Task Force 5: Purpose & Performance: Reassessing the Global Financial Order

The mobilisation and disbursement of climate finance at the scale and speed required to meet global targets is hindered by high cost of capital. At the root of this high cost are the perceived high risk of investment, institutional ambiguities across sectors and countries, and the fact that countries are politically accountable to their domestic stakeholders who may disapprove of such risk. Absent a transition from old business models to new low-carbon ones—a step that requires changes in the political economy—this perception will persist. Climate finance flows would be much better if governments are open to working on these new models. This Policy Brief proposes an institutional arrangement that can build on existing practices, institutions, and domestic acceptance to create a global network of risk reduction instruments for climate finance.

1. The Challenge

Climate finance remains among the most intractable challenges to global cooperation in climate action. To begin with, it is a fulcrum of mistrust between developed and developing countries, as the former have failed to fulfil their commitment to raise public climate financing per year to US$100 billion by 2020. Indeed, the 26th session of the Conference of the Parties (COP26) to the United Nations Framework Convention on Climate Change (UNFCCC) in 2021 passed an unprecedented resolution of “regret” at the failure. A new track of negotiations on finance, referred to as the New Collective Quantified Goal in climate finance, was opened in the negotiations.

Compared to estimates of the financing required to achieve net-zero greenhouse gas (GHG) emissions globally by 2050, green investments so far—despite their recent spurt—remain insignificant.[1],[2] Around US$4-6 trillion alone will be needed by 2030 to lay the ground, preparing a de-carbonisation pathway towards ‘net zero’.[3], [4], [5] (Of this, around 70 percent is expected to come from the private sector.[6])

So far, however, there is no indication of which parts of the finance will flow from international financial institutions and which through global finance deals. That most of the financial flows are towards mitigation—leaving adaptation significantly marginalised—is another issue altogether.[7] In developing and emerging economies, national financial frameworks and public budgets alone cannot provide the scale of financing needed[8] to align with sectoral transformations. Significant financial resources need to be mobilised to scale low-carbon technologies. Early phase-out of high-carbon technologies will have to be accompanied by schemes that will address the consequences on the workforce and the economy.

The policy challenge is clear: How to ensure that trillions of dollars in investment flow for climate action, particularly in developing countries. A related problem is making best use of public finance, which is limited and politically sensitive, to trigger a transformation in the financial markets, in turn spurring climate-friendly investments.

Financial flows into developing countries face both demand-side as well as supply-side challenges. The demand for climate finance is low because of the high transaction cost of accessing it, and the high cost of capital. Several factors contribute to the high transaction costs—ranging from procedural requirements of due diligence to challenges in acquiring regulatory clearances, mobilising technical capacity and supporting resources such as land and water. These procedural transactions costs, combined with the high-risk perception of climate-friendly projects in developing countries, add to the cost of capital. This is true of both international as well as domestic financial flows. The rise in non-concessional international loans to developing countries, without any favourable provisions such as grace periods, maturities, or low interest rates,[9] is only illustrative of these challenges. Even if there are provisions of concessional loans from multilateral agencies, the higher transaction costs of the process—acquiring loans from institutions such as the Green Climate Fund (GCF), for instance—make access difficult for the majority of project owners in developing countries.

