Task Force 3 LiFE, Resilience, and Values for Wellbeing

Abstract

Small islands in the G20 countries face unique challenges related to isolation, limited resources, and a pronounced vulnerability to climate change and natural disasters. A potential solution is to channel financial assistance to reduce disaster risk in these small islands by identifying their most pressing needs. The G20 countries can create financing mechanisms to support sustainable development, climate adaptation, and disaster risk reduction in their small islands. Collaboration and coordination among the G20 countries, their small island communities, and other stakeholders are essential to promote sustainable development and resilience in these unique regions.

The Challenge

Of the G20 countries, Indonesia, Japan, Australia, the US, China, Brazil, and certain EU countries (Netherlands, France, and Italy) have significant populations on their small islands. Small islands refer to “islands with at least 1.5 million population”. This definition has high generalisation, meaning significant differences across the world’s small islands remain uncaptured. To capture realistic conditions, this policy brief includes GNI per capita and its deviation from the national average, variables that represent each small island’s fiscal and economic capacity.

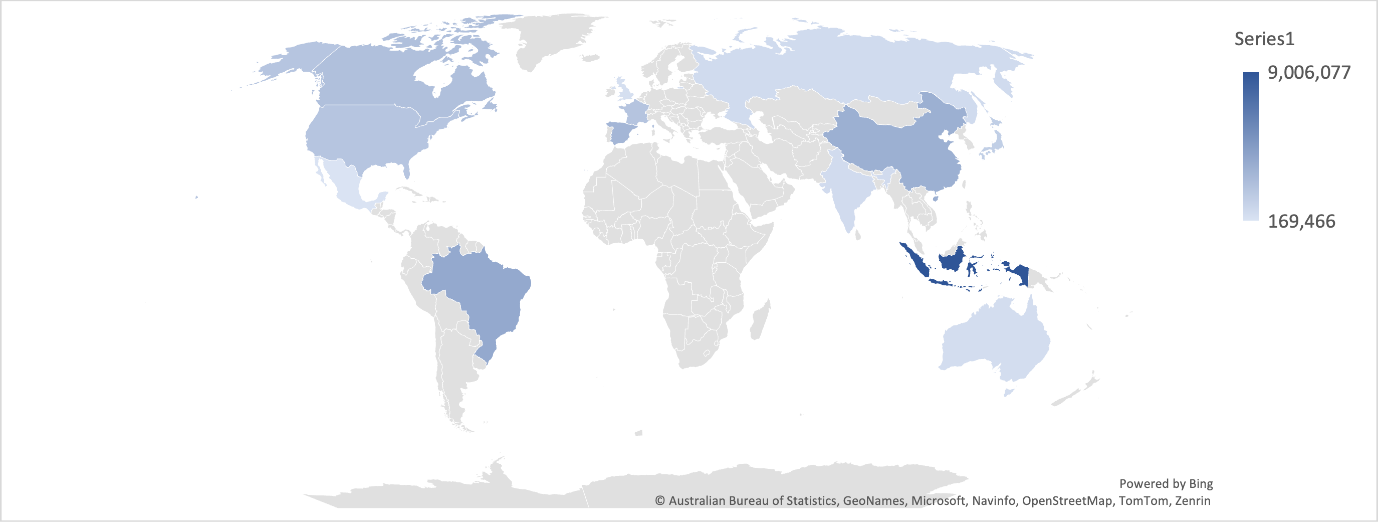

Within the G20, Indonesia has the largest population on its small islands—over nine million people reside in its 22 small islands. Brazil, China, Spain, Canada, and the US also have significant populations on their small islands (see Figure 1).

The small islands’ often-distant location from the mainland and unique topographies have resulted in somewhat varied economic growth levels compared to the countries, primarily in states with low GNI per capita, such as Indonesia, India, Brazil, and Mexico. As such, in addition to climate change impacts, these small islands must also confront challenges such as limited economic activity and the dearth of investments.

Figure 1: Population distribution on small islands within the G20 countries

Source: Authors’ illustration using World Bank data

Climate change impacts

China, the US, India, Russia, and Japan—all G20 countries—are the top five carbon emitters globally, contributing to 56 percent of global carbon emissions. As such, the G20 must act on this issue. Climate change is predicted to result in a global rise in sea levels in the coming century. Coastal areas, including small islands, will be severely impacted.

