Task Force 6: Accelerating SDGs—Exploring New Pathways to the 2030 Agenda

The Kartu Prakerja programme has been designed with the dual purpose of enhancing the competencies, productivity, and competitiveness of the Indonesian workforce, while also delivering essential social assistance during the COVID-19 pandemic. The programme applies digital transformation at all stages of its implementation, which include but are not limited to the registration and the distribution of training and incentive funds. In distributing social assistance, Kartu Prakerja applies the government-to-person 3.0 delivery system in collaboration with multiple payment platforms. Through digital transformation and financial inclusion, the Kartu Prakerja programme has reached 16.42 million beneficiaries from 514 regencies/cities throughout Indonesia. During the pandemic, the social provided by the programme helped the beneficiaries maintain a purchasing power. Kartu Prakerja has also proven successful in building economic resilience, encouraging financial inclusion and accelerating the accomplishment of multiple Sustainable Development Goals. The programme offers many lessons on ensuring ‘no one is left behind’.

1. The Challenge

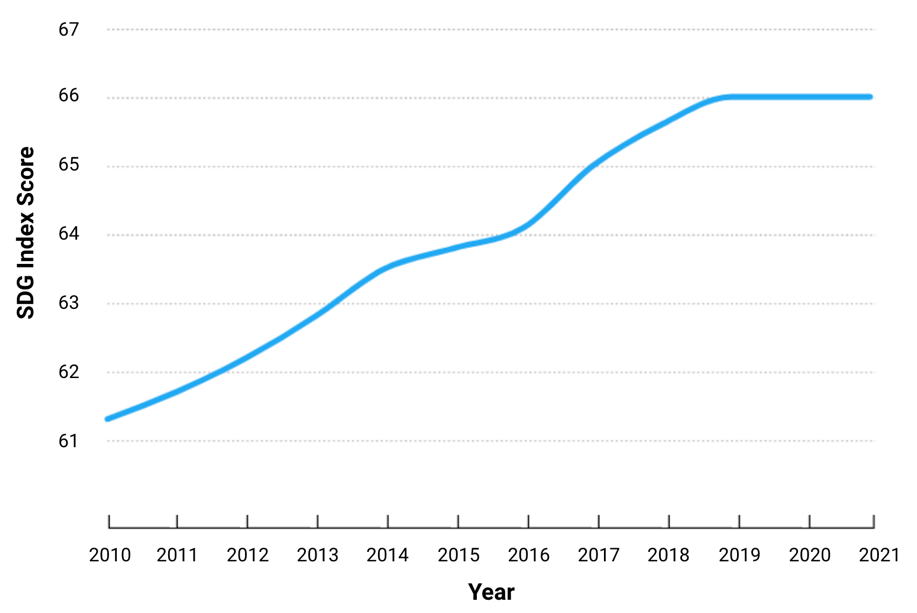

There has been limited progress towards achieving Sustainable Development Goals (SDGs) in the past two years. The average SDG index score declined slightly in 2021, partly due to slow development progress or even no progress at all in poor and vulnerable countries.[1] Various health crises, including the COVID-19 pandemic, caused bottlenecks and setbacks in the progress towards achieving the SDGs. This is a notable setback, especially considering that prior to the pandemic, global progress towards the SDGs was advancing at a rate of 0.5 point per year, which itself fell short of the necessary pace to achieve the 2030 target (see Figure 1).

Figure 1: SDG Index Score over time (world average: 2020–2021)

Source: United Nations [2]

