Task Force 4. Refuelling Growth: Clean Energy and Green Transitions

As countries adopt ambitious climate policies domestically, they also risk carbon leakage. To minimise such risk, a number of countries, including Canada, Japan, the United Kingdom, the United States, and the European Union (EU) are contemplating the adoption of carbon border adjustment mechanisms (CBAMs). However, given their potential impacts, developing countries are objecting to the implementation of CBAMs. This Policy Brief explores the trade impacts should CBAMs be adopted by Western Europe and the US based on the EU’s proposed model where six sectors are to be initially targeted. Using a computable general equilibrium model, the paper simulates the impacts of CBAMs on trade, welfare, and carbon dioxide (CO2) emissions following a US$100/tCO2e carbon tax. The brief outlines a series of policy recommendations for the G20 to prepare for and adjust to CBAMs.

1. The Challenge

Trade is a source of significant amounts of greenhouse gas (GHG) emissions: Over the past two decades, the production and transportation of goods and services accounted for 20-30 percent of global emissions.[1] As extreme weather events attributable to climate change become more frequent, many countries are pushing for ambitious climate policies. However, they equally fear the risk of carbon leakage, i.e., an increase in GHG emissions resulting from the movement of production by businesses away from countries with strict emission standards to those with more lenient regulations.[2] Therefore, many countries are also planning to adopt mechanisms that protect the competitiveness of domestic industries, such as the carbon border adjustment mechanism (CBAM). CBAMs are a form of tariff applied on imports whereby importers must bear regulatory costs concerning carbon emissions equivalent to those incurred by domestic producers.[3]

So far, Canada, the European Union (EU), Japan, the United Kingdom (UK), and the United States (US), have all indicated the possibility of introducing CBAMs in their jurisdictions.[4] The EU has come the farthest in terms of the design of its CBAM. The mechanism is to go into effect in 2026 after an initial phase starting in October 2023.[5] Countries exporting to the EU will need to purchase certificates corresponding to the EU carbon price to deter carbon leakage. The EU CBAM will initially apply to six sectors: cement, iron steel, aluminium, fertilisers, electricity, and hydrogen; it will subsequently apply to other emissions-intensive sectors.[6] The other countries will likely apply CBAMs in similar carbon-intensive sectors.[7]

While CBAMs could effectively mitigate carbon emissions, the imposition of such measures will significantly impact the competitiveness of exports and welfare in developing countries. A number of studies assessing the impact of the EU CBAM identify African and Asian countries as the ones who could be disproportionally affected by the adoption of this mechanism.[8] To capture the impacts of the price shock associated with CBAM across the global economy and related inter-sectoral effects, this Policy Brief uses a Computable General Equilibrium (CGE) model to simulate them on trade, welfare, and carbon dioxide (CO2) emissions in the context of US$100/tCO2e carbon tax applied by Western Europe[a] and the US.

According to the modelling results, the impact of the CBAM on G20 economies is likely to be mixed. Industries in countries with high carbon prices may benefit from increased competitiveness, as CBAMs would place a cost on imports from countries with lower carbon prices. On the other hand, industries in countries with lower carbon prices may face increased costs, which could make them less competitive in the destination market.

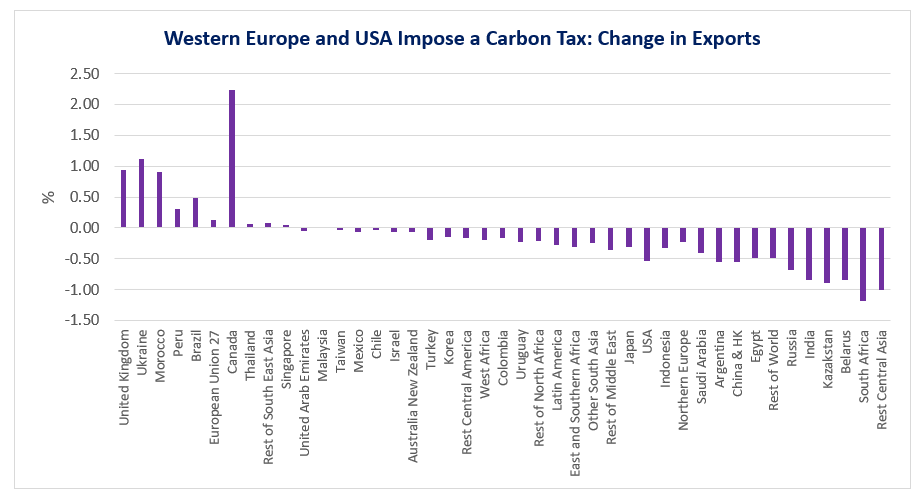

Fig. 1 Potential Change in Exports of G20 Countries

Note: *Includes New Zealand.

