Setting the Context

Accelerating Climate Risks

According to the Intergovernmental Panel on Climate Change (IPCC), in the coming decades, climate change will worsen in all regions.[2] With 1.5°C of global warming, there will be more intense heat waves, longer warm seasons, and shorter cold seasons. Asia is on the frontlines of these threats, with the region particularly vulnerable to extreme weather events and many people residing in low-lying coastal cities.[a]

Asia is experiencing the highest temperatures in the last 30 years, with average temperatures in 2021 reaching 0.86°C above the 1981–2010 average, and 2020 being the warmest year on record since 1900.[3] Extreme precipitation events such as storms, floods, and landslides, which directly affected over 48 million people and led to 4,000 lives lost in 2021 in the region, are becoming more frequent.[4]

Increasing Environmental Footprints of Trade and Investment

Trade and investment have played a remarkable role in the economic development of many countries in the world, enabling those without abundant natural resource endowments or fixed capital to seize the economic opportunities from specialisation and cross-border transactions of goods, services, and capital. Asia, in particular, embraced proactive trade and foreign direct investment (FDI) promotion strategies.[5] The region accounted for 35 percent of global trade in 2020, up 10 percentage points from a decade ago based on the Direction of Trade Statistics of the International Monetary Fund. A third of global FDI was attributed to Asia in 2019 according to the United Nations Conference on Trade and Development’s World Investment Report 2022 Statistics.

Yet, trade and investment leave a sizable environmental footprint. Asia alone is now responsible for around half of global annual emissions of carbon dioxide (CO2). Asia’s outsized contribution to climate change is a byproduct of its economic success, which has led to a crucial dilemma for the region: how to balance potential trade-offs between economic growth and environmental costs.

According to estimates using the CO2 emissions embodied in international trade (TECO2) database of the Organisation for Economic Co-operation and Development, global CO2 emissions embodied in production increased from 21.4 gigatonnes (GT) in 1995 to 33.6 GT in 2019. At the same time, CO2 emissions embodied in international trade increased from 5.2 GT in 1995 to 9.8 GT in 2019. Asia’s CO2 emissions embodied in production and demand both increased over time while that of non-Asia has been relatively stable (see Figure 1).

Figure 1: Production- and Demand-Based CO2 Emissions—Asia Vs. Non-Asia (gigatonnes CO2)

CO2 = carbon dioxide.

Notes: Asia includes Australia; Bangladesh; Brunei Darussalam; Cambodia; Hong Kong, China; India; Indonesia; Japan; Kazakhstan; the Lao People’s Democratic Republic; Malaysia; New Zealand; Pakistan; the People’s Republic of China; the Philippines; the Republic of Korea; Singapore; Taipei, China; Thailand; and Viet Nam. The shaded areas in the graph represent the absolute difference between production-based (CO2 emissions based on production, i.e., emitted by economies) and demand-based (CO2 emissions embodied in domestic final demand, i.e., consumed by economies) CO2 emissions.

Source: Asian Development Bank[6]

Asia’s CO2 emissions embodied in consumption have not grown as much as emissions embodied in production, leading to net CO2 emissions embodied in exports to the rest of the world.

Asia’s high CO2 emissions embodied in production is partly explained by the region’s economic structure, which relies more on the manufacturing sector than the primary and services sectors. Based on the World Bank’s World Development Indicators, Asia’s manufacturing share of gross domestic product (GDP) is estimated to exceed 20 percent—much higher than that of the US (11 percent) and the European Union (EU, 15 percent). As more Asian economies continue to develop and transition to more services-driven and digital economies, the effect of this factor is likely to diminish.[7] Nevertheless, the continuing need to expand manufacturing capacity to meet the ever-growing global demand of goods will likely pose environmental challenges to developing economies in the G20 for some time.

Drivers of Carbon Emissions from Trade and Investment

Many developing economies in the G20 have a positive CO2 balance with developed economies in Europe, North America, and Asia.

