Task Force 4: Refuelling Growth: Clean Energy and Green Transitions

Abstract

The global clean energy transition involves large-scale deployment of a suite of renewable energy, energy storage and other new technologies. These are highly mineral-intensive and accelerated adoption of such technologies will significantly increase the demand for critical minerals (CMs). Challenges to sustainable supply of CMs include inadequate investment in mining, increased and more volatile prices, higher supply risks, negative environmental and social impacts, concerns about corruption, misuse of public finances, and weak governance. The G20 can mitigate these threats to ensure a reliable, secure, and sustainable supply of CMs for a clean, just and inclusive energy transition. Key recommendations include strengthening international cooperation, improving mineral governance, adopting a circular carbon economy and mobilising finance and investment.

1. The Challenge

The global clean energy transition is a defining trend of the twenty-first century. It will be marked by the scale and speed of adopting a suite of renewable energy, energy storage, and other new technologies. These are highly mineral-intensive and accelerated deployment of such technologies will significantly increase the demand for critical minerals (CMs). While there is no universally agreed upon definition or list of CMs, there is consensus on their economic value, increasing strategic importance, and vulnerability to global supply chain disruption. Over the past decade, several countries, including G20 members such as the United States (US), the United Kingdom (UK), the European Union (EU), Canada, Australia, and Japan, have declared their lists of CMs. Cobalt, graphite, lithium, manganese, nickel, rare-earth and several other elements, are common across all lists.

Increasing Supply-Demand Gap

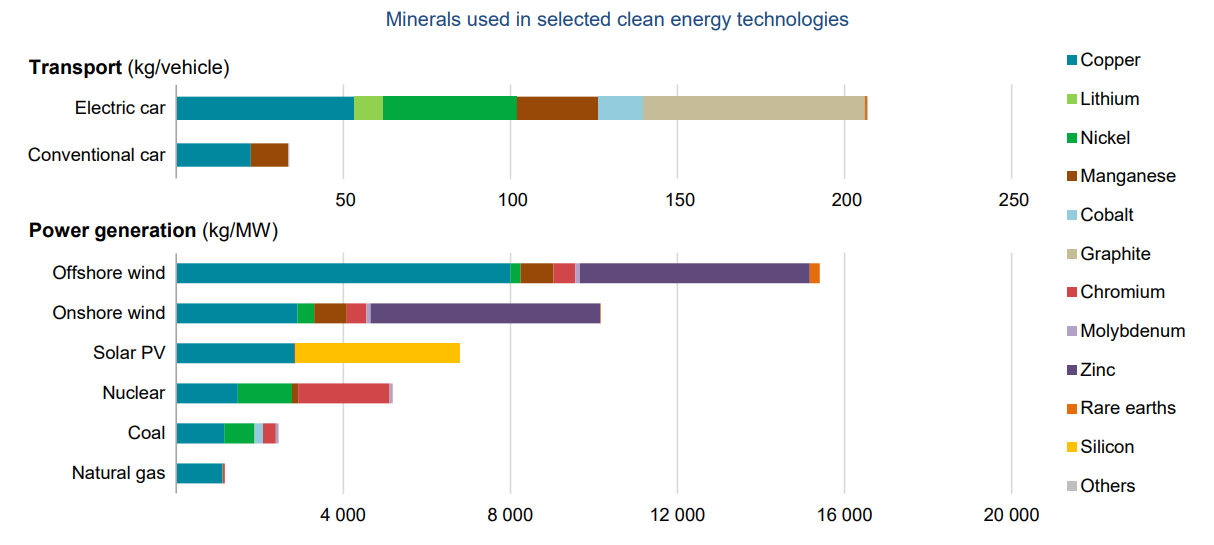

A single electric car uses more than 200 kg of CMs, such as copper, lithium, nickel and graphite—more than four times that used in conventional cars. Similarly, wind turbines use 10,000–15,000 kg of CMs per MW of installed power capacity, which is three to five times higher than the quantity of CMs used for coal- and natural gas-fired power plants (see Fig. 1).

