Taskforce 6: Accelerating SDGs: Exploring New Pathways to the 2030 Agenda

Nature-based solutions (NbS) are critical for building resilience against the threats of climate change and biodiversity loss that are triggered by unsustainable land use and poor agricultural practices. Despite this understanding, investment into NbS in the G20 economies—especially from the the private sector, multilateral development banks, and international financial institutions—is inadequate. This policy brief reviews the progress on the valuation of ecosystem services, the impact assessment of NbS, and the return on investment in NbS to identify the gaps and opportunities to build upon the existing body of knowledge for the creation of a global monitoring, evaluation, and learning framework aligned to the Sustainable Development Goals. It also argues that the framework must account for all types of capital (natural, social, human, manufactured, and financial) and allow for both quantitative and qualitative indicators and stock and flow concepts.

1. The Challenge

As of July 2023, around one-third of the global forest cover has been lost to humanity due to the expansion of agricultural land.[1] The shift from traditional nature-positive agricultural practices to modern methods driven by profits has caused degradation of two billion hectares of land. Furthermore, 12 million hectares are threatened by unsustainable land use.[2] Factors such as this, along with climate change, have not only lowered global farming productivity by 21 percent,[3] but in effect, have adversely impacted the security of our food systems, water, and ecosystem services (ES). Nature-based solutions (NbS) offer an opportunity to build resilience against these, thus contributing to the advancement of Sustainable Development Goal (SDG) 15 (life on land).

NbS are “actions to protect, sustainably manage, and restore natural or modified ecosystems that address societal challenges effectively and adaptively, simultaneously providing human well-being and biodiversity benefits.”[4] These are broadly categorised into ecosystem restoration, conservation, and improvement of land management practices. Restoring 160 million hectares of land is found to have the potential to create US$84 billion in annual economic benefits globally.[5]

Since its introduction in the International Union for Conservation of Nature Congress (2012), NbS has witnessed a broad uptake at international platforms. The most significant of these have been the G7 Environment Ministers Meeting (2018), the Convention on Biological Diversity (CBD) Conference of the Parties (COP) 14 Decision (2018), the United Nations Secretary General Climate Action Summit (2019), the Intergovernmental Platform for Biodiversity and Ecosystem Services’ ‘Global Assessment Biodiversity and Ecosystem Services (2019), and Post 2020 Biodiversity Framework (2022). Of these, the Post 2020 Biodiversity Framework represents an ambitious action plan to recognise human dependence on nature and foster public and private investment in its protection, restoration, and sustainable management.

Despite such traction, the investment towards NbS is inadequate. In 2020, the G20 economies invested US$120 billion into NbS-based interventions, accounting for 92 percent of the global NbS investment in that year. As much as 87.5 percent (US$105 billion) of this investment was internal allocation by domestic governments. The private sector drove only 11.67 percent (US$14 billion) of the pie. The remaining 0.83 percent (~US$1 billion) was Official Development Assistance from the G20 economies.[6] This trend of low investment into NbS by the private sector continues and is a matter of concern.

Generating evidence and comparing return on investment (ROI) are essential to increase funding for NbS projects. However, since no common framework exists at the global level that handles the conflicting roles of providing standardisation while permitting logical country-specific contextualisation, this evidence generation is often limited to particular countries and projects and prevents private and public agents from comparing the ROIs (same solution, different countries; same country, different solutions) and from confidently investing.

