Task Force 3: LiFE, Resilience, and Values for Well-Being

Abstract

Extreme weather events and climate change-induced disasters are increasing in frequency and intensity across the globe. This has devastating impacts particularly for sub-national entities such as cities and local regions that continue to record higher infrastructural damage and losses during climate change-induced extreme weather events and disasters. Building back better, post-pandemic, therefore necessitates building robust resilience systems by mainstreaming resilient infrastructure in the planning of these countries, especially at the sub-national level. This creates an opportunity for G20 countries to focus on sustainable urbanisation through adaptation in urban design and resource efficiency in built environments as a critical means to address disaster-induced damage. The necessary initiatives for efficient and resilient urban design will, however, require enhancement of technical and financial resources at the local levels of government through public and private sources of finance. In this regard, the G20 can steer not only embedding resilient design elements in sub-national infrastructure but also mobilise sustainable financing through innovative models for catalysing investments in disaster-resilient infrastructure.

This Policy Brief aims to further the Presidency’s priority on Green Development, Climate Finance & Lifestyle for Environment (LiFE) for this year’s G20 by:

- i) identifying the current barriers to financing resilient infrastructure at the sub-national and local levels;

- ii) proposing recommendations for the G20 on necessary policy, regulatory and institutional arrangements informed by international best practices and bilateral consultations with international disaster coalitions.

1. The Collective Challenge

Countries across the globe are incurring greater losses and damages from extreme whether events and climate change-induced disasters that have increased in frequency and intensity in the recent years. The year 2022 was one that recorded the highest losses, amounting to some US$ 270 billion, more than 30 percent of which was caused by hurricane Ian that affected Florida in the United States, the Western part of Cuba, and the Carolinas; the flooding in Pakistan from the record-breaking monsoon rainfall that year also caused massive damages (Munich Re, 2023).

Global economic losses from natural and man-made catastrophic events were estimated at US$ 75 billion in the first half of 2022, with insured losses amounting to US$ 35 billion, 22 percent above the average over the past 10 years of US$ 29 billion (Swiss Re, 2022). The losses incurred as a result of disasters affect the economy in more ways than one and need to be contained, especially in developing countries where scarce resources have to be diverted towards recovery and reconstruction. Enhancing adaptive capacity and reducing vulnerabilities is a cost-effective way of reducing climate risk to infrastructure from extreme weather events—e.g. heat waves, heavy precipitation and slow onset events such as sea level rise, glacial melt, and water shortages. A disaster-resilient infrastructure, on the other hand, addresses the proximate causes of disasters like floods, cyclones and landslides which may or may not be induced by climate.

To reduce such losses, “annual global investments of USD 6 billion in appropriate disaster risk reduction strategies” are required, to “generate full benefits in terms of risk reduction from the amount of $360,000 million” (United Nations, 2015). However, the cost of adaptation and adaptation financing needs of developing countries could be five to 10 times higher than current international public adaptation finance flows (UNEP, 2022). The Adaptation Gap Report published by the United Nations Environment Programme (UNEP) in 2022 estimated such needs to be in the range of US$ 160-340 billion by 2030 and US$ 315-565 billion by 2050.

2. The Imperative of Resilient Sub-National Infrastructure

As the impacts of climate change differ across geographies, terrains, sectors and even population, adaptation to climate change cannot be bracketed as a one-size-fits-all solution. Infrastructure, however, is one such aspect that cuts across sectors and bears the brunt of climate impacts and disasters. Consequently, a significant part of resilience and adaptability is hinged on infrastructure. This can be attributed to the fact that impacts of climate change and disasters on infrastructure have a crucial bearing on the efficacy of key response sectors such as health, transport, and power supply, where any disruptions can have severe implications in responses and recovery.

The impacts of climatic events are felt most acutely at the sub-national levels in the form of losses to infrastructure—especially in key sectors such as health, agriculture, energy, and livelihoods. In light of the changes in weather patterns and increased incidence of climate change-induced disasters, existing infrastructures need to be upgraded to deal with the new stressors, while embedding resilient designs in all new construction.[a]

The natural disasters that have occurred in the last 20 years, many of them exacerbated by climate change, reveal the urgent need to strengthen local governments. As the first line of defence against any calamity, sub-national and local actors have significantly borne the brunt of the impacts of more frequent and intense disasters.

