Task force 4– Refuelling Growth: Clean Energy and Green Transitions

Abstract

Clean energy technologies play a critical part in meeting global net-zero emission targets. Large economies in Asia, Europe, and North America are intensifying efforts to accelerate the deployment of clean energy technologies and maintain their manufacturing capacity. However, securing a sustainable and resilient supply of critical minerals poses several challenges, including the lack of mineral governance to manage the environmental, social, and economic impacts, and the absence of an ecosystem to support the emerging market and developing economies (EMDEs) to maximise the benefits from resource extraction.

This policy brief proposes that the G20 should strengthen the soundness and resilience of global critical minerals supply, support the establishment of downstream capacities in EMDEs, and foster regional value chain networks.

1. The Challenge

Risks of geographically concentrated critical minerals’ supply

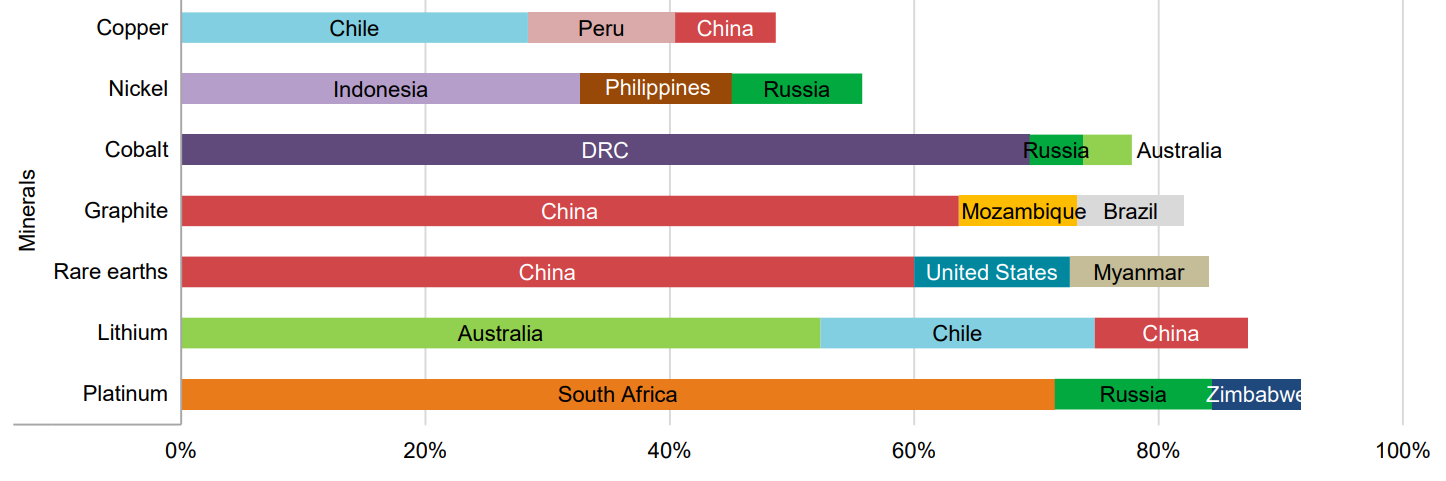

Given that there is no shortage of critical minerals worldwide, it is unlikely that there would be any constraint on their supply in the long term. Yet, the extraction, processing, and refining of these minerals is currently highly concentrated in a small number of countries. For lithium, cobalt, and rare earth elements (REE), the top three producing nations control over three-quarters of global output. South Africa and the Democratic Republic of the Congo are responsible for 70 percent of the global production of platinum and cobalt, respectively. China accounted for 60 percent of global REE production in 2019. The picture for copper and nickel is slightly more diverse, but still around half of the global supply is concentrated in the top three producing countries (see Figure 1). The level of concentration is even higher for processing and refining operations, in which China has gained a strong presence.[1]

Figure 1. Share of top producing countries in the extraction of selected minerals

Source: IEA[2]

Given the long lead times from discovery to production in mining projects, the rise in demand for critical minerals has precipitated a rise in resource nationalism. The risk index of resource nationalism increased significantly in 34 countries, covering most resource-rich countries in Africa, Latin America, and Asia.[3] This increase in resource nationalism will likely cause tensions between states that will want to maximise the value of their natural resources on one hand, and producers who will want to maximise production on the other. Change of royalty regimes, cancellation of retention licenses, or restrictions on export will discourage investors, adding further pressure on an already strained supply.

