TF-5: Purpose & Performance: Reassessing the Global Financial Order

Financial challenges inhibit the growth, diversification, and sustainability of MSME sectors and are especially acute for informal MSMEs. Informality, information asymmetry, and lack of collateral restrict the financial choices of MSME firms. The solutions to such challenges include leveraging newly developed fintech platforms, cooperative models to address the informality issue, and digital tools to mitigate the adverse impact of information asymmetry. This Policy Brief presents a robust fintech model that would provide redressal for the financial difficulties faced by MSME units. The G20 should act proactively to deal with such difficulties faced by firms in G20 as well as non-G20 countries.

1. The Challenge

MSMEs have emerged as catalysts of economic growth and employment creation, especially in emerging economies and developing countries. MSMEs account for approximately 90 percent of total businesses and provide more than 50 percent of global employment.[1] Despite the major contribution of MSMEs to economic growth and employment generation in the developing and least developed countries, access to financing remains a daunting challenge for the sector. In addition, MSMEs have been disproportionately impacted by multiple crises, including the COVID-19 pandemic, erratic weather patterns, and energy and food crises, all of which have resulted in financial insecurity, increased living costs, liquidity constraints, job losses, and business closures. The situation is critical for many MSMEs, particularly informal MSMEs and those led by women and young people.[2]

Approximately 400 million MSMEs in emerging economies lack adequate financing instruments. It is estimated that the total credit gap for MSMEs is in the range of US$5.2 trillion.[3] The situation is worse for informal MSMEs. High-interest rates, low financing by non-banking financial institutions (NBFI) and private investors, information asymmetry, and informality are other important barriers for MSMEs in accessing credit. Banks and other financial institutions do not have accurate information about MSMEs, which makes it difficult to provide credit to such firms. This is further exacerbated by the lack of digitised public information and the digital footprint of MSME transactions, as well as data scarcity and poor data quality. The majority of MSMEs are less productive and profitable compared to large firms, which is commonly attributed to MSME-specific barriers in scaling up and accessing strategic assets. MSMEs have also faced numerous challenges in recent years, and the COVID-19 pandemic has severely impacted the financial capabilities of firms in the sector.

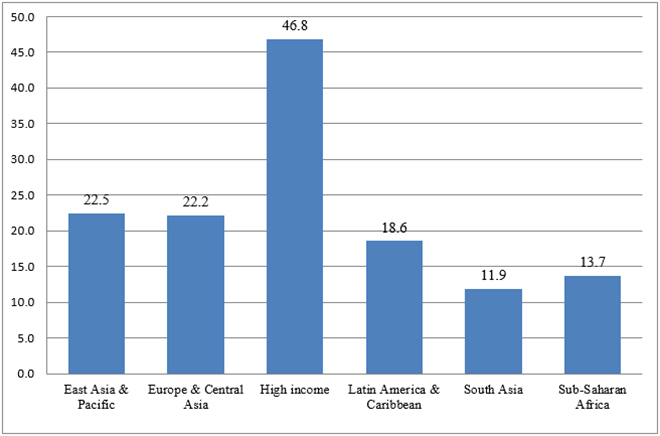

Despite significant efforts in financial inclusion, approximately 400 million MSMEs in emerging economies have insufficient adequate financing instruments.[4] As a result, many individuals and small enterprises lack a secure and dependable method of saving, investing, making payments, and insuring against risk. MSME loans from formal financial institutions are quite low, especially in South Asia and Sub-Saharan Africa[5] (Figure 1).