For local governments to be better prepared for disasters, there is need for deep, multi-hazard risk analytics to support robust planning; capacities and technical resources for retrofitting existing infrastructure while embedding resilient engineered and non-engineered design in new infrastructure, to avoid human and material losses. However, a crucial constraint that is currently faced in the adoption of resilient infrastructure across regions—and more so by sub-national entities—is the lack of scalable finance.

3. Barriers to Financing Resilient Infrastructure at the Sub-National Level

It is estimated that direct losses to infrastructure at the sub-national level costs households and firms at least US$390 billion annually. This is even higher when indirect costs are taken into account, including the toll on households, businesses, and communities (Hallegatte, Maruyama Rentschler and Rozenberg 2019). In his message for the International Day for Disaster Risk Reduction in 2019, UN Secretary-General António Guterres highlighted how a dollar’s worth of investment in disaster-resilient infrastructure (DRI) results in savings of up to six dollars; therefore, money can be saved and jobs can be created through resilience building (UN, 2019). However, investments in this regard have been few and far between.

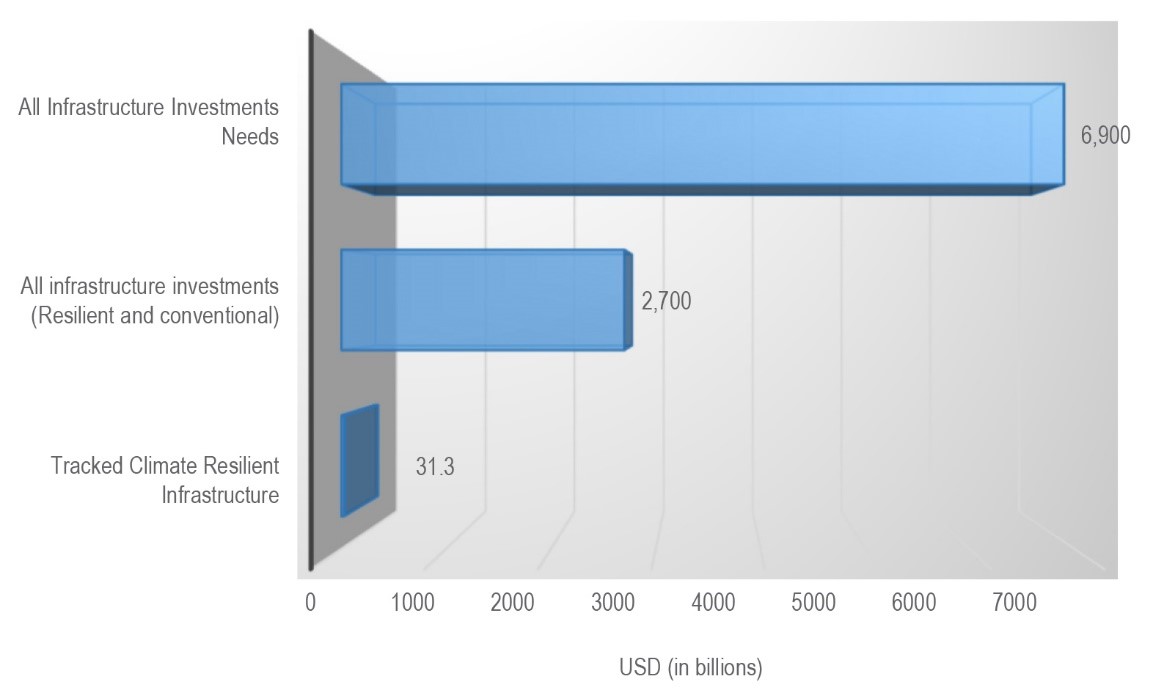

At present, for every $1 spent on climate-resilient infrastructure, $87 was spent on infrastructure projects that do not integrate climate resilience principles, thereby suggesting that investments in resilient infrastructure are still in their nascent stages (Padmanabhi, et al. 2022). Fig. 1 shows the investments made in CRI versus the actual investments required for the same.

Fig. 1: Investments Made in CRI vs Investment Needs (2019-20)

Source: Padmanabhi, Rajashree, Morgan Richmond, Baysa Naran, Elena Bagnera, and Sean Stout. 2022. Tracking Investments in Climate Resilient Infrastructure. Climate Policy Initiative.

This can be attributed to several factors, the most crucial of which are discussed in the following points:

- Lack of climate risk data and limited frameworks for data on vulnerability and exposure. The lack of climate data as well as the limited number of frameworks for data on climatic vulnerability and exposure to disasters, is a challenge that impedes the development of climate-resilient infrastructure. Such data and frameworks are required for adopting appropriate adaptation measures and applying to design standards for infrastructure (Rahiman 2019).

