Task Force 6: Accelerating SDGs: Exploring New Pathways to the 2030 Agenda

Private participation in infrastructure projects is showing signs of recovery after the COVID-19 pandemic. The overall trend, however, has remained stagnant over the last eight years. This means that the investment gap in infrastructure is expected to continue to widen. The figure is predicted to be even larger when the infrastructure requirements pertaining to the Sustainable Development Goals are taken into consideration. The public sector alone is unable to fill the gap. Therefore, this policy brief proposes a system that shares the spillover tax between the government and the investors and operators of the infrastructure to incentivise private-sector participation. This will increase the confidence of private-sector investors and the feasibility of infrastructure projects.

1. The Challenges

The COVID-19 pandemic left a lasting impact not only on human health but also on the financial health of various countries. Many governments have been struggling with fiscal deficits due to the large costs of dealing with the pandemic paired with significant decreases in government income. Data from the Asian Development Bank (ADB) (2022) show that many governments in developing Asian countries recorded double digit fiscal deficits in 2020 and some carried the fiscal imbalance to 2021.

The pandemic also highlighted the need for robust public infrastructure given that despite heavy mobility restrictions, day-to-day life can continue owing to infrastructure. Workers can work from home, students can attend class virtually, and shopping can be done online.

While infrastructure is crucial, the ability of most governments to build, operate, and maintain it is shrinking, given the insufficient amount of private investment. If current trends persist, by 2040, global infrastructure investment is estimated to reach US$79 trillion while needs are estimated to reach US$94 trillion (Global Infrastructure Outlook, 2023). To meet the United Nations Sustainable Development Goals (SDGs), the global infrastructure investment gap is expected to be higher. For example, achieving SDG-6 and SDG-7.1, which call for universal access to water and sanitation, and electricity respectively, is expected to require an additional US$3.5 trillion in global investment needs between 2016 and 2030.

To fill the financing gap, increased private sector participation is vital. While private sector investment in infrastructure is showing signs of recovery post-pandemic, the overall trend has remained stagnant for the last eight years (Global Infrastructure Hub, 2022). Governments have developed means to include the private sector in the development of infrastructure, via public-private partnerships (PPPs), which were introduced in the early 1990s for instance. However, private participation in PPP projects as a share of private infrastructure investment has declined from 36 percent in 2010 to 28 percent in 2019 (Lam-Frendo, 2021).

Land value capture is another means by which governments have collected additional revenues. The premise is that increases in land values that stem from government actions, such as through the development of infrastructure, should benefit both the landowners (private sector) and the public. Therefore, governments collect a part of the increase in land value and then use it to fund infrastructure and public services (OECD/Lincoln Institute of Land Policy, PKU-Lincoln Institute Center, 2022).

Land value capture has been successfully implemented in several countries, including Japan, the UK, France, and Republic of Korea. However, spillovers from infrastructure are not only limited to increases in land value. The development of infrastructure, starting from the construction stage to that of operations, is believed to create spillovers in various aspects, such as increased economic activities brought about by the creation of new jobs and businesses and improved human capital through greater access to education and healthcare. This inherently means that governments also have the potential to capture, for example, the increase in profits of businesses and incomes of workers, which benefit from the development of infrastructure, through increased taxation.

Indeed, a few studies have found that government tax revenues increase due to the development of infrastructure. For example, focusing on the development of information and communication in India, (Yoshino, Siregar, et al. 2023) found that a 1 percentage point increase in the number of mobile subscribers is expected to raise annual state tax revenues per capita by INR 134 (or 3 percent of average annual state tax revenue per capita in 2016). A similar result is also obtained for Yoshino and Hoa (2020), who showed that the operation of the Noi Bai–Lao Cai and Ha Noi–Thai Nguyen expressways in Vietnam added more than VND 38.51 billion to the income tax revenues of the affected provinces compared to non-affected provinces.

This policy brief argues that part of the increment in tax revenues should be used to incentivise the private sector to increase their participation in PPPs. Among the reasons for the declining trend in the involvement of the private sector in infrastructure projects is the perception that they are high-risk and non-profitable. This is partly true because if construction takes more time than previously anticipated or if its costs exceed estimates, the increased burden is usually borne by the private sector. There are also other risks, such as political risk, operation and maintenance risk, exchange risk if investors are foreign, and environmental risks (Yoshino, 2020). Moreover, even after the project is completed, failure can happen should demand for the infrastructure turn out to be less than projected. Note that the viability of infrastructure projects for public goods, such as roads, bridges, electricity, and water, usually depends on user charges, which tend to be low. The private sector, in contrast, is motivated by profit. Increasing charges for users may reduce consumer demand even if the private sector is able to do so to pay for construction and operations (under the PPP agreement). The incompatibility between user and investor needs could cause PPPs to fail.