Figure 1: Percentage of MSMEs Borrowing from Formal Financial Institutions

Source: OECD (2021)

The G20 can address some of these issues to ensure the availability and accuracy of information collected. As a result of their critical contributions, the role of MSMEs has long been a major topic of discussion in many global forums, including the G20. The G20 discusses and supports MSMEs through the Finance and Sherpa Tracks, as well as G20 Engagement Groups.[6] The Indian G20 presidency examines reducing and eliminating barriers for MSMEs, improving their business environment, and enhancing access to financial markets and technology. India’s G20 presidency should also continue to support and empower MSMEs in order to realise their full potential by encouraging innovation, creativity, and decent work for all. Moreover, MSMEs are essential for achieving the Sustainable Development Goals (SDGs). The Future of Work agenda will be bleak unless MSMEs are supported through proper policies and initiatives to realise their full potential.

To provide some relief to the sector, governments around the world have undertaken various initiatives, such as direct financial assistance, public guarantees on loans, and tax relief. This Policy Brief identifies three major challenges for MSME financing, i.e., traditional banking, information asymmetry, and informality.

Traditional banking

According to the World Bank, 40 percent of MSMEs across 128 nations face credit constraints, and only 15 percent of investments in MSMEs are financed by banks.[7] There is a potential demand for MSME loans; however, the supply of loans is a major constraint. It is estimated that, out of the US$8.9 trillion potential demand for MSME financing, only US$3.7 trillion is currently being supplied.[8] In other words, a US$5.2 trillion finance gap still exists in the MSME sector. Fintechs have emerged as an important instrument for financing and could offer customised and value-added financial services to MSME units.

Information asymmetry

Banks and other financial institutions do not have accurate information about MSMEs, which makes it difficult for them to process the loan applications of MSME units. The G20 could work with other countries to digitise MSMEs and expand bank branches at the sub-district level, outside metropolitan cities, in order to improve MSMEs’ access to credit and growth opportunities.

Informality

Around 80 percent of total MSMEs are informal, and access to finance is consistently cited as the most significant constraint.[9] Lack of accurate information about informal MSMEs is a major impediment for MSMEs to avail credit from the formal financial sector. The G20 could work out a cooperative business model that could be replicated across countries in the context of formalising MSMEs.

2. The G20’ Role

MSMEs have been a major topic of discussion at various G20 summits since the Mexico presidency in 2012, when it was recognised that MSMEs are essential to economic growth and the eradication of poverty.[10] The G20 countries have been committed to improving MSMEs’ access to capital, financial and investment capacity, and digital literacy by enabling reduced reliance on traditional lending channels and diversifying their access to finance mechanisms.[11] The G20/OECD High-Level Principles on MSMEs Financing, launched in 2015 during the Turkish presidency, aimed at strengthening MSMEs’ access to traditional bank financing, promoting non-bank finance, and increasing the G20 investment-to-GDP ratio by 1 percent in MSMEs.[12] These principles provided broad guidelines for developing cross-cutting policy strategies and evaluating MSMEs’ financing initiatives at the local, national, and international levels. There have been several significant developments in the MSME finance landscape since the launch of the principles. The updated version of the G20/OECD High-Level Principles on MSMEs Financing was submitted to the Indonesia presidency with the inclusion of three new principles—fintech institutions, sustainable finance for MSMEs, and strengthening the resilience of MSME finance.[13] The new principles could also examine the issues of information asymmetry, informality, and comprehensive data collection in MSMEs.

3. Recommendations to G20

a. Promoting fintech solutions

Digital financial services have a huge potential to increase MSMEs’ access to finance by potentially reducing financial fragility while also stimulating job creation, investment, innovation, and inclusive economic growth around the world. Fintech platforms have emerged as catalysts worldwide, achieving tremendous success in the last five years and evolving during and after the pandemic, thus providing MSMEs with hope for the rapid growth and resolution of their problems.[14] Demand for MSME loans increased nearly 1.6 times in 2022 compared to pre-pandemic levels.[15] Fintech platforms offer customised products and financing solutions for MSME firms in the form of small denominations and short-term loans. Such loan products have proven to be beneficial to the MSME sector in meeting working capital requirements. Fintech solutions are customer-friendly, requiring less documentation, quick turnaround time, and faster processing. In addition, fintech offers customers value-added services such as daily repayment options and flexible equated monthly instalments, which are typically not associated with formal banking sector loans. Aside from credit, some fintech firms offer digital financial services and marketplaces to small businesses, allowing them to connect with multiple digital solution providers across digital payments, delivery, and discovery platforms.