Fig. 1. Mineral Intensity for Selected Clean Energy Technologies

Source: IEA[1]

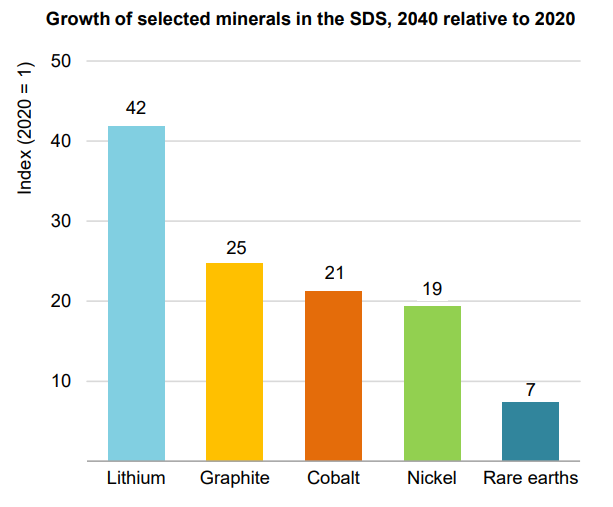

Fig. 2. Demand for Select Minerals from Clean Energy Technologies in the Sustainable Development Scenario, 2040, Relative to 2020

Source: IEA[2]

Inadequate Investments

Mining investments and mine development must catch up with the growing demand as the current project pipeline is limited, compared with the demand outlook.[5] Lack of geological data and mineral resource maps constrains exploration activities. Reports suggest that investments worth US$1.7 trillion will be required over the next 15 years for copper, cobalt, nickel and other CMs.[6] Other studies estimate the investment needed at US$100 billion for copper (by 2030)[7] and at US$21 billion for lithium production (by 2025).[8] Depletion of mineral deposits in existing mines, declining ore quality leading to increased wastage, lower mining productivity,[a] mine cost inflation,[9] and rising expenditure for decarbonisation have reduced mining profitability. This has led to increasing capital investment[b] in mining.[10] Long lead time for moving from mine discovery to production and infrastructure limitations on quickly ramping up production further tighten supply. Additionally, changing valuations driven by volatile equity prices and cyclical capital expansion for mining imply that current high prices may not be sufficient for mining companies to overcome financing challenges.[11]

Increased Prices and Volatility

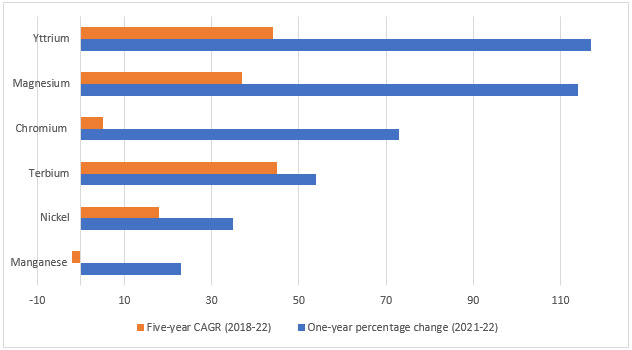

Prices of several CMs have increased by 20–115 percent from 2021 to 2022 and the five-year compound annual growth rate (CAGR) has risen by up to 45 percent (Fig. 3).

Fig. 3. Percentage Change in Prices of Selected CMs

Source: U.S. Geological Survey[12]

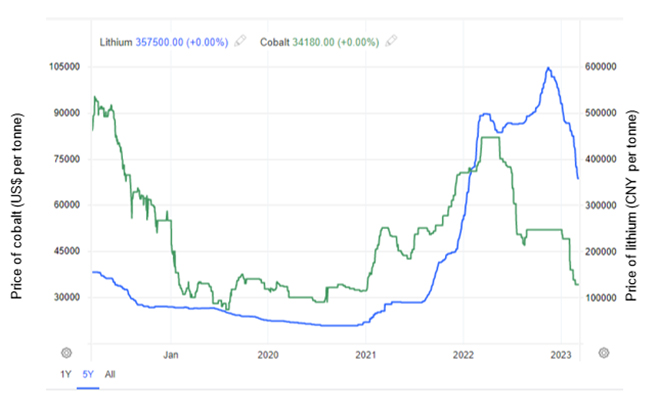

Fig. 4. Market Prices of Lithium and Cobalt

Source: Trading Economics[13]

