Task Force 5: Purpose & Performance: Reassessing the Global Financial Order

Abstract

Among the challenges facing developing countries, none is arguably more crucial than the significantly deteriorating fiscal situation that threatens to stall economic recovery. Close to 60 percent of the poorest countries are either in or at high risk of debt distress. Last year, total debt service payments rose to over US$70 billion in several countries, exceeding combined expenditures on health, education, and social protection. Despite holding about 27 percent of the debt, the private sector accounts for 37 percent of the debt service due to the relatively higher cost of private debt. This Policy Brief recommends that the G20 explore a Brady bond-like scheme to replace the current private sector debt with new bonds that have guarantees and longer maturities. Under reasonable assumptions, the authors estimate that this scheme could reduce external debt repayments of developing countries by up to US$100 billion over the next five years and quickly restore much needed fiscal sustainability.

1. The Challenge

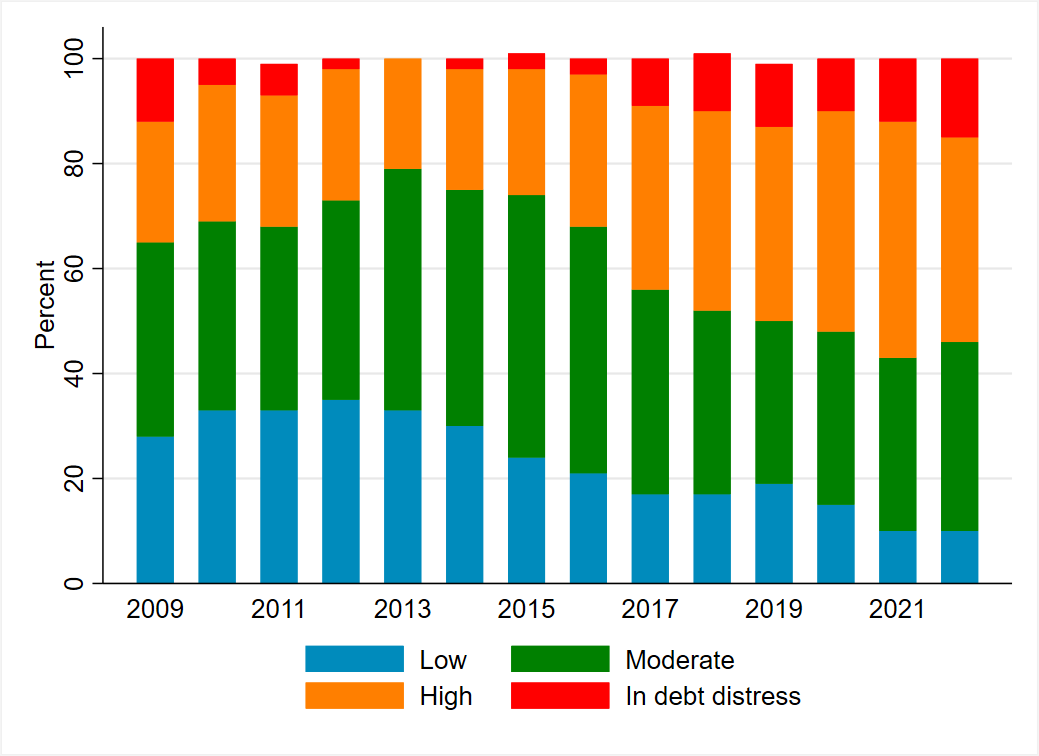

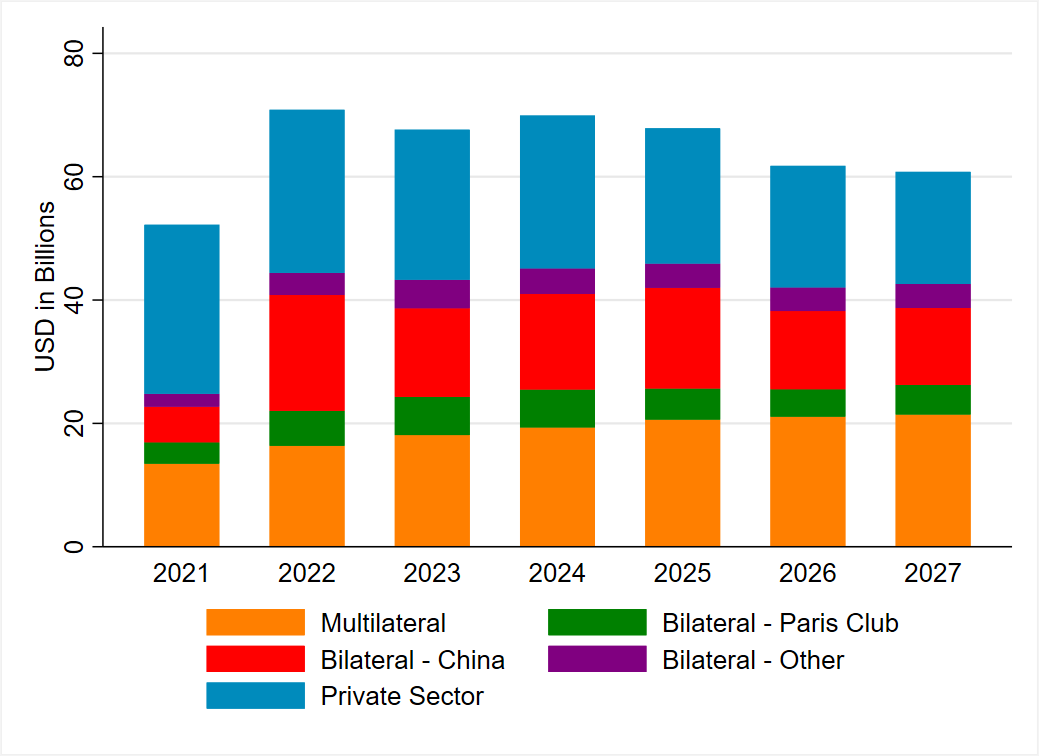

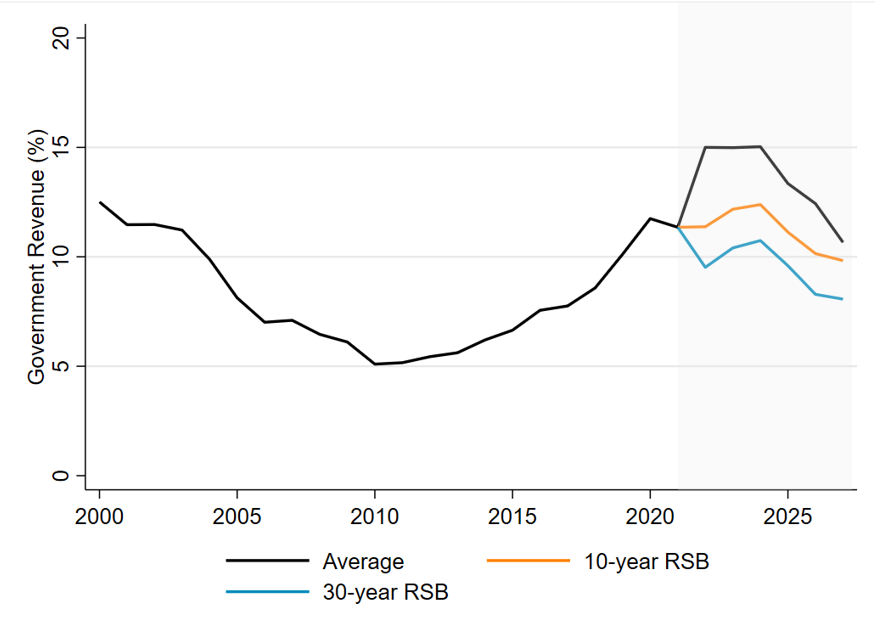

According to some estimates, almost 60 percent of the poorest countries, nearly doubling since 2015, are either in or at high risk of debt distress (Figure 1).[1],[2] Total debt service payments on public and publicly guaranteed (PPG) external debt of the poorest countries rose to over US$50 billion in 2021, with repayments representing 11.3 percent of government revenue of the poorest countries, up from 5.1 percent in 2010 (Figure 2).[3],[4] In several developing countries, the cost of servicing external debt exceeds combined expenditures on health, education, and social protection.