Besides lending, fintech firms offer several alternative financing tools, such as equity finance, peer-to-peer lending, and wealth management, with widespread application in the edu-tech, agri-tech, and health-tech sectors. Given the growing reliance on fintech-based transactions, there is a need for seamless integration between enterprise-financing demands and service providers. Commercial banks are responding to this fintech surge by introducing fintech platforms to their existing business lines. Overall, fintech would reduce transaction costs significantly for retail and MSME borrowers and help ensure the steady and timely flow of credit to the productive sectors of the economy. The G20 should develop a mechanism for promoting the adoption of fintech solutions in member countries as well as in other developing countries and Least Developed Countries (LDCs). Table 1 presents the features of traditional financial service providers and fintech platforms.

Table 1: A Comparison of Traditional and Fintech Platforms

| Traditional Banks and Financial Institutions | Fintech Platform |

| v Little track record

v Collateral requirements v Time-consuming v High costs v Lack of customised options |

v Faster processing

v High-risk borrowers v Less time v High interest rate v Customised lending options |

Source: Authors’ own

b. Addressing information asymmetry

Lack of accurate information about informal MSMEs makes access to credit uncertain and default risks high. This is exacerbated by the lack of digitised public information and the digital footprint of MSME transactions, as well as data scarcity and poor data quality. The G20 could address these challenges by issuing guidance and developing a framework on how to source and process data by using unique identifiers such as passports, social security numbers, and tax identification numbers. The G20 countries could work with each other to digitise their records while also promoting the development and availability of open data systems and standards for MSMEs. In addition to improving overall digital infrastructure in banks, opening more branches in rural areas and at the district level could bridge the information gap, as a greater number of borrowers could be efficiently served by nearby rural branches than a few branches located in cities and urban areas.

c. Leveraging on the cooperative model

MSME ecosystems in developing countries, including LDCs and Small Island Developing States (SIDS), are characterised by informality and lack of incentives to formalise, making them more vulnerable to economic shocks and global supply-chain disruptions. This challenge is exacerbated by a general lack of comprehensive data on MSMEs in developing countries, making it more difficult for governments and financial institutions to provide targeted support and services tailored to their needs.[16] By adopting the cooperative enterprise model in line with the ILO instruments of the Promotion of Cooperative Recommendation, 2002 (No-193), MSMEs could help mitigate financing challenges to a greater extent. Experience from Uganda and Kenya illustrates the strength of the cooperative model in organising MSME units in a particular sector, with significant developmental outcomes, such as in employment generation.[17] For instance, the Uganda Shoeshiners Industrial Cooperative Society, which was begun informally by homeless street children in 1975, was organised into a cooperative with a legal status which enabled them to scale up and diversify in order to manufacture shoe brushes and related products.[18] As of 2007, the cooperative had more than 600 members, with branches in cities across Uganda. This was made possible because of loans extended by the Cooperative Savings and Credit Union of Uganda to the cooperative; it would otherwise have been difficult for individual members to access credit from the market. Likewise, motorcycle and taxi operators in Nanyuki town, Laikipia County, Kenya, formed an informal cooperative society in 2011, which enabled them to borrow money and buy spare parts for their requirements. These examples demonstrate the effectiveness of the cooperative model in enhancing access to finance and securing the viability of their businesses in a predictable manner. While other G20 efforts to strengthen MSME financing need to persist, the cooperative model could be adopted as a potent supplementary financing instrument towards supporting the growth and diversification of the MSME sector, with an aim to generate and promote job generation in developing countries and LDCs.

d. Innovative financing options

Innovative financing options, both public and private, would be highly effective sources of MSME funding. De-risking is an interesting risk mitigation strategy. Similarly, impact investors could bring about a sea change in MSME funding patterns. The mechanisms could be tailored to the diverse sectors and sizes of MSMEs, which will help increase financial inclusion and de-risk lending, particularly when combined with technical assistance. Guarantee schemes, impact investing microfinance, sustainability-related financial instruments, alternative risk models, and other promising blended finance initiatives indicate that public or donor funding can unlock much larger amounts of private finance to alleviate the financial constraints faced by MSMEs.