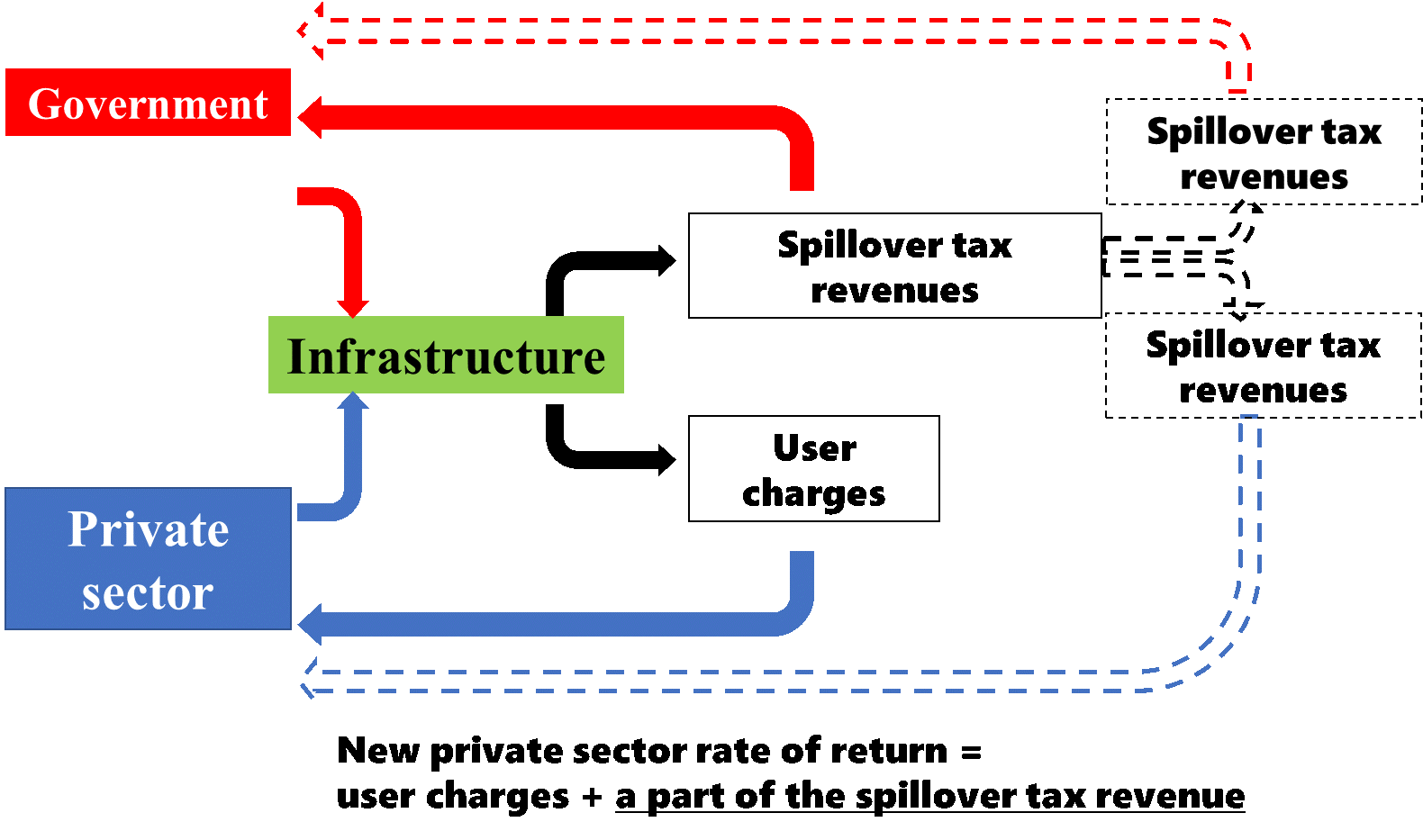

Figure 1: Challenges, Proposals, and Expected Outcomes

Source: Authors’ own, based on Asian Development Bank and Coordinating Ministry for Economic Affairs Republic of Indonesia (2021).

