Task Force 1: Macroeconomics, Trade, and Livelihoods: Policy Coherence and International Coordination

Abstract

External shocks inflicted by the pandemic and geopolitical upheavals have disrupted supply chains, resulting in production delays and rising manufacturing costs in the cross-border movement of essential goods and services. This Policy Brief analyses how recent bilateral interim trade agreements such as the India-Australia Economic Cooperation and Trade Agreement (INDAUS ECTA) can be key policy instruments for supply chain resilience in sectors susceptible to disruptions. Examples from this agreement are discussed, which offer key insights for the G20 members to strategise future actions. The Brief proposes specific recommendations pertaining to the role of the G20 in delivering a resilient supply chain framework. Such a framework should be based on robust control, visibility, flexibility, collaboration, technology, and sound governance. A key primary recommendation is to explore the creation of a Rapid Response Forum (RRF) for vulnerable, critical, and essential goods to aid preparedness for unforeseen disruptions.

1. The Challenge

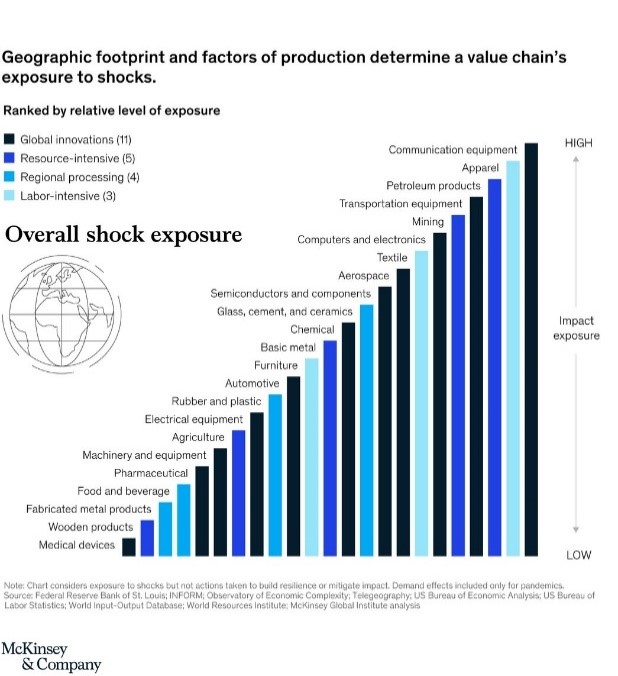

Uncertainties generated by external shocks due to global trade conflicts, the COVID-19 pandemic, and the Russia-Ukraine war have all exposed the G20 member countries and businesses to unprecedented supply chain disruptions. These have resulted in significant production delays and rising manufacturing costs involving the cross-border movement of essential goods and services. The effects of these external shocks have been disproportionate across industries, depending on the complexity of their supply chains and exposure to international trade across multiple stages of production. Figure 1 shows how supply chains across 23 major industries globally are impacted according to their exposure to a range of risks that can potentially disrupt them.

Figure 1: Degree of Supply Chain Risks by Industry

Source: Lund et al. (2020)[1]

The need for supply chain resilience

It is estimated through business surveys that a one-time shock to the production process can reduce nearly 30 to 50 percent of a firm’s earnings before interest, taxes, and depreciation.[2] A May 2021 report by the Economist Intelligence Unit (EIU) on the business costs of supply chain disruptions, based on a survey of executives in the US and EU, observed that the losses from such disruptions have averaged 6 to 10 percent of annual revenues.[3] Furthermore, there are additional costs of such disruptions due to the damage to brand reputation because of prolonged delays in response to consumer demand.

Therefore, the need to build resilience to future supply chain disruptions is considered a top priority for global executives over the next five years. The World Economic Forum (WEF) has broadly defined ‘resilience’ as the ability of supply chains to withstand any external or internal shocks effectively, thereby managing to deliver on core functions.[4] Businesses globally are contemplating strategies to achieve such resilience using multiple strategies, including digital technologies such as 3D printing, blockchain, and artificial intelligence (AI) as part of the production process to pre-empt and manage future disruptions. However, there is a distinct need for a policy mix facilitated through intergovernmental forums such as the G20, which strengthens the resilience of supply chains without undermining the gains from value-chain-based trade.

