Task Force 4: Refuelling Growth: Clean Energy and Green Transitions

Abstract

The transition to cleaner modes of transport is of primary importance to meet the challenges of global warming. Existing technological capabilities and policy frameworks have increased emphasis, globally, on using electric vehicles (EVs) in the transport sector. Most countries have aligned their policies to incentivise and provide infrastructural support to develop EVs and enhance consumer acceptance. While some developed countries have followed a more comprehensive approach by including End of Life (EoL) batteries in their policy framework, many are yet to initiate clear guidelines. Recycling EoL batteries benefits the environment and human health, and unscientific management of EoL batteries may have dangerous implications. This Policy Brief explores current technological and policy opportunities for, and barriers to improving circularity in EV battery systems. The brief recommends developing a sustainable global framework in this direction.

1. The Challenge

Decarbonising the transport sector is critical to meet climate change commitments. This task presents the G20 countries with an opportunity to emerge as a collaborative strategic unit in new sustainable mobility solutions. The grouping is uniquely positioned to deploy electric vehicles (EVs) at an augmented scale, leapfrogging traditional mobility models that perpetuate congestion, air pollution, and oil-import dependence while driving down the costs of batteries through economies of scale even faster than the rate at which current projections anticipate.[1]

Policymakers across the world have been pushing for the indigenous development of lithium cells, which is expected to increase the demand for raw materials. A number of deals and treaties have been signed in the past four or so years for supplying raw materials like rare-earths and other critical minerals required for manufacturing battery cell components. Individual countries have small reserves of essential critical minerals for lithium-ion (Li-ion) batteries. Many countries do not have reserves of some essential Li-ion components, including lithium, cobalt, and nickel, nor of the copper used in conductors, cables, and busbars. China is the world leader in cell component manufacturing for lithium-ion batteries (LiB), with a global share of about 51 percent.[2]

In Li-ion batteries, cathode materials vary, but standard formulations include minerals such as lithium, aluminium, cobalt, manganese, and nickel, while the anode is made of graphite. Recycling batteries can generate approximately 95 percent of these metals to be reused in manufacturing new batteries. In this regard, a sustainable and resilient value chain calls for addressing key challenges such as limited resource availability, environmental implications of extensive mining primary sources, unutilised batteries ending up in landfills, and geopolitical risks involving dependence on importing these critical components amidst price fluctuations in the global market due to supply chain irregularities.

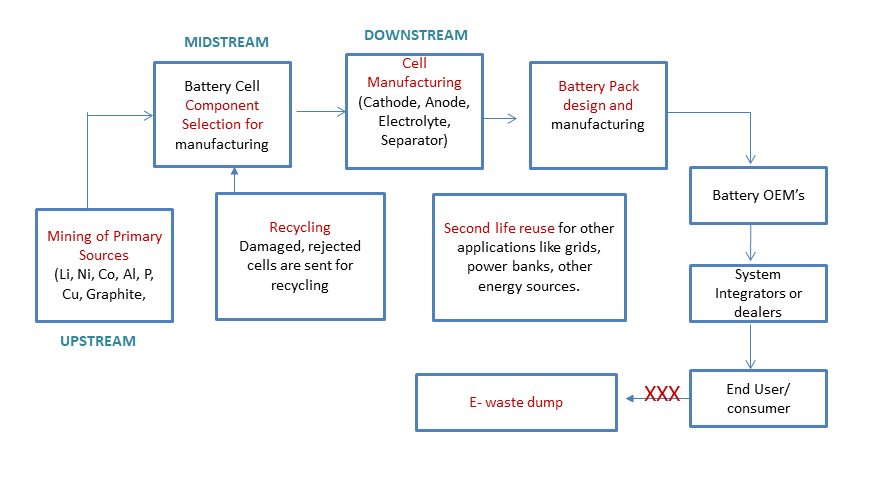

Components of the Battery Value Chain

The general ‘cradle-to-grave’ EV battery supply chain processes comprise four stages: extraction of raw materials; production, which includes cell and battery production, and vehicle assembly; consumption; and recycling, use, and final disposal.[3] The value chain of EV batteries begins from mining resources like lithium, nickel, cobalt, phosphorous, copper, and graphite, followed by cell manufacturing. Components like cathodes, anodes, electrolytes, and separators are assembled to manufacture cells and batteries. Consumption of cell components leads to reduced efficiency, with the increased scope of recycling and reuse (Figure 1).