The increase in carbon emissions can be attributed to the following factors:

- Economic scale effect is the increase in carbon emissions when production scales up, without any changes in technology (e.g., emission intensity) or industrial composition. This occurs as the economy’s production increases along with economic growth (furthered by trade and investment).

- Industrial structure effect is how an economy’s share of production in carbon-intensive sectors changes, keeping constant the economy’s economic size and the technology level. It can be driven by specialisation via trade and FDI in carbon-intensive industries. FDI may be attracted to less stringent environmental policies and regulations.

- Technological advancement effect captures changes in the emission intensity of production, holding the scale and industrial structure of the economy constant. Emission intensities can decline when businesses adopt new technology (such as decarbonisation) or employ environmental goods and services to lower carbon emissions per unit of output.

Policy responses to abate the carbon emissions of trade and investment should take into account the above driving forces, and the need to focus particularly on improving the industrial structure effect and reinforcing the technological advancement effect.

Promoting Global Cooperation

Given the ‘public bad’ nature of climate change, and the transboundary spillover impacts of carbon emissions, no single country can effectively cope with climate change risks. Moreover, mitigating the carbon footprints associated with international trade and investment requires joint efforts and collaboration among the key economic players. The G20 is in a strong position to promote such an international cooperation agenda and take proactive actions. G20 economies could prioritise the following policy agenda both individually and collectively:

- The G20 economies should intensify national and international efforts to expand energy-efficient and emission-reducing production capacity and trade. In the short-term, carbon intensity of production and trade could be lowered by adopting cleaner technologies, for which knowledge transfer through regional and international cooperation and free trade in environmental goods and services can play crucial roles. In the medium- to long-term, moving up the value ladder by accelerating industrial transformation into high-end, high-value added manufacturing and services, and making research and development investments in green technology will contribute not only to economic growth but also to sustainable development.

- Trade and investment need to be part of the climate solution. Trade and investment can bring clean technologies and the know-how embedded in them to the entire world. However, insufficient regulatory harmonisation can be a barrier to achieving such opportunities. International cooperation can help streamline cross-border economic transactions of green technologies and increase interoperability of certification and emissions accounting systems.

- A reduction in emission intensity can be brought about by adopting green technologies to abate carbon emissions. Economies can adopt these technologies through two channels—trade of environmental goods and services, and technology transfer from foreign investment and firms. Reducing the costs of such transactions can bring down the cost of adopting new green technologies and drive innovation. The rapid decline in solar photovoltaic panel and wind energy costs are an example.

What the G20 Can Do

Promote Trade in Environmental Goods and Services

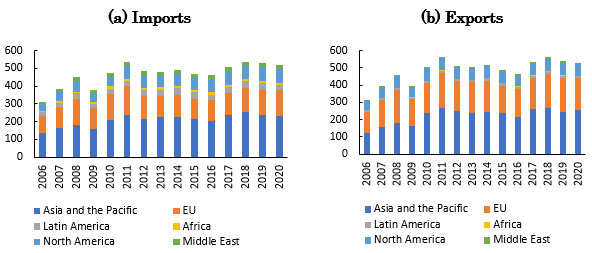

Global exports and imports of goods on the Asia-Pacific Economic Cooperation (APEC) list of environmental goods have increased over time. Asia’s trade volume in these goods has likewise been increasing over the years (see Figure 2). Environmental services such as sanitation, environmental protection, engineering, and scientific services are also crucial inputs for climate mitigation efforts. For instance, even with lower cost solar panels, their placement and installation still require engineering consulting services that may be scarce and expensive. Efforts at the international level should prioritise lowering trade barriers on environmental goods and services.

Figure 2: Total Environmental Goods Imports and Exports by Region (US$ billion)

EU = European Union (27 members).

Note: Environmental goods are defined according to Asia-Pacific Economic Cooperation (APEC) List of Environmental Goods.