Policy action tools to achieve supply chain resilience

The Organisation for Economic Co-operation and Development (OECD) has identified four key policy action tools to achieve supply chain resilience: risk management, domestic policy, public-private, and international economic policy coordination tools.[5]

It is in the above context that G20 governments have recognised the need to design trade and investment policies that make supply chains agile and sustainable, particularly through provisions in new-age bilateral and regional trade agreements (RTAs).[6] While multilateral forums such as the World Trade Organization (WTO) have recognised the need for a holistic approach for governments to better understand supply chain disruptions, regional and bilateral efforts have simultaneously stepped up to explore mechanisms to achieve the same. A specific example in this direction is the signing of the India-Australia Economic Cooperation and Trade Agreement (INDAUS ECTA) between the G20 members Australia and India, which entered into force in December 2022. This is a building block towards a full-fledged trade deal that is currently being negotiated, called the Comprehensive Economic Cooperation Agreement (CECA).

The deal also reflects the post-pandemic reality, where the extent to which countries are open to global trade if it protects them from concentration shocks makes domestic industries competitive and encourages other countries to invest in their economies.

INDAUS ECTA and supply chain resilience

The INDAUS ECTA deal reflects post-pandemic reality. This deal was signed in record time,[7] echoes contemporary urgencies, and has tackled issues with a higher level of ambition to enable a more robust and predictable trading environment.

The analytical framework of Australia’s Productivity Commission identifies supply chains that are susceptible to disruptions and have also been a focus of the INDAUS ECTA negotiations. The notions of vulnerable, essential, and critical goods and services are at the core of this framework (See Appendix 1).[8] Pharmaceuticals, critical minerals, and skill shortages are identified as sectors of crucial importance and are also relevant for G20 members.

Reconfiguring pharmaceuticals supply chain

According to the Therapeutic Goods Administration (TGA), Australia imports over 90 percent of medicines. This presents a risk of medicine shortages because of uncontrollable external factors related to manufacturing, trade, and transportation.[9]

In December 2022, the TGA confirmed the dire shortage of 320 drugs, of which 50 were listed as critical and in short supply.[10] Reports suggest that Australia heavily relies on the United States (US) as its primary source of medicines, whereas the US is mainly dependent on India and China for the import of alternative generics to meet its own domestic demand.[11]

INDAUS ECTA for the pharmaceutical sector provides duty-free entry of most products, preferential tariff system for goods originating in either country, and a better understanding of each other’s regulatory, customs, and trade systems. Annex 7A of the INDAUS ECTA Agreement (Pharmaceuticals) states that the Australian regulator TGA and the Indian regulator Central Drugs Standard Control Organisation (CDSCO) shall work together to facilitate trade in prescription medicines and medical devices in relation to the premarket evaluation of products manufactured and utilising Good Manufacturing Practice (GMP) reports. Many of the medicines in short supply in Australia are generic medicines, which India manufactures.[12]