Figure 1: Dimensions of the Life Cycle of EV Batteries

Source: Authors’ own.

Reuse and Recycling Stage for Batteries

Generally, batteries are retired from use in EVs when the range and performance is no longer acceptable to the driver. EV batteries usually retain 70-80 percent valid energy after completing their whole life cycle and are reused for grid-connected and BTM applications. Compared to those in two- and three-wheelers, EV batteries in cars cater to more reuse applications due to their capacity. Reuse for grid applications is in the range of two to five years. Usually, their performance is assumed to fall below 70-80 percent of the initial nameplate capacity, which needs scientifically designed treatment strategies.[4]

Increase in Demand for Battery Reuse and Recycling:

India’s recycling and reuse volume is expected to be more than 20 GWh in 2030. The cumulative potential of lithium-ion batteries in India from 2022–30 across all segments is estimated to be around 600 GWh (base case).[5] It has been found that the existing battery waste materials have immense potential and can generate value of about US$ 4800-5200 per ton.[6] There are associated material values in the discarded batteries, recovery of which will save the environment from toxic waste and generate precious metal resources of significant economic value. The recycling volume from deploying these batteries is projected to reach 128 GWh by 2030, of which almost 59 GWh will be from the EV segment. The recycling industry alone could create a US$6-billion profit pool by 2040. Revenue could exceed US$40 billion, a three-fold increase from 2030 values.[7]

Existing Policy Support and Challenges

Battery recycling policies for electric vehicles are evolving; at present, they are restricted to a few countries like China, the European Union, South Korea, and India. These policies have set battery collection targets and obligations, material recovery targets, and mandatory minimum recycled content in new batteries. Table 1 gives an overview of the battery recycling policies for electric vehicles.

Table 1: Policies with a Focus on EV Battery Recycling

| Country/ Union | Regulation | Status | Battery Collection Obligations & Targets | Key Features

|

| India | Battery waste management act 2022[8] | Implemented | Producers (including importers) shall have the obligation of Extended Producer Responsibility (EPR) for the battery that they introduce in the market to ensure its collection and recycling. | – Ensure safe handling of battery or waste battery, such that there is no damage to human health and environment.

– EPR certificates purchased by the producer will be automatically adjusted against their liability. |

| UK | Waste Batteries and Accumulators Regulations 2009 (as amended )[9] | Implemented | – Compulsory collection and recycling batteries by the manufacturer or importer that first places batteries on the UK market.

– Two-wheeler manufacturers have to mandatorily collect 70 percent of their batteries sold in the market in 2022-23 with a 7-year compliance timeframe starting 2026-27. |

– Prevent batteries from being pyrolysed or landfilled.

|

| European Union | Batteries: Deal on new EU rules for design, production, and waste treatment (Dec, 2022)[10] | Implemented | – Extended Producer Responsibility requires that automotive companies ensure that retired batteries are collected and reused, repurposed, or recycled.

– Collection targets are set at 45 percent by 2023, 63 percent by 2027, and 73 percent by 2030 for portable batteries, and at 51 percent by 2028 and 61 percent by 2031 for LMT (Light Means of Transport) batteries. |

– The use of labelling to clarify battery characteristics, battery passport, get detailed information on the material supply chain, use of the battery, and the state of health.

– It also sets a compulsory minimum recycled content in new batteries. |

| China | Ministry of Industry and Information Technology[11] | Implemented | – In China, every battery produced or imported for use in EVs has a unique code to track and for effective processing at the end of the battery’s first life. | – The national government has created a structure for battery dismantling and recycling enterprises, which are regulated at the provincial level. |

Current and Emerging Technologies for Battery Recycling

Renowned global recyclers include Umicore (Belgium), Accurec (Germany), SungEel (South Korea), Kyoei Seiko (Japan), and Brunp (China), among others.[12]

Conditioning of the battery is performed to fully discharge electrically either through high ionic conductivity or recycling of batteries, which requires mechanical pre-treatments in which the different components of the battery, such as assembly, battery control unit, and the stack dissembled and its significant constituting parts are separated physically. Further, to recover precious metals from e-waste and batteries, pyrometallurgical techniques involve heating waste to high temperatures of 1200℃.