[5] Currently, higher global interest rates and exchange rate depreciations against major currencies is adding to the fiscal challenge by raising the cost of external financing and debt service. Last year, debt service payments for the poorest countries rose 36 percent to over US$70 billion and are projected to remain elevated through at least 2027 (Figure 3).

Against the onset of the COVID-19 pandemic and amid rising debt service burdens, the G20 launched the Debt Service Suspension Initiative (DSSI) in 2020 to defer official debt service due by the poorest countries and provide temporary liquidity by somewhat easing constraints on fiscal space.[6] The G20 also adopted the Common Framework for Debt Treatments (CF) for developing countries that provides an opportunity to restructure debts, and address solvency issues and protracted liquidity problems.[7] However, it is increasingly evident that the CF is facing serious operational challenges, and has struggled to deliver quick and coordinated action required to restore debt sustainability. Echoing these widely shared concerns about the limitations of the CF, the Managing Director of the International Monetary Fund (IMF) called for changes to it while the World Bank President urged for the acceleration of its implementation.[8][9] Likely due to the challenges with the CF, out of the 37 countries at high risk of or in debt distress, only four have requested assistance under the framework so far. A pre-emptive and wholesale approach is required to restore fiscal sustainability and avert debt crises across the developing world before it is too late.

The COVID-19 pandemic was the latest in a series of shocks that contributed to wider budget deficits and the gradual build-up of debt since 2012. The first shock responsible for destabilising debt sustainability in the last two decades was the global financial crisis in 2008, followed by the European debt crisis in 2009 and, importantly, the oil shock in 2014-15. The oil shock was particularly devastating for commodity-dependent countries. These global shocks led major central banks to reduce global interest rates to record low levels for over a decade.[10] The ultra-low interest rate environment facilitated the issuance of private sector debt, notably sovereign bonds by low-income countries, in many cases for the first time, as global investors took on more risk to reach for higher yields.[11]

Figure 1: Low-Income Countries Debt Sustainability Analysis

Source: Authors’ calculations, using data from the IMF 2022 Annual Report, and IMF Debt Sustainability Analysis for Low-income Countries.

Figure 2: External PPG Debt Servicing Cost (2000-2022)

Source: Authors’ calculations, using World Bank 2021 International Debt Statistics, and the IMF World Economic Outlook database.

Figure 3: Total External PPG Debt Service Coming Due

Source: Authors’ calculations, using World Bank 2021 International Debt Statistics.

2. The G20’s Role

The G20 has an important role to play in efforts to restore fiscal sustainability in the developing world. The DSSI postponed almost US$13 billion in debt repayments, providing some much-needed fiscal space to the 48 poorest countries that participated in the initiative.[12] The expiration of the DSSI at the end of 2021 added to the debt service burden of the beneficiary countries from 2022 onwards.

In late 2020, the G20 also adopted the Common Framework for Debt Treatment (CF) to help the poorest countries restructure their debt, and to address solvency issues and protracted liquidity problems. The aim was to help provide a framework for debt resolution beyond the DSSI. However, it has faced significant operational challenges.