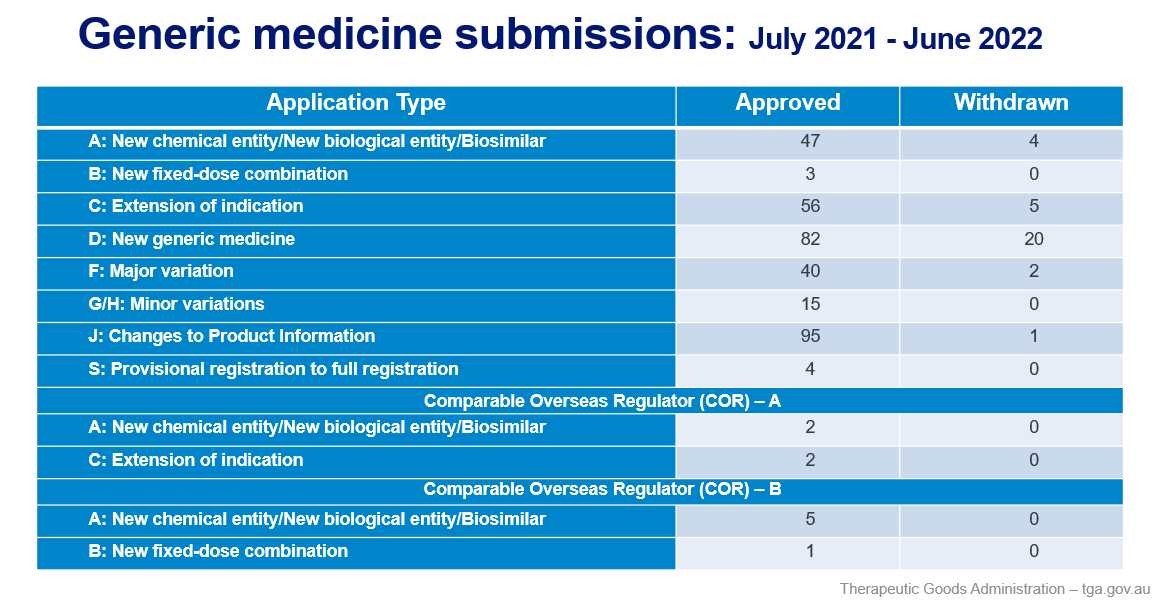

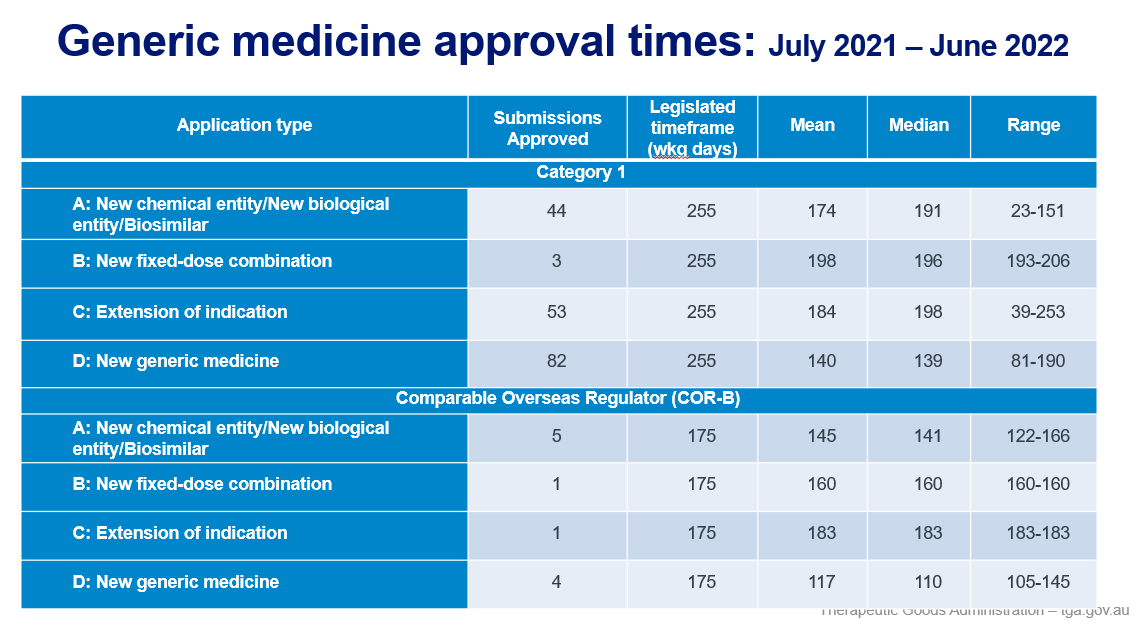

INDAUS ECTA has also initiated discussions on offering fast-track approval for patented, generic, and biosimilar medicines using the Comparable Overseas Regulator (COR) pathway and fast-track quality assessment/inspections of manufacturing facilities. The current approval timelines for generic medicine submissions are shared in Appendix 2. This will allow the Australian market cheap and swift access to Indian medicine brands. India supplies over 40 percent of generic demand in the US and 25 percent of all UK medicines, both being examples of supply chains involving G20 members.[13]

The INDAUS ECTA, through its provisions, reiterates the need for a robust understanding of the medical supply chain, which includes Active Pharmaceutical Ingredients (APIs) suppliers, manufacturers, distributors, and regulators, ensuring transparency, responsibility, and accountability throughout the chain. The rules of origin of this agreement are designed to enable regional supply chain risk diversification for trade in essential goods such as medicines.[14]

The Pharmaceuticals Export Promotion Council of India (Pharmexcil) also led a delegation of over 20 pharma companies to Australia in February 2023 to further boost business partnerships with pharma industry stakeholders as part of the pharmaceutical supply chain resilience initiative.

Securing critical minerals supply chain through partnerships

Critical minerals are important across the telecommunications, electronics, energy, healthcare, defence, aerospace, and transportation sectors. Developing G20 members such as India require a stable supply of critical minerals to achieve business competitiveness and transition to Industry 4.0. Developed G20 members such as Australia have reserves of 21 of the 49 critical minerals identified by the Government of India, which could play a significant role in securing India’s supply chains.[15]

The INDAUS ECTA reduces and eliminates customs duties for most critical minerals, including manganese ores, tungsten ores and concentrates, rare earth oxides, and zirconium concentrates, which are key intermediate inputs to energy transition (battery and electric vehicle (EV) manufacturing). Such provisions allow for risk diversification across the critical minerals value chain trade.

The Indian government’s international exploration programme (Khanij Bidesh India Ltd [KABIL], a joint venture formed between three state-run companies—National Aluminium Co, Hindustan Copper Ltd, and Mineral Exploration Corp) is its latest initiative aimed at acquiring critical minerals such as lithium, nickel, cobalt, and rare earth mines overseas to address growing demands in the domestic market and safeguard future supplies.