Lack of capacity in EMDEs to develop downstream sectors

The net-zero transformation has generated huge industrial, economic, and geopolitical shifts across the globe. Major G20 members (such as the US, the European Union (EU), the UK, Canada, China, and India) have stepped up their efforts, rolling out supportive measures to increase investment in clean energy infrastructure and domestic production capacities. Industrial policies, including tariffs, subsidies, preferential loans, tax breaks, and local content requirements, are increasingly being used in green industrial plans to build economic advantages from the clean energy transition.

Compared to major players in the midstream, however, most of the resource-rich EMDEs face significant challenges to generating sustainable social and economic benefits from mineral resource development (see Figure 2). Limited incentive policies and regulatory frameworks, a lack of adjacent industries, constrained infrastructure, and inadequate technical capabilities present difficulties for EMDEs to design and implement industrial strategies that could boost the domestic market for clean energy technologies and create value-added downstream industries for critical minerals. International support and cooperation are needed to improve the enabling ecosystem in EMDEs and ensure a fair and sustainable energy transition.

Figure 2. The supply chain of selected clean energy technologies

Source: IEA[4]

Lack of investment in EMDEs in support of energy transition

In the future, EMDEs will make up the largest sources of global energy demand growth. It is expected that the EMDEs will provide 40 percent of the needed emissions reductions. To accomplish this, transition funding in these nations would need to reach US$600 billion per year by 2030. However, currently, clean energy investment into EDMEs only reaches US$150 billion per year, accounting for 20 percent of the global total.[5]

Meanwhile, investment in critical minerals mining and development is far below what is needed to accelerate the clean energy transition. The IEA[6] estimates that the total global anticipated investment in critical minerals mining until 2030 will be between US$180 billion and US$220 billion against a required investment of US$360 billion andUS$450 billion to achieve the net-zero target. The mineral-rich countries in the developing world hold most of the untapped potential. In general, the cost of capital is higher in EMDEs than in advanced economies due to heightened macroeconomic risks, underdeveloped financial systems, and less fiscal space to support economic recovery and transition. The lack of derisking policies and financing channels imposes difficulties for increasing investment in capital-intensive net-zero technologies and clean energy infrastructures. The lack of effective energy infrastructure hampers investment in mining and refining activities in resource-rich EMDEs, for example in Guinea, the Democratic Republic of Congo, Madagascar, and Mozambique.[7]

2. The G20’s Role

Several G20 members, including the US, the EU, Japan, Canada, and Australia, have adopted and updated critical mineral strategies. Several partnerships have been formed among some G20 members to address challenges to critical minerals.

- The US State Department launched the Energy Resource Governance Initiative (ERGI) in 2019 to promote improved mining-sector governance and resilient supply chains for critical minerals through sharing and reinforcing best practices, from the mapping of mineral resources to the closure and reclamation of mines. The founding partners-Australia, Botswana, Canada, Peru, and the US- released the ERGI Toolkit to share and reinforce best practices.

- The Geoscience Australia, the Geological Survey of Canada, and the US Geological Survey launched the Critical Minerals Mapping Initiative in 2019 to promote critical mineral discovery and improve knowledge sharing in these three countries.

- The European Raw Materials Alliance (ERMA) was announced in 2020 as a key part of an action plan on critical raw materials. The ERMA is tasked with securing access to critical raw materials, advanced materials, and processing knowledge for EU industrial ecosystems by diversifying supply, enhancing resource efficiency and circularity, and encouraging responsible sourcing worldwide.

- Australia, Canada, Finland, France, Germany, Japan, South Korea, Sweden, the United Kingdom, the United States, and the European Union announced the Minerals Security Partnership (MSP) in 2022 to catalyse investment in mining, processing, and recycling of critical minerals. MSP partners also announced support for a shared commitment to high environmental, social, and governance (ESG) standards.