Therefore, one way to attract private sector involvement in infrastructure projects is by ensuring that they will have a steady stream of income, not only relying on user charges but also on spillover tax revenues. Such projects will increase their rate of return from the investments. This is where the government must step in by sharing a part of their spillover tax revenues brought about by the project with the investors of the infrastructure. A more detailed discussion of this proposal will be outlined in the section “Recommendations to the G20”.

2. The G20’s Role

Infrastructure development has been one of the priorities of several G20 presidencies. In 2014, the G20 established the Global Infrastructure Hub (GI Hub), which produces data and insights and facilitates connections across public and private sectors, academia, development banks, and international organisations. The GI Hub can accumulate data on the spillover impacts of various infrastructure investments and can show the approximate rate of return for private investors.

To support the recommendations of this policy brief, the G20, through the GI Hub, can continue its work at providing reliable case studies, datasets, analysis, and recommendations. More importantly, the establishment of a spillover tax-sharing system, which is the main proposal of this policy brief will need considerable capacity building across national, subnational, and individual levels. The GI Hub can support by facilitating and analysing such activities.

3. Recommendations to the G20

This policy brief recommends a spillover tax-sharing system between governments and the private sector. In order to do so, it proposes the following steps, as shown in Figure 1:

- establish a tax-sharing system between the government and the private sector;

- obtain involvement of multilateral institutions; and

- begin with a pilot project

- scaling up.

Step 1: Develop a tax-sharing system between the government and the private sector

As previously discussed, the development of infrastructure is expected to bring higher economic activities in addition to other economic and non-economic benefits. In turn, this increases land values and also business revenues and income for workers. Therefore, the proposal complements the land value capture scheme by offering a solution to return the entire “value”, including business tax, income tax, and sales tax revenues created by infrastructure development, to private sector investors. The rationale is as follows:

First, it is important to acknowledge that the rise in land value due to the development of infrastructure is only a part of the entire spillover of infrastructure investments. For example, infrastructure investment intensifies economic activities, which will increase corporate revenues. In turn, this will raise revenues from corporate tax, sales tax, and value added tax. Moreover, increased business activities may push up productivity and employment opportunities, consequently raising the income of residents, which will augment income tax. Finally, land values will increase given the development in that area. This will lead to raises in property tax revenues.

Conventionally, all these increased spillover tax revenues are collected by governments, both central and local. However, these increased tax revenues were created by infrastructure projects, so a part should be returned to investors and operators. Along with user charges, a part of this spillover tax revenue will increase the rate of return. This will increase the confidence of private sectors to engage in infrastructure projects. Furthermore, the injection of spillover tax revenues can also be used for maintenance and repair costs of the infrastructure.

Note that this approach applies to only a share of the incremental tax revenues created by the development of infrastructure. Therefore, there is no impingement on the existing tax base.

Figure 2: Spillover Tax Revenues Increase the Rate of Return for Investors

Source: Authors’ own, based on Yoshino, et al. (2019).

The development of this scheme requires a transparent and reliable tax-sharing system. Therefore, a conducive regulatory framework is necessary. Moreover, governments, both national and subnational, must commit themselves to this system. Since this may be difficult to achieve with the change in administration every few years, in addition to the scale of infrastructure projects which may cross several administrative borders, involvement of multilateral supervisory institutions is necessary. This will be elaborated in Step 2 of this policy brief.