Both countries are also exploring offtake and investment agreements with development-ready projects to secure critical mineral supply chains. Advanced vanadium[16] developer Technology Metals Australia Limited (ASX: TMT) in October 2022 entered into a memorandum of understanding (MoU) with Tata Steel Limited, one of the world’s largest steel manufacturing companies. The MoU establishes a framework regarding the offtake of vanadium pentoxide and other downstream vanadium products to safeguard its future needs and address price volatility.[17] Indian battery manufacturer Delectrik Systems Private Limited has secured a primary producer of vanadium through an MoU with TMT in April 2023 to support the deployment of vanadium redox flow batteries (VRFBs) for long-duration energy storage across the globe.[18] More than 80 percent of vanadium is currently used as an alloy in steel and titanium. Vanadium also plays an important part in reducing emissions in steel applications, as the world progresses towards net zero carbon emissions. These are all examples of how private sector engagement across the G20 countries can future-proof critical and essential supply chains.

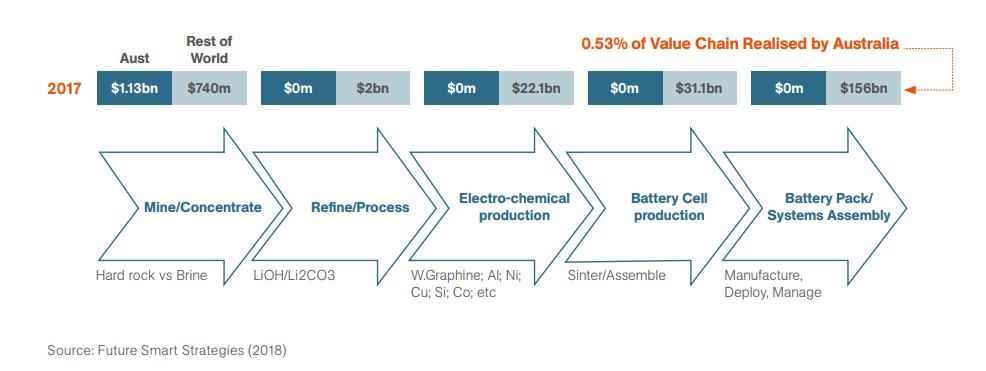

Australia’s resource endowment can be aligned with India’s manufacturing potential and scale to create a whole-of-value-chain model. To explain this further, the bulk of value-adding in the critical minerals space occurs in the processing and manufacturing stages rather than mining. Future Smart Strategies asserts that, even as one of the largest producers of lithium globally, Australia earns only 0.53 percent of its exported ore (A$1.13 billion). The remaining 99.5 percent (of an estimated A$213 billion) of the value of Australian lithium ore is added through offshore electrochemical processing, battery cell production, and product assembly (Figure 2). INDAUS ECTA has an opportunity to fill this gap.

Figure 2: Australia’s Lithium Value Chain[19]

Reimagining talent supply chain

Labour mobility restriction during the pandemic has exposed countries to severe talent shortages. Australia relies on its skilled migrants programme to fill its workforce shortage gap. According to the National Skills Commission, the number of skilled occupations experiencing labour shortages has doubled, from 153 occupations dealing with shortages in 2021 to 286 in 2022. The labour shortages have affected sectors including manufacturing, construction, engineering, transport and logistics, and healthcare, among others.

According to the Australian Bureau of Statistics (ABS), one in four Australian businesses have been struggling to find suitable staff to fill job vacancies.[20] The nursing and technology sectors are expected to face a workforce shortage of more than 123,000 nurses and 653,000 tech workers by 2030. These massive labour shortages have significant impacts on price, the manufacturer’s ability to increase production, and the availability of services for the consumer.

Against this backdrop, the INDAUS ECTA has also included provisions to enhance mobility outcomes that can minimise future skill shortages and secure industries against supply chain risks.[21] The Migration and Mobility Partnership Arrangement is focused on encouraging cross-border movement for professionals and students. This will enhance cooperation through a Professional Services Working Group recognising qualifications, licensing, and registration procedures between the two countries. Such an arrangement will enhance growth in bilateral trade through the exchange of specialist skills across sectors, where domestic expertise is limited.

Newland Global Group is currently working with stakeholders across both countries to establish a workforce mobility framework that is aligned with qualification and experience requirements, addressing existing barriers to enable easier movement of technology and healthcare workers. This further reaffirms the proactive measures being taken by G20 members (in this case, Australia and India) to address skilled shortages in the event of future labour mobility disruptions.

2. The G20’s Role

The focus of the current G20 leadership is on being a force of good that helps both big and small countries to create jobs, sustain innovation, and attain development goals. Creating mechanisms to minimise future supply chain disruptions is critical to ensure this. INDAUS ECTA is a key policy instrument to achieve supply chain resilience in the above-discussed sectors and provides insights for G20 members.