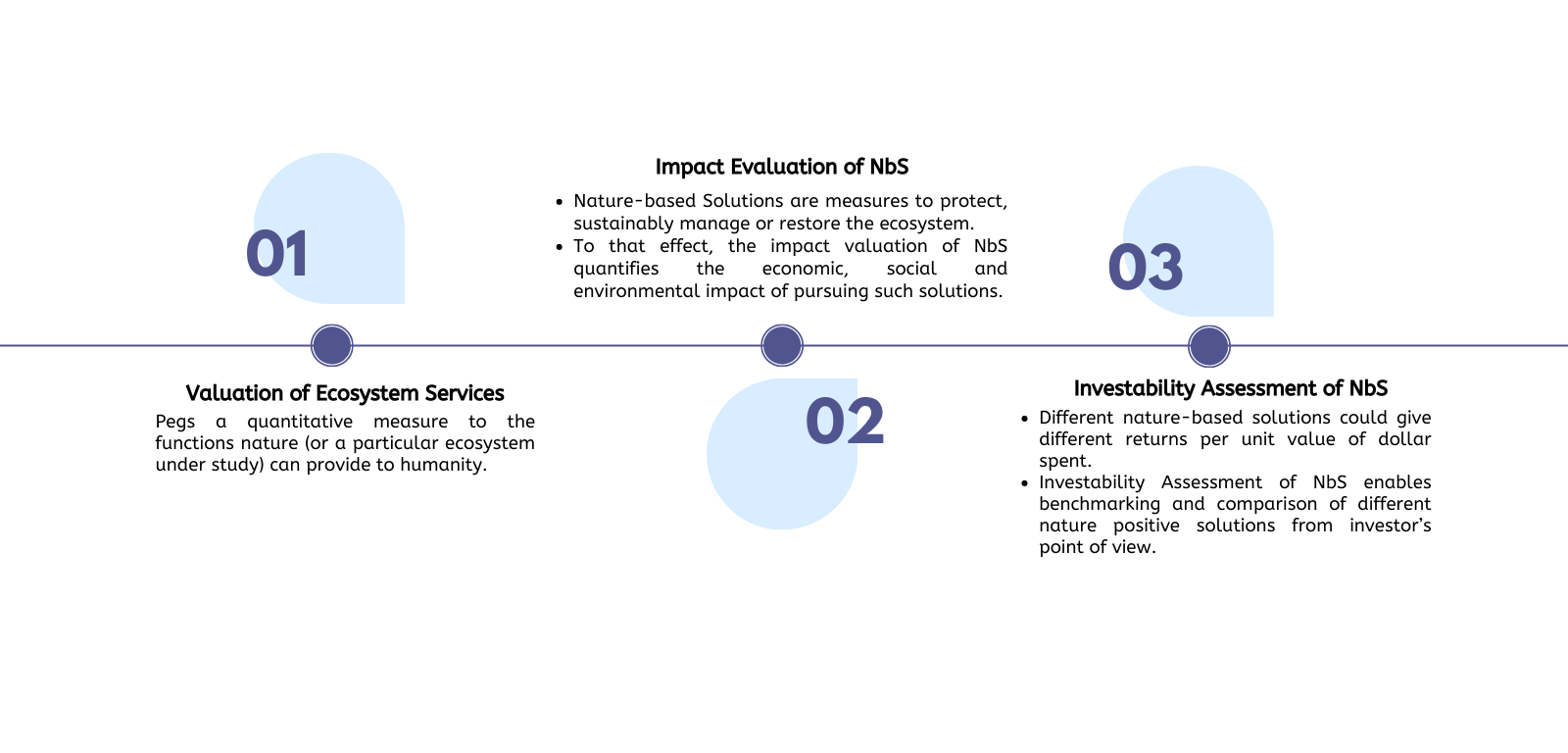

A review of the progress on the valuation of ES, impact evaluation, and investability assessment of NbS reveals gaps and opportunities for building upon these for the creation of an SDG-Aligned Global Monitoring, Evaluation and Learning Framework. Often used interchangeably, these three concepts are not the same (see Figure 1). A policymaker or an activist might prefer an NbS that yields high-value services to society. Still, unless the solution offers a high per unit return (economic, social, environmental, or financial) on money invested, the valuable social returns are out of reach and investment will not be forthcoming.

Figure 1: Explainer of valuation of Ecosystem Services, impact evaluation and Investability Assessment of Nature-based Solutions

Source: Authors’ own

Valuation of ES

While the idea of nature as a beneficial resource dates to Plato’s time, the evolution of ES as a definite concept emerged in the nineteenth and twentieth centuries. In 1864, George Perkins Marsh argued that natural resources are finite in his book Man and Nature. In 1977, Walter Westman’s paper titled “How Much Are Nature’s Services Worth?” attempted to increase public interest in biodiversity conservation by framing the ecosystem’s functions as nature’s services to humanity. It was, however, in Enrlich and Enrlich (1981) and Enrlich and Mooney (1983) that the term ES first came to be used.[7].