Source: Authors’ estimations using GTAP and UNCTAD CO2 emissions data.

The CBAM would have a significant impact on trade between G20 countries. Countries heavily reliant on exports of goods with high carbon-embedded emissions—such as fossil fuels and steel—could see a significant reduction in demand for these products. This could lead to a shift in the global supply chains as countries seek to reduce their carbon footprint. Trade by G20 economies in duty-exposed products would witness a total decline of 2.3 percent in case the EU and other Western European countries impose a carbon tax of US$100/tCO2e. Decline in exports from South Africa, India, and Russia would be the largest, at 0.9 percent, 0.6 percent and 0.5 percent, respectively. Exports from China would register the largest absolute loss of US$11 billion following the CBAM. On the other hand, Canada, the UK, Brazil, and the EU could witness an increase in exports as a result of an improvement in the terms of trade following the slowdown in exports from countries such as China, India, Russia and South Africa.

The simulation of the case in which Western Europe and the US apply CBAM, finds that China’s mineral products register the largest absolute decline in exports worth US$10.5 billion, followed by India’s Iron and Steel with a decline of about US$4.2 billion. The most significant gains in exports, on the other hand, are witnessed by the EU across all sectors. It is important to note that the sectors affected by the CBAM are price-inelastic. For instance, demand for fertilisers would not see substantial declines as fertilisers are essential for agricultural activities. For sectors not covered under the CBAM, the situation could be much different.

Fig. 2 Final Exports Change for Directly Affected Exports After Introducing CBAM

Note: Changes in exports here reflect the change following a $100/tCO2e tax imposed by the WE and US. WE= Western Europe, including EU27, UK, and northern Europe (Norway, Switzerland); Intra-EU trade included in EU27.

*Includes New Zealand.

Source: Authors’ estimations, using GTAP and UNCTAD CO2 emissions data.

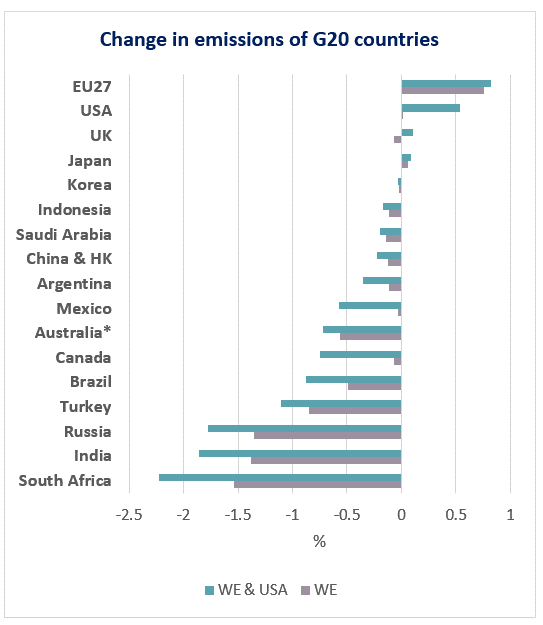

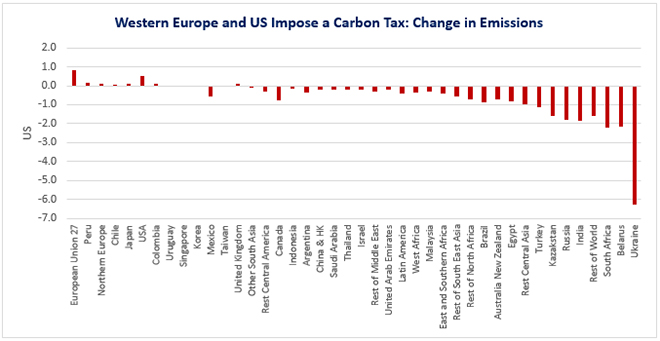

While the carbon tax will achieve a reduction in emissions by most countries, those by the EU and the US will experience an increase as a result of fewer imports and an expansion of domestic production. Countries that are predominantly net exporters in terms of CBAM-affected sectors will witness steep declines in emissions. However, countries such as India will likely face significantly higher costs of emissions reduction, making them inefficient in production compared to the baseline. The reduction in emissions following a US$100 carbon tax imposed on G20 countries in both scenarios[b] is expected to reduce emissions by 0.3 percent. The declines in emissions under both scenarios would be the largest for South Africa, India, and Russia. These declines stand at 2.2 percent, 1.8 percent, and 1.7 percent, respectively, under scenario 2.