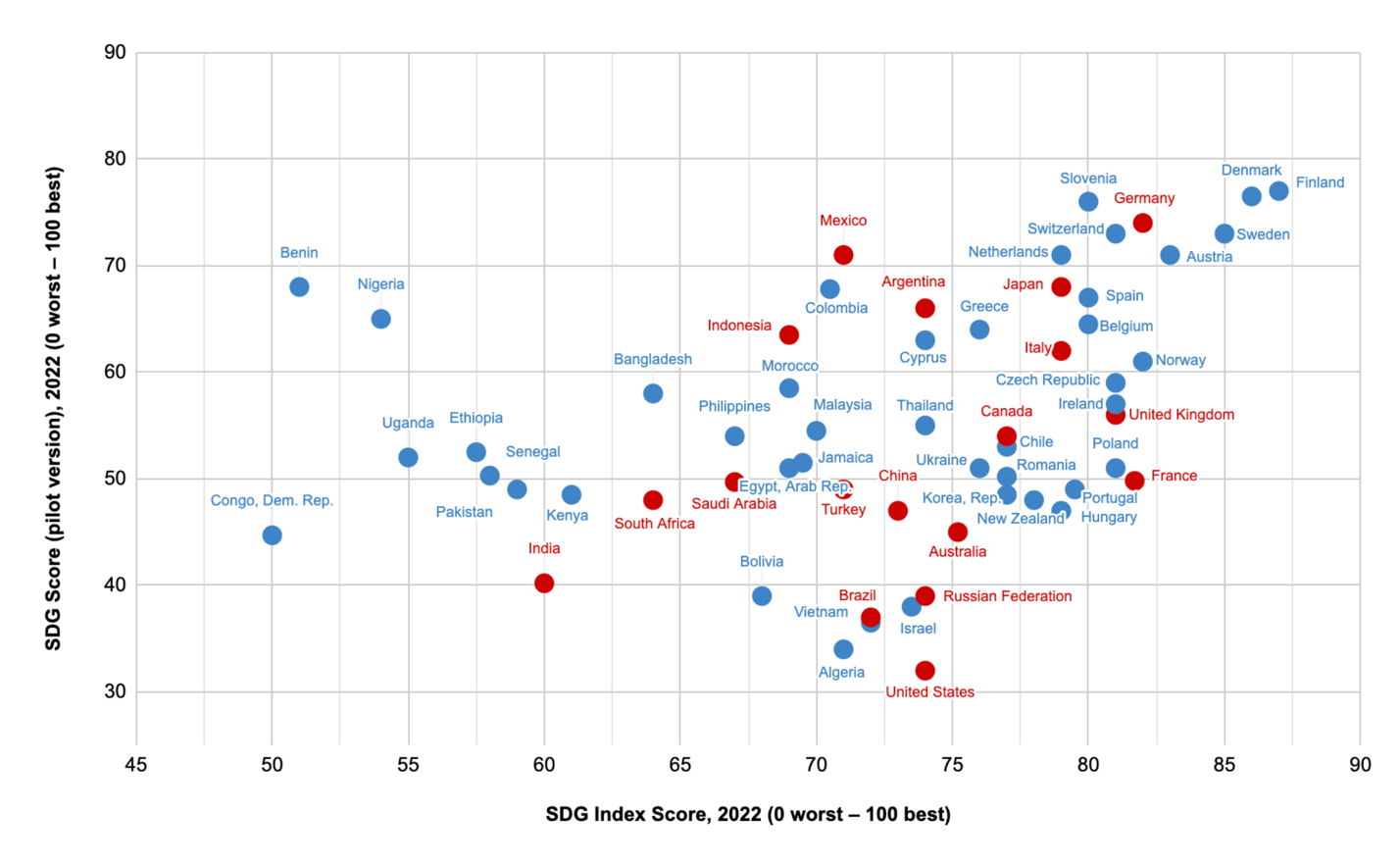

Figure 2: Various governments’ commitment and efforts towards SDGs Score (pilot version) versus SDG Index Score

Note: The score for Ukraine reflects the situation as of January 2022.

Source: United Nations[3]

Digital transformation can help accelerate progress in achieving each of the 17 SDGs. Massive digitalisation is needed to achieve the 2030 SDG Agenda, and it will likely have a major impact on society and economic growth. With digitalisation, all areas, including underdeveloped ones, can be reached to reduce inequality.