The interests of the small islands within the G20 countries need to be better represented in terms of their funding needs to tackle climate-related events. The G20 must establish a facility to allocate finance fairly to these prioritised areas within the grouping.

The projected global mean sea level is about 0.43-0.84 m by 2100 relative to 1986-2005 levels. This will depend on significant local and regional variations and warming scenarios. Figure 2 indicates that the urban atoll islands with relatively lower GNI than the resource-rich coastal cities will have considerable additional risk due to sea-level rise.

Figure 2: Risk to coastal geographies at the end of the century with different scenario projections

Source: Oppenheimer, M. et al. “Sea Level Rise and Implications for Low-Lying Islands, Coasts and Communities.” In IPCC Special Report on the Ocean and Cryosphere in a Changing Climate. New York: IPCC, 2019, 328, 4-3.

Small islands are more intensively impacted by climate change. This is mainly because their locations typically face the large ocean, while their small size makes it relatively difficult to build buffer zones. Many small islands develop their infrastructure and commercial and residential areas near the shore since it is more efficient and practical. However, the rise in sea levels and frequency of storms increases the danger to people and infrastructure. Many small islands’ economies are dependent on tourism and fisheries. Increasing sea temperature jeopardises fish stocks and the ocean ecosystem, while natural disasters drive away tourists from the islands. Figure 3 highlights the vulnerability of islands that do not see sufficient investment and disaster mitigation policy response and indicates that their recovery will be more challenging.

Figure 3: The impact of alternative climate change adaptation actions and policies

Source: Nurse et al. “Small Islands.” In Climate Change 2014: Impacts, Adaptation, and Vulnerability. Part B: Regional Aspects. Contribution of Working Group II to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. New York: IPCC, 2014. 1636, 29-5

Limited economic activities

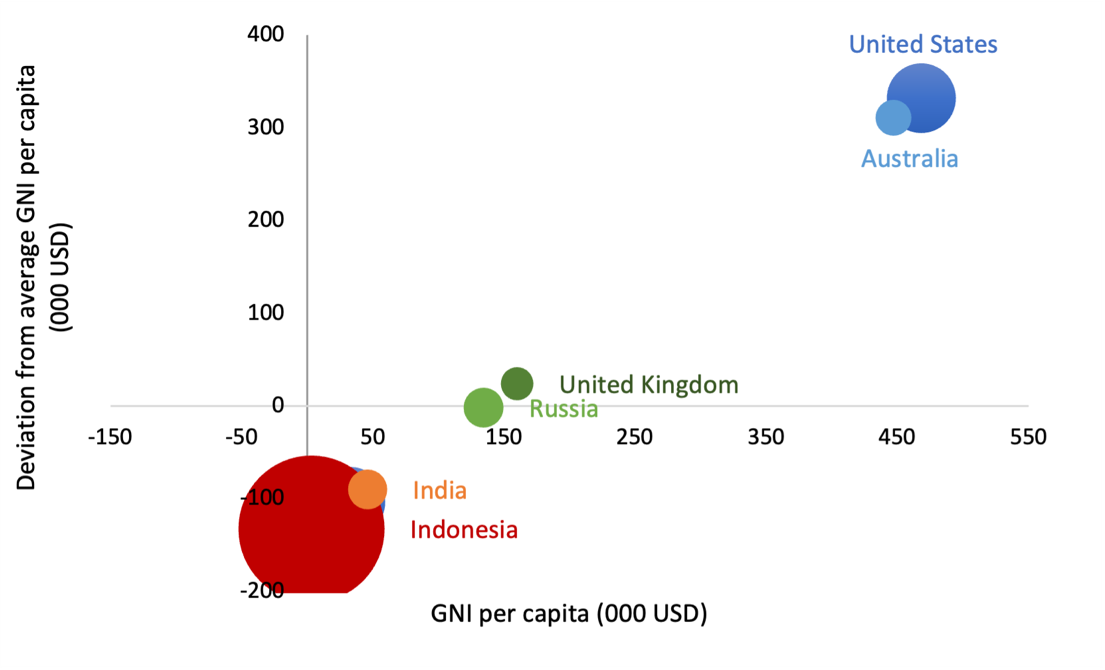

The small islands in the G20 group, especially those in Indonesia, are characterised by low economic activity compared to the mainland. The GNI per capita of such small islands[a] differs from the GNI per capita of their countries. Figure 4 shows the relationship between population, GNI per capita, and its deviation from the average GNI per capita in the G20 group. The GNI per capita axis shows each corresponding country. The small islands of Indonesia, China, and Brazil have many small islands and the highest negative deviation from the average. This indicates that their small islands are relatively worse than developed countries like the US and Australia.

