Task Force 4: Refuelling Growth: Clean Energy and Green Transitions

In the wake of the energy crisis triggered by the Russian war on Ukraine, G20 countries—and the rest of the world—have become exposed to the risks of energy insecurity.[1] To secure the supply and stability of electricity, existing power systems must be redesigned to be forward-looking and fit for net-zero. Every country will have a different approach and solutions; however, all should engineer their policies to harness more flexibility in their power systems and align their power sector transitions with the Paris Agreement.

This policy brief looks to establish the need for development and implementation of necessary policy reforms to increase renewable energy supply for energy security; the G20’s role in identifying the biggest policy impediments to agile power sector transformation; and what India’s presidency must do to ensure that the G20 countries—both in the Global North and South—steps up to show leadership in renewables and enhanced grid flexibility.

1. The Challenge

Decarbonising power systems is a significant milestone towards achieving net-zero. As they are the backbone of modern economies, building reliable power systems to ensure a stable supply of clean electricity is critical not only for effective climate action, but also green economic growth.

The majority of the world’s top economies make up the G20, and they are accountable for about 80 percent of the world’s greenhouse gas emissions. Thus, the group needs to reduce its dependency on fossil fuels and move towards a power system fuelled by renewable energy if there is to be any hope of achieving the Paris Climate Targets.

A major challenge to the clean energy transition is the structure of the power market. An inflexible and obsolete market structure can contain regulatory and structural obstacles that may not bring ‘fair’ competition to renewables in terms of price and availability of supply in the market.[2] Globally, there are various forms of power sector markets (see Figure 1). Among them, the most inflexible market, i.e., a vertically integrated and regulated monopoly, would make it particularly difficult for renewables produced by various suppliers to enter the market.[3]

Figure 1: Overview of Global Power Markets

Source: International Energy Agency[4]

A similar concern presents itself in South Africa, where the state-owned energy monopoly, ESKOM (established as Electricity Supply Commission in 1923), teeters on the brink of bankruptcy. Given South Africa’s sizable domestic coal supply, ESKOM was able for years to power the country on fossil fuels. Now, ESKOM produces and distributes 90 percent of South Africa’s energy, while turning a profit. As ESKOM manages the majority of the national grid, renewable energy producers are unable to access the transmission network without its permission. Moreover, ESKOM’s recent major investments have been in coal. This has proved problematic, as international pressure against coal is likely to render these assets stranded. South Africa now relies on the Just Energy Transition Partnership to help recoup its losses without risking a devastating blow to the national economy. This could have been mitigated, if not avoided, with a more flexible energy market.[6]

Luckily, an inflexible structure can be reformed. For instance, Germany opened up its power market by revising the Energy Economy Act at the request of the EU. As a result, energy generation and system operation were separated, allowing all players access to the grid.[7] In the UK, the power market is governed by multiple entities; the Department of Business and Industrial Strategy oversees the entire sector, with the Office of Gas and Electricity Markets regulating it, and the National Grid Electricity System Operator) operating the system and 14 regional distribution companies.[8]

The G20 can recommend its members to review the existing design of their power market structures, removing or reforming any policy and regulatory barriers hindering renewable energy enhancement and greater grid flexibility. Moreover, the G20 can influence and lead its member states to adopt more ambitious climate targets and policies, attainable through market reorganisation.

2. The G20’s role

According to International Energy Agency’s 2022 Annual Renewables Report, renewable energy capacity is projected to grow by 2,400 GW and account for over 90 percent of global electricity generation over the 2022-2027 period.[9] To unlock the potential of renewables, the G20 power markets will need fair competition and equal access to the grid for renewables.

The challenge cannot be addressed without the G20 urging for the need to establish a fair market and a level playing field for renewables. Although different countries may have different characterisations best fit for their own markets, they should be fully aligned on the challenge. In centrally regulated power markets, renewables and flexibility resources—technologies that improve the efficiency, efficacy, and elasticity of meteorologically inconsistent energy sources—have less of a chance of competing on the same terms as fossil fuels, since these structures have been designed to favour the latter.