Moreover, financial inclusion plays a vital role as a catalyst for achieving other goals outlined in the 2030 Agenda. By promoting inclusive financial systems, we can foster enhanced economic growth. Financial inclusion not only reinforces the stability of financial institutions and economies but also stimulates domestic resource mobilisation through national savings, thereby contributing to increased government revenue.

2. The G20’s Role

The G20 has committed to achieving the SDG targets by 2030. The responsibility towards achieving these targets is shared, particularly among G20 countries that have taken an initiative to expedite the process. The G20 has specifically pledged to enhance digital financial inclusion[4] and promote digital transformation.[5] Encouraging the widest possible access to financial inclusion has been recognised as a collaborative effort to address existing challenges. G20 countries have committed to improving financial inclusion through Digital Economy Working Group (DEWG), which was initiated in Germany in 2017. Digital transformation can serve as a valuable tool to achieve the SDG targets in a more inclusive manner. As The importance of digitalisation as a means to promote inclusion has been acknowledged by the Digital Innovation Network within the G20, as evidenced during the G20 Indonesia meetings.[6]

Technology and the internet are powerful means to ensure that no one is left behind and to connect everyone through digitalisation.[7] The availability of internet access in G20 countries is one of the technological resources that can be further utilised. Data indicates that the average ownership of mobile devices in G20 countries is 281 million, and on average, 81 per cent of people access the internet.[8] Internet access and device ownership makes the programme’s reach more inclusive to the farthest regions.

The quality of the workforce is key to maintaining productivity. In the Indonesian context, in 2019, the Indonesian workforce was 120 million, and 90 per cent had never participated in training.[9] The lack of participation in training in the Indonesian workforce can be attributed to limited access, financial constraints and a lack of information. The infrastructure inequality in Indonesia exacerbates this, and the disparity in facilities and quality of training in urban and rural areas presents an additional challenge.

Lessons learnt from Kartu Prakerja

The Indonesian government initiated Kartu Prakerja in 2020 as a capacity-building programme for the local workforce. Improving the quality of the Indonesian workforce is a priority to boost the country’s productivity and economy. However, before the Kartu Prakerja programme had officially begun, the COVID-19 pandemic forced social restrictions.

The programme has embraced digital transformation and financial inclusion breakthroughs to adapt to the pandemic. Apart from aiming to increase employability, this programme provides social assistance for those affected by COVID-19. The distribution of Kartu Prakerja assistance employs a government-to-person (G2P) 3.0 scheme, which serves as a significant breakthrough in promoting financial inclusion. It uses advanced technologies and digital channels to provide a pathway for beneficiaries to digital financial services and promote financial inclusion.

Digital transformation involves integrating digital technologies into all aspects of an organisation or system, fundamentally changing how it operates and delivers value to its stakeholders. This transformative process often entails a shift in mindset, embracing innovation and adaptability to stay competitive and responsive to the evolving needs of society. Some examples of digital transformation include adopting cloud computing, using artificial intelligence and data analytics to inform decision-making, and implementing digital platforms for improved communication, collaboration and service delivery.

Digital transformation plays a pivotal role in enhancing the efficiency, accessibility and impact of the Prakerja programme. By leveraging digital platforms, Kartu Prakerja connects beneficiaries to relevant training opportunities, job platforms and financial services, ensuring that even individuals in remote areas can access the resources and support they need to improve their skills and livelihoods. The programme’s end-to-end digital approach also enables real-time monitoring and evaluation of its performance, allowing for continuous improvement and adaptation to emerging needs and challenges.