4. Conclusion

Financial institutions prefer to lend to enterprises that have better documentation and a proven track record; in other words, financial institutions prefer to lend to low-risk businesses. This leads to a mismatch between the supply and demand for MSMEs loans. The G20 should investigate these concerns and consider launching a cooperative model initiative as well as developing a data-collection mechanism for MSMEs. The G20 should develop frameworks for countries to bridge the financing gap and increase connectivity between suppliers and last-mile delivery through its Digital Economy and Development Working Groups, in collaboration with the W20, B20, C20, and other engagement groups. In this regard, the G20 should encourage national policies and strategies that promote the access and utilisation of alternative digital financing opportunities.

Attribution: Priyadarshi Dash and Rahul Ranjan, “Addressing MSMEs’ Financing Challenges Through G20 Action,” T20 Policy Brief, July 2023.

Endnotes

[1] United Nations Conference on Trade and Development, Trade and Development Report 2020 (New York: United Nations Publications, 2020).

[2] Mohsin Shafi, Junrong Liu, and Wenju Ren, “Impact of COVID-19 Pandemic on Micro, Small, and Medium-Sized Enterprises Operating in Pakistan,” Research in Globalization 2 (2020).

[3] World Bank, “Small and Medium Enterprises (SMEs) Finance: Improving SMEs’ Access to Finance and Finding Innovative Solutions to Unlock Sources of Capital,” last modified 2022.

[4] IFC, World Bank, SME Finance Forum, MSME Finance Gap: Assessment of the Shortfalls and Opportunities in Financing MSME in Emerging Markets (Washington, DC: International Finance Cooperation, 2017).

[5] Daniel F. Runde, Conor M. Savoy, and Janina Staguhn, “Supporting Small and Medium Enterprises in Sub-Saharan Africa through Blended Finance,” Center for Strategic & International Studies, 2021.

[6] G20, “G20 Turkey Presidency Leader Declaration,” 2015.; Governo Italiano, “G20 Rome Leaders’ Declaration,” 2021,

[7] World Bank, “Small and Medium Enterprises (SMEs)”

[8] IFC et al., MSME Finance Gap

[9] Asian Development Bank, Asia Small and Medium-Sized Enterprise Monitor 2022: Volume-I-Country and Regional Reviews (Manila: Asian Development Bank, 2022).

[10] G20, “G20 Mexico Presidency Leader Declaration,” 2012.

[11] G20, “G20 Bali Leaders’ Declaration,” 2022.

[12] OECD, “G20/OECD High-Level Principles on SME Financing,” 2015.

[13] OECD, “2022 Updated G20/OECD High-Level Principles on SME Financing,” 2022.

[14] Naoko Nemoto and Naoyuki Yoshino, eds., Fintech for Asian SMEs (Tokyo: Asian Development Bank Institute, 2019).

[15] Ananya Upadhyaya, “MSME Credit Demand Up 1.6x From Pre-Pandemic Levels,” Financial Express, August 17, 2022.

[16] World Bank, “Micro, Small, and Medium Enterprise (MSME) Finance,” 2013.

[17] UN-DESA, Promoting Micro-, Small- and Medium-Sized Enterprise Formalisation through the Cooperative Enterprise Model (United Nations Department of Economic and Social Affairs, 2021).

[18] UN-DESA, Promoting Micro-, Small- and Medium-Sized Enterprise Formalisation.