The G20 can encourage its expert groups to advise member states and non-members alike on best practices, and work to achieve innovative energy governance by developing relevant laws and regulations to enhance renewables in the power system, as well as enforcement mechanisms to ensure compliance therewith. For example, the Indian G20 leadership could utilise global initiatives such as the International Solar Alliance to convene stakeholders among the member states with similar power market structures and/or policy impediments for solar deployment to share regulatory concerns, challenges to reforming such markets, and success stories.

Moreover, the G20 could look to coordinate regional integration and investments in building energy infrastructure. Interconnection of the power grid to neighbouring markets enables easier imports, which can be cheaper and provide a market for surplus generation, allowing for more efficient use of electricity across the region.

3. Recommendation to the G20

The G20 has been essential in driving innovations in policy, regulation, and governance, and in building partnerships between member states for implementation. The following recommendations could help the G20 drive changes in the power market that can enhance the adoption of renewables:

Set stronger ambition and targets

To achieve carbon neutrality and power sector decarbonisation, there is a need for all G20 countries to enhance their ambitions for renewable energy adoption and set strengthened renewable energy targets. To enable this, the G20 energy ministers should consider cooperating to set a pan-G20 target for renewable energy adoption in line with the Paris Agreement. This will provide the right signal for member countries, and the rest of the world, to set their own national commitments.

The G20 must also look to encourage collective progress towards renewable energy deployment. The climate crisis is global in nature, and the actions of one country can affect the conditions of another. To do this, the G20 can develop clean energy benchmarks and policies at the national and regional level. By identifying key countries or regions that can lead in setting these targets and benchmarks, the G20 can foster bilateral and multilateral discussions and agreements among its members. It is vital that every country be involved, to the fullest extent possible, in deploying renewables quickly and efficiently.

Inda’s presidency presents a unique opportunity to manage the above, by leveraging its leadership in solar energy development to investigate the possibility of, and hopefully establish, a High Renewable Energy Coalition. Such a concept would encourage partnership and cooperation in renewable deployment.

The Indian G20 presidency is also a prime opportunity to develop regional ambition and ambitious goals. India’s influence both within and outside of the G20 should be used to enhance renewable energy deployment in Asia. Developing regional ambitions would necessarily include identifying gaps and needs as well. These can include concerns of financing, supply chains, and so forth. India should use its G20 presidency to further the understanding of these limitations to leverage support for addressing and mitigating them at national levels.

Establish transparent governance and power market structure

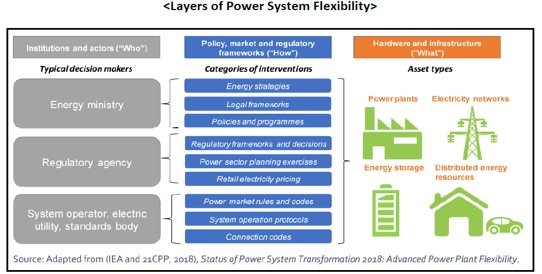

The G20 needs a thorough and accurate assessment of whether their power systems are equipped to accommodate renewables and flexibility resources (see Figure 2). This will mean identifying which players, regulatory schemes, and technological advancements are considered when redesigning their power market structures.

Figure 2: Layers of power system flexibility

The G20 should look to set up specific task forces within the Energy Transition Working Group to identify key principles and implementation pathways for aligning the power market structure with the need to create a level playing field for incorporating renewable energy in the power grid. It is not enough to base discussion solely on phasing out fossil fuels; the global energy system must be reformatted. This demands a paradigm shift. The G20 should put forth clear guidelines for its member states to examine the ways their domestic energy systems can be quickly fitted for renewable energy reliance. This would also demand a G20 mandate that power systems be operated in a fair and Paris-aligned way, via the establishment of effective market and regulatory conditions. For example, G20 could impose a ‘clean grid’ mandate for regulators, system operators, and utilities. It is important that these requirements be clear, concrete, and discernible.Power systems should ingrain fairness for renewables. The redesigning process should be transparent, encouraging sector inquiries into electricity generation and wholesale markets, while strengthening data access. In practice, this means energy prices must reflect the cost of production. It also imposes a limit on power curtailing; renewables cannot be shut out of the power grid due to must-run regulations or concerns over its low cost.[12] Finally, a fair power system as pertains renewables must include flexibility resources, such as batteries, and better transmission planning systems to ensure readily available energy even during unfavourable conditions.