Fig. 3 Potential Change in Emissions of G20 Countries

Note: *Includes New Zealand.

Source: Authors’ estimations, using GTAP and UNCTAD CO2 emissions data.

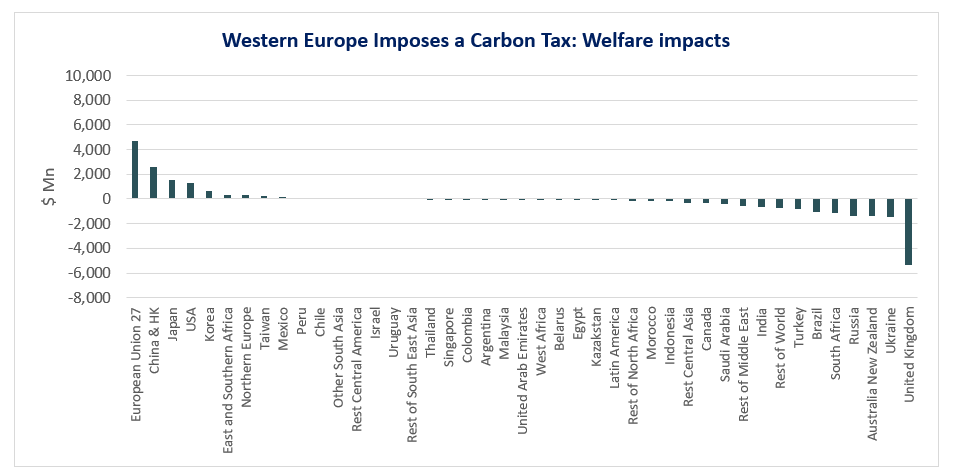

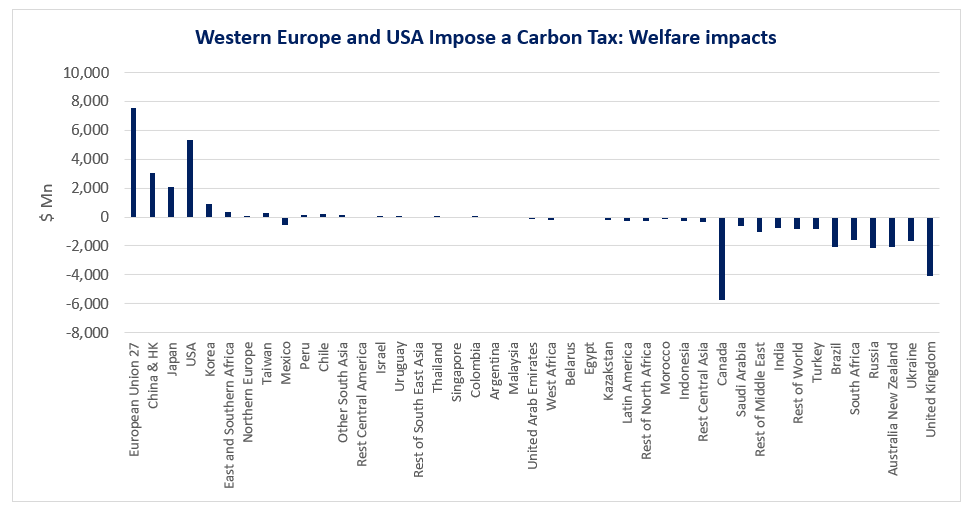

The CBAM affects utility of households and, in turn, welfare by changing the relative prices of consumer products. Results on welfare impacts suggest that the EU and US increase domestic production, reduce their reliance on imports, and accrue increased revenues from CBAMs worth US$6.1 billion and US$7.8 billion, respectively. However, the UK and Canada, which are net importers of commodities produced by the CBAM-affected sectors, register a decline in welfare. China witnesses an increase in welfare despite its exports of CBAM-affected sectors facing declines. This is due to the country’s productive reallocation of resources towards sectors not covered under the tax and a consequent increase in thus exports and overall welfare. Countries outside the G20 are also expected to witness welfare declines of around US$7.7 billion; global losses worth US$5.9 billion are expected; and the reduction in emissions is minimal. A better mechanism is needed.