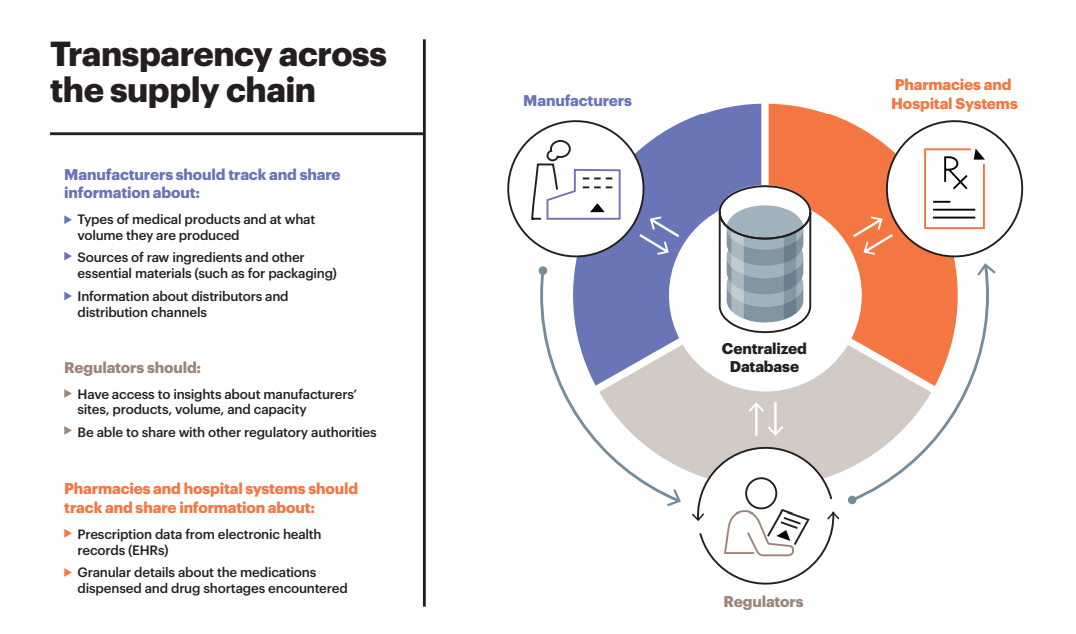

- The G20 can enable greater visibility within the medical supply chain (development, manufacturing, and distribution) through adopting voluntary and mandatory approaches. These could include standardisation of regulations, common definitions of ‘shortage’ and ‘criticality’, greater interoperability, and financial incentives for proactive reporting, risk assessments, and medicine shortage mitigation plans. At the core is ensuring greater coordination, transparency, and communication between stakeholders (Figure 3).

Figure 3

Source: USP (2020)[22]

- To future-proof critical mineral supply chains, the G20 can accelerate discussions on collective economic gains, setting clear policy principles. Measures can include enabling access to finance for critical minerals projects for early- to mid-stage projects, binding offtake agreements to attract investment and bank loans for projects and a standardised market for critical minerals globally.[23] Noting the discussions of the INDAUS ECTA, G20 members could also assess and align their competitive strengths to a whole-of-value-chain model.

- In the skill shortage context, the G20 has an opportunity to stimulate discussions on the need for talent mobility across nations for driving innovation and growth with redesigned migration policies that encourage knowledge-sharing. It can identify approaches towards democratising access to training and skills development.

The G20 as an intergovernmental forum can thereby enable the creation of a new supply chain framework. The G20 can also accelerate discussions on collective economic gains by setting clear policy principles on clean energy transitions.

3. Recommendations to the G20

The new supply chain resilience framework should be anchored on the pillars of visibility, flexibility, collaboration, technology, sound governance, and robust control (Figure 4). This should be based on the core principles of trust, transparency, security, timeliness, and sustainability. Such a framework should offer sound global governance across the issues of trade regulation, facilitation, logistics network, support for MSMEs, and global talent movement. This can be implemented through the Trade and Investment Working Group of the G20.

Figure 4: Pillars of the Resilient Supply Chain Framework

Source: Author’s own

Creation of a Rapid Response Forum (RRF) for vulnerable, critical, and essential goods

Being better prepared for unforeseen disruptions requires a framework that incorporates an RRF. This can inform businesses with an early warning involving shipment delays, or unforeseen disruptions at the border. An RRF can funnel information and ensure international coordination on the trading of vulnerable, critical, and essential goods by proactively monitoring and seeking information from member countries.

