Task Force 5: Purpose and Performance: Reassessing the Global Financial Order

Abstract

Reducing borrowing costs for emerging markets (EMs) remains a massive challenge. While the interest rate differential (IRD) is near-zero for advanced economies, for EMs, it is always positive. Excess exchange rate volatility is often due to global and not domestic factors, so that a pure float fails to act as a shock absorber. The additional country risk premia that foreign investors seek are primarily driven by a fear of unexpected currency depreciation; which often does not take place, and thus there are positive excess returns from EM assets. To reduce EM IRDs, exchange rate volatility, risk and risk-perceptions have to fall. A suitable exchange rate regime and domestic as well as international prudential regulation on cross-border capital flows can lower exchange rate volatility. Global pooling/insurance mechanisms and better payment systems can reduce exchange rate risk at a low cost. If the G20 communiqués address these issues it could help reduce risk-perceptions.

1. The Challenge

Most emerging and developing economies (EMDEs) moved to flexible exchange rates and inflation targeting as cross-border capital flows from advanced economies (AEs) became freer. Surges and sudden stops in capital flows, however, raised exchange rate volatility and country risk premia in EMDEs. Relatively thin EMDE FX markets[1] can get trapped in cumulative one-way movements and panics due to global risk-on and risk-off. Excess volatility in financial variables hurts the real sector. EMDEs had lower growth in the global crisis-hit 2010s compared to the previous decade.[2]

Yet mainstream advice is to let the exchange rate act as a buffer, floating in response to capital flows. This is thought to allow some autonomy for domestic monetary policy. Canonical inflation targeting policy responds to exchange rate fluctuations only after they affect inflation or output, so domestic interest rates need not rise immediately. However, as excess depreciation raises inflation, policy rates do rise sharply. Contrary to conventional macroeconomic theory, merely relying on the flexibility of exchange rates is not enough to shield the domestic economy from global spillovers. Floating exchange rates can sometimes even exacerbate booms and busts resulting from global shocks.[3],[4] FX intervention greatly enhances the efficacy of inflation targeting in EMDEs.[5] Other types of prudential policies are also required. Pragmatic EMDE central bankers understand floating does not work in practice and intervene, ignoring advice that is based on theory. Past G20 communiqués have, however, not supported such interventions, and preferred to follow theory. While exchange rates have to be flexible enough to stay near real equilibrium rates, excess volatility is better moderated.

Uncovered interest parity (UIP) gives the relationship between expected depreciation and the interest rate differential (IRD) for a country. Under free capital flows and perfect markets, higher interest rates must cover expected depreciation through cross-currency arbitrage. This implies that if domestic interest rates rise, the currency jumps up immediately, so the interest rate gap is covered by an expected depreciation. However, the “forward discount” anomaly, wherein high interest currencies show appreciation instead of the depreciation expected if the currency has over-appreciated.[6] It follows that markets are not efficient and there are excess returns from the carry trade that involves borrowing in low interest rate and investing in high interest rate countries. This is one source of excess inflows to emerging markets (EMs). A summary of the work done on UIP[7] notes the heterogeneity between AEs and EMs. What works for AEs, therefore, need not work for EMs. A pure float is not the appropriate currency regime for EMs.

Use of survey data on exchange rate expectations and to decompose the bias into risk premium and errors in exchange rate expectations, shows the magnitude of expected depreciation is always high, especially for EMs.[8] This risk requires IRD to be high for EMs, although that depreciation is only rarely observed in the data.

The literature finds that global interest rate shocks aggravate EM UIP premia on local-currency debt.[9],[10] Significant spillovers from AE policies affect not only the capital flows and exchange rate volatility in EMs[11] but also their borrowing costs.[12]

In covered interest rate parity (CIP) there is no uncertainty since it holds at a point in time. It requires that, for any two countries, the IRD should equal the gap between the spot and forward currency rates (the Forward Premium). Empirical literature on CIP, however, shows that forward exchange rates do not insulate the domestic economy from global policy shocks. Unconventional AE policies have worsened CIP deviation. CIP held closely for three decades until the global financial crisis (GFC), after which CIP deviations went up significantly, as a result of the US dollar strength and FX liquidity conditions.[13]

A second strand of literature is related to global uncertainty originating from AE policies, and the effect of global volatility on EM borrowing costs. UIP deviations of a group of 34 AE and EM currencies with respect to the US dollar were found to co-move with global risk perception.[14] Interest rate differences explain this deviation better in EMs. Global investors charge an excess premium from EMs that may be driven by policy uncertainty and expectations of exchange rate fluctuations.