- Lack of viable funding models and bankable project pipelines at the sub-national levels. This, in turn, limits their potential of mobilising diverse sources of finance for resilient infrastructure. An estimated financing gap of about 3-5 percent is for early-stage project preparation finance for cities, which can potentially go up to 10 percent for developing countries (World Bank 2020). Additionally, limited transparency on long-term infrastructure pipeline and resilience measures is a key barrier in attracting

- Asymmetric information on risk-adjusted returns to inform and drive private sector investment. With the scale of infrastructure required, public sector investment will be inadequate and private sector investment towards resilient infrastructure remains limited due to structural and foundational barriers. These obstacles include limited information on risk to investment, asymmetric information regarding range of vulnerabilities and exposure as per location, lack of regulation and policy on design standards for resilient infrastructure, and limited incentive mechanisms (Mercer and IDB 2017; Singh et al 2020).

- Lack of enabling policies and appropriate financial mechanisms to integrate climate concerns in infrastructure development further hampers the adoption of DRI (Rahiman, 2019). In order for disaster resilience to be incorporated and mainstreamed into the planning and policy process of a country, the identification of entry points at different levels of decision-making is crucial—this could be at the national, sub-national, local and/or project level (OECD 2018).

Given the increasing trend of natural disasters as a consequence of climate change, and after the massive fallout of the Tsunami of 2004 that hit South and Southeast Asia, the international community raised the need to carry out joint actions to avoid both human losses and material damages. The governments recognised that coordinated and complementary action at the community, provincial, national, and international levels is a priority for strengthening both prevention and responses to natural disasters.

4. Relevance to G20 and Propositions

Much of the infrastructure is to be developed in emerging economies, with an estimated US$ 4 trillion for resilient infrastructure in the Global South required till 2030 (Mercer and IDB 2017). With this scale of finance needed and the urgency posed by rapidly intensifying extreme weather events, the G20 countries have the opportunity to embed regulatory and governance measures to not only institutionalise resilient infrastructure practices at the sub-national levels but also embed measures that can help mobilise and incentivise greater amounts of private sector investment in the same. The following are some propositions, informed by international best practices and experiences.

a. Embedding infrastructural resilience through engineered and non-engineered methods, designed to address sub-national vulnerability and build adaptive capacity across regions.

In 2019, the G20 set forth the Quality Infrastructure Investment (QII) Principles, which were voluntary and non-binding and built on the consensus that infrastructure was a significant driver of economic prosperity and sustainable infrastructure was critical to maximise the impacts of these long-term investments (Government of Japan 2019). These principles lay emphasis on undertaking environmental considerations across the life-cycle of the infrastructure project and factoring-in the required DRR design elements to ensure resilience of all infrastructure, and more so, critical infrastructure. It is imperative to extend this as part of the regulatory frameworks at sub-national levels.

One example in this context is of building sub-national resilience in critical power infrastructure in the state of Himachal Pradesh in India (World Bank 2023). Transmission and distribution infrastructure in the power sector lasts for at least 40 years and up to 75 years, thereby making them highly vulnerable to future impacts of exacerbated climate change-induced extreme weather events. The state government, supported by MDBs such as the World Bank, are strengthening institutional capacities to build resilience of the power sector through “advanced power sector infrastructure across generation, transmission, and distribution.”[b]