Benefits

- Provides real-time data on supply chains

- Ensures advance information of an impending disruption

- Identifies potential supplier risks in real time across all parties

- Enhances control across the value chain

- Helps organisations better identify demand-supply intersections

- Secures products more effectively and sustainably

Action Points

- The G20 should work towards establishing an RRF. It should include stakeholders who have a direct visibility of supply chain challenges (which can include trade bodies and MSMEs across sectors). An RRF as a real time responder will have access to advanced and timely information on possible disruptions, saving substantial costs for businesses, ultimately benefitting the consumers. Predictive data analytics and AI platforms should be employed to generate such real-time data on the movement of goods and services across the supply chain.

- To create RRF as an effective task- and action-focused forum, the G20 must form an expert committee to identify its building blocks, brainstorm on manufacturer, supplier, and distribution issues within trade in vulnerable, critical, and essential goods.

- The G20 must note that, in order for RRF to emerge as a capacity-building forum, it must be based on trust, timeliness, and transparency.

Securing collaboration through Best Practices Portal (BPP)

Visibility in a supply chain is defined as the ability of a business to track its products, components, and material inputs, all the way from the first stage of production to the destination. For example, a car manufacturer should be able to track down the sources of all its component suppliers, including microprocessors and semiconductor chips. This was a key issue during the pandemic and has also been addressed as a key goal in the INDAUS ECTA across the three sectors analysed earlier. This has highlighted the need for collaboration and sharing of best practices to improve visibility across supply chains globally.

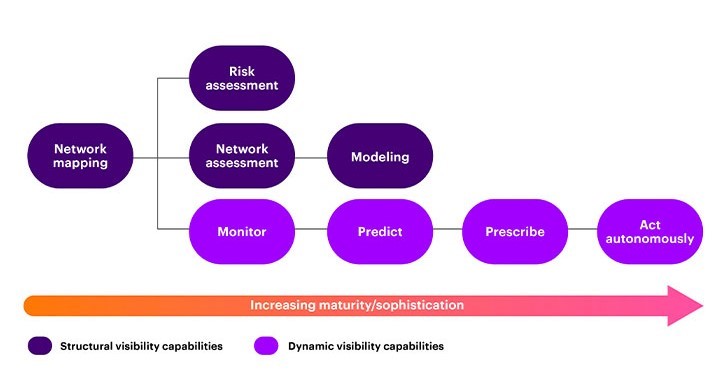

The key role of the G20 is to enhance capabilities for dynamic visibility, focusing on what is happening in the real time across the supply chain of critical and essential goods. Figure 5 provides the framework that integrates both aspects of visibility capabilities within the supply chain to reduce impending risks from future disruptions.

Figure 5: Supply Chain Risk Mapping to Enhance Visibility Capabilities

Source: Accenture (2022)[24]

Benefits

- Countries at different levels of economic development can achieve better visibility across the supply chain for critical, vulnerable, and essential goods.

- Better resource utilisation and mobilisation.

- Aids ‘building back better’ through readiness measures and customised solutions to specific needs.

- Vulnerabilities are identified at each stage of production, whether as an upstream or a downstream supplier. Lessons can be learnt from the INDAUS ECTA and the ongoing bilateral discussion for a Comprehensive Economic Cooperation Agreement (CECA).

Action Points

- The G20 can create a task force to build the BPP. The portal should provide reference-class information to enable a deeper understanding of how member countries have navigated supply chain disruptions. Any innovative practices learnt via BPP could be embedded in countries and businesses building their own resilience strategies.

- This task force should also work towards the standardisation of regulatory procedures pertaining to critical, vulnerable, and essential sectors, as discussed above. Any regulatory measure that has historically posed an impediment to the smooth delivery of products across the supply chain in these sectors should be reviewed, with an aim of identifying ways to remove such barriers.

Deepening collaboration through Track 2 Dialogue

It is important to acknowledge the multi-stakeholder nature of supply chain resilience initiatives. Hence, initiating a Track 2 Dialogue can maximise the range and understanding of factors impacting supply chain resilience. This should involve key stakeholders from the private sector, academia, public policy, and research organisations.

Benefits

- Supply chain risks are more proactively assessed and evaluated.

- Sectoral vulnerabilities are better understood for effective future strategies.

- Invigorates discussions on supply chain monopolies and restrictive practices.

- Initiates responsible measures for sound governance of supply chains

Action Points

- Create a G20 Track 2 Dialogue to develop a time-bound, outcome-led framework.

- The foundation for such a framework should be based on data collated on sectoral vulnerabilities identified by the proposed RRF.