Source: Asian Development Bank[8]

Regulation and Policy Incentives

Environmental laws and regulations have helped regulate pollution and incentivise a switch to renewables and less-polluting production inputs. Establishing a regulatory environment and institutional framework conducive to attracting foreign investments into renewable energy and clean industries can expand the scope for green trade and investment. Renewable energy standards, tax credits, and low-cost financing can also support growth in renewable energy use. However, regulations of the command-and-control type, by setting certain limits on emissions and requiring specific pollution control facilities or technologies to be used, can prevent polluters from exploring a more cost-efficient way of reducing emissions through various technologies available, and further limit incentives for pollution abatement below the limits and innovation in green technologies. Other mechanisms, such as performance-based standards, market-based instruments, and responsible business systems often have been more effective in promoting energy transition. Increasing public scrutiny, public disclosure programs, and other non-regulatory mechanisms can also encourage companies to improve environmental performance.[9]

Many economies need to catch up with innovation through the adoption and adaptation of existing green technologies as well as indigenous technology development. Research and development policy incentives for innovation in the environmental sectors, curbing policy distortions on free trade in clean technologies, and removing subsidies on fossil fuels can help accelerate the pace of green technology innovation. Stringent but flexible environmental regulations can also induce innovation and increase competitiveness.

Certification can be critical to make trade greener and inform how products contribute to mitigating environmental or climate change challenges. The fundamental motivation for certification is to correct information failures for consumers regarding the attributes of a certain product. They are particularly relevant where the key attributes of process and production methods of a product are difficult or impossible to verify based on the characteristics of the final product. The case of hydrogen is illustrative in recent progress to develop certification systems.

In 2020, 63 percent of businesses worldwide with ISO 14001 certifications for environmental governance and more than 50 percent of sites where business activities are supported by the certificate were located in Asia (see Figure 3). While more businesses are becoming certified, certification needs to involve a wider range of businesses to promote greener trade.

Figure 3: ISO 14001 Certificates and Sites, 2020

Notes:

(i) ISO 14001 sets out the criteria for an environmental management system and can be certified to. It maps out a framework that a company or organisation can follow to set up an effective environmental management system.

(ii) ‘Certificates’ are the documents issued by ISO when the business demonstrates conformity to the standard. ‘Sites’ are the locations where the business carries out the activity.

Source: Asian Development Bank[10]

Bilateral, Regional, and International Cooperation

Regional and international cooperation is essential for the development of a green and sustainable trading system. Facilitating trade in environmental goods, ensuring interoperability and regulatory coherence, and fostering green investments are key areas for action.

More efforts are needed to strengthen the greening function of bilateral and regional trade agreements (RTAs). While RTAs have increasingly acknowledged the importance of environmental sustainability, environmental provisions often are limited in scope and depth and climate change provisions are still scant. Only some RTAs make specific commitments on environmental laws or regulations, and only recently have RTAs started to address liberalising trade in environmental goods and services. Looking ahead, expanding the coverage and depth of environmental and climate change provisions will be useful to ensure effective environmental commitments. To enhance the transparency and clarity of commitments, economies could also consider incorporating a separate chapter in RTAs on climate change and the environment instead of having various provisions scattered across multiple chapters.

While RTAs are increasingly including environmental provisions, more efforts should be made. Exploring new innovative avenues for international cooperation including through green economy agreements could forge focused and deep collaborative arrangements in addressing common climate challenges.

International investment agreements can also promote climate action by influencing green investment decisions. However, many international investment agreements have yet to mainstream climate change-related issues. As investment frameworks become more ambitious with respect to climate policy, policymakers may consider introducing substantive standards on environmental protection and access to investor–state dispute mechanisms in climate-related cases. New-generation international investment agreements could also consider facilitating market access and investment facilitation in green industries.