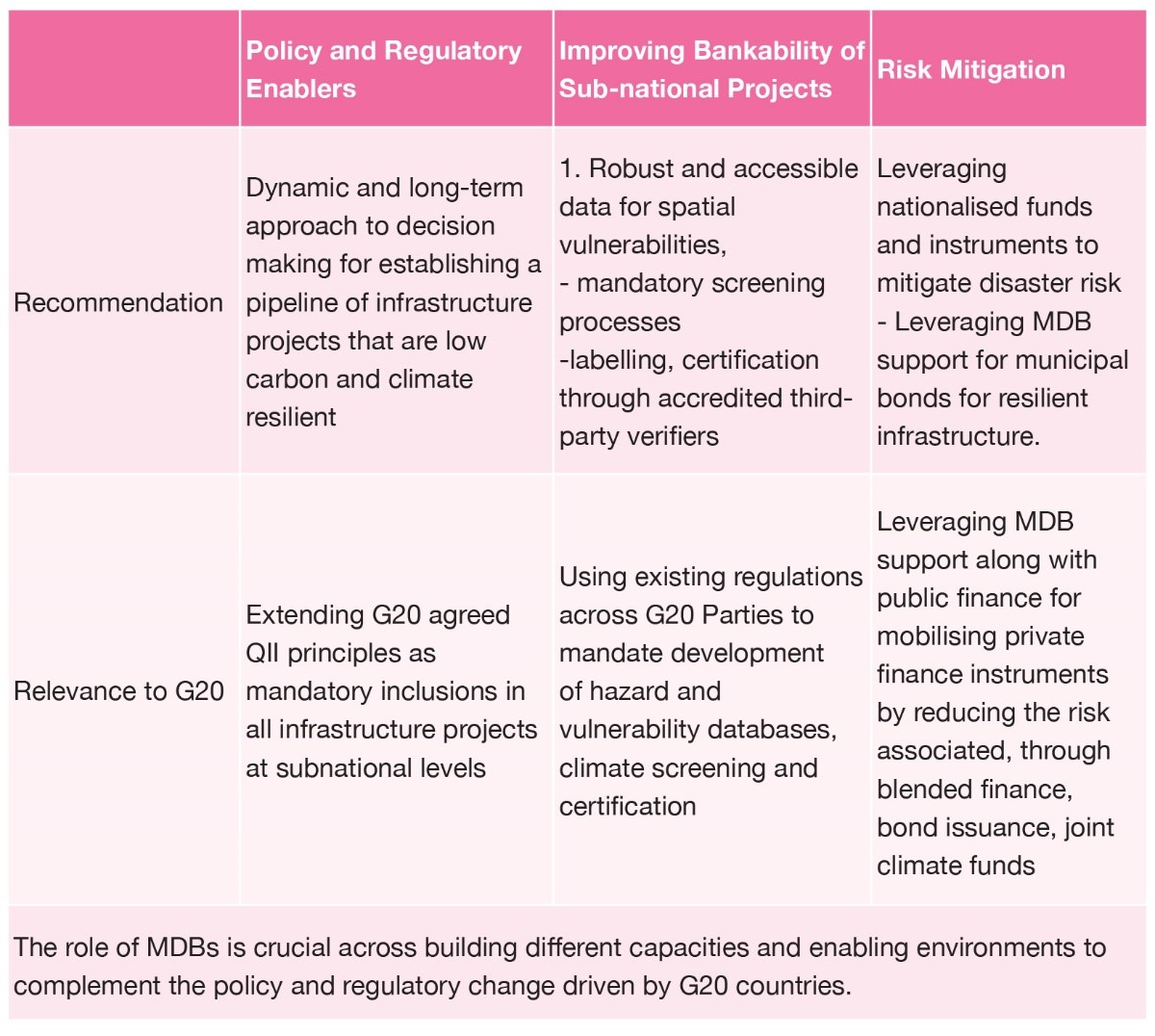

Extending the QII principles to the sub-national levels, while adopting a dynamic and long-term approach to decision-making at sub-national levels, can be advanced by the G20 countries. Establishing a pipeline of infrastructure projects that are low-carbon and climate-resilient while accelerating economic growth (OECD 2017), will be key drivers of sustained jobs, economic well-being, and prosperity at the sub-national levels. Regulatory measures of this kind would include sub-national governments defining a minimum standard of resistance for all critical infrastructure such as roads, water, and power supply. (Hallegatte, Maruyama Rentschler and Rozenberg 2019).

b. Improving Bankability of Subnational Infrastructure Projects and Enabling Private Financing

In line with developing a pipeline for resilient infrastructure projects for the national and sub-national levels, it is crucial to complement these with necessary policy and regulatory reforms that will form the backward linkages for building the capacity to develop resilient infrastructure projects. The G20 can issue guidance on inclusion of three key subcomponents: a) robust and accessible data on spatial vulnerabilities, natural hazards, and climate change at subnational levels. This will not only help improve infrastructure design but will also enable risk-informed urban planning, which in turn can increase local-level resilience to extreme weather events; b) mandatory screening processes utilising the data on climate vulnerability and hazards over the lifespan of the planned infrastructure and using it to inform infrastructure projects; c) labelling, certification through accredited third-party verifiers, on classification of resilient infrastructure projects, as an incentive for private sector interventions towards sustainable design especially including non-engineered designs for resilience building (Bersanetti, et al. 2022).