The valuation of ES took a giant leap in the Pew Scholars in Conservation and the Environment meeting in October 1995 in New Hampshire. Here, the ecological economist, Robert Costanza proposed assembling all information into a quantitative global assessment of the value of ES. By 1997, he had studied the existing literature on 17 ES across 16 biomes and concluded that the value of the entire ecosystem was in the range of US$16 trillion to US$54 trillion per year. The 1995 meeting also led to the publication of Nature’s Services: Societal Dependence on Natural Ecosystems in 1997, under the editorship of Gretchen Daily. This book culminated in 21 chapters covering specific ecosystems’ definitions, history, economic valuation, and case studies.[8]

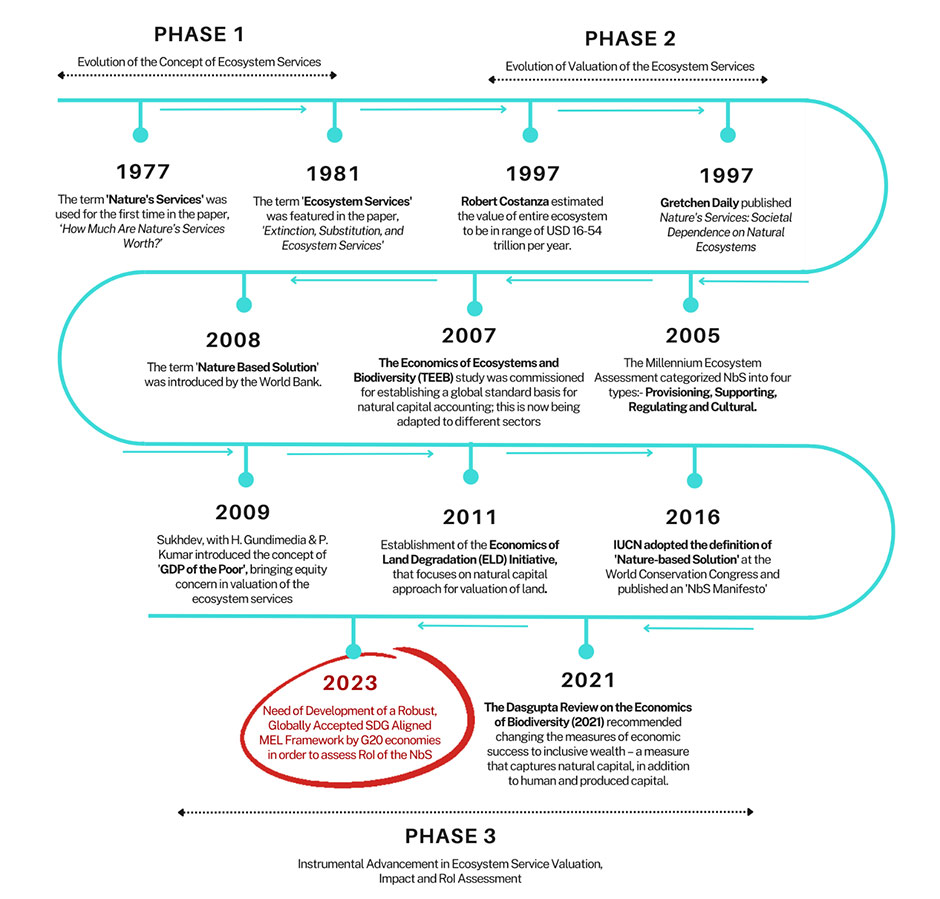

The concept of ES and their valuation has progressed exponentially since then (see Figure 2). In 2005, the Millennium Ecosystem Assessment categorised ES into four types: provisioning, supporting, regulating, and cultural. The Economics of Ecosystems and Biodiversity (TEEB) study, led by Pavan Sukhdev from 2007 to 2011, revised it by adopting a final services-based valuation. TEEB took into account that regulating services also included supporting services and replaced the former with ‘habitat services’ to avoid double counting during ecosystem audits.[9]

Sukhdev (2009) with H. Gundimedia and P. Kumar also introduced an equity concern in the valuation of ES. They argued that the impact of ecosystem degradation and biodiversity loss mostly affected the forest, water, and soil sectors, which the poor heavily depended upon. Thus, the “GDP of the Poor” must be used to account for the contribution of these services to their livelihoods and well-being.[10] Further developments in the refinement of the concept and/or approach towards the valuation of ES include the establishment of the Economics of Land Degradation (ELD) Initiative (2011) as well as the Dasgupta Review on the Economics of Biodiversity (2021) which urges changing economic success to inclusive wealth, a measure that captures natural capital as well as human and produced capital.[11]

An analysis of these existing frameworks provides evidence of the need to separate supporting services and/or ecosystem functions in the valuation exercise. Similar gaps exist in today’s frameworks, which include Systems of Environmental-Economic Accounting, the Natural Resource Governance Framework, and the Conceptual Framework for Biodiversity Assessment in the Global Value Chain. An ideal framework must capture qualitative and quantitative indicators to assess stock and flow concepts.