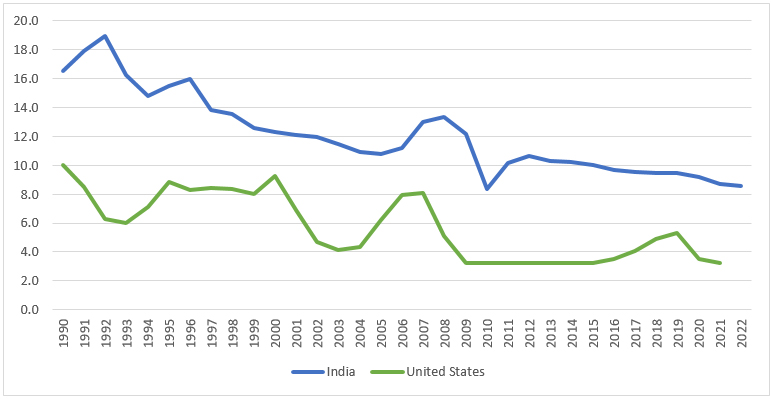

Poor access to affordable capital constrains green transition. In addition to high base rates, influenced by central monetary policies, factors contributing to high risk perception in developing countries[10] make investors demand greater returns. There are also other risks that drive up the cost of capital in countries such as India. Data on bank lending rates across countries over the last decade reveals that the cost of capital in India has been consistently and significantly higher than in the United States (Figure 1). The unfavourable terms of trade for developing countries thus add another layer of risk to the cost of capital. Over the years, exchange rates movements have made loan repayments in international currency more expensive for borrowers in developing countries.

Figure 1: Lending Rates in India and the U.S. (1990-2022)

Source: The World Bank, Lending Interest Rate[11]

Two observations sum up the complexity of the climate finance challenge for developing countries. First, overall access to debt remains expensive with significantly high interest rates. Second (and despite the first), investments in climate action have been rising over the years. Together, these two trends are adding to the already high level of indebtedness of developing countries. Indeed, the Sharm El-Sheikh Implementation Plan, agreed upon in November 2022, emphasised the need for “taking into account debt burdens” while substantially increasing climate finance.[13]

The Politics of Acceptability

Climate finance is politically sensitive. Even though, in principle, the developed countries have agreed under the UNFCCC that they have a responsibility to provide financing to the developing economies, there are questions of when, how much, for what specific purpose, with what accountability, and through which instruments and channels, that remain contested. The desire of developed countries to control the terms of utilisation of finance provided to developing countries[14] is also a reason why the US$100 billion per year target by 2020 has not been achieved. The ongoing negotiations between the G7 countries[a] and select developing countries in the context of the Just Energy Transition Partnerships (JETPs)[b] again underline that domestic political acceptability within the providing developed country as well as the recipient developing country is always a relevant issue.

The scale, sources, and instruments of financial flows are context-dependent—i.e., they depend on domestic capacities, national development priorities, macroeconomic circumstances, and climate vulnerability. Sectoral transformations involve different asset types and business models, have varying degrees of capital intensity, and attract different investors; therefore, different financial and regulatory instruments are needed to drive the change. The appropriateness of instruments also depends on the stage of innovation—whether it is concept development or establishing proof-of-concept of scaling for commercial use—and is responsive to cost and investor confidence.

Taxonomy Issues

According to the Intergovernmental Panel on Climate Change (IPCC), focusing on “a grant equivalent net flows definition of climate finance” that is comparable across institutions, instruments, countries, and measurement could address many uncertainties and thereby reduce risk perception.[15] Tracking international financial flows is saddled with definitional ambiguities.[16],[17] Should purely commercial loans by developed countries to developing ones related to climate be included as part of the former meeting their climate finance obligations? What about the due-diligence costs incurred? Lack of clear answers to such questions and definitions of instruments for tracking financial flows, and their impacts, such as blended finance, limits the possible innovations that would allow financial institutions to extend finance without overstepping their regulatory frameworks and fiduciary standards.

Summing up, mobilisation and disbursement of climate finance at scale and speed is hindered by the high cost of capital. The cost is high due to the perceived high risk of investment, the institutional ambiguities that arise from such finance being needed across diverse sectoral and country contexts, and the political accountability of countries to their domestic stakeholders. What is required is a transition from old business models and technologies to new, low-carbon ones, which in turn calls for changes in the regulatory framework and political economy. Building on the premise that climate finance will flow faster and in larger quantities if governments are open to working on such models and ready to fund them through international public finance, this Policy Brief proposes an institutional arrangement that can enhance existing practices, institutions, and domestic acceptance to create a global network of risk reduction instruments.