Fig. 4 Potential Welfare Impacts in G20 Countries

Due to their considerable adverse impact on developing countries, CBAMs raise concerns regarding fairness and equity, even more so because these countries have historically been among those least responsible for GHG emissions. Between 1751 and 2017, emissions from the United States, the EU, and the UK accounted for approximately 47 percent of cumulative global emissions,[9] whereas Asia and Africa, 29 percent and three percent, respectively. Brazil, Russia, India, China, and South Africa issued a Joint Statement at the BRICS High-level Meeting on Climate Change in May 2022, describing CBAMs as “green trade barriers” that “seriously undermine multilateral cooperation and the ability of the concerned countries to combat climate change.”[10] While there is consensus that all countries must take action to reduce emissions, an approach based on differentiated responsibilities and a compensation package to go with it must be considered.

2. The G20’s Role

With the world’s largest advanced and emerging economies as members, the G20 is an ideal platform for initiating high-level global political dialogue on carbon leakage and CBAMs, and for promoting requisite international coordination and collective action on these issues. CBAMs will have significant implications for global commerce, as it stands to create both winners and losers in the context of international trade. The G20 can tackle potential risks of trade disputes and fragmentation by facilitating dialogue, enabling greater understanding of diverse perspectives and concerns, and identifying areas of common ground. G20 countries can adopt a multilateral approach for designing and implementing CBAM that strives for consensus on ways to tackle carbon leakage and to address the needs and concerns of developing countries. Moreover, by coordinating efforts at the international level, the G20 can ensure that CBAMs are consistent with international trade rules and mitigate the risk of trade disputes.

3. Recommendations to the G20

a. Advocating for multilateral solutions and ensuring policy coherence

While CBAMs can be effective in addressing carbon leakages, unilateral measures will only further complicate the international trading system to the detriment of developing and least-developed countries (LDCs). There is a range of other instruments that can be adopted to prevent carbon leakage at the international level. Multilateral cooperation is key to addressing such issues. For instance, some experts have called for an international carbon pricing floor that targets all key emitters and a differentiated price floor that takes into account the development levels of countries.[11]

Alternatively, international instruments such as the Paris Agreement could be further leveraged to address concerns associated with carbon leakage. The Paris Agreement comprises provisions encouraging countries to establish market mechanisms such as the EU Emissions Trading System (ETS). Further assistance could be given to developing countries enabling them to establish their respective ETS. ETS operating in some of the largest polluters among developing countries could help level the playing field and mitigate risks of carbon leakage. Some experts have also suggested the adoption of a global system trading in pollution rights as envisaged under the Kyoto Protocol.[12]

In the long run, multilateral solutions will be crucial for addressing carbon embedded in trade. The G20 can begin advancing talks on multilateral solutions through different platforms, including the World Trade Organization (WTO) and the United Nations Framework Convention on Climate Change (UNFCCC). It would be important for the G20 to coordinate with these institutions in setting up regulatory and institutional frameworks, both in the case of CBAMs or their alternatives. This is also to ensure compatibility with WTO rules and other international agreements, including the Paris Agreement and Kyoto Protocol, especially as it relates to the principle of ‘common but differentiated responsibilities’.

b. Adopting international reporting standards and guidelines for measuring CO2

As CBAMs and other carbon pricing systems are being adopted globally, countries will have to concomitantly adopt international reporting standards and guidelines for measuring CO2 emissions that are compatible across, and equivalent between countries. In the absence of common ground, different standards and guidelines adopted across countries run the risk of turning into non-tariff barriers that increase cost of trade. Thus, the G20 can play an important role in setting a common agenda and prioritising the development of common standards for CBAMs.