The G20, with MDB support can help develop a sub-national platform for data regularly updated by contributions of the local communities, enabling both the public and private sector developers to assess the local vulnerability before an infrastructure project.[c] Piloted across three cities of Batticaloa (Sri Lanka), Dhaka (Bangladesh), and Kathmandu (Nepal), a partnership supported by the GFDRR,[d] enabled collection and access to city-level data on exposure to climate risks, primarily relevant for resilient urban planning and infrastructure development (Open Cities 2012a). Developed and operationalised with a diverse set of stakeholders including local stakeholders such as local communities, universities, NGOs, in addition to government counterparts, a platform with robust data and visualisation tool was made accessible for mapping development projects in line with local vulnerabilities. For example, Kathmandu has mapped over 100,000 buildings and collected exposure data for 2,256 educational and 350 health facilities within Kathmandu Valley (Open Cities 2012b). Such data can support in the design of urban forms that will be resilient to climate change-induced extreme weather events.

c. Risk Mitigation Instruments and the Leveraging Role of MDBs in Finance Inflows

A critical barrier facing private sector finance towards Resilient Infrastructure is the lack of bankable projects with adequate risk-adjusted returns and of infrastructure pipelines, as well as uncertain policy and regulatory frameworks around resilient design requirements (Mercer and IDB 2017). Risk mitigation framework, in addition to enabling policy environments as outlined earlier, are crucial for bankable resilient infrastructure projects at the sub-national level. Investment guarantees, currency risk hedging, owing to the long-term nature of these projects are instruments to allay perceived risks around long-term financing for resilient infrastructure. Greater opportunities for blended finance at the sub-national levels can be explored as a means of not only channelling greater finance but also addressing the underlying risk of investment in resilient infrastructure. In this regard, a two-pronged approach is proposed: i) leveraging nationalised development banks for financing projects; or ii) leveraging MDB support for municipal bonds for resilient infrastructure.

It is imperative that the central governments provide support to sub-national entities that are highly vulnerable to extreme climate events and mobilise public investment to these areas, creating, for example, specific funds and programs for the development of Disaster Resilient Infrastructure. Several G20 countries have dedicated funds to de-risk investment in climate projects. For example, India created a State Disaster Risk Management Fund (SDRMF) at the sub-national level, comprising: a) a Disaster Mitigation Fund and b) a Disaster Response Fund, both at the sub-national level (National Disaster Management Authority of India 2021). From the total earmarked grants for disaster management funds, 20 percent is earmarked for disaster mitigation which includes building resilience at the community level.

In another example, the Mexican government has established the Fondo Nacional de Desastres Naturales (FONDEN, or Fund for Natural Disasters in English), as a fund which enabled risk-transfer instruments, such as insurance to be taken up for public assets at the national and subnational levels, and at the same time guarantees for infrastructure projects, including those that enhance resilience to climate change impacts (OECD, World Bank, 2019). While the fund is a national level fund, it supports sub-national resilience in infrastructure through ex-ante and ex-post support. Ex-ante support includes nudging subnational governments to invest in disaster risk transfer, i.e. insurance for public buildings.[e] Ex-post support includes rehabilitation and reconstruction of affected subnational public infrastructure and support for affected populations.

5. Conclusion

In the past, G20 has provided efforts in the form of guidelines on resilient infrastructure. However, as impacts of climate extremes continue to exacerbate, sub-national entities are bearing the brunt of devastation. In order to build resilience, it is imperative that G20 countries issue guidance and enablers for sub-national entities to be equipped with the necessary resources. These include: i) developing robust regulation and institutional capacity around RI pipelines; ii) supporting with adequate data and technical assessments to ensure all new projects are screened for resilient design; and iii) leveraging the support of MDBs to mitigate risk and build capacity.

There have been recent developments around revamping and restructuring the approach of MDBs towards addressing climate change and making their operations consistent with the norms of sustainability and climate. G20 can play a role in providing for global resources aimed at DRR and climate resilience especially for the most vulnerable countries (Gelles and Bearak 2022). The G20 holds the unique convening power to bring together a diverse range of stakeholders to engage on this issue and enable sub-national entities and communities to build the necessary resilient infrastructure.

Bibliography:

Bersanetti, Fulvio, Nicolas Buchoud, Raffaele Della Croce, Milindo Chakrabarti, Carla Patrizia Ferrari, Valeria Lauria, Paolo Mulassano, Francesco Profumo, and Jiajun Xu. “REALISING THE POTENTIAL OF NATIONAL DEVELOPMENT BANKS AND FOUNDATIONS IN SCALING UP GREEN AND INCLUSIVE INFRASTRUCTURE.” T20 Indonesia, 2022. Accessed March 29, 2023.