Implement effective policy and regulatory frameworks for renewables procurement

Clean energy transition depends inherently on stable, progressive policy interventions. The G20 should remove policy and regulatory barriers that hamper the deployment of renewable energy and grid flexibility, such as via reforms to accelerate the permitting and siting procedures and reduce curtailment for generation from renewables.[13]

Stringent permitting processes sit at the forefront of several barriers to deploying solar or wind energy. Some G20 countries have taken steps to simplify the process by reducing the permitting period for renewable projects to a maximum of two years (the REPowerEU Implementation in May 2022, for instance) or one year (UK’s Energy Strategy), or to speed up offshore wind projects by leveraging planned locations (Japanese Act on Promotion of Utilisation of Sea Area for the Development of Marine Renewable Energy Generation). However, permitting remains a significant hurdle in some locations. For instance, in South Korea, there are 29 individual laws exercised by as many as 10 ministries. The process is complex and riddled with structural delay, taking an average of 68 months to complete before beginning any development.[14]

To alleviate this, G20 countries should work together to establish national ‘one-stop shop’ policies for renewable energy permitting. This includes having a single point of contact during the permitting process, rather than requiring developers to engage with several disparate actors. Furthermore, there must be open dialogue between authorities and local communities to best understand actual barriers, ensuring that risks are mitigated during the development process. The G20 must establish best practices under which to engage in such a conversation, providing a template for its members to follow. Moreover, India, in its role as voice of the Global South, can use its presidency to share those practices with countries outside the G20 as well.

Attribution: Saehee Jeong, Kyle Heitmann, and Promit Mookerjee, “Accelerating the Energy Transition by Rethinking Power-System Flexibility: Imperatives for the G20,” T20 Policy Brief, July 2023.

[1] OECD, Competition in Energy Markets, OECD Competition Policy Roundtable Background Note, OECD, 2022.

[2] Hiroaki Nagayama, “Electric Power Sector Reform Liberalization Models and Electric Power Prices in Developing Countries: An Empirical Analysis Using International Panel Data”, Energy Economics, Vol. 31/3 (2009): 463-472.

[3] OECD, Competition in Energy Markets

[4] International Energy Agency, Re-powering Markets: Market design and regulation during the transition to low-carbon power systems, IEA, 2016).

[5] Solutions For Our Climate, Renewables ‘Go to Jail’ in Monopoly: How South Korea’s Governance is Stifling its Energy Transition, SFOC, 2020.

[6] International Renewable Energy Agency, Global landscape of renewable energy finance, IRENA, 2023).

[7] Agora Energiewende, The Liberalisation of Electricity Markets in Germany: History, Development and Current Status, Agora Energiewende, December 2019.

[8] Iona Stewart, Introduction to the domestic energy market, United Kingdom House of Commons Library, March 28, 2023.

[9] International Energy Agency, Renewables 2022, IEA, 2022.

[10] International Energy Agency, Status of Power System Transformation 2018: Advanced Power Plant Flexibility, IEA, 2018.

[11] International Energy Agency, Status of Power System Transformation 2019: Power system flexibility, IEA, 2019.

[12] Solutions For Our Climate and NEXT Group, Jeju’s 2030 Carbon-Free Vision Begins With Renewable Curtailment Freedom: Cost Analysis of Solutions to Renewable Curtailment on Jeju Island, South Korea, SFOC and NEXT, 2022.

[13] SFOC and NEXT, Jeju’s 2030 Carbon-Free Vision

[14] Sang-geun Byun, “Denmark’s practical permitting system builds trust as an advanced power market,” ETNews, October 28, 2022.