Studies explored the issue of low AE interest rates leading to credit booms in EMs, or what is called the “risk taking channel of monetary policy”.[15] Domestic banks with more exposure to international capital markets in Turkey transmit the global financial cycle locally. The fall in local currency borrowing costs is larger than foreign currency borrowing costs since the UIP premium tracks the movement in this cycle.[16]

Therefore, the challenge is two-fold- How can excess exchange rate volatility and excess returns demanded on EM investments, which raise EM borrowing costs, be reduced? This Policy Brief presents some stylised facts on the relation between exchange rate volatility and interest rates in the next section before proceeding to the G20’s role and policy recommendations for the G20.

1.1 Stylised facts

A dataset on major EMs and AEs is used to derive the i) government bond yield differential over 3, 6, and 12 month horizons with respect to the US rates, ii) actual depreciation with respect to USD, and iii) Forward Premium (FP). CIP tells us riskless arbitrage across currencies should imply that the IRD equals the FP. Since UIP involves the expected exchange rate, the IRD covers expected depreciation plus a risk or a UIP premium. Table 1 has the annual IRD, FP,[17] and depreciation for a few EMs from 2005 to 2022. Both the IRD and the FP substantially exceed actual depreciation. China has a positive IRD even though its currency appreciated on average in that period.

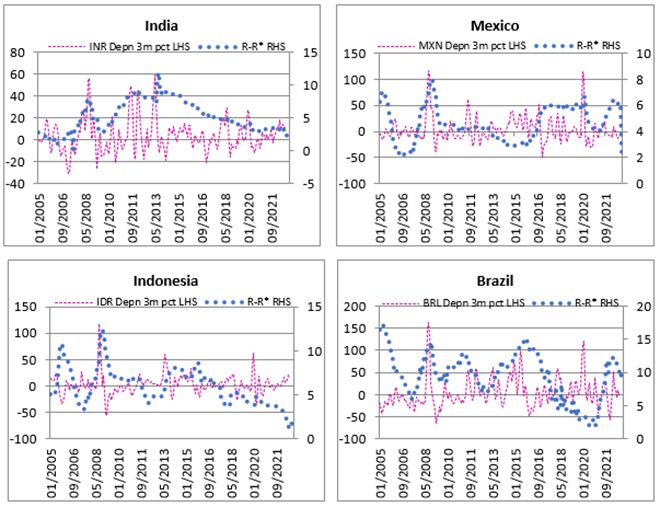

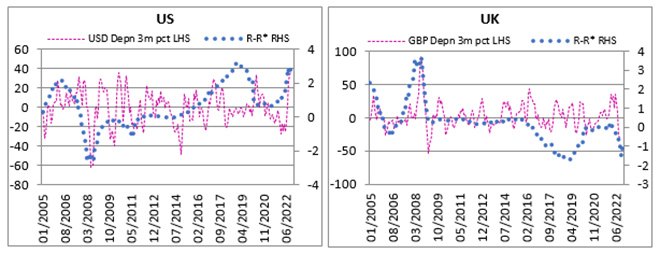

Table 2 gives the mean and standard deviation for three month IRD and depreciation, and Figures 1 and 2 show these time series for select EMs and AEs.[18] Volatility, as measured by the standard deviation of actual depreciation over a three month period, has remarkably doubled for all EMs since 2013-16, excluding India where volatility is lower in the second half. Table 2 shows the calculation of the means and volatilities for two sub periods for some countries.