Figure 4: Relationship between population (bubble size), GNI per capita, and deviation of GNI per capita average in G20 countries with small islands

Source: Authors’ calculations using World Bank data and related national and regional statistics per country (for 2022)

Table 1 lists countries whose small islands have the highest and lowest vulnerability. The vulnerability can be linked to the size of the population (exposure size) and the capability of these islands to recover from disaster (GNI per capita). The hypothesis is that the highest vulnerability will be experienced in a country whose population is large and the deviation from GNI per capita is negative (for example, Indonesia). Conversely, the vulnerabilities of small islands in developed countries like the United States and Australia are very low.

Table 1: Deviation from GNI per capita average in G20 countries with small islands

| Country | Small islands population | GNI per capita (US$, 2022) | Deviation from GNI per capita average (US$, 2022) |

| US | 2,031,474 | 468,165 | 331,845 |

| Australia | 542,000 | 447,079 | 310,759 |

| United Kingdom | 449,400 | 160,138 | 23,818 |

| France | 2,098,053 | 32,487 | -103,833 |

| China | 3,352,477 | 14,571 | -121,749 |

| Brazil | 3,766,358 | 18,071 | -118,250 |

| Mexico | 169,466 | 12,338 | -123,982 |

| Indonesia | 9,006,077 | 3,378 | -132,942 |

Source: Authors’ calculation based on various regional and national data mentioned in the table

Current funding programmes are usually focused on small island countries, with little consideration of the small islands that are part of other developing countries. The G20 forum must direct funding to these specific regions in its member countries by observing the needs of small islands in mitigating and adapting to climate change.

Inadequate investment

Small islands are typically unattractive investment destinations with no economies of scale and significant natural challenges. Private investors must hedge their risks, while the insurance and reinsurance for these risks, especially in developing economies, are rare and come at high premiums. Public finance deals with limitations, and its budget allocation competes. In democratic countries, the governments care more for highly populated areas due to the size of the voters. Small islands with a small population are typically of less priority.

Building infrastructure is expensive, especially if it must be adaptive to climate change impacts. Meanwhile, the adverse effects of not having adequate and climate-adaptive infrastructure are significant. However, the positive impacts of good infrastructure are difficult to monetise, leaving them as externalities (off-sheet). This means the cost-benefit analysis is not comprehensive because it may include the potential financial risks but not the potential benefits from saving the damages and minimising the fatality toll. The underestimated net benefit calculation results in the rejection of the project. Therefore, to attract private investments, national governments and not-for-profit organisations can intervene and leverage the bankability of the projects.

The G20’s Role

The G20 provides direct funding for disaster reconstruction efforts in small island developing states (SIDS) only on some occasions. Still, it has recognised the vulnerability of the SIDS to natural disasters and has taken steps to support their resilience and recovery.

In 2016, for example, the group established the G20 Initiative on Supporting Industrialization in Africa and Least Developed Countries, which includes support for SIDS. The initiative aims to promote sustainable industrialisation in these countries to create jobs, increase productivity, and foster economic growth. In 2017, the G20 launched the G20 Africa Partnership, which entails support for disaster risk reduction and resilience-building in African countries, including SIDS.

The small islands of the G20 member countries also require similar support. The G20 can consider developing a seven-step framework to channel financial resources to its member countries’ small islands to build resilience and reduce disaster risks (see Figure 5).

Figure 5: Framework to channel financial resources to G20 countries’ small islands

- Define a criterion for small islands based on population, GDP, and distance to the capital city for larger resource exporters and tourism-based economies.

- Identify the needs of the small islands based on the cost of reconstruction after a disaster, climate change adaptation, and developing sustainable infrastructure.

- Develop a new financing mechanism by exploring the member country’s fund for the small island (grants, loans, and other financial support), or expand the mandate of existing frameworks for support, such as those for the SIDS.