At the same time, ensuring compatibility in the design of different CBAMs and consensus on ways for determining equivalence between different carbon pricing instruments can decrease the administrative burden on exporters and importers. Some experts have proposed the setting up of a multilateral body that operates either at the level of the WTO or the UNFCCC and facilitates the determination of carbon levies to be paid.[13] Essentially, such a body will serve as a clearing house for permissible carbon emissions.

c. Building and facilitating the developing world’s capacity in adopting climate-friendly production techniques

Based on the development levels and needs of developing countries, advanced economies can help them build their capacity to respond to CBAMs and adopt climate-friendly production techniques. This can include financial assistance, transfer of technology, and the sharing of best practices. The G20 must advocate for such efforts as they can ensure that developing countries are neither disproportionately impacted by nor left behind in the transition to a low-carbon economy. Assistance could also be directed at empowering private sector operators by equipping them with necessary skills and expertise to adjust to CBAMs. This can include supporting the formulation of strategies and responses to CBAMs, determining embedded carbon emissions in production, and other types of technical assistance and capacity building.

d. Redistributing CBAM revenues for climate finance for developing countries

In the case of the EU, the European Commission has proposed that the revenue collected from CBAM will be allocated to the general EU budget.[14] Developed countries should devise programmes through which CBAM revenues can be redistributed among impacted countries as assistance. However, given the severity of CBAM’s impacts on the developing world, it would be more favourable to redistribute CBAM revenues among developing countries as assistance for implementing net-zero policies and practices. Assistance programs can be tailored to address carbon intensity of production or other related challenges. CBAM revenues can also be used for climate finance activities. Moreover, if CBAM revenues will be used to such ends, it could mitigate risk of trade disputes that may arise from the imposition of a carbon tariff. The G20 can thus play an important role in influencing the utilisation of CBAM revenues by the global community.

e. Adopting concessions and Special and Differential treatment for developing countries

At the multilateral level, countries need to discuss the possibility of providing concessions, including special and differential treatment for developing countries. For instance, low-income countries with limited capacity to transition to clean production methods in the short run can be provided with exemptions to CBAMs. Building on the special and differential treatment in WTO agreements, developing countries can be granted longer periods for complying with the requirements of CBAMs and can be provided with support to implement their technical aspects. Pending a multilateral agreement, which may take years, advanced economies can engage with vulnerable trade partners through existing preferential trade agreements.

For example, the Generalised System of Preferences (GSP) schemes provided by developed countries to LDCs and/or developing countries can be used to extend concessions or preferential carbon tariffs concerning CBAMs. Concessions and special and differential treatment will ensure adherence to the principle of ‘common but differentiated responsibilities’ that governs international environmental conventions.

f. Flexibility for industries and countries to choose how to reduce their emissions

Apart from considering only the carbon intensity embedded in products and the operationalisation of an equivalent carbon pricing system within countries, firms can undertake a range of other measures, such as participation in carbon-offsetting schemes. Implementing such flexibilities in the design of CBAMs can provide greater ease to firms that cannot switch production techniques and reduce emissions immediately. Likewise, other than implementing carbon taxes or introducing emissions trading schemes, countries can undertake other reforms aimed at greening manufacturing. However, the EU-CBAM model does not acknowledge such initiatives. The design of CBAMs should include certain flexibilities based on developing countries’ circumstances, capacities and needs. Certain thresholds or exemptions can also be introduced to limit the negative impact of CBAMs on small firms or firms with limited capacity to comply with CBAMs.

g. Improving trade in environmental goods and services

Finally, it is also crucial for the G20 to address concerns pertaining to the root causes of high-carbon production. Improving trade in environmental goods and services (EGS) will improve developing countries’ access to clean technology, including renewable energy and energy-efficient systems, as well as better practices such as sustainable waste management. In a recent study, it was found that addressing half of the trade barriers in solar cells and modules alone can reduce CO2 emissions by 4 to 12 gigatonnes between 2017 and 2060, equivalent to a cumulative drop of 0.3-0.9 percent in global emissions.[15] Moreover, access to environmental services can impart the necessary expertise and knowledge to facilitate the transition to cleaner and more sustainable practices.

Environmental services can also help build capacities of countries and firms essential for the design and implementation of CBAMs. Thus, countries should aim to reduce tariffs and restrictions on trade in EGS and accelerate WTO negotiations on an Environmental Goods Agreement for which there are currently only 18 participants (representing 46 WTO members).[16] Over time, the lower cost of EGS will render cleaner technologies and environmental services less costly and more accessible to developing countries.

Attribution: Paul Baker et al., “Devising a Response to Carbon Border Adjustment Mechanisms for G20 Countries,” T20 Policy Brief, July 2023.

Appendix A: Results

Western Europe (EU27, UK and northern Europe (Norway, Switzerland)) impose a US $100 carbon tax on imports.