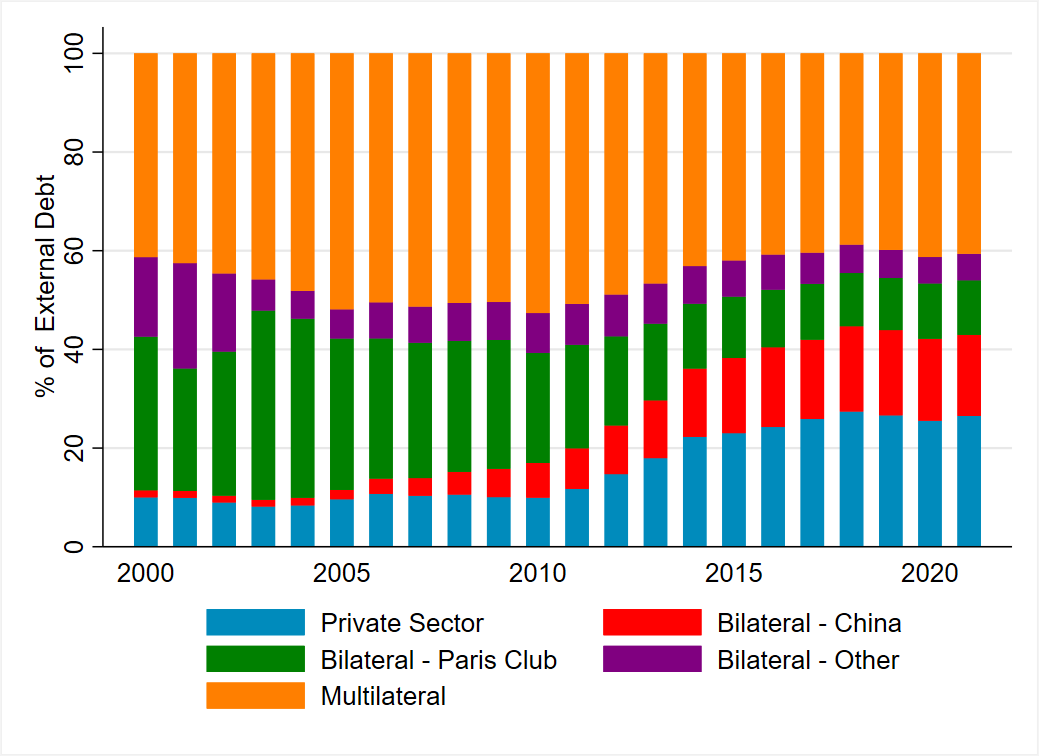

A notable feature of the debt build-up compared with the era before the Heavily Indebted Poor Countries and Multilateral Debt Relief Initiative is the diffusion of the creditor base. Indeed, as shown in Figure 4, the share of debt owed to private sector and official bilateral creditors, notably to China, has increased sharply while the share of debt owed to Paris Club creditors and multilaterals has declined. While an increase in the number of creditors can provide a welcome diversification in funding sources for developing countries, it makes debt workout complex. Negotiations under the CF have proved difficult and protracted.

Figure 4: Share of Total External PPG Debt by Creditor

Source: Authors’ calculations, using World Bank 2021 International Debt Statistics.

Likely reflecting these challenges, so far, only four countries (Chad, Ethiopia, Zambia, and Ghana) have asked for debt treatment despite a significantly deteriorated fiscal outlook.[13] Countries in need of support are either hesitant to seek assistance or engage private creditors forcefully for fear that it will negatively affect their hard-fought-for sovereign credit standing. At the current pace, the CF alone will not be enough to avert a cascading sovereign debt crisis. A key concern is that the support countries will receive at the end of protracted negotiations will come a bit too late when conditions have worsened and have become more costly to resolve.