Higher Supply Risks

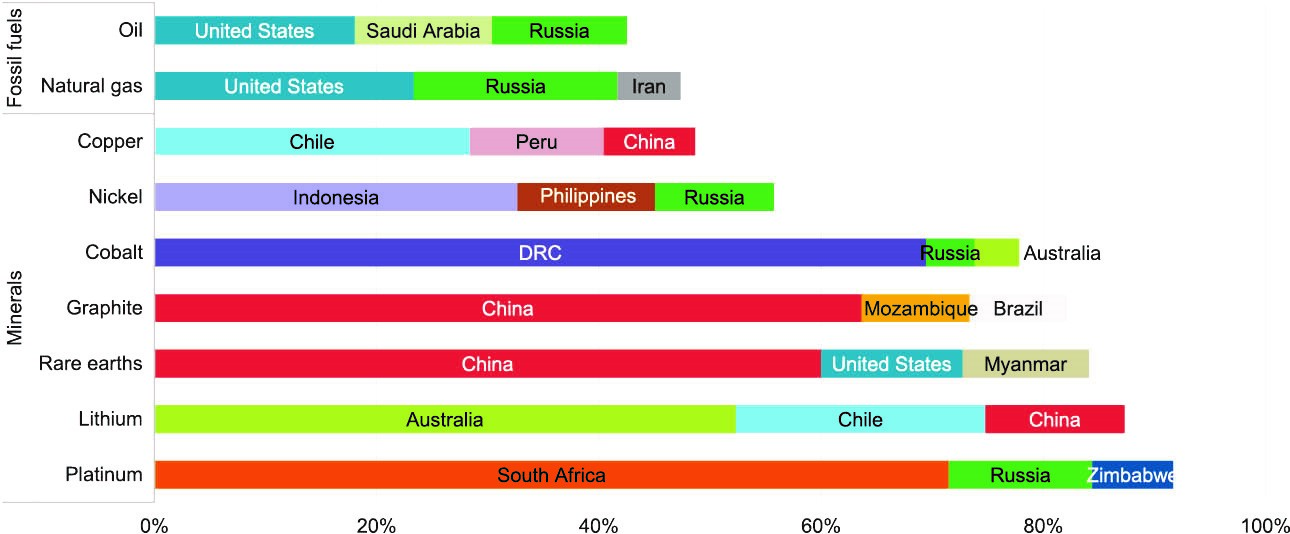

Uneven resource distribution and concentration of mineral value chains compounds the supply risks. For certain minerals, a handful of countries dominate extraction and production (Fig. 5).

Fig. 5. Share of Countries in the Extraction of Selected Minerals in 2019

Source: IEA[14]

Environmental and Social Impacts

Mining is associated with high land use change and has a significant environmental footprint—from waste production (mine tailings), water and soil contamination, and biodiversity and habitat loss. Mineral extraction and processing are energy-intensive and currently dependent on fossil fuels, leading to greenhouse gas (GHG) emissions. The social impacts of mining may include forced labour, child labour, escalation of wealth and gender inequalities, and health and safety issues.

High prices can incentivise mining in more environmentally and socially sensitive areas. Many mines are located on the territories of indigenous and other land-connected people or overlap with conservation areas.[15] Water is a crucial flashpoint, and women and girls are disproportionately impacted when mines reduce community access to water.

Strong mineral demand can also incentivise more artisanal and small-scale mining (ASM) activities, which are often poorly regulated. Increased unregulated ASM can cause environmental damage, pose public health and safety threats, and lead to conflict and spikes in illicit activities, such as smuggling.

Corruption and Public Finance Risks

The business opportunities associated with a mining boom can make licensing processes vulnerable to corruption. Companies may be tempted to offer bribes to speed up approvals and officials may cut corners, raising the risk of politically connected or unqualified companies acquiring mining rights. Procurement of goods and services by mining companies and negotiation for commodity trading deals can similarly be vulnerable to corruption.

For countries dependent on mining, there are public finance risks. Price volatility may make it challenging to anticipate revenue from the sector, destabilise government budgets and undermine public spending. Without adequate safeguards, the growing participation of state-owned enterprises—which may include large capital investments—can put a strain on public finances. Governance risks can increase due to exercising excessive control over the mining sector. The sale of the state’s share and deals with commodity traders can also be vulnerable to corruption.

Responsible Mining for Enhancing Sustainable Outcomes

If leveraged well, responsible mining—which involves all relevant stakeholders—minimises socio-environmental and governance risks, and promotes fair division of financial benefits. It can have significant positive spillover effects at the national level and for mining communities. Investments in mining and its supply chains can generate employment and tax revenue and attract foreign direct investment and new infrastructure, among others.