These platforms facilitated collaboration in the G20 to ensure the security of critical mineral supply. They also offered opportunities for engaging EMDEs in developing socially responsible projects along the value chain from mining to processing and recycling.

However, there is a lack of coordination in the G20 to tackle the above-mentioned challenges. Many of these initiatives are limited to like-minded partners. More inclusive cooperation with major players from the developing world, such as Argentina, Brazil, China, India, Indonesia, Mexico, Saudi Arabia, South Africa, and Türkiye, is needed for the G20 to play a leading role in the development of a sustainable, responsible, and affordable global supply chain of critical minerals.

Future G20 summits should consider aligning national and multilateral strategies to address critical mineral concerns. A joint platform in the G20 will become essential to prioritise principles of fairness and equity and use the Sustainable Development Goals as an overarching framework to ensure economic, social, and environmental concerns are addressed coherently.[8] Additionally, the G20 could promote public–private partnerships, encourage knowledge-sharing among members, and develop better investment and trade agreements with resource-rich countries. The G20 also needs to make a concerted effort to minimise negative trade-offs that may arise as a result of attempts to address critical minerals supply chain vulnerabilities and account for consequences for non-member countries. These actions are crucial for achieving the long-term climate mitigation goals and just transition.

In addition, the G20 can support the development of clean energy supply chains, including the deployment of new technologies and the creation of integrated regional networks. The G20 has already taken important steps in this direction, with a focus on energy and climate change issues. For example, the G20 has committed to phasing out inefficient fossil fuel subsidies, promoting energy efficiency, and supporting the deployment of renewable energy technologies.

3. Recommendations to the G20

Strengthening the soundness and resilience of global critical mineral supply

The G20 can lead the development of the global minerals supply chain with better governance and higher resilience through enhanced cooperation between the G20 member countries and extended support to EMDEs.

- Fostering cooperation and knowledge sharing among the G20 members and with major mineral producers

Proven reserves for most critical minerals are more geographically widespread than current production. This suggests considerable opportunities for increasing investment and exploration activities among the G20 member countries. Improving information sharing and R&D coordination in the G20 to advance the development of substitute materials and improve the practice of reuse and recycling is also important to address critical mineral supply chain challenges.

The G20 can foster cooperation among members and extend knowledge sharing with non-G20 major mineral-producing countries. Productive actions may include creating databases on the geological occurrence and distribution of critical minerals to support information collection and study of commodity-specific mitigation strategies. It is also important to conduct assessments to help with mineral exploration and development of conventional sources (minerals obtained directly through mining an ore), secondary sources (recycled materials, post-industrial, and post-consumer materials), and unconventional sources (minerals obtained from sources such as mine tailings, coal byproducts, extraction from seawater, and geothermal brines).[9]

- Promoting a globally-recognised minerals governance framework

Decisions within the mining industry are based on a number of factors and are largely shaped by complicated government frameworks and bodies operating within globalised mineral value chains. There is an urgent need to coordinate and reform this governance landscape to address enduring challenges such as commodity price volatility, lack of linkages between mining and other economic sectors, inadequate management of environmental impact, and sociopolitical and geopolitical risks of mining.[10]

International organisations have created some platforms to promote sustainable and responsible extraction, such as the World Bank’s Climate Smart Mining Initiative, Global Battery Alliance, International Council on Mining & Metals (ICMM), and the Inter-governmental Forum on Mining, Minerals, Metals and Sustainable Development. However, an overarching international governance framework for critical minerals and a coordinated policy action between major critical minerals producers and consumers are still lacking.

At the international level, the G20 can support the creation of an International Minerals Agency, or the signing of an international agreement, to coordinate and share data on economic geology and mineral demand needs and promote transparency on impacts and benefits. The existing international platforms could serve as fora for negotiating an international consensus regarding the specific policy options and programs for the implementation of the new global governance framework for the extraction sector.

- Supporting the adoption of better ESG practices in EMDEs and major industrial players

Regulatory safeguards need to be strengthened across sectors in the EMDEs. The performance of corporate responsibility policies and ESG practices varies significantly among industry actors and challenges are more substantial in resource-rich developing countries. Governments play a critical role in adopting better policies and moving beyond ESG reporting toward public disclosure, transparent supply chain tracking, and international certification of critical minerals.