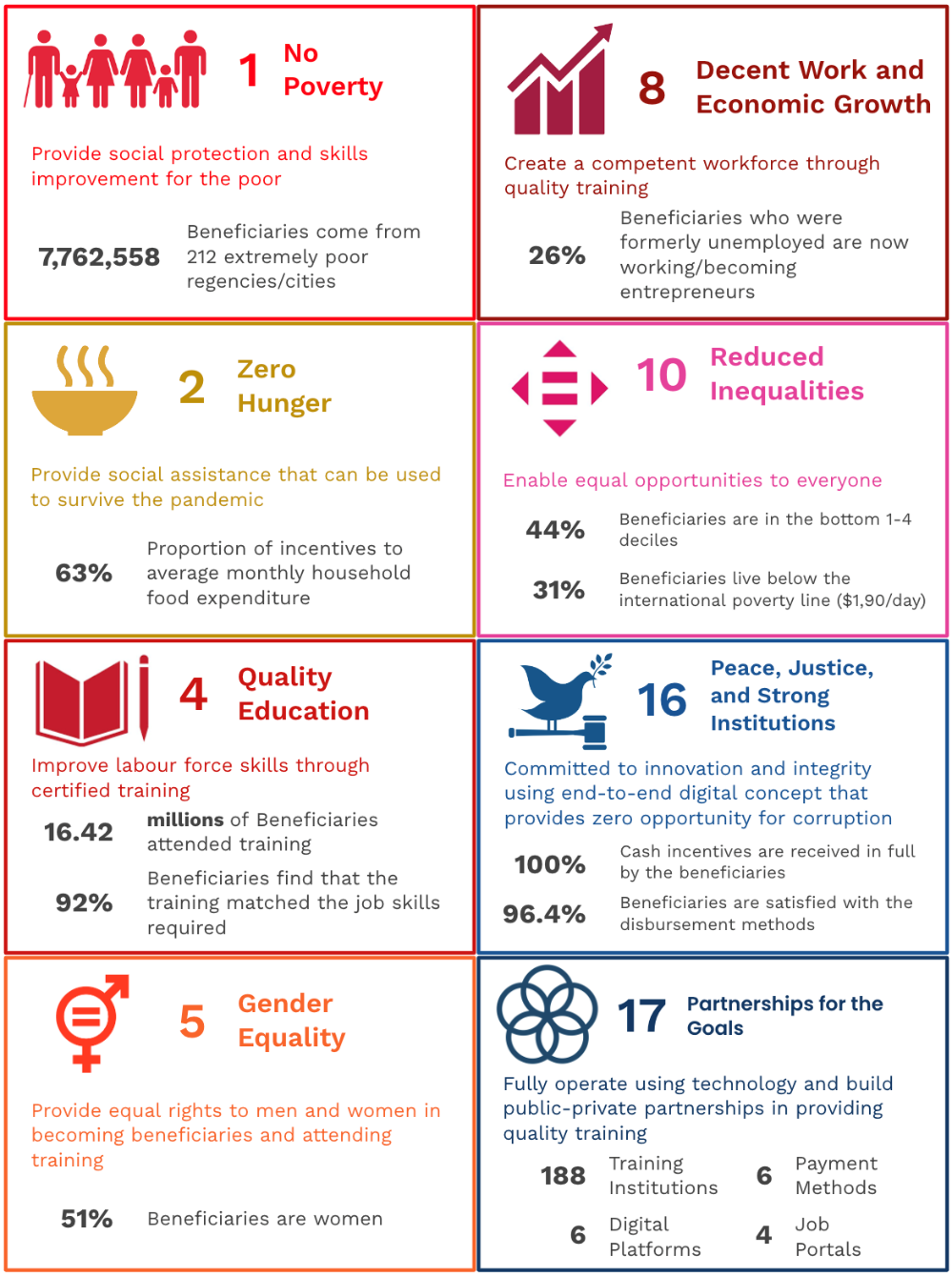

Overall, digital transformation is a crucial enabler for the Kartu Prakerja programme in achieving eight of 17 SDGs, driving its success in promoting inclusive and sustainable development in Indonesia. This digitally-driven approach has allowed Prakerja to address multiple SDGs simultaneously, including poverty reduction, quality education, gender equality, decent work and reduced inequalities by enhancing its efficiency, scalability and inclusiveness interventions. Furthermore, by fostering multi-stakeholder collaboration and leveraging digital technologies for monitoring and evaluation, Kartu Prakerja promotes peace, justice, strong institutions and global partnerships for sustainable development, further illustrating the transformative power of digital transformation in advancing SDGs.