3. Recommendations to the G20

This Policy Brief proposes that the G20 establish a working group to develop a solution that consists of the issuance of lower cost sovereign bonds with long maturities as a replacement for the high-cost sovereign debt that countries currently carry on their balance sheets. This scheme is similar, in spirit, to the Brady bond transactions of the 1980s and ’90s to restructure the debt of emerging markets and developing countries. In response to the global debt crisis of the 1980s, then US Secretary of the Treasury, Nicholas Brady, proposed a plan to convert bank loans into tradeable bonds with long maturities.[14] Under the Brady Plan, a debt-distressed country obtained credit enhancement from the IMF or the World Bank. It then purchased a zero-coupon 30-year US Treasury Bond which was used as collateral to issue ‘Brady bonds’ on the market. The proceeds from the Brady bonds were used to repay the bank loans. The Brady bond scheme assured debt repayments for creditors even if with haircuts, and restored debt sustainability of indebted countries by lowering debt service burden and through IMF/World Bank-assisted economic reform. A similar scheme adapted to the current environment could prove decisive for efforts to avert debt crises in the developing world.

Design features of Brady Plan 2.0

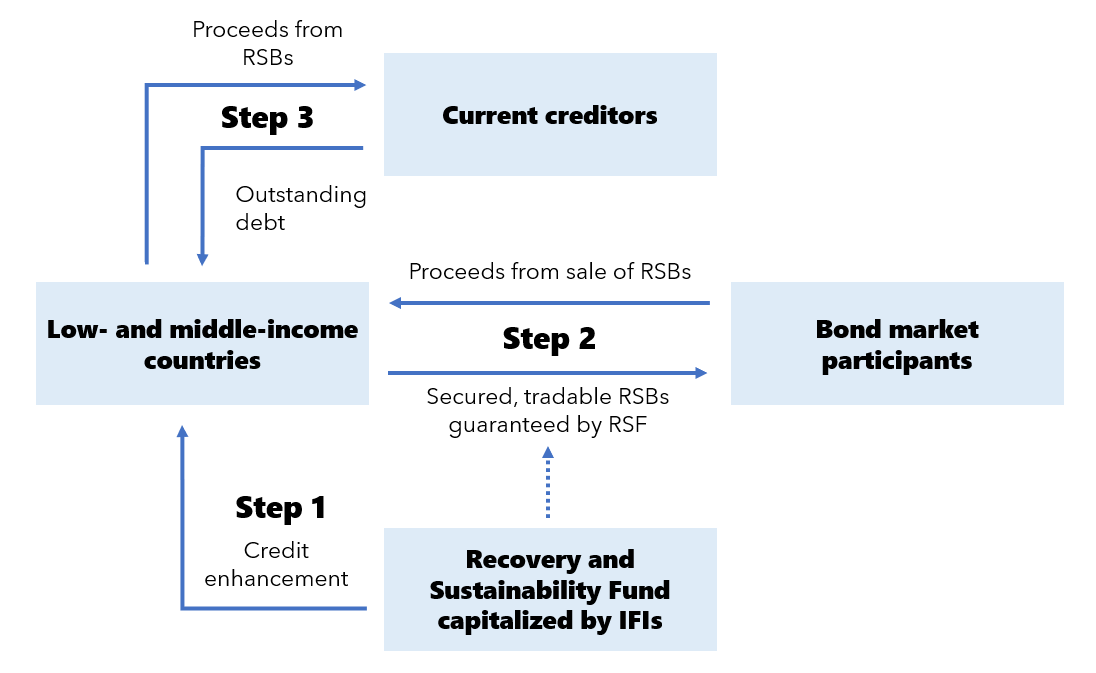

The scheme proposed in this Policy Brief can achieve outcomes similar to that of the Brady bond restructuring, albeit with some differences. Figure 5 provides a schematic illustration of the following three-step process involved in the proposed scheme:

- First, we recommend the creation of a Recovery and Sustainability Fund (RSF), a new fund to be managed by the World Bank and IMF, with contributions from various International Financial Institutions (IFIs), bilateral donors, and the possible inclusion of Special Drawing Rights (SDRs).

- Second, the fund will be pledged as collateral against new tradable bonds—Recovery and Sustainability bonds (RSBs)—issued by indebted developing countries participating in the scheme. With the guarantees, the RSBs will command a coupon rate lower than the interest rates on current external debt owed to private creditors. The bonds would also have long maturities, ideally 30 years, like the Brady bonds.