The G20 could provide both financial and technical support to decision-makers within EMDE governments to strengthen their institutional and regulatory capacity. Standardisation of guidelines issued by a cluster of ESG-focused organisations such as the Responsible Minerals Initiative and the ICMM is also needed to boost the sector’s environmental and social acceptability. In addition, promoting the use of digital tools can help the mining industry in tackling the challenge of tracking, monitoring, and managing ESG performance.

- Promoting the use of life cycle analysis in the policy design and implementation of EMDEs

Life cycle analysis (LCA) is a comprehensive form of analysis that utilises the principles of life cycle assessment, life cycle cost analysis, and various other methods to evaluate the environmental, economic, and social attributes of energy systems. These range from the extraction of raw materials from the ground to the use of the energy carriers and disposal of components and materials. As the clean energy transition progresses, more comprehensive and accurate information is needed in policy, planning, and investment decisions. In the EU and the US, the LCA has been applied as a tool and framework for evaluating energy technology pathways and policy options. However, limited interest from industries and governments and a lack of data and capacity have restricted the use of LCA in EMDEs to support its sustainable development.

Mining and processing activities are an integral part of most complex material cycles so the application of LCA to minerals and metals has gained prominence[11]. In critical mineral mining, especially, LCA should be considered a key part of ESG standards and procedures implemented at the global level.

The G20 could promote the use of LCA to eliminate any discordance between the benefits of renewable technologies and the impacts associated with critical minerals, especially in EMDEs. The G20 can support the establishment of centers of excellence on LCA to facilitate best practice sharing and capacity building for government officials, research scholars, and industrial players. Encouraging EMDEs governments to adopt and implement LCA methodologies and procedures in policy assessment for energy and mining industries is important. However, making it a mandatory requirement might be costly and inappropriate for EMDEs at this stage.

Building robust downstream manufacturing capabilities and fostering a regional value chain network

The G20 can mobilise resources to support EMDEs in improving the ecosystem for downstream industries and facilitating the establishment of a regional value chain network for clean energy technologies.

- Improving the ecosystem in EMDEs for downstream industries

Mineral-rich developing economies have a strong desire to nurture downstream industries and capture better economic and social benefits from the clean energy transition. For example, the Minister of Energy and Mineral Resources of Indonesia has shared the vision of the country to provide not only raw materials of nickel but also to cooperate with other parties to develop large-scale downstream industries to create competitive outputs.[12]

Many African economies have vast critical mineral reserves and clean energy resources. The Democratic Republic of Congo is home to 70 percent of the world’s cobalt reserves. South Africa holds 60 percent of the global manganese supply, and 75 percent of the platinum supply. Zimbabwe holds the largest lithium deposits in Africa, and Mozambique is an important producer of graphite. However, to develop downstream capacity, support from the international community is pivotal to improving infrastructure, investment climate, and governance in these states.[13]

Latin America is an important producer of several minerals required for clean energy technologies. It accounts for 40 percent of the global production of copper, led by Chile, Peru, and Mexico. It also supplies 35 percent of global lithium, led by Chile and Argentina. The abundant availability of clean energy resources, such as hydropower, solar, and wind gives the region a competitive advantage for developing local processing capabilities and production of clean energy technology components.[14]

However, realising such components would require significant capital investment, appropriate policy incentives, and a specialised workforce.

The G20 could help improve the industrial ecosystem in these countries through concerted financial and technical support. Knowledge-sharing and technical assistance programs delivered by multilateral development agencies and international organisations could be expanded to include programs for building industrial manufacturing capacity in EMDEs. Specialised funding can be convened for education and training programs, as well as creating apprenticeships and other workforce development initiatives. The provision of blended capital from international and development finance institutions is critical to attracting private investment at early stages of readiness.

- Promoting regional integrated value chains of critical minerals and clean energy technologies

The regionalisation of the supply chains has offered opportunities for new economic growth in the era of clean energy transition. The EU has the most integrated institutions, infrastructure, technologies, corporate governance systems, currency, and harmonised rules and regulations. This deep integration has allowed companies to exploit economies of scale and universities to share information and collaborate. Similarly, under the Regional Comprehensive Economic Partnership, 15 nations, including China, Japan, and all of ASEAN, take on tariffs and make local content rules easier to navigate.[15] The US-Mexico-Canada Agreement is advancing an integrated North American supply chain.