Table 1: Excess Returns in Emerging Markets

| IRD %pa | FP %pa | Currency depn (+) %pa | |

| India | 5.16 | 4.75 | 3.44 |

| China | 1.71 | 0.77 | -1.07 |

| Indonesia | 5.43 | 5.46 | 2.75 |

| Mexico | 4.70 | -0.02 | 3.99 |

| Brazil | 9.25 | NA | 5.45 |

Source: Calculated with data from CEIC Global Database

Table 2: Exchange Rates and Interest Differentials

| Exchange rate change (Domestic Currency/USD) (-appreciation) | Interest Differential | |||

| Mean | SD | Mean | SD | |

| Emerging Economies | ||||

| India | ||||

| 01-2005 to 09-2013 | 4.45 | 18.94 | 5.14 | 2.74 |

| 10-2013 to 12-2022 | 3.24 | 9.57 | 5.19 | 2.01 |

| 01-2004 to 01-2022 | 3.84 | 14.92 | 5.17 | 2.39 |

| Indonesia | ||||

| 01-2005 to 01-2022 | 3.34 | 18.55 | 5.89 | 2.01 |

| China | ||||

| 01-2005 to 03-2015 | -2.92 | 3.56 | 2.22 | 2.75 |

| 04-2015 to 12-2022 | 2.20 | 11.31 | 2.45 | 1.17 |

| 01-2005 to 01-2022 | -7.57 | 8.21 | 2.32 | 2.22 |

| Mexico | ||||

| 01-2005 to 01-2022 | 3.89 | 24.31 | 4.65 | 1.34 |

| Brazil | ||||

| 01-2005 to 01-2022 | 5.17 | 34.05 | 9.48 | 3.59 |

| Russia | ||||

| 01-2005 to 04-2014 | 3.31 | 26.76 | 4.55 | 2.50 |

| 05-2014 to 12-2022 | 10.10 | 52.51 | 6.17 | 2.13 |

| 01-2005 to 01-2022 | 6.56 | 41.19 | 5.44 | 2.44 |

| Turkey | ||||

| 01-2005 to 01-2016 | 7.95 | 26.95 | 10.98 | 3.38 |

| 02-2016 to 12-2022 | 31.72 | 48.88 | 13.44 | 6.64 |

| 01-2005 to 01-2022 | 16.80 | 38.34 | 11.92 | 5.02 |

| Advanced Economies | ||||

| USA | ||||

| 01-2005 to 01-2023 | -0.86 | 17.22 | 0.70 | 1.26 |

| UK | ||||

| 01-2005 to 01-2023 | 2.96 | 18.77 | 0.19 | 1.03 |

| European Union | ||||

| 01-2005 to 01-2023 | 1.62 | 17.74 | -0.70 | 1.26 |

| Japan | ||||

| 01-2005 to 01-2023 | 1.93 | 19.28 | -1.21 | 1.53 |

Source: Calculated with data from CEIC Global Database

While the interest rate differential is near-zero or negative for AEs, for EMs it is always positive and aggravated by excess exchange rate volatility. The latter was often due to global, and not domestic, factors in this period. Exchange rate volatility is in the middle range for AEs, but varies much more across EMs. Episodes of sharp depreciation in EMs are not fully offset by appreciation, whereas in AEs there is more even two-way movement (Figures 1 and 2). Depreciation is followed by appreciation, thus reducing the necessity for domestic interest rates to rise and impact the IRD. But IRD over-compensates and exceeds depreciation in EMs.

Unlike in AEs, exchange rates in EMs, therefore, fail to act as a shock absorber. The UIP premium is consistently positive. The literature has estimated an average positive value of 3 for UIP in EMs.[19] This additional country risk premia or excess returns demanded by foreign investors is affected by political and default risk. In practice, however, they are primarily driven by a fear of unexpected currency depreciation, which often does not take place. It is not there in the data. Shocks to the IRD between EMs and AEs are usually not offset by realisations of EM depreciation.

FP is also higher on average than the actual depreciation, implying that FX markets do not work well. IRD is found to be consistently higher than FP also for EMs. IRD being higher than FP confirms that there are positive excess returns from EM assets, i.e., investors enjoy a significant excess compensation from investing in EM assets.

Figure 1: Emerging Markets: Variations in Exchange Rates and Interest Rate Differentials

Source: Own estimation using data from CEIC Global Database.