Figure A: Western Europe (EU27, UK and northern Europe (Norway, Switzerland)) impose a US $100 carbon tax on imports, change in Emissions

Source: Author estimations using GTAP

Figure B: Western Europe (EU27, UK and northern Europe (Norway, Switzerland)) impose a US $100 carbon tax on imports, change in Exports

Source: Author estimations using GTAP

Figure C: Western Europe (EU27, UK and northern Europe (Norway, Switzerland)) impose a US $100 carbon tax on imports, welfare impacts

Source: Author estimations using GTAP

Western Europe (EU27, UK and northern Europe (Norway, Switzerland)) and the US impose a US $100 carbon tax on imports.

Figure D: Western Europe (EU27, UK and northern Europe (Norway, Switzerland)) and the US impose a US $100 carbon tax on imports, Change in Emissions

Source: Author estimations using GTAP

Figure E: Western Europe (EU27, UK and northern Europe (Norway, Switzerland)) and the US impose a US $100 carbon tax on imports, Change in Exports

Source: Author estimations using GTAP

Figure F: Western Europe (EU27, UK and northern Europe (Norway, Switzerland)) and the US impose a US $100 carbon tax on imports, Welfare impacts

Source: Author estimations using GTAP

Endnotes

[a] Western Europe includes EU27, UK and northern Europe (Norway, Switzerland, Iceland, Liechtenstein)

[b] Scenario 1: Western Europe imposes a duty of US$100/tCO2e and Scenario 2: Western Europe together with US impose a duty of US$100/tCO2e

[1] World Trade Organisation, The Carbon Content of International Trade, Trade and Climate Change: Information Brief No. 4, (Geneva: World Trade Organisation, 2021).

[2] Intergovernmental Panel on Climate Change, Contribution of Working Group III to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change, (Cambridge: Cambridge University Press, 2007).

[3] Erin Campbell, Anne McDarris, and William Pizer, Border Carbon Adjustments 101, (Washington DC: Resources for the Future, 2021).

[4] Brendan Vickers, Ali Salamat, and Kimonique Powell, “The EU’s Carbon Border Adjustment Mechanism: Implications for Commonwealth Countries,” Commonwealth Trade Hot Topics, no. 178 (2021).

[5] European Parliament, “EU carbon border adjustment mechanism: Implications for climate and competitiveness”, (Brussels: European Parliament, 2022).

[6] “Carbon Border Adjustment Mechanism,” Taxation and Customs Union, European Commission, accessed April 2023.

[7] Paul Baker, Taahirah Zahraa Boodhoo Beeharry, Loan Le, Ria Roy, and Pablo Quiles, Designing an African response to Carbon Border Adjustment Mechanisms (African Economic Conference, 2022).

[8] Markus Zimmer, and Arne Holzhausen, EU carbon border adjustments and developing country exports: saving the worst for the last, (Munich: Allianz Trade, 2020).

[9] Hannah Ritchie, Max Roser, and Pablo Rosado, “CO₂ and Greenhouse Gas Emissions,” Our World In Data, August 2020.

[10] “Joint Statement issued at the BRICS High-level Meeting on Climate Change,” BRICS 2022, Ministry of Ecology and Environment of the People’s Republic of China, last modified May 24, 2022.

[11] Ian Parry, Simon Black, and Black Roaf, Proposal for an International Carbon Price Floor Among Large Emitters, (Washington DC: International Monetary Fund, 2021).

[12] Jan Cernicky, Bernice Lee, and Ricardo Melendez-Otis, Avoiding a Carbon Trade war: G20 dialogue and coordination and the European Carbon Border Adjustment Mechanism (T20 National Coordinating and Chair, 2021).

[13] Cernicky et al., 2021. Ibid.

[14] European Commission, Proposal for a Regulation of the European Parliament and of the Council establishing a carbon border adjustment mechanism (Brussels: European Commission, 2021).

[15] Mudan Wang, Xianqiang Mao, Youkai Xing, Jianhong Lu, Peng Song, Zhengyan Liu, Zhi Guo, Kevin Tu, and Eric Zusman, “Breaking down Barriers on PV Trade Will Facilitate Global Carbon Mitigation,” Nature Communications 12, no. 6820 (2021): 2.

[16] “Environmental Goods Agreement,” World Trade Organisation, accessed March 12, 2023.