In comparison with these three blocs, South America, Africa, and West Asia have room to grow. Coordinated energy market designs and regulatory frameworks can scale up the market. Further, access to a larger regional energy market can increase the region’s attractiveness for investment in manufacturing capacities. A regionally coordinated approach to Local Content Requirements can improve the overall efficiency of resource allocation and help small economies overcome hurdles to capturing the benefit of clean energy industrialisation.[16]

The G20 could encourage and support the development of regional hubs of clean energy value chains. For example, the Gulf Cooperation Council aims to develop the advantages of hydrogen and carbon capture, utilisation, and storage hubs through shared carbon storage capacity and transport infrastructure. Africa and South America present significant opportunities for creating regional hubs for solar and wind components manufacturing. North America continues to race ahead in electric vehicle manufacturing.

The G20 could support the creation of regional, shared R&D centers for clean energy technologies and the development of unified standards and accredited testing facilities. This can help reduce technical barriers to the interregional trade of components and intermediates and improve regional integration of clean energy technology value chains.

Additionally, the G20 could facilitate the establishment of regional platforms to enhance cooperation along the critical minerals value chain. These regional platforms, in the form of regional industrial associations, can play an active role in incubating green manufacturing projects and mobilising industry participation.

Attribution: Dongmei Chen et al. “Accelerating the Just Energy Transition Through Enhanced and Integrated Critical Minerals Supply Chains,” T20 Policy Brief, June 2023.

Endnotes

[1] International Energy Agency, The Role of Critical Minerals in Clean Energy Transitions, May 2021, Paris, IEA, 2021.

[2] IEA, 2021.

[3] Verisk Maplecroft, Political Risk Outlook 2021: The Age of Flux and Flex, March 2021, Verisk Maplecroft, 2021.

[4] IEA, 2021.

[5] IEA, Financing Clean Energy Transitions in Emerging and Developing Economies, June 2021, Paris, IEA, 2021.

[6] IEA, Energy Technology Perspectives 2023, January 2023, Paris, IEA, 2023.

[7] Cullen S Hendrix, “Building Downstream Capacity for Critical Minerals in Africa: Challenges and Opportunities,” December 2022, Peterson Institute for International Economics.

[8] Nandakumar Janardhanan et al., “Critical Minerals for Net-Zero Transition: How the G7 can Address Supply Chain Challenges and Socioenvironmental Spillovers,” April 2023, G7 Policy Brief.

[9] US Department of Energy, Government of the United States of America, Critical Minerals and Materials: US Department of Energy’s Strategy to Support Domestic Critical Mineral and Material Supply Chains (FY 2021–FY 2031), 2021.

[10] UN Environment Programme and International Resource Panel, “Mineral Resource Governance in the 21st Century: Gearing extractive industries towards sustainable Development,” Nairobi, Kenya, 2020, UNEP and IRP.

[11] Mohan Yellishetty, Ranjith P.G., A. Tharumajah, and Sheshanath V Bhosale, “Life cycle assessment in the mineral and metals sector: A critical review of selected issues and challenges,” The International Journal of Life Cycle Assessment (2009) 14(3):257-267.

[12] Atlantic Council, “Global collaboration is needed on critical minerals to support the energy transition, says Indonesian energy minister,” Atlantic Council, 2023.

[13] Hendrix, “Building Downstream Capacity for Critical Minerals in Africa”

[14] Alejandra Bernal, Joerg Husar, and Johan Bracht, “Latin America’s opportunity in critical minerals for the clean energy transition,” IEA, 2023.

[15] Shannon K O’Neil, The Globalization Myth: Why Regions Matter (New Haven, Connecticut: Yale University Press, 2022).

[16] International Renewable Energy Agency and United Nations Economic and Social Commission of Western Asia, Evaluating renewable energy manufacturing potential in the Arab region: Jordan, Lebanon, United Arab Emirates, 2018, Abu Dhabi, IRENA and UN ESCWA.