The business processes of the Kartu Prakerja programme are conducted through web-based platforms. The programme offered online training in 2020–2022, with a wide range of available options. There are 1,224 trainings, 188 training institutions, 6 digital platforms and 6 payment partners. The learning process applies Learning Management System (LMS) and is self-paced so beneficiaries can adjust their training time. Flexibility in time and place is an extraordinary potential provided by Prakerja through digital transformation.

By implementing the principle of digital transformation, the Kartu Prakerja programme successfully reached an inclusive beneficiary base of 16.42 million people from 2020 to 2022. The beneficiaries of the programme come from 514 districts and cities across Indonesia, including women (51%), people with disabilities (3%), former migrant workers (3%) and rural residents (64%). The Kartu Prakerja evaluation survey results show that more than 83 per cent of beneficiaries experienced skilling, reskilling and upskilling. Additionally, 70 per cent of beneficiaries expressed their intention to include their certificates when applying for jobs, highlighting the value and recognition of the program’s training. Furthermore, it is noteworthy that 26 per cent of previously unemployed beneficiaries have successfully secured employment or ventured into entrepreneurship, indicating the positive impact of the programme in addressing unemployment challenges.

The results of impact evaluations from independent institutions, such as J-PAL SEA and Presisi Indonesia, scientifically prove the long-term benefits of Prakerja (see Figure 3). The programme beneficiaries experienced an increase in competencies (2.2%), productivity (2.7%), competitiveness (3.8%) and entrepreneurial ability (48.5%).[10] In addition, beneficiaries of Prakerja experienced a 10-per-cent increase in their monthly income or the equivalent of IDR 122,500 compared to non-beneficiaries.[11]

Figure 3: Snapshot of the SGDs in Kartu Prakerja

Source: PMO Kartu Prakerja Administrative Data 2020-2022, [12] PMO Kartu Prakerja Evaluation Surveys 2020-2022. [13]

3. Recommendations to the G20

Promoting adoption of digital technology for inclusive programmes and to support SDG principle of ‘no one is left behind’

The Kartu Prakerja programme fully embraces digital technology throughout its implementation, including the registration process, training selection, learning modules and evaluation surveys. The recommendations and results derived from the implementation of digital transformation in the Kartu Prakerja programme are as follows:

- End-to-end digital process: The Prakerja programme runs 100 per cent digitally. The end-to-end digital principle of the programme is carried out using a web-based application that minimises requirements and ensures easily accessibility to its users. All user journey processes are accessed through the website with complete information and instructions. Only a simple digital device that can access a browser and is connected to the internet is needed to participate in the program. With this principle, Prakerja provides opportunities for equal access and benefits to everyone regardless of race, gender, age and others. This is especially relevant in developing countries that often have varied disparities in access and infrastructure. Moreover, the end-to-end digital principle also provides opportunities to those commonly marginalised. The inclusive aspect of end-to-end digital implementation can be seen in millions of Prakerja beneficiaries spread across 514 districts and cities in Indonesia. Prakerja beneficiaries come from various groups, including people from 3T areas—frontier, outermost and least developed.

- Beneficiary-centric approach: To achieve the goal of “no one left behind”, the provision of access needs to be accompanied by a comprehensive digital strategy that considers the requirements and challenges of various groups, as well as the specific contexts in which they live and work. The Kartu Prakerja program implements a user-oriented digital end-to-end system and a user-friendly interface. It is receptive to feedback through ratings and reviews of beneficiaries on the training they attended and evaluation surveys. Feedback from beneficiaries serves as the foundation of the Prakerja programme, driving continuous improvement and enhancing the overall quality of the programme. In addition, the programme provides a dependable contact centre as part of its responsibility to address and resolve complaints and issues raised by beneficiaries This is crucial for delivering high-quality service and maintaining positive relationships with beneficiaries.