CMs can help achieve Sustainable Development Goal (SDG) 7 (energy) and SDG 13 (climate change) while mining activities indirectly impact SDG 3 (health), SDG 5 (gender), SDG 6 (water), SDG 8 (economic growth), SDG 9 (infrastructure and industrialisation), SDG 12 (sustainable production and consumption) and SDG 15 (life on land). Costs and benefits from mining of CMs must be equitably shared so that the energy transition can be just and inclusive and support the achievement of the SDGs. CMs need to be mined and sourced responsibly; producing countries should be able to optimise and distribute social and economic benefits from the financial gains of mining CMs; and lower-income countries should be able to afford the transition. Therefore, ensuring a sustainable supply of CMs calls for greater political attention and targeted policies.

2. The G20’s Role

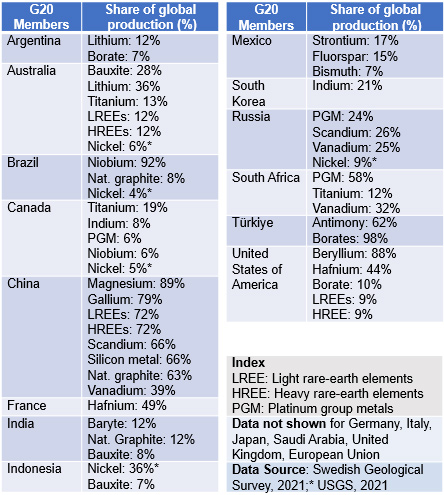

As a grouping of the world’s most influential economies, producers (Fig. 7) and large consumers of CMs, the G20 can play a vital role in addressing the challenges highlighted above.

Fig. 7. Share of Global Production of Some CMs in Select G20 Countries

Data source: Swedish Geological Survey[16] and U.S. Geological Survey

By taking a proactive approach, the G20 can help ensure a reliable, secure and sustainable supply of CMs at the pace and scale needed for the global clean energy transition. This Policy Brief proposes a model for an International Critical Minerals Observatory (ICMO) (Fig. 8). This model can be supported by the UN regional economic commissions and other relevant organisations.

Adopting CM Strategy and Transition Plans

Strategic planning—supported by mineral demand and supply estimations, mapping, resource assessments and data reporting for improved coherence, coordination and harmonised actions—is vital for ensuring a sustainable supply of CMs. Government entities, regulatory bodies, mining industry representatives and civil society must be consulted while preparing such plans. A number of critical mineral strategies have been adopted, including those by Australia, the UK, the EU, the US and Canada, which can provide guidance for other G20 countries. Formulating a clear strategy and an integrated roadmap can help in implementing strategic plans. Improved planning, bolstered by legislation,[c] can also promote investor confidence and support implementation of international agreements.

Creating a CM dashboard

Creating a CM value chain dashboard can improve tracking, reporting and transparency of data. Such a dashboard should have information about reserves, resources, mining projects, mine sites, investments, mining costs and use and is aligned with international standards, such as the United Nations Framework Classification for Resources (UNFC)[17] and the United Nations Resource Management System (UNRMS).[18] Such a dashboard should be publicly accessible like the Critical Minerals Mapping Initiative.[19] The critical minerals policy tracker, which collates key policies related to CMs for the energy transition, is one tool that can be leveraged to inform governments about effective policies.[20]

Promoting Inclusive Mineral Governance

Principles-based standards can improve mineral governance by systematising the criteria for sustainable mineral extraction and supply chains. These provide clear objectives instead of prescriptive rules and are more flexible and adaptable to changing circumstances. The UNRMS provides a principles-based framework to address the environmental, social and governance (ESG) and SDG risks, related to the value chain involving CMs.

Industry associations, such as the International Council on Mining and Metals (ICMM), set out principles and performance expectations for the mining industry. Similarly, the Extractive Industries Transparency Initiative (EITI) is a key global framework for good governance for mining and functions as a multistakeholder initiative, governed by governments, companies and civil society. The Initiative for Responsible Mining Assurance (IRMA) also provides comprehensive and internationally recognised standards while providing third-party certification for industrial-scale mine sites to improve responsible mining. Adoption of similar initiatives across the G20 can support more robust ESG performance in the mining sector and enhance sustainable outcomes.