CDRI. “CDRI Overview.” Coalition for Disaster Resilient Infrastructure. Accessed May 3, 2023. https://www.cdri.world/cdri-overview.

Gelles, David, and Max Bearak. “Poor Countries Need Climate Funding. These Plans Could Unlock Trillions.” November 11, 2022.

Government of Japan. “G20 PRINCIPLES FOR QUALITY INFRASTRUCTURE INVESTMENT.” Ministry of Finance, Government of Japan. 2019. Accessed March 23, 2023.

Hallegatte, Stephane, Jun Erik Maruyama Rentschler, and Julie Rozenberg. “Lifelines: The Resilient Infrastructure Opportunity (Vol. 2).” Washington, D.C: World Bank Group. 2019.

Mercer and IDB. “Crossing the Bridge to Sustainable Infrastructure Investment.” Report. United Nations. 2017.

National Disaster Management Authority of India. “XV FINANCE COMMISSION SALIENT FEATURES” 2021. Accessed May 2, 2023.

OECD. “Investing in Climate, Investing in Growth.” Report, OECD, 2017.

OECD. “Climate-resilient Infrastructure: Policy Perspectives”. Report, OECD, 2018.

OECD/ World Bank. “Mexico.” In Fiscal Resilience to Natural Disasters: Lessons from Country Experiences, by OECD/ World Bank. Paris: OECD Publishing. 2019.

Open Cities. “Educational Facilities Critical Educational Sector Infrastructure.” Accessed May 2, 2023.

Open Cities. “About.” Accessed May 2, 2023.

Padmanabhi, Rajashree, Morgan Richmond, Baysa Naran, Elena Bagnera, and Sean Stout. “Tracking Investments in Climate Resilient Infrastructure.” 2022. Climate Policy Initiative.

Rahiman, Riya. “Climate Resilient Infrastructure – the Way Forward.” Urbanet, September 5, 2019.

Munich Re. “Climate change and La Niña driving losses: the natural disaster figures for 2022.” Munich Re. Accessed May 2, 2023.

REDUCTION, U. O. “How To Make Cities More Resilient, A Handbook For Local Government Leaders.” Geneva. United Nations Office for Disaster Risk Reduction (UNISDR). 2017.

Swiss Re. “Floods and storms drive global insured catastrophe losses of USD 38 billion in first half of 2022, Swiss Re Institute estimates.” Press Release, Zurich: Swiss Re Institute. 2022.

United Nations. “Global Assessment Report on Disaster Risk Reduction” Making Development Sustainable: The Future of Disaster Risk Management. Report, United Nations, 2015.

United Nations. “Meetings Coverage and Press Releases.” United Nations. Accessed March 28, 2023.

UNDRR. Principles for Resilient Infrastructure. United Nations Office for Disaster Risk Reduction. 2022.

United Nations Environment Programme. “5 ways Countries can Adapt to the Climate Crisis.” United Nations Environment Programme. Accessed May 1, 2023.

United Nations Environment Programme. “Adaptation Gap Report 2022: Too Little, Too Slow – Climate adaptation failure puts world at risk.” Report, United Nations Environment Programme, 2022.

World Bank. “City Climate Finance Gap Fund.” Accessed March 29, 2023.

World Bank. “Himachal Pradesh Power Sector Development Program (P176032)”. Program Information Document, World Bank, 2021.

World Bank. “QII: Advancing Green, Resilient, Inclusive Development”. Accessed May 5, 2023.

[a] This Policy Brief defines ‘resilient infrastructure’ as infrastructure that is able to absorb shocks and continue functioning during and after a disaster, climatic extremes and/or impacts as well as infrastructure that is adaptable and can be easily repaired or replaced following a disaster. Within the ambit of resilient infrastructure, this brief also touches upon – Climate Resilient Infrastructure (CRI) and Disaster Resilient Infrastructure (DRI). CRI is defined as infrastructure systems that can withstand shocks from extreme climate impacts while DRI can be defined as infrastructure systems that are resilient to disaster risks.

[b] https://documents1.worldbank.org/curated/en/480341628674428452/pdf/Concept-Stage-Program-Information-Document-PID-Himachal-Pradesh-Power-Sector-Development-Program-P176032.pdf

[c] Open Cities project by the World Bank makes available data on vulnerabilities at the city level easily accessible to project developers especially for infrastructure projects.

[d] Global Facility for Disaster Reduction and Recovery (GFDRR)

[e] This is done through creating a negative incentive, by limiting the sub-national government’s eligibility for post-disaster support for uninsured public assets.