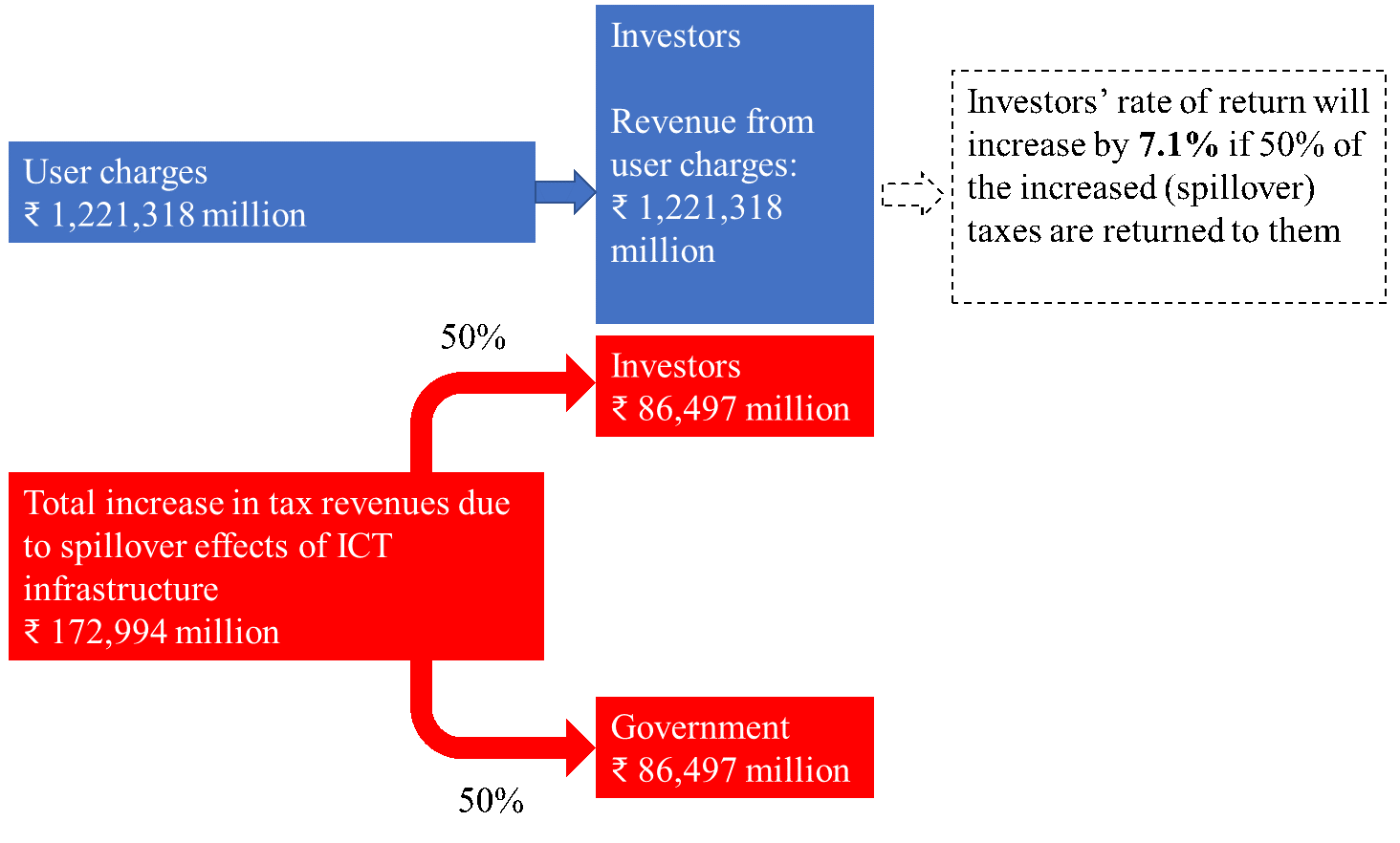

How to then decide the types of taxes as well as estimate the amount of spillover taxes created by infrastructure development and how much of it should be shared with the private sector[1] and for how many years? As for the amount of spillover tax revenues to be shared between the government and private sector, a simple procedure could be to divide the increased tax revenues equally. See Figure 3 for an illustration of the tax-sharing scheme.

Figure 3: An illustration of the tax-sharing scheme

Source: Authors’ calculation based on (Yoshino, Siregar, et al. 2023).

Note: Yoshino et al. (2022) found that a 10-percentage point increase in the number of GSM (mobile) subscribers per capita is expected to raise the total tax revenue per capita by INR 134. Multiplying this figure by 1.291 billion people (the projected Indian population in 2016), the total state tax revenue owing to the rise in the number of GSM subscribers is INR 172,994 million. If that amount is divided in half between the government and the investors in information and communications technology infrastructure, the rate of return is expected to increase by 7.1 percent.

Step 2: Obtain involvement of multilateral institutions

In order to guarantee the efficiency and continuity of the spillover tax-sharing system, participation of multilateral institutions is necessary. This is because infrastructure projects typically last years and are likely to span across more than one government administration. Moreover, infrastructure, such as roads, expressways, railways, electricity, and water supply are likely to cross more than one administrative boundary and need the involvement of various government bodies. Therefore, in addition to a leading implementing institution (such as a ministry or other national organisation/department), multilateral institutions must be involved to ensure the continuity of the project and to enforce the sharing of spillover tax revenues.

Given that multilateral development banks (MDBs) are already broadly involved in the development of infrastructure, it would be more practical and efficient to have existing ones appointed as watchdogs for such projects. For example, ADB has played an enormous role in PPPs across its member countries.