Figure 2: Advanced Economies: Variations in Exchange Rates and Interest Rate Differentials

Source: Own estimation using data from CEIC Global Database.

Since the average of IRD and FP is higher than depreciation in both annual and monthly series, and the exchange rate volatility is due to common external shocks, some type of global pooling/insurance should be able to reduce EM IRDs considerably. A suitable exchange rate regime and domestic as well as international prudential regulation on cross-border flows can also lower exchange rate volatility.

1.2 Reducing volatility

Domestic policy action to prevent spikes in depreciation, while maintaining two-way movement may, over time, contribute to reducing the IRD and excess returns from EM assets. The Indian experience shows it is possible to reduce excess depreciation despite global risk-on and offs. While in most EMs exchange rate volatility rose after the taper-tantrum in 2013, in India it fell.

India’s exchange rate after the 1990s reform was market determined with intervention to reduce excess volatility. In the GFC period, however, intervention became minimal because of the fear that inflows were now too large. A new governor intervened heavily after 2013 and was able to substantially reduce volatility.[20] Over 2014-17 the mean IRD was 6.9 and average depreciation was 1.3. Real appreciation above equilibrium, despite a large current account deficit and higher relative inflation, increased the chances of a sharp depreciation. This occurred in 2018, and after this period there was more even two-way nominal movement with middling volatility (Table 3) and stability around competitive equilibrium exchange rates. Over 2019-22 mean IRD was 3.4 and average depreciation was 4.2 despite the pandemic shocks. Risk premiums fell. Thus, domestic policies can counter global shocks.

EMs with flexible exchange rate regimes require additional capital flow management instruments to cope with large capital inflows.[21] Analysis with the disaggregated IMF iMaPP database shows that on average, the frequency of prudential policy usage is much higher in EMs than that in AEs.[22] A companion policy brief[23] shows that the types of regulations used also differ. Net tightening was more for credit-demand than for credit-supply in most AEs and the reverse for most EMs. Tightening in AEs was largely in the banking sector, while EMs used more broad-based measures. Some minimum global utilisation of prudential regulation can reduce arbitrage and excess cross border flow volatility.

Table 3: Yearly Volatility of the Indian Nominal Exchange Rate

| Years | Monthly high-low % change | Standard deviation |

| 2005 | 8.8 | 2.7 |

| 2006 | 6.6 | 2.1 |

| 2007 | 13.6 | 3.8 |

| 2008 | 29.2 | 8.1 |

| 2009 | 13.4 | 4.3 |

| 2010 | 8.0 | 2.5 |

| 2011 | 23.4 | 7.3 |

| 2012 | 17.5 | 6.0 |

| 2013 | 29.1 | 10.9 |

| 2014 | 9.1 | 3.8 |

| 2015 | 9.2 | 4.0 |

| 2016 | 3.9 | 1.8 |

| 2017 | 7.2 | 3.3 |

| 2018 | 17.4 | 7.8 |

| 2019 | 5.6 | 2.7 |

| 2020 | 8.5 | 4.2 |

| 2021 | 5.5 | 2.8 |

| 2022 | 12.5 | 6.6 |

| 2023 March | 2.1 | 1.2 |

Source: Calculated with data from www.rbi.org.in

Innovative hedging, pooling and insurance products can lower EM borrowing costs. Hedging exchange rate risk is expensive and operationally difficult. Funds are coming up with structures that pool risk and should be scaled up. TCX[24] uses pooling to provide synthetic hedges to Development Finance Institutions (DFIs). ILX[25] co-invests in syndicated private-sector loans arranged by Multilateral Development Banks (MDBs) and DFIs to provide medium and long-term finance to EM projects and companies. A well-diversified portfolio delivers required risk-adjusted returns for its investors. Seafarer[26] finds that the cost of currency risk is substantially less than the cost of hedging such risk for portfolios that are diversified across regions and sectors, and identify and reduce exposure to problematic currencies.