Developing People-Centred Mining Practices and Partnerships

Partnerships between mining companies and local communities lead to improved engagement with key stakeholders. These are essential for identifying needs, understanding concerns and implementing solutions to mitigate negative social impacts of mining and to enable a just transition. It is important to increase the capacity of local communities to understand the socioeconomic costs and benefits of mining activities, initiated in the vicinity of their homes. Mining projects must ensure positive impact on communities and local populations by obtaining community consent, negotiating community development agreements, improving health and safety measures, respecting labour rights, and addressing gender and indigenous rights issues to build resilient communities.[21] All stakeholders should be sensitised and trained in effectively handling the socio-environmental impacts of mining.

Catalysing Mineral Supply Chain Investment

Timely investment in exploration and production of CMs is necessary to avoid delays or increased costs. Encouraging private-sector investment in CM supply chains and mining infrastructure generates economic benefits and increases resilience.[22] This can lead to local job creation, tax revenue, economic diversification, infrastructure development, and promotion of economic growth. Public–private partnerships between governments and mining companies attract investment and funds for mining research, ensure improvement of mining technology, encourage dialogue, and build the mutual trust needed to support sustainable mining activities.

Future-Proofing the Industry – Innovative Technologies and Alternative Materials

Adopting the circular carbon economy (CCE)[d] with its 4R components (reduce, reuse, recycle and remove) can help future-proof the mining industry. Mandating closed-loop systems can lead to adoption of innovative technologies for upstream mining activities, including ore extraction, reuse and recycling of raw materials from waste streams and mine tailings, thereby improving the efficiency of mineral extraction, processing and refining. Introducing monitoring and control technologies, automation and robotics, data analytics and other digital technologies can minimise environmental impacts and also significantly contribute to promoting social and community welfare.

Substitution of CMs with sustainable materials can reduce waste, conserve resources and create jobs. For example, use of different materials and technologies can reduce the demand for cobalt to produce lithium-ion batteries. Legislation for repair and reuse of goods, recycling products at the end of life, and implementing efficient collection can curtail extraction of CMs. It is also essential to close the supply-demand gap by establishing organised business models to reclaim CMs from electronic waste (e-waste), referred to as urban mining. These measures can minimise demand for minerals, reduce prices and promote responsible mineral production.

Forging a G20 Critical Minerals Security Partnership (G20-CMSP)

Improved coordination and coherence in the global mineral market is vital for a clean and just energy transition. Fostering international partnerships can be an effective way for mining companies, governments and industries to promote sustainable mining practices and ensure reliable and secure supply chains for CMs. International partnerships, such as the Critical Minerals Mapping Initiative (2019) and the Mineral Security Partnership (2022), can ensure robust CM supply chains. The G20 provides an excellent forum to include countries from the Global South; creating a G20 Critical Minerals Security Partnership (G20-CMSP) will expand the scope of existing international alliances. Measures can include stockpiling of CMs to enhance supply chain resilience and coordinated responses for sharing of critical minerals.

3. Recommendations to the G20

The G20 aims to support a sustainable supply of CMs for a clean, just and inclusive energy transition through coordinated efforts. This Policy Brief calls on the G20 governments to recognise the importance of critical minerals and strengthen their supply chains. Efforts in this regard can include:

Fostering international cooperation

- Creating an International Critical Minerals Observatory (ICMO) supported by the UN regional economic commissions.

- Supporting countries to develop a long-term strategic plan and formulate a clear implementation roadmap for advancing the CMs sector.

- Adopting data reporting framework and resource management systems and maintaining a central database of CMs.

- Creating a G20 Critical Minerals Security Partnership (G20-CMSP) through an active forum, including stockpiles of various CMs.

Improving mineral governance

- Advancing and adopting global ESG (environmental, social, and governance) standards linked to a possible SDG Risk Index and ensuring strict compliance;

- Establishing standards for including all stakeholders in consultation and decision-making processes and incorporating benefit-sharing agreements for impacted communities;

- Ensuring transparency and accountability in mining operations by public reporting, third-party audits and establishment of independent oversight bodies;

- Sharing best practices for streamlining and fast-tracking licensing for mining, reducing administrative inefficiencies while maintaining strong ESG safeguards and improving policy coherence; and

- Investing in capacity-building and training of personnel to improve understanding and skills.