2. The G20’s Role

Climate goals of G20 countries differ in timelines, sectoral emphasis, and technological pathways. International finance flows must also vary to suit and support national transition strategies, corresponding to their unique requirements, particularly related to cost of access, availability at scale, and reliability over time. The prohibitive cost of capital eventually slows down finance flows and the transition process. It discourages small-scale and sub-national participation, which is critical for transition in emerging economies, from using climate funding. The G20 includes countries which are key sources of climate finance (public, private, and institutional) as well as those that are major recipients. With significant influence on the policies adopted by multilateral development banks, the G20 is an apt platform for devising mechanisms that can reduce the cost of capital by connecting financial needs and sources with appropriate instruments and thereby accelerating implementation of long-term climate goals. Combining the idea of ‘synchronisation of fragmented regimes’, accommodating the uniqueness of country-specific financial needs with a ‘clubs’/climate alliance perspective, this brief explores if a network of risk reduction instruments could be conceived at the G20 level.

‘Clubs’ and the G20

Two initiatives which emerged in the G20 context are relevant here. On one side is the Climate Club proposed by the G7 countries; on the other is the Global Climate Alliance (GCA), proposed by Indian policymakers.

The G7 proposed a Climate Club in 2022, to pursue ambitious climate action in a plurilateral manner. The Club builds on three pillars: the first related to an increasingly ambitious climate policy; the second to international cooperation for the de-carbonisation of industry; and the third to international climate partnership building. For climate finance, the Club plans to enhance the use of existing finance by playing a matchmaking role between members that offer, and those that seek climate finance.

The GCA, as emerging in the G20, is wider in terms of sectors, and aims to address both mitigation and adaptation. It aims to build a coalition of willing countries to significantly enhance climate finance contributions, as well as of countries willing to deploy climate finance to accelerate towards ‘net zero’. The GCA recognises the need for joint policy initiatives at sectoral level among potential member countries, building on experiences with e.g. breakthrough alliances, and explicitly addresses the need to significantly scale up finance to support such initiatives through various sources and mechanisms.

While the relationship between the Climate Club and the GCA is yet to be spelt out, the two are highly complementary, and could well set the institutional framework needed to improve flows.

The G20 as Synchronising Platform

All the G7 countries are part of the G20 as well. The G20 can initiate a plurilateral club or alliance and help synchronise otherwise fragmented regimes, including the Climate Club and other initiatives. As a political coordinator, the G20 can steer the different independent parts towards a common, coordinated goal.

3. Recommendations to the G20

The G20 should play a facilitative role to support and help convergence of emerging plurilateral initiatives like the climate club and the GCA. More bridges between the Global North and the Global South are needed to meet the latter’s climate finance requirements. The G20 is ideally suited to provide an umbrella commitment, encouraging member countries to come together, agree, and develop an institutional mechanism that reduces risk and thereby the high cost of capital. Ideally, all G20 countries should be represented at a common technical secretariat. Even so, to accommodate differences, every club may be allowed to have its own secretariat, broadly guided by a political agreement at the G20 level.

Specifically, a network of risk guarantee schemes involving G20 countries and multilateral financial intuitions should be set up.

A risk guarantee mechanism aims to moderate the risk perception of financial institutions about investments in domains such as energy efficiency. It involves setting up of a risk guarantee fund, which is accessible as insurance (without any premium) for member financial institutions against possible defaults on loans extended to a pre-identified category of investments. Such a guarantee gives confidence to financial institutions to invest in sectors and projects where there is little historic track record of performance necessary to assess the financial viability of such projects. This confidence translates into lowering the cost of capital, which in turn increases the demand for credit. In all likelihood, a well-designed risk guarantee fund will rarely be utilised, minimising the need for replenishment with public money.

As observed from many small-scale risk guarantee schemes, actual guarantee claims are marginal—the perceived risk of repayment failure is higher than the actual risk. Risk guarantees at scale can therefore reduce the cost of capital. Many G20 countries already have different types of risk guarantee measures in operation, either to encourage the financial sector to invest in targeted activities or to stabilise the banking system. The instrument is reasonably tested,[18] and proven to have reduced the actual financial burden on the exchequer.

In many countries there exist more than one risk guarantee fund. So far, the endowments for such funds have come primarily from national governments (such as the Partial Risk Guarantee Fund which supports the ‘Perform, Achieve and Trade (PAT) scheme[c] in India) or multilateral development banks such as the World Bank (which, in partnership with the UN Industrial Development Organisation UNIDO, India’s Bureau of Energy Efficiency, and the Small Industries Development Bank of India supports investment in Indian MSMEs). Developed countries have avoided providing such guarantees as it is difficult for them to get political clearance to commit to insure investments against defaults in other countries.