Commercially available battery recycling technologies are expensive and need to be more environment-friendly. New and emerging technologies are nascent and need support for scale-up investigations. There are also limited studies on optimising resources during battery manufacturing.

Pyrometallurgical technology that employs high-temperature heating of waste material is the most commonly used battery treatment technique and can handle limited materials like cobalt. However, recycling technologies must also pivot as cell technologies shift towards higher nickel and lower cobalt content.

With existing infrastructure and policies, no member of the battery’s value chain can understand the current status of efficiency, ESG performance, material content, and stage of recycling or reuse of any battery. There are no suitable policies and clear guidelines about the status of the battery on the entire value chain. The lack of digital identifiers for batteries poses hurdles to designing their recycling or reuse capacity.

There have been global policy-level challenges as battery composition and technologies quickly evolve. It is becoming a challenge to draw policies covering all battery types available in the medium and long term. While many national governments have extended to mandate collection, data on the exact batteries collected, recycled, and technologies adopted for the same must be included.

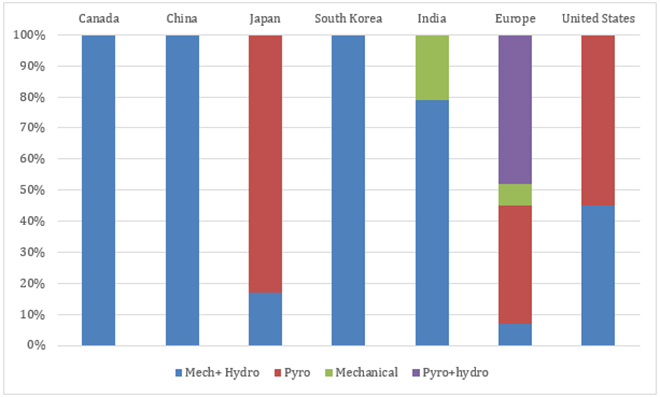

Figure 2: Mapping Global Recycling Capacity by Technology

Source: Niti Aayog, 2023[13]

In the domain of technological development for battery recycling and resource utilisation, various treatment techniques are employed alone or in combination by battery manufacturers. Mechanical treatment, followed by hydrometallurgical treatments, is most commonly practiced in Canada, China, and South Korea (Figure 2). The African continent relies on multiple methods, including a combination of pyro and hydrometallurgical (48 percent), pyrometallurgical (38 percent), mechanical (7 percent), and a variety of mechanical and hydrometallurgical techniques (7 percent). India largely utilises mechanical and hydrometallurgical methods (79 percent).[15]

2. The G20’s Role

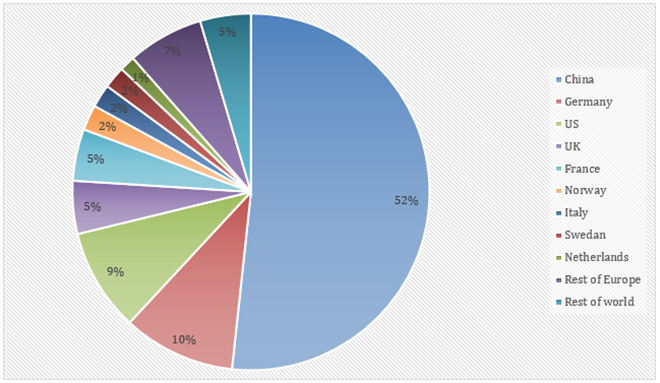

G20 countries’ dominance in EV supply chain

The G20 countries have a dominant position in EV adoption, battery raw materials, and manufacturing, accounting for over 85 percent of the total electric vehicles sold globally in 2021 (Figure 3).[16] The G20 countries also account for a significant share of battery raw materials. Australia and Argentina hold around two-thirds of global lithium reserves, while Indonesia is home to 22 percent of the world’s nickel reserves. China dominates global production in battery cells with a share of around 70 percent of the worldwide output of battery cells.[17]

Figure 3: EV Sales, by Country (2021) [18]

Battery recycling is at a nascent stage, and there are gaps concerning technology in reducing the costs of the recycling process and improving the material recovery capacity. There are also gaps relating to global policies around the data sharing of batteries. There is a need for joint coordination spearheaded by G20 nations to improve recycling technologies and create global frameworks for battery recycling to strengthen the circularity of the battery supply chain and thereby aid in EV adoption.