Carbon Pricing Mechanisms

Carbon pricing is an integral element of the broader climate policy architecture to help economies reduce emissions in a cost-efficient manner. Embodied in tax and emission trading systems, carbon pricing helps internalise the external costs of greenhouse gas (GHG) emissions, thereby incorporating climate costs into production, investment, and consumption decisions. Carbon pricing disincentivises the use of fossil fuels, making deployment of renewables more attractive. It can generate revenues that can be re-invested to support energy transition or used to realise other sustainable development goals.[11] There is robust evidence that carbon pricing instruments have been effective at promoting low-cost emission reductions.[12] If carbon pricing is internationalised, it can promote more efficient and better coordinated climate reduction efforts across countries.

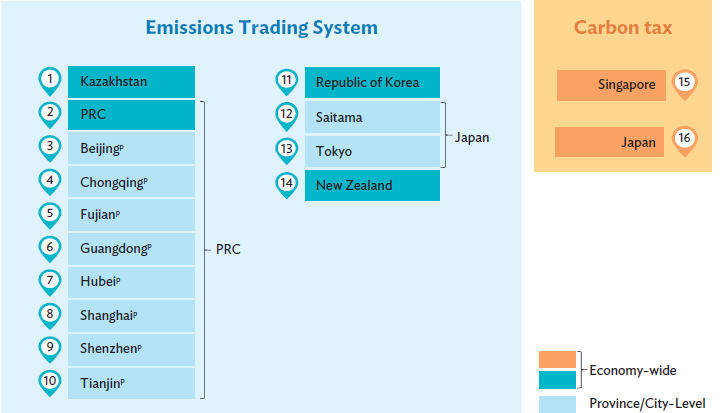

Carbon taxes and emissions trading schemes (ETS) are the two most common direct pricing instruments. There is growing momentum on their use with a total of 68 carbon taxes and ETSs operating globally and three more scheduled for implementation.[13] In Asia, there are six direct carbon pricing initiatives implemented at the national level that cover 38 percent of carbon emissions in the region. Japan and Singapore employ a carbon tax while Kazakhstan, New Zealand, South Korea, and China have launched an ETS (see Figure 4). India recently approved the creation of a national carbon trading platform.[14] In addition, Vietnam and Indonesia are making rapid progress in introducing a carbon price in their jurisdictions.[15]

Despite this progress, several challenges remain for the adoption of effective carbon pricing mechanisms. Carbon taxes often lack public or political support, have less predictable impacts, and disproportionately affect certain industries or income groups. Emissions trading schemes face challenges including low realised carbon prices the absence of consistent monitoring and accounting rules, concerns about the quality of carbon credits and environmental integrity, lack of involvement of local stakeholders, and perverse incentives to lower emission reduction targets.

Figure 4: Carbon Pricing Initiatives in Asia

p = pilot, PRC = People’s Republic of China.

Note: As of April 2022.

Source: Asian Development Bank[16]

CBAM has raised concerns among EU trading partners who argue that it imposes European carbon prices on other countries contrary to the principle of voluntary mitigation efforts. Other concerns are the inadequacy of the scheme in differentiating firm-level heterogeneity in carbon intensity of production, the scheme’s inability to reflect global social costs of emissions due to its bilateral nature, CBAM could prompt developing economies to adopt and expand their own carbon pricing mechanisms as a response and thus accelerate their green transitions. One way to address the criticism that the scheme penalises developing countries is to recycle CBAM revenues back to those countries to support carbon-reducing investments.

A global approach to carbon pricing presents multiple benefits compared to a unilateral approach. An international framework on cross-border carbon measures or a global carbon pricing mechanism can be considered a first-best solution to achieve required reductions in emissions along the most efficient path. In deciding on the best global or regional approaches, environmental effectiveness, costs, and feasibility of implementation are important factors to consider. In an international emissions trading system, in theory a top-down approach through a global cap-and-trade system still offers the best prospect for meeting carbon emissions reduction targets. Nevertheless, more bottom-up, decentralised approaches to establishing ETS remain a plausible alternative, and can serve as building blocks for the eventual establishment of a global carbon market.