- Giving voice and choice to select training: Another essential aspect of creating an inclusive programme is providing flexibility. The Kartu Prakerja programme provides choices for its users in each user journey. Users are free to choose to register, select the training of their interests and decide on preferences for the cash-incentive distribution. Trainings were conducted online during the pandemic using the webinar method and learning management system. With the concept of self-paced learning, Kartu Prakerja programme gives users the freedom to attend training anytime and anywhere and determine the pace of the learning process themselves. One example is housewives who may only be able to attend training at night or workers who can only attend training after working hours or on weekends. This flexibility is certainly beneficial as it enables the programme to cater to the unique needs and circumstances of individual users, regardless of their diverse backgrounds. This further enhances the inclusivity of the programme.

Collaborating with multiple digital financial services to promote financial inclusion and support the achievement of SDGs

Financial inclusion refers to the accessibility and utilisation of affordable and formal financial services by all members of society, especially those traditionally underserved such as low-income individuals, women and rural populations. Examples of financial inclusion initiatives include offering basic bank accounts, mobile banking and e-wallet services, microcredit and microinsurance products, and promoting financial literacy and education.

Prakerja is a prime example of how financial inclusion can be integrated into development programmes to maximise their impact. By partnering with banks and e-wallet providers, the programme ensures that beneficiaries can securely and conveniently access their financial incentives, encouraging the use of formal financial services and promoting financial literacy. This approach enables the programme to reach remote and underserved populations, providing them with the necessary resources and opportunities to improve their skills and livelihoods.

Financial inclusion is particularly relevant to the achievement of several key SDGs, including poverty reduction (SDG 1), gender equality (SDG 5), decent work and economic growth (SDG 8) and reduced inequalities (SDG 10). By providing access to essential financial services and tools, financial inclusion initiatives can help lift people out of poverty, promote economic empowerment for women, create jobs and reduce income disparities. In the case of Prakerja, integrating financial inclusion into the programme has contributed to its success in achieving 8 of the 17 SDGs, demonstrating the transformative potential of combining digital transformation and financial inclusion to drive inclusive and sustainable development.

The G20 countries should use the lessons learnt from Indonesia’s Prakerja G2P 3.0 to foster inclusivity. As one of the best practices of G2P 3.0 implementation, Kartu Prakerja has proven the effectiveness of G2P 3.0 in distributing social assistance and accelerating financial inclusion inclusively. G2P 3.0 provides easier choices to access government benefits and services, which are highly oriented towards the convenience of its users. In 2020–2022, the Kartu Prakerja programme distributed IDR 40.17 trillion to 16.42 million beneficiaries. The distribution of G2P 3.0 funds, along with digital transformation, has proven to maximise the benefits provided by the programme. Thus, the following are specific recommendations to G20 countries regarding implementing G2P 3.0 based on the case study of Kartu Prakerja:

- G2P 3.0: Kartu Prakerja Program distributes cash incentives using the G2P 3.0 scheme, which uses a multi-channel approach. It gives beneficiaries the freedom to choose the channel of distribution according to their preferences. This scheme allows the programme to distribute large-scale incentives with high accuracy, speed, and transparency. In collaboration with six payment service providers, Prakerja provides six options for channelling cash incentives: two banks and four digital wallets. Direct disbursement from the government to beneficiary accounts eliminates complicated and slow bureaucracy. The G2P 3.0 distribution process has made delivering cash incentives more efficient, secure and cost-effective.Precise and effective distribution of massive cash incentives: API integration between Kartu Prakerja and payment partners and the Know-Your-Customer (KYC) feature can ensure that the account receiving cash incentives belongs to the appropriate beneficiary. This effort is made to prevent fraud and illicit transactions. Prakerja also adopts the liveness feature to verify the beneficiary’s face according to the beneficiary’s ID card data. These features are supported by cloud technology, which enables centralised and integrated data storage, ensuring a high level of security and facilitating easier data management.

- Eliminating opportunities for corruption and bribery: G2P disbursement schemes can significantly bypass previous stages or intermediaries for payment, which will eliminate the potential for corruption and bribery. The withholding of cash incentives by irresponsible parties threatens good governance in assisting the community.