- Finally, proceeds from RSBs will be used to retire the outstanding balance on costly existing debt held by private creditors.

The combination of lower yields and longer maturities is expected to significantly reduce debt service to more sustainable levels and help restore fiscal sustainability. Like the Brady plan, participating countries would agree to implement programs negotiated with the IMF and the World Bank to restore medium to long-term fiscal sustainability, and commit to full transparency on all current and future issuances of public debt and publicly guaranteed debt.

Figure 5: Design for Brady-Bond-Like Mechanism

Source: Authors’ own

Simple simulations

We conduct simple simulations under various maturity scenarios for the newly issued sovereign bonds. These simulations provide a credible indication of the potential of such scheme to significantly lower the debt burden of developing counties. A more comprehensive analysis at the national level and securities level will be required to obtain more precise estimates of the impact.

We simulated external debt reductions for 41 LMICs (low and middle-income countries) for which complete data on current debt stock, principal and interest repayments, and total debt service for private sector debt, including both bondholders and commercial debt, were available.

We assume a 30-percent haircut on outstanding private sector external debt and a coupon rate of 5 percent. We also assume that no new private sector debt is added to the stock. The coupon rate is at the lower end of those of existing sovereign bonds due to credit enhancement, but with a spread of about 150-basis points relative to US Treasury Bonds of equal maturities. The principal and interest repayments are spread in equal amounts each year until the bond reaches maturity. With these assumptions, we simulate two different maturity scenarios with 10-year and 30-year bonds. The estimation exercise under these scenarios finds that debt repayments as a share of government revenues decline by upto 4 percentage points for the average country. This amounts to a cumulative reduction in total debt service repayment of up to US$100 billion over the next five years for the 77 developing countries. The reduction in debt burden stems from the haircut, lower yields on the new bonds due to the credit enhancement afforded by the guarantees, and the maturity extension.

Figure 6: Average Simulated External PPG Debt Service

Source: Authors’ calculations, using World Bank 2021 International Debt Statistics and IMF 2022 World Economic Outlook database.

Practical considerations

The G20 working group will need to address some important practical considerations in creating a Brady Plan 2.0. The first consideration is the selection of countries who will be deemed eligible to participate in the scheme. The authors propose that the scheme should target all the countries that are eligible for treatment under the CF, particularly those in or at high risk of debt distress, and include Eritrea, Sudan, Syria, and Zimbabwe.

Another consideration is the nature and structure of the guarantees. During the implementation of the Brady Plan, the US Treasury provided leadership and facilitation by issuing zero-coupon US Treasury Bonds that served as collateral. The World Bank can play this role for the proposed scheme, which includes the responsibility of issuing a similar zero-coupon bond or other guarantee instruments. The funding for the RSF would be sourced from contributions by international financial institutions and bilateral donors. The SDRs can also provide important catalytic funding if recycled creatively to adhere to the restrictions on their use. One approach could be transferring SDRs to eligible IFIs in order to bolster their balance sheets and facilitate their participation.

As with the Brady Plan, participating countries would work closely with the IMF and the World Bank to negotiate an inclusive plan for restoring the macroeconomic fundamentals of their economies. The countries would also commit to full transparency on all new PPG debts. To facilitate transparency, the contracts governing new debts should contain no confidentiality provisions. With these measures, the risks of default associated with RSBs would be minimised. The remarkably low number of defaults under the Brady plan—only four countries—is a reassuring historical precedent. Moral hazard has often been an important consideration in the formulation of debt restructuring. However, concerns about moral hazard are outweighed by the benefits of averting debt crises.