There is also growing momentum to take advantage of the voluntary carbon market by increasing voluntary commitments from the private sector to achieve net-zero targets.[17] However, challenges remain, particularly in establishing credible baselines and counterfactual scenarios. Technical assistance and capacity building may be needed to understand different types of carbon markets, their technical options, and key issues affecting their implementation.

Conclusion

The G20 economies should lead the transformation of trade and investment policies to become ‘climate smart’ and ‘climate sensitive’ to ensure that trade and FDI contribute to the climate solution rather than being part of the problem. They need to take the lead in spearheading individual as well as collective efforts to set the agenda for policy reforms to ‘green’ trade and investment while allowing economies to continue gaining positive economic benefits from cross-border flows of goods, services, and capital. Urgent actions need to be taken in four key policy areas.

First, promoting trade in environmental goods and services can help facilitate renewable energy transition and enable the spread of low-carbon production technologies. Second, environmental regulations, and standardisation and certification of green products along with policy incentives including tax credits and low-cost financing, can also support the greening of production procedures and international trade. Third, more efforts are needed to strengthen the greening function of bilateral and regional trade agreements and investment treaties in facilitating trade in environmental goods, ensuring interoperability and regulatory coherence, and fostering green investments across the borders. Fourth, carbon pricing mechanisms are an integral part of the broader climate policy architecture to help economies reduce emissions by addressing the negative externalities associated with climate change and helping internalise various climate costs into production, investment and production decisions. A global approach to carbon pricing mechanism, in particular, retains a huge potential to accelerate the pace of global net-zero transition and minimise the risks of cross-border carbon leakages.

Albert F. Park is Chief Economist and Director General, Economic Research and Cooperation Department, Asian Development Bank.

Jong Woo Kang is Principal Economist, Regional Cooperation and Integration Division, Economic Research and Cooperation Department, Asian Development Bank.

Endnotes

[a] Unless otherwise specified, Asia, or Asia and the Pacific, refers to the 49 regional members of the Asian Development Bank (ADB). The list of ADB economies and subregional groupings.

[1] Asian Development Bank, Asian Economic Integration Report 2023: Trade, Investment, and Climate Change in Asia and the Pacific, February 2023, Manila, ADB, 2023.

[2] “Climate change widespread, rapid, and intensifying – IPCC”, IPCC News release, August 9, 2021.

[3] World Meteorological Organization, State of the Climate in Asia 2021, November 2022, Geneva, WMO, 2022.

[4] WMO, State of the Climate in Asia 2021.

[5] ADB, Asian Economic Integration Report 2023.

[6] ADB, Asian Economic Integration Report 2023.

[7] ADB, Asian Economic Integration Report 2023.

[8] ADB, Asian Economic Integration Report 2023.

[9] Madhu Khanna, “Growing Green Business Investments in Asia and the Pacific: Trends and Opportunities,” ADB Sustainable Development Working Paper Series, no. 72, 2020.

[10] ADB, Asian Economic Integration Report 2023.

[11] Asian Development Bank, Carbon Pricing for Green Recovery and Growth, November 2021, Manila, ADB, 2021.

[12] Navroz Dubash et al., “Chapter 13: National and Sub-national Policies and Institutions,” in Intergovernmental Panel on Climate Change, Climate Change 2022: Mitigation of Climate Change, Geneva, IPCC, 2022.

[13] World Bank, State and Trends of Carbon Pricing, Washington DC, World Bank Group, 2022.

[14] Lou Del Bello, “India Gets Ready to Launch a National Carbon Market,” Energy Monitor, October 18, 2022.

[15] Mari Elka Pangestu, “Carbon Pricing Leadership Coalition Report 2021-2022,” World Bank Blogs, May 25, 2022.

[16] ADB, Asian Economic Integration Report 2023.

[17] “Home”, The Integrity Council for the Voluntary Carbon Market, accessed June 1, 2022.