Figure 2: Timeline of important events in the evolution and valuation of nature-based solutions to assess the return on investments

Source: Authors’ own

Impact-evaluation of Nature-based Solutions

The valuation of ES has generated momentum to protect, sustainably manage, and/or restore such landscapes. NbS have witnessed increased traction on this account, increasing the need to evaluate their effectiveness. Such assessments of impact can lead to a better knowledge of the scope and nature of outcomes that the solutions may yield. If applied properly, this knowledge can make NbS cost-effective by design and efficient in implementation.

This understanding reflects in the priority objectives set by the Seventh General Union Environment Action Programme in 2013, one of which aimed to “improve the knowledge and evidence base for environmental policy.”[12] The development of the project, Establishing a European Knowledge and Learning Mechanism to Improve the Policy-Science-Society Interface on Biodiversity and Ecosystem Services (EKLIPSE),[13] between 2016 and 2020 was a direct consequence of this. The first study commissioned under EKLIPSE by the European Commission was on NbS in cities.

In 2016-17, the European Taskforce for NbS Impact Assessment built upon the knowledge base created by EKLIPSE.[14] To serve as a reference for relevant EU policies and activities, the task force laid out a list of indicators and methodologies for assessing the impact of the NbS across 12 societal challenge areas.

Limitations of impact assessment frameworks of nature-based solutions

Despite the availability of various impact assessment frameworks, the evidence-setting mechanism for NbS needs resetting. Most of these frameworks struggle with the following limitations:

- Limited scope of capital: A holistic evaluation of the impact of NbS requires the intervention to be studied with respect to all types of capital including natural capital, social capital, human capital, manufactured capital, and financial capital.[15] The assessment frameworks available today lack that approach and often have a scope limited to one or a few of these.

- Absence of quantifiable indicators: The existing frameworks define the process for assessing the impact of NbS without listing the indicators. In cases like that of the European Taskforce for NbS Impact Assessment, the indicators may be listed but not quantifiable.

- Limited contextualisation: The outcome of nature-based solutions heavily depends on local factors. Except for a few selected frameworks like TEEB, most currently available frameworks do not acknowledge the need for country/geography-specific assessment. This yields inaccurate impact results.

- Less emphasis on qualitative assessment: A grave error on account of the current impact assessment frameworks of NbS is the focus on quantifying all impact, which is neither possible due to data gaps nor the right method, considering that some impact areas (especially social) may be best captured qualitatively.

Lack of alignment with country-specific targets and non-differentiation between stock and flow concepts are two other limitations undermining the impact reportage of NbS.

Assessment of investability of nature-based solutions

Scaling up investment into nature-based solutions, especially from the private sector, necessitates establishing a good business case for the financial viability or investability of nature-positive projects. Unfortunately, while various frameworks exist at the national and global levels for the valuation of ES and impact evaluation of NbS, the progress on assessing the investability of NbS has been sporadic because of two reasons.

First, similar to impact, the ROI in NbS are geography specific. This requires careful assessment and documentation to establish a case for the range of ROI by type of geography.

Second, calculating the per unit dollar worth of investment differs by the type of impact. For instance, the methodology for calculating the RoI on account of carbon mitigation (as an impact of the intervention) may differ from that of the area of land restored (another impact of the same intervention).

Most frameworks do not account for these two variations which limits their acceptance for increasing investment in NbS.

2. The G20’s role

Past G20 presidencies have acknowledged the manyfold benefits of investment in nature. The Global Initiative on Reducing Land Degradation and Enhancing Conservation of Terrestrial Habitats, under the G20 Riyadh Leaders Declaration in 2020, had set bold targets for a 50 percent voluntary reduction of degraded land by 2040.[16] The role of blue carbon, NbS, and ecosystem-based adaptation as well as funding mechanisms for these initiatives have been discussed in the subsequent G20 presidencies.