The fear of a large depreciation, which raises the IRD for EMs, is like a catastrophe risk, which is normally covered by reinsurance. If reinsurance can be provided for the small chance of a large depreciation, insurance may offer a better way to lay off exchange rate risk. The IMF’s large data base on exchange rates could be used to design reinsurance and lower the otherwise high cost of insurance. Pooling risk for different country clusters can lower costs for those with less volatility and expected depreciation. Natural cross-country hedges could be utilized. There is a Multilateral Investment Guarantee Agency (MIGA) with reinsurance facilities that could design suitable products.[27]

2. The G20’s Role

Past G20 communiqués have emphasised market-determined exchange rates and have given inadequate attention to research that finds FX intervention and prudential regulation greatly enhance the efficacy of inflation targeting, by potentially reducing spikes in the country risk premium and in EMDE borrowing costs. These aspects should be noted and a range of polices that reduce volatility flagged for adoption by EMDEs, AEs and Multilateral Development Banks (MDBs).

G20 communiqués illustrate the neglect of the EM perspective. For example, finance ministers and central bank governors (Ankara, Turkey Sept 2015) decided:

‘We reiterate our commitment to move toward more market-determined exchange rate systems and exchange rate flexibility to reflect underlying fundamentals, and avoid persistent exchange rate misalignments. We will refrain from competitive devaluations, and resist all forms of protectionism.’ [28]

There was nothing in the communique, however, on mitigating the effect of QE and global risk-on and off on exchange rate volatility at a time of major outflows from EMs.

In the 2012 G20 meeting, finance ministers agreed not to manipulate exchange rates for competitive advantage, but interest rate or liquidity boosting policy in response to domestic needs that AEs typically use, were not regarded as manipulation. The impact of such policies on EM exchange rates and the need for better global safety nets was not noted.

Communiqués adopted when EMs are presiding will hopefully show greater understanding of issues affecting EMs. If the G20 communiqués explain that perceptions exceed actual risk, and that there are ways to reduce risk, it could help lower risk-perceptions.

3. Recommendations to the G20

- The G20 should continue to emphasise the importance of good macroeconomic fundamentals and maintaining competitive market-determined real exchange rates.

- In order to reduce globally driven exchange rate volatility and its impact on EMDE borrowing costs, the importance of precautionary reserves and intervention as well as prudential capital flow management policies in both, target and source countries, should be highlighted. EMDEs should not be pushed towards pure floats even as flexibility of nominal exchange rates is encouraged in order to ensure that there are no large deviations from equilibrium real exchange rates. G20 communiqués should note the issue of excess volatility in EM exchange rates due to global risk-on and off and the need for some universal prudential regulations and reform in the international financial architecture to counter this.

- MDBs should be encouraged to introduce policies to mitigate the effect of global shocks and prevent large depreciation spikes in EMs. Examples of this are improving information and analysis that would moderate excessive risk premiums, and providing swap lines that get triggered with global volatility.

- New structures that pool risk across portfolios are becoming available and should be scaled up. Since the fear of a large depreciation is like a catastrophe risk, which is normally covered by reinsurance, insurance may be a better way to lay off exchange rate risk compared to hedging, provided the IMF makes available its large data base on exchange rates to lower the cost of insurance.

- Using CBDCs, as they become operational, could aggregate multiple transactions, thus reducing payment risk and cost as intermediation reduces in cross border transactions. Bilateral central bank swaps can be designed to lower long-term borrowing costs since hedging is not available for the long horizons of infrastructure and SDG/ESG investment.

The authors thank a referee for very useful comments.

Attribution: Ashima Goyal and Sritama Ray, “Exchange Rate Volatility and its Impact on Borrowing Costs,” T20 Policy Brief, June 2023.

Endnotes

[1] C. Emre Alper, Oya Pinar Ardic, and Salih Fendoglu, “The economics of the uncovered interest parity condition for emerging markets,” Journal of Economic Surveys no. 23 (2009): 115–138.

[2] Ashima Goyal, Akhilesh K. Verma, and Rajeswari Sengupta, “External shocks, cross-border flows and macroeconomic risks in emerging market economies,” Empirical Economics 62, 2111-2148 (2021).

[3] Raghuram Rajan, “Competitive monetary easing: is it yesterday once more?” Macroeconomics and Finance in Emerging Market Economies 8, no. 1-2 (2015): 5-16.

[4] Hélène Rey, “Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence,” Proceedings of the 2013 Jackson Hole Symposium (2013): 285-333.