The participation by the private sector might be contingent on comparable treatment, an approach that is sanctioned by the CF. We suggest two options. The first option is to use the haircut under this scheme as the baseline for negotiations with other creditors. The other option involves a significant contribution to the RSF by bilateral official creditors in amounts that are at least comparable to haircuts taken by private creditors. With success of the program, official creditors would be repaid at the outset, minimising their losses. The assurance to collect on their debts provides an incentive for their participation. The incentive for private sector participation is the assurance of recouping a sizeable share of their investment as well as the option to exit from their current positions and improve the risk-return profile of their portfolios. The incentives outlined above can be enhanced if IFIs announce their intention to continue lending to countries in arrears. Even so, participation is not guaranteed. It will require strong political will and commitment from the G20 countries to obtain the necessary concessions and cooperation.

Attribution: Brahima S. Coulibaly and Wafa Abedin, “A Proposed ‘Brady Plan 2.0’ to Avert Sovereign Debt Crises in the Developing World,” T20 Policy Brief, June 2023.

Endnotes

[1] World Bank, “Debt Service Payments Put Biggest Squeeze on Poor Countries since 2000,” Press release, December 6, 2022, https://www.worldbank.org/en/news/press-release/2022/12/06/debt-service-payments-put-biggest-squeeze-on-poor-countries-since-2000.

[2] “List of LIC DSAs for PRGT-Eligible Countries,” International Monetary Fund, accessed December 2022. See list for debt distress ratings of most low-income countries.

[3] This policy brief focuses on a group of 77 countries who are eligible for the CF, plus Eritrea, Sudan, Syria and Zimbabwe who were excluded from the CF because on ongoing arrears with the World Bank/IMF. Kiribati, Marshall Islands, Micronesia, South Sudan, and Tuvalu were excluded from the analysis due to the absence of data.

[4] This policy brief uses data from the 2021 World Bank International Debt Statistics database and the 2022 World Economic Outlook database.

[5] Covid-19 and the Looming Debt Crisis: Protecting and Transforming Social Spending for Inclusive Recoveries, Office of Research-Innocenti, UNICEF, April 2021, COVID-19 and the Looming Debt Crisis: Protecting and Transforming Social Spending for Inclusive Recoveries (unicef-irc.org).

[6] “Debt Service Suspension Initiative,” World Bank, March 10, 2022, https://www.worldbank.org/en/topic/debt/brief/covid-19-debt-service-suspension-initiative

[7] Masood Ahmed and Hannah Brown, “Fix the Common Framework for Debt Before It Is Too Late,” Center for Global Development (blog), January 18, 2022.

[8] Kristinalia Georgieva and Ceyla Pazarbasioglu. “The G20 Common Framework for Debt Treatments Must be Stepped Up,” IMF (blog), December 2, 2021, https://www.imf.org/en/Blogs/Articles/2021/12/02/blog120221the-g20-common-framework-for-debt-treatments-must-be-stepped-up.

[9] “Remarks by World Bank Group President David Malpass at the G20 Session on International Financial Architecture – Lead Intervention,” World Bank, July 9, 2021, https://www.worldbank.org/en/news/speech/2021/07/09/remarks-by-world-bank-group-president-david-malpass-at-the-g20-session-on-international-financial-architecture.

[10] World Bank, “Special Focus 1: With the Benefit of Hindsight: The Impact of the 2014-2016 Oil Price Collapse,” January 2018, https://elibrary.worldbank.org/doi/10.1596/978-1-4648-1163-0_Focus1.

[11] “World Economic Situation and Prospects: November 2016 Briefing, No. 96,” United Nations Department of Economic and Social Affairs, November 14, 2016, https://www.un.org/development/desa/dpad/publication/world-economic-situation-and-prospects-november-2016-briefing-no-96/

[12] “Debt Service Suspension Initiative,” World Bank, Accessed February 1, 2023, https://www.worldbank.org/en/topic/debt/brief/covid-19-debt-service-suspension-initiative.

[14] Adam Hayes, “Brady Bonds,” Investopedia, October 19, 2022, https://www.investopedia.com/terms/b/bradybonds.asp