Reducing global warming up to 2℃ above the pre-industrial average with efforts to limit it to 2℃, as a result, halting land degradation and biodiversity loss, necessitates the G20 economies to increase their internal annual NbS spending by 140 percent (an additional US$165 billion per annum) by the year 2025. Additionally, this investment needs to be directed strategically towards nature-based solutions that are cost-effective, high-yielding, and high-impact in terms of ROI. The lack of a universally accepted monitoring tool is a critical impediment to concerted action in this regard. The G20 economies must develop a robust globally accepted monitoring, evaluation and learning (MEL) framework whose role is outlined below:

- enables a comparative evaluation of the ROI in NbS across solutions and countries;

- furthers the alignment of investment with SDGs, CBD, national biodiversity targets (NBT), land degradation neutrality (LDN) target of India, and intended nationally determined contribution (INDCs); and

- enables the G20 governments to assess the impact of their domestic investment into NbS. This will establish a business case for not only the private investors but also the multilateral development banks and international financial institutions, to augment investment into such solutions.

3. Recommendations to the G20

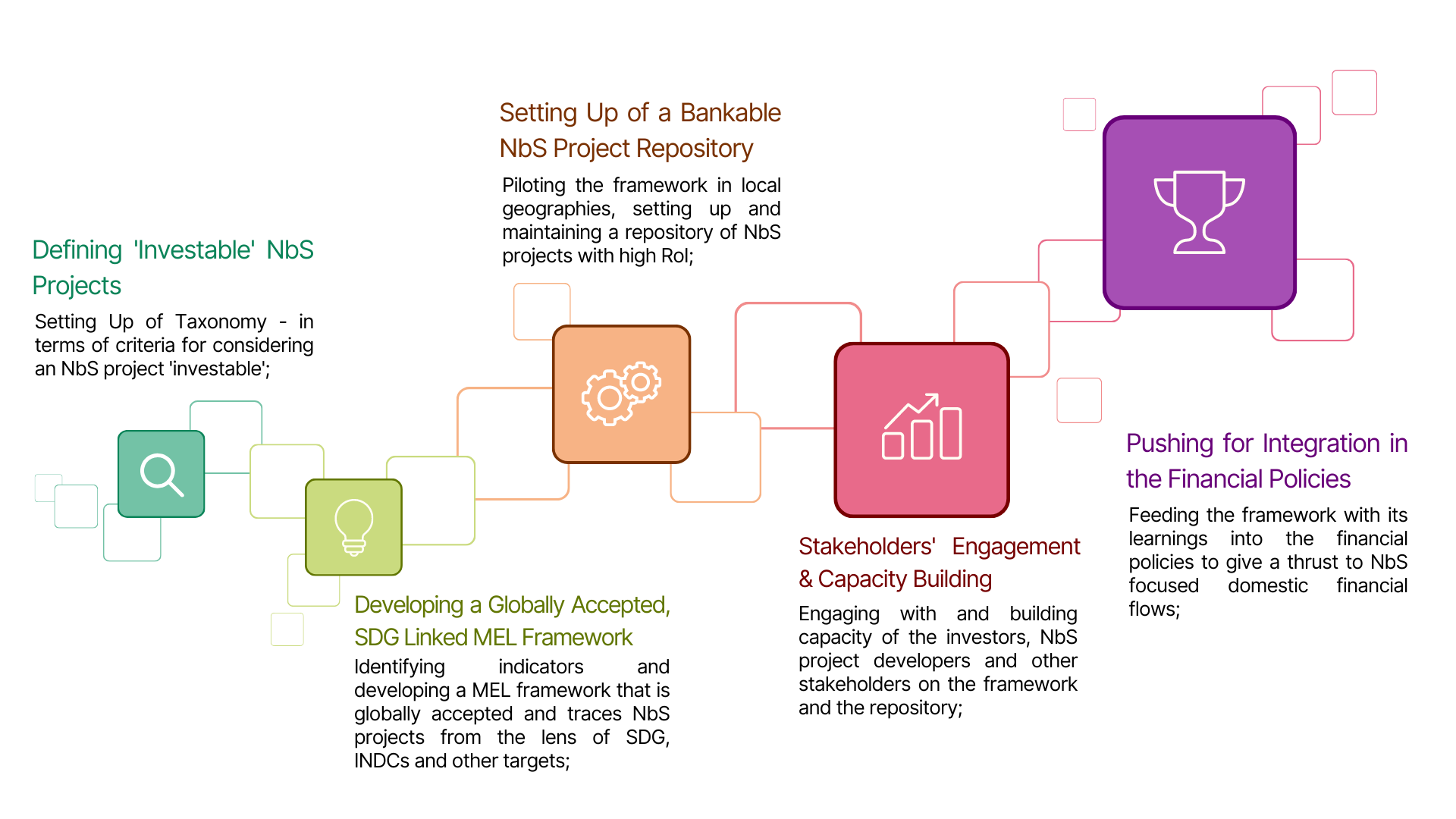

The G20 economies are uniquely placed to close the current gap in financing for nature-based solutions, and position themselves as anchors of climate, nature, and economic ambition on the global stage. Achieving this requires systemic processes that not only fill the current architectural gaps in financing but also empower the ecosystem towards building a self-sustaining mechanism for driving such investments. This policy brief then recommends the following (see Figure 3):

Figure 3: Recommendations to the G20

Source: Authors

-

Set up a taxonomy for assessing investability of NbS

Sustaining investment into NbS requires the creation of a well-defined criteria for what constitutes an ‘investable’ project. Such criteria must also be accepted and endorsed globally to lend credibility and increase adoption. Attempts have been made at institutional levels to define ‘investable’ or ‘bankable’ projects, but as of date, no universally accepted definition or criteria for such a definition exists. The Worldwide Fund defines bankable nature solutions as “solutions for environmental challenges that at the same time generate an acceptable (risk-adjusted) return on the money invested.”[17]

-

Develop a globally accepted, SDG aligned MEL framework for assessing investability of NbS practices

The G20 economies must collaborate to develop an MEL framework for assessing the investability of NbS practices. Similar to taxonomy, the success of such a framework will bank upon its acceptance among the G20 economies (and subsequently, at a global level). Considering that each economy has its own challenges and priorities in terms of targets, this MEL framework must be aligned with the SDGs, CBD, NBT, LDN target of India, and INDCs.