EVs with lower carbon footprints and higher conversion efficiency have emerged as an inevitable medium for mobility and as an alternative to internal combustion engines. The 2022 G20 host, Indonesia, employed more than 1,400 EVs to shuttle G20 participants.[19] Indonesia is the world’s largest miner of nickel, a crucial EV battery component. The EV market is nascent in India, with only 0.1 percent of EV sales in 2019. The Government of India plans to expand the scope of EVs with the launch of the National E-Mobility Program, targeting to achieve a 30-percent EV share by 2030.[20]

Sole reliance on lithium-ion batteries will only add a chink in the armour. The paucity of reserves globally means global supply chain disruptions will continue to impact countries. Looking at economic losses due to unscientifically managed battery wastes, coupled with economical material losses, various governments have initiated battery waste management policies and assigned battery producers to collect, store, recycle, and reuse battery waste.

European Commission Directive on Recycling

The European Commission (EC) is working on a long-term framework, the European Battery Directive, which actively encourages recycling with a phased approach to mandating minimum recycled content thresholds across key commodities. The regulation proposes recycled content standards, a measure requiring a certain percentage of recycled materials to be used to manufacture new batteries. These standards start at 16 percent for cobalt, 6 percent for lithium, and 6 percent for nickel in 2030, then increase to 26 percent, 12 percent, and 15 percent, respectively, in 2035. The legislation aims to recover 90 percent of cobalt, copper, lead, and nickel, as well as 35 percent of lithium from batteries by 2025. These figures would rise to 95 percent and 70 percent by 2030. The legislation suggests a set percentage of recycled materials for new battery manufacturers. Minimum levels of recovered cobalt (16 percent), lead (85 percent), lithium (6 percent), and nickel (6 percent) from manufacturing and consumer waste must be reused in new batteries.[21]

The UK Government has committed to meeting the net-zero deadline by 2050 and is planning to shift to total EV-based vehicles by 2040 (Department of Transport, 2018). The government’s Waste Batteries and Accumulators Regulations 2009 (as amended) have made the collection and recycling of batteries compulsory. The rules also prevent batteries and accumulators from being pyrolysed or landfilled.[22] Similarly, waste collection centres have been established by the Ministry of Environment in South Korea with a focus on preventing the disposal of toxic substances directly into the environment. The Ministry of Trade, Industry, and Energy (MOTIE) is also encouraging the reuse of end-of-life batteries of EVs as an Energy Storage System (ESS).[23] The Government of Australia is also reported to be working on the first National Electric Vehicle Strategy.[24]

Push from Indian Government

The government of India has formulated several policies, such as the National Electric Mobility Mission Plan 2020 (NEMMP 2020), aimed at increasing EV share in the entire automobile sector and indigenous manufacturing technology.[25] Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME India) was launched in 2015 to boost indigenous production of EVs in the country.[26] The EV industry was also significantly increased in the FY24 Union Budget. The Battery Waste Management Act 2022 by the Ministry of Environment, Forest and Climate Change, India, is a step towards handling waste batteries, where producers have EPR obligation for the battery and must ensure recycling or refurbishing of the same.[27] Regulation has set targets for recoverable materials out of the dry weight of the battery at 70 percent by 2024-25 and 90 percent by 2026-27.

In addition, innovations in clean technologies for waste management are underway globally. However, specific barriers in the transition need the attention of the G20 countries.

Since the value chain of EVs is complex, the role of international cooperation and collaboration becomes critical in the sector’s sustainable development. Since the development of EV batteries, value-chain assessment, and battery waste management is multidisciplinary and involve a broad area of research, no country can achieve a sustainable EV supply chain alone within a short period. There is a need for technical cooperation for the scaling-up of these emerging technologies, developing new battery chemistries that have fewer raw material issues, and strengthening the global supply chain of electric vehicle batteries.

3. Recommendations to the G20

The transition to EV will not be complete without taking care of the circular economy context. Mining and treatment of metals used in EVs are expensive and limited. The following recommendations can be used to steer global policies toward recycling batteries at EoL and will serve the dual purpose of resource conservation and waste minimisation:

- Battery data: There is a strong need for regulations to standardise data generation on EoL batteries and their open access across the globe.