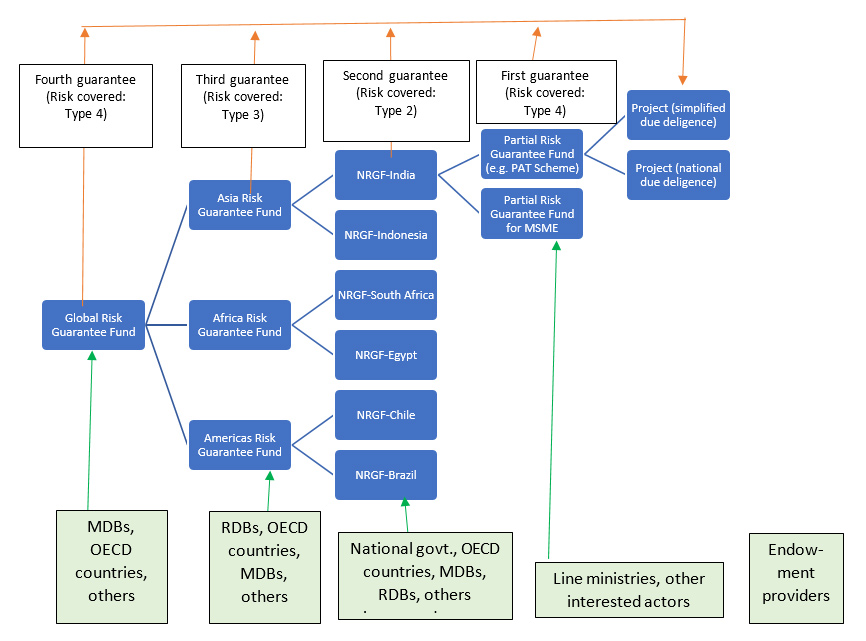

Given the track record of risk guarantee schemes, increasing the size of guarantee funds can potentially unlock the dynamism of domestic financial markets. A network of risk guarantee funds, in a ‘club-of-clubs’-like arrangement will have a high level of political acceptability across countries and financial institutions. Such a network should have the following key features (also see Figure 2).

Figure 2: A Network of Risk Guarantee Funds (With Flow of Guarantees to India)

Endowment Structure

Risk guarantee schemes are designed depending on national priorities. Governments provide the initial endowments through respective line ministries. Each scheme acts as an independent club. However, at the national level, a coordinating national risk guarantee fund (NRGF) is recommended for developing countries, which can receive endowments from developed countries through bilateral arrangements such as JETPs, in addition to those from their own governments. The NRGF would include members of regional risk guarantee funds (RRGFs) receiving endowments from regional development banks. The RRGFs should also be members of a Global Risk Guarantee Fund (GRGF) getting endowments from multilateral development banks and multilateral financial mechanisms such as the GCF or the Global Environment Facility (GEF).

The GRGF could also serve as a starting point in the reform of multilateral development banks and financial institutions (about which there has been much debate). It could provide grants or grant equivalent net flows. A risk guarantee can be construed as a grant equivalent flow, applicable, however, only in case there is a default. Each of the Funds can be kept open to receiving endowments from other actors, such as foundations and philanthropic organisations. Of course, developed countries and multilateral development banks can also contribute to regional and national funds. The quantum of endowment could be estimated based on a target for lowering the interest rate—say, by 2 percent in the first three years—and gradually increasing it.

Disbursement Structure

The NRGFs should primarily extend guarantees to member domestic financial institutions. (The NRGF in India would guarantee Indian financial institutions, while the German NRGF would protect financial institutions in Germany.) This would allow the developed countries to encourage their financial institutions to offer loans at lower interest rates in developing countries. The NRGFs in developing countries can also support member domestic financial institutions for their investments in other developing countries, as part of the South-South development cooperation. The RRGFs should support their NRGF with a pre-decided share of regional endowment or as second order of guarantee. (The RRGFs guarantees will be needed only after NRGF guarantee has been utilised.) The GRGF, similarly, will be needed only after the RRGFs’ guarantees have been used up in a given country.