The efficiency of such an approach is evident from the evaluation of land remediation activities conducted by Development Alternatives in the Bundelkhand region of India between 2011 and 2018. The evaluation adopted the ELD approach to track the benefits through SDG, NDC, and NBT lenses and estimated a 75 to 120 fold ROI in nature.[18]

-

Develop of a databank or bankable NbS project repository

The variance in the ROI due to local topographical factors must be captured for an accurate accounting of the investability of NbS. Thereby, the G20 economies must undertake piloting of the framework for NbS projects within their territorial boundaries. This variance must especially be captured taking in to account the difference in topography between the Global North and the Global South. The development of a databank or an NbS project repository will preserve all such data and learnings.

At a country level, Development Alternatives maintains a repository of policies, practices, and perspectives embodying regenerative and circular practices and promoting sustainable livelihood at the platform – Mainstreaming Alternative Perspectives – South Asia or MAP-SA.[19] Though it is specific in scale and purpose, it serves as a good example of open information stimulating adaptation of initiatives. A similar platform for mapping and documenting NbS and their bankability should be pursued.

-

Engage with stakeholders for knowledge dissemination and capacity building

The framework and repository development process needs to be undertaken in close engagement with those who will use it i.e., the investors and non-investing stakeholders (such as NbS project developers). These efforts must be complemented with dedicated knowledge dissemination and capacity building to ensure optimal usage and feedback. A flexible approach that allows for retrospection after each stage of development and corrective measures is the best way to proceed with this.

-

Integrate financial policies

In the long run, the above-mentioned recommendations must feed into the financial policies at the level of G20 economies. The lags in the current frameworks for assessing ROI in the NbS and lack of contextualised (location-specific) evidence are two prime barriers that limit the scope of streamlined investment into domestic NbS within the G20 economies. Defining taxonomies, establishing a globally accepted, SDG-aligned MEL framework, development of a databank or bankable project repository, and knowledge dissemination among stakeholders will address these barriers and strengthen the ecosystem for their integration in the financial policies.

Building upon existing frameworks

Development of a globally accepted, SDG Aligned MEL Framework stands to learn from the flaws and errors of existing frameworks. With adaptation, these existing frameworks can form the basis for experimentation to arrive at a comprehensive assessment framework that accounts for all types of capitals, stocks and flows concepts, and quantitative and qualitative components. A potential adaptation is given below for reference.