Another role of the MDBs would be to ensure the accountability and transparency of the system. The Extractive Industries Transparency Initiative (EITI), whose members agree to share data along the extractive sector value chain, is an illustration of this. (Extractive Industry Transparency Initiative, 2023). Similarly, for the case of the proposed tax-sharing system, individuals and businesses should self-report the amount of taxes they paid. These numbers are then matched with the tax revenues reported by the government and determine how it is returned to infrastructure investors and operators.

Step 3: Start with a pilot project

After completion of Step 1 and Step 2, a pilot project could kick-start the proposed scheme. Note that the project should be scalable and replicable. An instance of such a pilot project would be the conversion of strategically placed land parcels into interchange hubs that would contain multistorey parking structures, bus interchanges, and retail establishments/supermarkets. (Asian Development Bank and Coordinating Ministry for Economic Affairs Republic of Indonesia, 2021). These types of infrastructure development can be done within a relatively short time and should be completed in high-density urban areas such as in the Greater Jakarta Metropolitan Area (Indonesia) or Delhi Metropolitan Area (India).

Step 4: Scale up

After the pilot project creates spillover tax revenues, similar/larger projects can be done in other regions. During and after this step, it is expected that the tax-sharing system be continuously optimised, along with the development/adjustment of other laws and regulations based on the lessons learned from the pilot project and to prepare for upcoming infrastructure projects.

Attribution: Tifani Husna Siregar et al., “Bridging the Infrastructure Investment Gap: Proposal for a Spillover Tax Sharing System,” T20 Policy Brief, July 2023.

References

Asian Development Bank and Coordinating Ministry for Economic Affairs Republic of Indonesia. Innovative Infrastructure Financing through Value Capture in Indonesia. Manila: Asian Development Bank, 2021.

Asian Development Bank. Asian Development Bank Basic Statistics. Asian Development Bank, 2022.

Extractive Industry Transparency Initiative. “2023 EITI Standard”. Accessed March 31, 2023.

Global Infrastructure Hub. Infrastructure Monitor 2022. Global Infrastructure Hub, 2022.

Global Infrastructure Outlook. “Global Infrastructure Hub”. Global Infrastructure Outlook. Accessed March 22, 2023.

Lam-Frendo, Marie. “Do we need private investment to fund recovery?” Global Infrastructure Hub. February 12, 2021.

OECD. Global Compendium of Land Value Capture Policies. Paris: OECD Publishing, June 21,2022.

Yoshino, Naoyuki, KE Seetharam, Satoshi Miyazawa, and Kai Xu. “Innovative Measures of Infrastructure Investments: Illustrating Land Trust Scheme and Spillover Effect.” ADBI Working Paper Series, No. 1053 (December 2019).

Yoshino, Naoyuki, and Truong Thi Hoa.”Effects of Infrastructure Projects on Government Revenue: The Casw of Expressway Projects in the Northern Midland and Mountainous Area of Vietnam.” ADBI Working Paper No. 1171 (August, 2020).

Yoshino, Naoyuki, and Umid Abidhadjaev.”An impact evaluation of investment in infrastructure: The case of a railway connection in Uzbekistan.” Journal of Asian Economics, 49 (2017): 1-11.

Yoshino, Naoyuki, and Umid Abidhadjaev. “Impact of Infrastructure on Tax Revenue: Case Study of High-Speed Train in Japan.” Journal of Infrastructure, Policy and Development, Vol. 1 (2) (2017): 129-148.

Yoshino, Naoyuki, and Victor Pontines.”The Highway-Effect on Public Finance: Case of the STAR Highway in the Philippines.” ADBI Working Paper No. 549.(November, 2015).

Yoshino, Naoyuki, Tifani Husna Siregar, Deepanshu Agarwal, KE Seetharam, and Dina Azghaliyeva. “An Empirical Evidence and Proposal on the Spillover Effects of Information and Communication Technology Infrastructure in India.” In Infrastructure Spillover Impacts in Developing Asia, edited by Dina Azhgaliyeva, KE Seetha Ram, and Naoyuki Yoshino, 1 – 34. Tokyo: Asian Development Bank Institute, 2023. https://www.adb.org/publications/infrastructure-spillover-impacts-in-developing-asia

[1] Theoretically, a trans-log production function can be used to estimate the spillover effects of infrastructure projects as demonstrated the Philippines’ STAR highway, Uzbekistan’s railway, and Japan’s high-speed railways (Yoshino and Abidhadjaev, 2017a; 2017b; Yoshino and Pontines, 2015). Using econometric techniques, such as difference-in-differences to compute the incremental tax income created by infrastructure investments, is another feasible way of estimating the spillover tax revenues of infrastructure projects.