- Define the eligibility to receive funding based on the severity and frequency of natural disasters experienced, level of economic development, and efforts to mitigate and adapt to climate change.

- Determine the funding sources (contributions from member countries, private sector investments, and philanthropic donations).

- Developing monitoring and evaluation systems such as performance intelligence of infrastructure development (social and hard).[b]

- Establish partnerships with international organisations and regional development banks. In addition to the national governments and intra-government cooperation, multilateral agencies and philanthropic organisations can enhance the bankability of the projects and reduce risk exposures. Countries must explore financing schemes that combine the projects’ environmental and social values. Additionally, blended finance is ideal for financing infrastructure projects in small islands.

Recommendations to the G20

Engaging new players to finance the G20’s small islands programmes and projects

Insurance and reinsurance institutions are missing players in financing infrastructure in disaster-prone regions. Given the high vulnerability of such projects, financiers, especially private investors, seek special protection for their invested funds. There are only a few insurance and reinsurance companies with specific businesses in this field. However, multilateral agencies can establish and develop such entities. For instance, the World Bank and the Japanese government have established the Pacific Catastrophe Risk Financing and Insurance Initiative to create a market-based disaster risk insurance, the Pacific Catastrophe Risk Insurance Company.

The Secretariat of the Pacific Community’s Applied Geoscience and Technology Division implemented an updated information risk platform called PACRIS for six Pacific Island countries. The project provided post-disaster budget extension guidelines to the six governments, essentially tools for managing financial demands after natural disasters.

Similar post-disaster guidelines can also be established for the small islands within the G20 countries based on their current condition and needs. The G20 must explore potential ways to encourage new sources of financing for infrastructure development on their member countries’ small islands. Local engagement will be crucial to increase ownership and market participation. This is a key step in the proposed framework to channelise funding for the G20’s small islands.

Furthermore, the G20 can promote innovative financing mechanisms, such as climate bonds, green bonds, or insurance instruments, to provide additional sources of finance for small island communities. These mechanisms can leverage private-sector finance and reduce the burden on public financing sources.

Managing knowledge through collaboration and coordination among G20 countries and small island communities

The G20 countries should work together to identify common challenges and opportunities for collaboration to bolster their small islands. This could include sharing best practices and expertise in disaster risk reduction, climate adaptation, and sustainable development. Collaboration could also involve pooling resources and expertise to provide targeted support to small island communities. In addition to existing efforts in financing infrastructure, especially in developing economies, the G20 may need to establish a coherent strategy to establish a knowledge hub for infrastructure investment to be more efficient and multiply the impacts of this agglomerated intelligence. For instance, it can begin by focusing on specific sectors, such as water and mobility investment. Learnings from such a project can be replicated in the larger area of infrastructure development.

The G20 countries should involve small island communities in decision-making to ensure their voices are heard. This could include establishing mechanisms for consultation and engagement of these communities in designing and implementing programmes and projects.

Attribution: Hafida Fahmiasari, Danang Parikesit, and Fauziah Zen, “Channelling Disaster Finance Resources in Small Islands in the G20 Countries,” T20 Policy Brief, May 2023.

Bibliography

Nurse, L. A., R. F. McLean, J. Agard, L. P. Briguglio, V. Duvat-Magnan, N. Pelesikoti, E. Tompkins, and A. Webb. 2014. Small islands. In: Climate Change 2014: Impacts, Adaptation, and Vulnerability. Part B: Regional Aspects. Contribution of Working Group II to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. IPCC.

IPCC. 2019. Summary for policymakers. IPCC Special Report on the Ocean and Cryosphere in a Changing Climate. Periodic, IPCC.

Hurley, Gail. 2015. Financing for Development and Small Island Developing States: A Snapshot and Ways Forward. New York: UNDP.

OECD. 2018. MAKING DEVELOPMENT CO-OPERATION WORK for SMALL ISLAND DEVELOPING STATES. Paris: OECD.

Oppenheimer, M. et al. “Sea Level Rise and Implications for Low-Lying Islands, Coasts and Communities.” In IPCC Special Report on the Ocean and Cryosphere in a Changing Climate. New York: IPCC, 2019, 328.

[a] GNI per capita small island = GNI island/population of island

[b] Collecting and analysing data on the performance of infrastructure systems to make informed decisions about maintenance, repairs, upgrades, and future investments