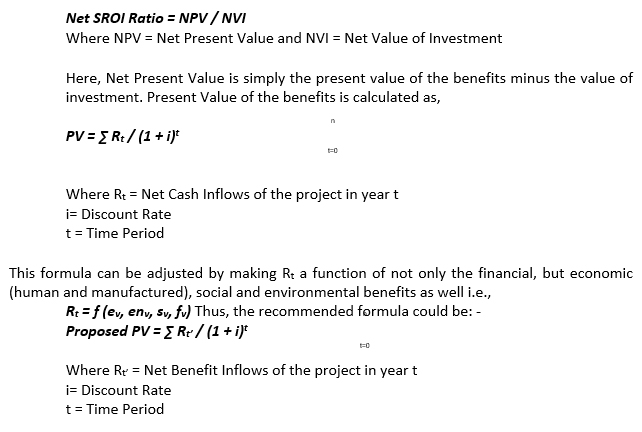

Adaptation from Social Return on Investment (SROI)[20]

Social return on investment (SROI) is a standard framework used by investors to measure returns per unit of investment into a specific project. It differs from the usual ROI approach in how it can be adjusted to account for the social, economic, and environmental values that are traditionally not reflected in financial statements. It could be calculated as follows:

A list of indicators to draw the net benefit values from must be carefully designed to account for both quantitative and qualitative data, as well as stock and flow concepts.

Attribution: Gitika Goswami et al., “Assessing Return of Investment in Nature Through an SDG-Aligned Global Monitoring, Evaluation, and Learning Framework,” T20 Policy Brief, July 2023.

[1] Hannah Ritchie, “The World Has Lost One-third of Its Forests, but an End to Deforestation Is Possible,” World Economic Forum, February 25, 2021.

[2] “Action Against Desertification,” Food and Agriculture Organization, accessed April 1, 2023.

[3] “Seven Years of Agricultural Productivity Growth Lost Due to Climate Change,” Stanford Woods Institute for the Environment, April 1, 2021.

[4] “Nature-based Solutions,” IUCN, accessed April 03, 2023.

[5] Jonathan Cook and Rod Taylor, “Nature Is An Economic Winner for COVID-19 Recovery,” World Resources Institute, July 6, 2020.

[6] The United Nations Environment Programme, The State of Finance for Nature in the G20 Report (The United Nations Environment Programme, 2022).

[7] Robert Costanza et al., “Twenty years of ecosysttem services: How far have we come and how far do we still need to go?,” Ecosystem Services 28, Part 1, (December 2017): 1-16.

[8] Gretchen C. Daily, Nature’s Services: Societal Dependence on Natural Ecosystems (Washington, DC: Island Press, 1997)

[9] José Ángel Zabala et al., “A Valuation-Based Approach for Irrigated Agroecosystem Services,” Paper prepared for presentation at the 172nd EAAE Seminar ‘Agricultural policy for the environment or environmental policy for agriculture?’, May 28, 2019.

[10] Nilanjan Ghosh, “Promoting a “GDP of the Poor”: The Imperative of Integrating Ecosystems Valuation in Development Policy,” ORF Occasional Paper No. 239, March 2020,

[11] Patha Dasgupta, The Economics of Biodiversity: The Dasgupta Review (London: HM Treasury, 2021).

[12] “Decision No. 1386/2013/EU of the European Parliament and of the Council on a General Union Environment Action Programme to 2020 ‘Living well, within the limits of our planet,” FAOLEX Database, assessed July 24, 2023.

[13] “History,” Eklipse, accessed March 27, 2023.

[14] European Commission, Evaluating the Impact of Nature-Based Solutions: a handbook for practitioners (Luxembourg: European Union, 2021).

[15] Maria H. Maack, and Brynhildur Davidsdottir, “Five Capital Impact Assessment: Appraisal Framework Based on the Theory of Sustainable Well-being,” Renewable and Sustainable Energy Reviews 50:1338-1351 (April 2015).

[16] “G20 Announces New Initiative to save Degrading Land,” United Nations Convention to Combat Desertification (UNCCD), last modified November 23, 2020.

[17] “Bankable Nature Solutions,” World Wide Fund For Nature, assessed on March 26, 2023.

[18] Development Alternatives et al., Land Remediation for Achieving Global and National Targets: Case Study of Bundelkhand (India) through Capitals Approach (Development Alternatives, 2020).

[19] Mainstreaming Alternative Perspectives – South Asia.

[20] Cabinet Office, A Guide to Social Return on Investment (CabinetOffice, Office of the Third Sector, 2023).