Adopting a Circular Carbon Economy Framework:

- Promoting resource efficiency, scaling up recycling and using alternative materials;

- Implementing a strategic environmental assessment process for the life cycle of a mine, using adaptive management approaches and mandating annual environmental reporting; and

- Supporting research and innovation to develop new and improved technologies to reduce the environmental impact of mining and increase productivity along the entire mining value chain.

Mobilising finance and investment

- Integrating the CM agenda into existing G20 working groups, including those pertaining to international financial architecture, sustainable finance and global partnership for financial inclusion, to address CM investment shortages;

- Mobilising a fund for CMs as a dedicated channel for investments;

- Promoting public investment in resource-mapping, mineral exploration and open access to mineral resource maps; and

- Enabling private investment by creating market conditions throughout the value chain for the CM sector by adopting clear policies, de-risking investment and promoting innovative business models.

Attribution: Kapil Narula et al., “Ensuring Sustainable Supply of Critical Minerals for a Clean, Just and Inclusive Energy Transition,” T20 Policy Brief, May 2023.

Endnotes

[a] 28 percent lower, as compared with the last decade

[b] The capital expenditure of 20 leading miners increased by 20 percent in 2021 and was expected to increase to 22 percent in 2022.

[c] For example, the European Critical Raw Material Act, which sets benchmarks in terms of the share of domestic content as a percentage of the EU’s annual consumption of CMs for extraction (10 percent), processing (40 percent) and recycling (15 percent)

[d] Formulated under the Saudi Arabia G20 presidency and endorsed by all G20 countries.

[1] IEA, The Role of Critical Minerals in Clean Energy Transitions (Paris: IEA, 2021).

[2] IEA, The Role of Critical Minerals in Clean Energy Transitions (Paris: IEA, 2021).

[3]Harrison Bontje and Don Duval, “Critical Minerals Supply and Demand Challenges Mining Companies Face,” Ernst & Young Global Limited, last modified April 25, 2022.

[4] Seaver Wang et al., “Future demand for electricity generation materials under different climate mitigation scenarios,” Joule, Volume 7, Issue 2 (2023): 309-332.

[5] Harrison Bontje and Don Duval, “Critical Minerals Supply.”

[6] Pratima Desai, “Low Carbon World Needs $1.7 Trillion in Mining Investment,” Thomson Reuters, May 10, 2021.

[7] James Attwood, “The World Will Need 10 Million Tonnes More Copper to Meet Demand,” MINING.COM, March 19, 2021.

[8] Harrison Bontje and Don Duval, “Critical Minerals Supply.”

[9] Ajay Lala, Mukani Moyo, Stefan Rehbach, and Richard Sellschop, “Productivity in Mining Operations: Reversing the Downward Trend,” McKinsey & Company, May 1, 2015.

[10] GlobalData, “Mining Capital Expenditure to Rise by 22% across Leading Miners in 2022,” Mining Technology, March 1, 2022.

[11] Sigurd Mareels, Anna Moore, and Gregory Vainberg, “Through-Cycle Investment in Mining,” McKinsey & Company, July 8, 2020.

[12] U.S. Geological Survey, Mineral commodity summaries 2023 (Reston, VA: U.S. Geological Survey, 2023).

[13] “Lithium – 2023 Data – Summary,” Trading Economics, Accessed March 8, 2023.

[14] IEA, “Share of Top Producing Countries in Extraction of Selected Minerals and Fossil Fuels, 2019,” IEA, Accessed February 28, 2023.

[15] Kathryn Sturman et al., “Mission Critical – Strengthening Governance of Mineral Value Chains for the Energy Transition,” (Oslo: Extractive Industries Transparency Initiative, 2022).

[16] “Global production of critical raw materials (CRM),” Geological Survey of Sweden, Accessed March 13, 2023.

[17] “United Nations Framework Classification for Resources,” UNECE, Accessed March 03, 2023.

[18] “United Nations Resource Management System (UNRMS),” UNECE, Accessed March 03, 2023.

[19] “Critical Minerals Mapping Initiative,” Geoscience Australia Portal, Accessed March 30, 2023.

[20] “Critical Minerals Policy Tracker”, IEA, Accessed March 15, 2023.

[21] Sarita Ranchod, “Mining minerals sustainable development Southern Africa,” (South Africa: African Institute of Corporate Citizenship, 2001).

[22] Shunta Yamaguchi, “Securing reverse supply chains for a resource efficient and circular economy,” OECD Trade and Environment Working Papers, no. 2022/02 (2022).