Create a Digital Trade Facilitation Framework (DTFF) to improve supply chain resiliency

The divisions between the developed and developing members of the G20 are wide and deep. There is an evident need for a dedicated DTFF to address the existing gaps among member countries. As noted in Figure 4, technology is a key pillar of the Supply Chain Resilient Framework. Digital trade facilitation is also a key area of discussion within the ongoing CECA deliberations, following up from the INDAUS ECTA.

Benefits

- Improves operational resilience, thereby reducing costs of product and service delivery.

- Greater certainty in the planning and production process, with improved cross-border connections.

Action Points

- The G20 should work towards establishing a DTFF, which could build capacities for the effective utilisation of digital technologies such as blockchain and AI in managing future supply chain disruptions. There can be lessons in the partnership initiatives involving G20 members in the Pan Asian eCommerce Alliance (PAA). PAA utilises blockchain technologies that allow for the automation of the trade facilitation process at customs, reducing customs clearance times from half a day to just 15 minutes.[25]

- The G20 members should focus on building and investing on smart infrastructure-led initiatives as part of the DTFF. For example, in Australia, the Melbourne port has automated its operations using AI, which has resulted in increased port-handling capacity by 40 percent. Such initiatives have improved the resilience of ports with respect to labour mobility disruption as experienced during the pandemic.

All the above recommendations reiterate that a resilient supply chain framework requires harnessing shared capabilities among G20 members. The call to action involves delivering on measurable outcomes anchored on strong commitment and dependable partnerships.

Appendices

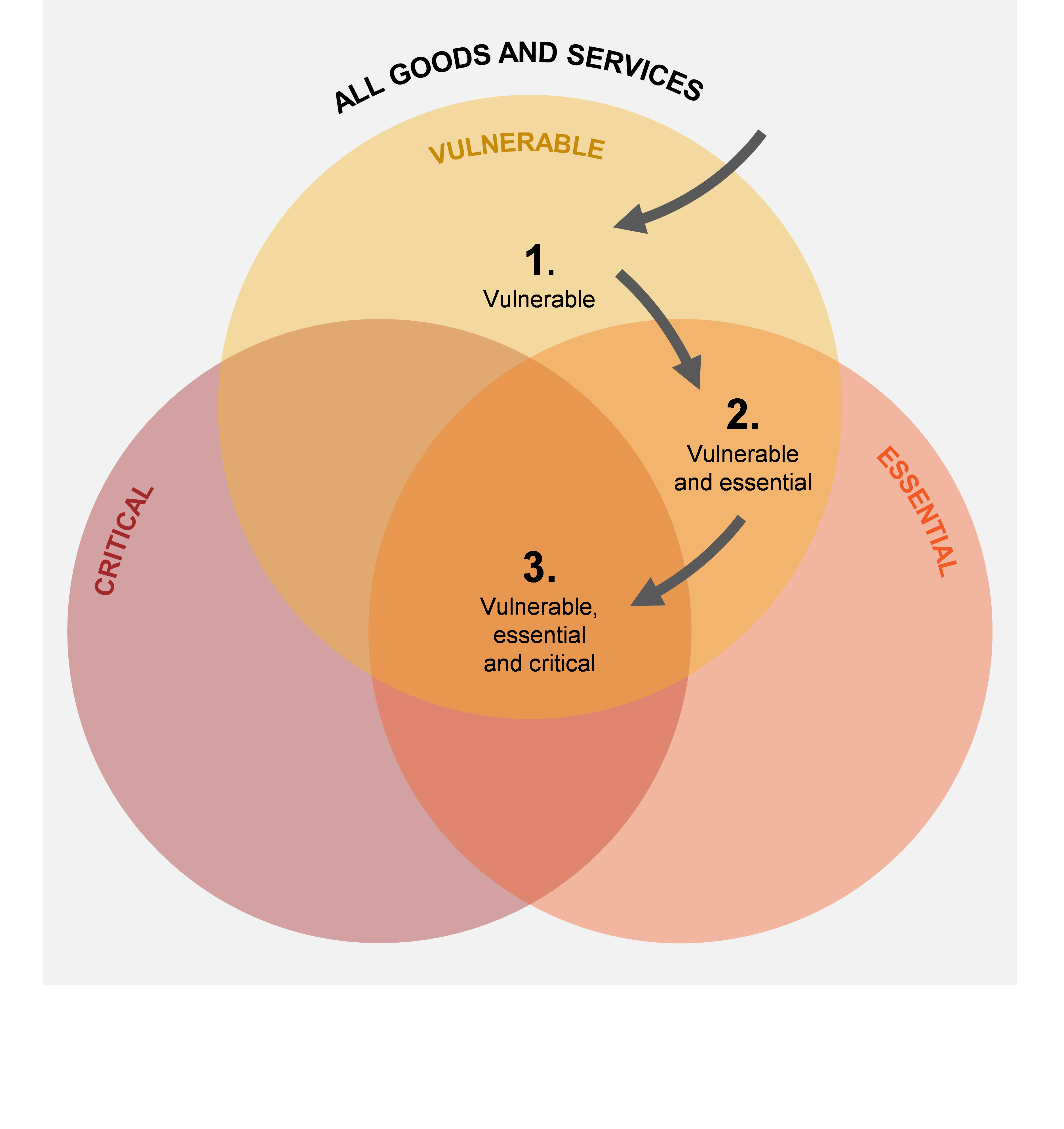

Appendix 1

The Analytical Framework of Identifying Critical, Essential, and Vulnerable Goods and Services