In conclusion, the Kartu Prakerja programme in Indonesia has demonstrated significant positive impacts on the achievement of multiple SDGs by leveraging digital transformation and financial inclusion as key enablers. The programme has successfully addressed a range of SDGs, including poverty reduction (SDG 1), food security (SDG 2), quality education (SDG 4), gender equality (SDG 5), decent work and economic growth (SDG 8), reduced inequalities (SDG 10), peace, justice, and strong institutions (SDG 16) and partnership for the goals (SDG 17). These accomplishments highlight the critical role that innovative, technology-driven approaches can play in accelerating progress towards the 2030 Agenda.

Therefore, it may be said that digital transformation and financial inclusion breakthroughs accelerate progress towards achieving SDGs. By leveraging digital technology and fostering greater financial inclusion, it is possible to bridge the gaps in access to essential services, reduce inequalities and promote sustainable economic growth. This is particularly relevant as it recognises that humanity is part of one earth, one family and shares a common future.

Emulating the Kartu Prakerja digital transformation and financial inclusion breakthrough in other G20 countries can significantly achieve multiple SDGs, positioning it as an SDG multiplier and SDG accelerator.[14] Prakerja’s model, which combines skill development with conditional cash transfers, has the potential to address various interconnected goals.

By replicating the Prakerja model and adapting it to their specific contexts, G20 countries can harness the power of digital transformation and financial inclusion to tackle some of the most pressing global challenges. In doing so, they contribute to building a more inclusive, equitable and sustainable world where everyone can access opportunities and resources for a better life, reinforcing the significance of global cooperation and shared responsibility in realising the SDGs.

Attribution: Riatu Mariatul Qibthiyyah et al., “Ensuring Progress on SDGs through Digital Transformation and Financial Inclusion,” T20 Policy Brief, July 2023.

Endnote

[1]United Nations, “The Sustainable Development Goals Report 2022,” April 5, 2023. United Nations.

[2] United Nations, “The Sustainable Development Goals Report 2022.”

[3] United Nations, “The Sustainable Development Goals Report 2022.”

[4] Global Partnership for Financial Inclusion and G20 China, “G20 High-Level Principles for Digital Financial Inclusion,” Department of Economic and Social Affairs, Sustainable Development, 2016, United Nations.

[5] “Proposing Human Rights-Centred Digital Compact, Secretary-General Urges Universal Connectivity, Online Autonomy for Ordinary People, at G20 Summit,” Meetings and Press Releases, United Nations.

[6] ERIA, Whitebook, G20 Digital Innovation Network, 2022.

[7] Isabelle Deganis, Pegah Zohouri Haghian and Makiko Tagashira, “Leveraging digital technologies for social inclusion,” Policy Brief no. 92. UN DESA, February 2021.

[8] “Individuals Using the Internet (% Population),” Data: World Bank.; “Mobile Cellular Subscription,” Data: World Bank.

[9] Statistics Indonesia, The National Labour Force Survey 2019, Indonesia, 2022, ILO.; Indrawati Mulyani (ed.), In Keeping Indonesia Safe From The Covid-19 Pandemic: lessons learnt from the National Economic Recovery Programme, ISEAS Publishing, Singapore, 2022.

[10] Mugijayani Widdi et al. Impact Evaluation of Kartu Prakerja as a COVID-19 Recovery Program, Indonesia, February 2022. Presisi.

[11] Alatas Vivi et al. Kartu Prakerja Impact Evaluation: Preliminary Findings. Southeast Asia. October 4, 2021. J-PAL.

[12] PMO Kartu Prakerja, Administrative Data 2020–2022 (17 April 2020 – 10 December 2022), 2022.

[13] PMO Kartu Prakerja, Evaluation Surveys 2020–2022 (5 August 2020 – 10 December 2022), 2022.

[14] “SDG Acceleration Actions: Program Kartu Prakerja,” The Project Office of Kartu Prakeja (Government), United Nations, Indonesia.