[5] Edward F. Buffie, M. Airaudo, and Felipe Zanna, “Inflation targeting and exchange rate management in less developed countries,” Journal of International Money and Finance 81 (2018): 159-184.

[6] Eugene F. Fama, “Forward and spot exchange rates,” Journal of Monetary Economics 14, no. 3 (1984): 319-338.

[7] Alper, Ardic, and Fendoglu, “The economics of the uncovered,” 115-138.

[8] Kenneth A. Froot and Jeffrey A. Frankel, “Forward Discount Bias: Is It an Exchange Risk Premium?” The Quarterly Journal of Economics 104, no. 1 (1989): 139–61.

[9] Sebnem Kalemli-Özcan and Liliana Varela, “Five facts about the UIP premium,” NBER Working Paper no. 28923 (2021).

[10] Mitali Das, Gita Gopinath, and Ṣebnem Kalemli-Özcan, “Preemptive Policies and Risk-Off Shocks in Emerging Markets,” NBER Working Paper no. 29615 (December 2021).

[11] Krittika Banerjee and Ashima Goyal, “Monetary spillovers and real exchange rate misalignments in emerging markets.” International Journal of Emerging Markets 17 (2022): 452–484.

[12] Ṣebnem Kalemli-Özcan, “U.S. monetary policy and international risk spillovers,” NBER Working Paper no. 26297 (September 2019).

[13] Eugenio M Cerutti, Maurice Obstfeld, and Haonan Zhou, “Covered interest parity deviations: macrofinancial determinants,” IMF Working Paper no. 2019/014 (January 2019).

[14] Sebnem Kalemli-Özcan and Liliana Varela, “Five facts about the UIP premium,” NBER Working Paper no. 28923 (2021).

[15] Valentina Bruno and Hyun Song Shin, “Capital Flows and the Risk-Taking Channel of Monetary Policy,” BIS Working Papers no. 400 (December 2012).

[16] Julian di Giovanni, Şebnem Kalemli-Özcan, Mehmet Fatih Ulu, and Yusuf Soner Baskaya, “International spillovers and local credit cycles,” The Review of Economic Studies 89 (2022): 733–773.

[17] Since many EMs do not have well-developed FX markets, the FP may not be available (Brazil) or is not properly priced.

[18] For the US IRDs are with the Euro, and the USD/Euro rate is taken.

[19] Das, Gopinath, and Kalemli-Özcan, “Preemptive Policies,” 38.

[20] Ashima Goyal, “Evaluating India’s Exchange Rate Regime under Global Shocks”, Macroeconomics and Finance in Emerging Market Economies 11(3) (2018): 304-321.

[21] Nicolas E. Magud, Carmen M. Reinhart, and Esteban R. Vesperoni, “Capital inflows, exchange rate flexibility, and credit booms,” IMF Working Paper no. WP/12/41 (2012).

[22] Zohair Alam, Adrian Alter, Jesse Eiseman, Gaston Gelos, Heedon Kang, Machiko Narita, Erlend Nier, and Naixi Wang, “Digging Deeper–Evidence on the Effects of Macroprudential Policies from a New Database,” IMF Working Paper no. 2019/66 (March 2019), https://www.imf.org/en/Publications/WP/Issues/2019/03/22/Digging-DeeperEvidence-on-the-Effects-of-Macroprudential-Policies-from-a-New-Database-46658.

[23] Ashima Goyal and Sritama Ray, “The pattern of global macroprudential regulations and its impact on borrowing costs,” Policy Brief (2023), TF5, T20, India.

[24] https://www.tcxfund.com/cross-currency-swaps/

[26] https://www.seafarerfunds.com/commentary/managing-currency-risk-in-the-emerging-markets/

[27] In an email exchange Dr. Frannie Leautier, Chair of the G20 Capital Adequacy Framework Report 2022, backed the proposal and remarked, ‘I think IFC-MIGA using the IDA Private Sector Window would be ideal for local currency risk solutions for EM clients.’

[28] G20, “Communique G20 finance minister and central bank governors meeting 4-5 September, Ankara, Turkey.” (2015).