Source: Australian Productivity Commission (2021)[26]

Generic Medicine Submission and Approval Times in Australia

Source: Therapeutic Goods Administration (TGA)[27]

[1] Susan Lund et al., “Risk, Resilience, and Rebalancing in Global Value Chains,” McKinsey, August 6, 2020.

[2] Knut Alicke et al., “Supply Chains: To Build Resilience, Manage Proactively,” McKinsey, May 23, 2022.

[3] GEP, “The Business Costs of Supply Chain Disruptions,” Economist Intelligence Unit (EIU), May 2021.

[4] Amitendu Palit and Preety Bhogal, “COVID19, Supply Chain Resilience, and India: Prospects of the Pharmaceutical Industry,” Globalisation Impacts: Countries, Institutions and COVID19 (2022): 159-181.

[5] “Keys to Resilient Supply Chains,” Organization for Economic Cooperation and Development (OECD), accessed March 30, 2023.

[6] Basu Das and Sen in their 2022 ADB Working paper establish that RTA membership has cushioned against the adverse impacts of COVID-19 on trade in essential medical goods, including vaccine value chain products and Personal Protective Equipment (PPE). See

[7]Natasha Jha Bhaskar, “India-Australia Free Trade Deal Offers Australia First Mover Advantage in the World’s Fastest Growing Economy,” Institute for International Trade, The University of Adelaide, April 13, 2022.

[8] Australian Productivity Commission, “The Vulnerable Supply Chains, Productivity Commission Study Report,” July 2021.

[9] “Reforms to the Generic Medicine Market Authorisation Process Consultation Paper,” Australian Government, Department of Health, Therapeutics Goods Administration (TGA), accessed March 29, 2023.

[10] Balot Henry, “Common Antibiotics Scarce as Medicine Shortage in Australia Worsens,” The Guardian, January 10, 2022.

[11] Eliza E. Cameron and Mary-Jessimine A. Bushell, “Analysis of Drug Shortages Across Two Countries During Pre-Pandemic and Pandemic Times,” Research in Social and Administrative Pharmacy 17, no. 9 (2021): 1570-1573.

[12] “Australia-India ECTA Annex 7A Pharmaceuticals”, Department of Foreign Affairs and Trade (DFAT) Australia, accessed April 5, 2023.

[13] “Pharmaceuticals,” Invest India, accessed April 6, 2023.

[14] Amitendu Palit, “Economic Cooperation and Trade Agreement: Transformative Impact on India-Australia Trade,” ISAS Insights, November 28, 2022.

[15] Natasha Jha Bhaskar, “India-Australia Cooperation on Trade in Critical Minerals,” ISAS Insights, March 2021.

[16] Vanadium is listed as one of the top five minerals needed for renewable energy technologies, with demand forecasted to increase by 173 percent to 2050 requirements.

[17]ASX Announcement, “MoU Executed with India’s Tata Steel”.

[18] ASX Announcement, “MoU to supply vanadium to Indian Battery Manufacturer”.

[19] “The Lithium-Ion Battery Value Chain: New Economy Opportunities for Australia,” Austrade, accessed April 5, 2023.

[20] “A Quarter of Businesses Unable to Find Suitable Staff,” Australian Bureau of Statistics (ABS), June 24, 2021.

[21] “Australia-India ECTA Benefits for Australian Service Suppliers and Professionals,” Department of Foreign Affairs and Trade (DFAT) Australia, accessed April 5, 2023.

[22] USP, “Increasing Transparency in the Medicines Supply Chain,” accessed April 5, 2023.

[24] “How Visibility Boosts Supply Chain Resilience,” Accenture, August 8, 2022.

[25] Andre Wirjo and Sylwyn Calizo Jr, “Trade Networks amid Disruption: Promoting Resilience through Digital Trade Facilitation,” APEC Policy Support Unit Policy Brief No. 53, December 2022.

[26] Australian Productivity Commission, The Vulnerable Supply Chains, Productivity Commission Study Report, July 2021.

[27] Therapeutic Goods Administration (TGA) Australia, accessed April 5, 2023.