- Battery traceability: Uniform regulations are required and need to be discussed among various nations for efficient battery-tracking mechanisms.

- Battery collection responsibility: A clear definition of who is responsible for the battery when it reaches the end of life should be an integral part of all national EV policies.

- Standardising designs: There should be global design standards, through standardising a particular aspect, to allow for the safe recycling of EVs and their components with minimal disposal.

- Financial support for technological innovation: Technological innovations should be provided financial support globally. International collaborations are necessary to build sustainable and eco-friendly recycling infrastructure supporting a battery market to improve material recovery capacity.

- Global fund to improve recycling capacities: A central fund should be set up to provide incentives for scaling up recycling facilities across the globe.

- Monitoring for the adoption of guidelines: An international committee should be set up to monitor and make a case for recycling content thresholds. Consider models implemented by other industries. Legislation and policies with adequate enforcement and engagement from stakeholders, including the informal sector, must be created and supported.

Timely, focused, and dynamic policy-level support, technological innovations, infrastructure, governance, and global cooperation can encourage the recycling and reuse of the EV battery value chain and create multiple benefits like waste minimisation, environmental protection, and resource conservation. The creation of an international EV alliance similar to the International Solar Alliance can also assist in fostering a sustainable and resilient EV battery value chain globally.

Attribution: Perminder Jit Kaur et al., “Building a Resilient EV Battery Value Chain,” T20 Policy Brief, June 2023.

[1] “Use of Electric Vehicles at G20 Encourages Application of Alternative Energy in Indonesia,” accessed January 30, 2023.

[2] “Visual Capitalist Resource,” accessed Febuary 16, 2023.

[3] Mohammad Ali Rajaeifar et al., “Challenges and recent developments in supply and value chains of electric vehicle batteries: A sustainability perspective,” Resources, Conservation and Recycling 180 (2022):106144

[4] “Advanced Chemistry Cell Battery Reuse and Recycling Market in India,” Report by Niti Aayog, India, accessed April 10, 2023.

[5] Niti Aayog, “Advanced Chemistry Cell Battery Reuse and Recycling Market in India.”

[6] “Capturing Battery Value-Chain Opportunity,” accessed March 10, 2023.

[7] Niti Aayog, “Advanced Chemistry Cell Battery Reuse and Recycling Market in India.”

[8] “India Battery Waste Management Rules,” CPCB, accessed April 1, 2023.

[9] “UK Waste Management Guidelines,” accessed January 17, 2023.

[10] “Europe’s Battery Strategy,” Geopolitical Intelligence Services, accessed January 27, 2023.

[11] “MIIT of China to promote recycling of used EV batteries,” accessed January 5, 2023.

[12] “Comparative Study of Li-Ion Battery Recycling Processes,” accessed January 12, 2023.

[13] Niti Aayog, “Advanced Chemistry Cell Battery Reuse and Recycling Market in India.”

[14] Garima Chauhan et al., Sustainable Metal Extraction from Waste Stream (Wiley publishers, 2020).

[15] Niti Aayog, “Advanced Chemistry Cell Battery Reuse and Recycling Market in India.”

[16] McKinsey, “Capturing Battery Value-Chain Opportunity.”

[17] McKinsey, “Capturing Battery Value-Chain Opportunity.”

[18] McKinsey, “Capturing Battery Value-Chain Opportunity.”

[19] “Indonesia deloys Electric Vehicle for G20 Summit,” accessed March13, 2023.

[20] “E-Mobility: National Mission on Transformative Mobility and Battery Storage,” accessed April 5, 2023.

[21] Government of UK, “UK Waste Management Guidelines.”

[22] Government of UK, “UK Waste Management Guidelines.”

[23] Yong Choi and Seung-Whee Rhee, “Current Status and Perspectives on Recycling of End-of-life Battery of Electric Vehicle in Korea (Republic of),” Waste Management 106 (2020): 261-270.

[24] “Australia’s first National Electric Vehicle Strategy,” accesesd April 19,2023.

[25] “National Electric Mobility Mission Plan,” accessed April 15, 20203.

[26] “Electric Vehicles Manufactures registered under FAME-India Scheme phase-II,” accessed April 18, 2023.

[27] CPCB, “India Battery Waste Management Rules.”