An important consideration would be to identify specific risks that can be covered either by the Fund as a whole or by different guaranteeing agents. For example, failure or delay in repayment due to physical climate risks can be covered by developed countries, but if the same is due to policy change, the concerned developing country government should cover that risk.

Due Diligence and Taxonomy

While due diligence is necessary, a mechanism to reduce its cost must be devised. Since the national fund will bear the first guarantee, a localised due diligence fund with suitable protections may be agreed upon. For small-scale businesses to access the benefits of such a network, a simplified due diligence procedure will be necessary. Another option would be to have a broad agreement to treat comparable taxonomies across countries as the same, or begin with a simplified common taxonomy. Eventually, this can also facilitate harmonising of taxonomies across countries.

Attribution: Manish Kumar Shrivastava et al., “A Framework for Enhancing International Climate Finance Flows,” T20 Policy Brief, July 2023.

Endnotes

[a] The G7 countries are Canada, France, Germany, Italy, Japan, the UK and the US.

[b] JETPs are partnerships of members of developed countries and multilateral funding agencies with select developing countries. So far, such partnerships have been reached with South Africa, Indonesia and Vietnam.

[c] The PAT scheme is aimed at reducing the energy consumption of energy intensive industries, mapping average consumption of each industry and providing certification of the energy saved, which can then be traded.

[1]International Renewable Energy Agency, Climate Action With Energy Transition: Enhancing and Implementing Nationally Determined Contributions, (IRENA, 2022).

[2]UNEP (United Nations Environment Program), Emission Gap Report 2022, (UNEP, 2022).

[3]IEA (International Energy Agency), Net Zero by 2050: A Roadmap for the Global Energy Sector (IEA, 2021).

[4]IEA (International Energy Agency), World Energy Outlook 2022, (IEA, 2022).

[5]UNFCCC (United Nations Framework Convention on Climate Change), Report of the Standing Committee on Finance. Policy Report, (UNFCCC, 2021).

[6]IEA, World Energy Outlook.

[7]UNFCCC, Standing Committee on Finance.

[8]Silvia Kreibiehl, Tae Yong Jung, Stefano Battiston, Pablo Esteban Carvajal Sarzosa, Christa Clapp, Dipak Dasgupta, Nokuthula Dube, Raphaël Jachnik, Kanako Morita, Nahla Samargandi, and Mariama Williams, “Investment and finance”, in IPCC, 2022: Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change, (Cambridge University Press, 2022).

[9]Tracy Carty and Jan Kowalzig, Climate Finance Short-changed: The real value of the $100 billion commitment in 2019–2020, (Oxfam, 2022).

[10]“Country Default Spreads and Risk Premiums,” NYU Stern School of Business, last modified July 14, 2023.

[11]“Lending interest rate (%) – United States, India,“ The World Bank, accessed 10 July 2023.

[12] Sebastian Rockstuhl, Simon Wenninger, Christian Wiethe and Björn Häckel, “Understanding the risk perception of energy efficiency investments: Investment perspective vs. energy bill perspective”, Energy Policy 159, No. 1 (2021): 112616

[13]UNFCCC (United Nations Framework Convention on Climate Change), Sharm el-Sheikh Implementation Plan, (UNFCCC, 2022).

[14] Manish Kumar Shrivastava and Prabhat Upadhyaya, “Whither multilateralism? Implications of bilateral NAMA finance for development and sovereignty concerns of developing countries,” in Development and mitigation forum, eds. M. Jooste, E. Tyler, K. Coetzee, A. Boyd, & M. Boulle (University of Cape Town, 2014), 78–89.

[15]Shukla et al., Climate Change 2022: Mitigation of Climate Change, (Cambridge University Press, 2022).

[16]Carty and Kowalzig, Climate Finance Short-changed.

[17]Kreibiehl et al., “Investment and finance.”

[18] World Wide Fund for Nature, Financial instruments used by governments for climate change mitigation. WWF policy brief, (WWF, 2018).