Task Force 6: Accelerating SDGs: Exploring New Pathways to the 2030 Agenda.

This Policy Brief explores the scale and nature of commercial opportunities from adaptation to climate change, whilst stressing that adaptation to climate change is also a public good. It samples some enterprises in the real economy in India that produce adaptation goods and non-financial services, such as flood forecasting and drought-resistant seeds. The aim is to understand the diversity, size, and potential of these markets and discuss various policies as well as the financial barriers and other hurdles that these enterprises face. The brief uses this analysis to recommend that the G20 urgently mobilise greater volumes of private investment in adaptation solutions. This includes designing new innovative financing instruments to de-risk investments, advancing how adaptation is defined in green taxonomies, and encouraging national policy reform to break down barriers to private investment in adaptation.

1. The Challenge

1.1 Defining adaptation investment

Finance for adaptation is not flowing at a pace that could keep up with the worsening impacts of climate change, already being felt across the globe. International adaptation finance flows to low-and-middle income countries are five to 10 times below estimated requirements, and the gap is widening. Estimated annual adaptation requirements are US$160 billion to US$340 billion by 2030 and US$315 billion to US$565 billion by 2050.[1]

However, accurately tracking and estimating adaptation finance flows is difficult. Adaptation can take many forms and adaptation solutions being offered are not well-defined. The Intergovernmental Panel on Climate Change (IPCC) defines ‘adaptation’ as “the process of adjustment to actual or expected climate and its effects, in order to moderate harm or exploit beneficial opportunities” and an ‘adaptation activity’ is “the array of strategies and measures that are available and appropriate for addressing adaptation.”[2] These definitions are very broad, leaving much room for debate.

To unpack the definition of private investment in adaptation, it is useful to distinguish their three key characteristics:

- Protection against avoided losses in the future (the adaptation ‘benefit’).

- A profitable revenue stream (this is what makes them attractive to private sector operators).

- A public good benefit (they help reduce climate risks to the public or wider economy).

Some adaptation investments meet the first two criteria but not the third. These investments are designed purely to protect the operations of the company in question (‘adapted activities’ according to a green taxonomy – [Box 1]). These are important, but the government’s role is likely to be limited to raising awareness of the private sector on the necessity of making these investments.

This Policy Brief focuses on investments that meet all three criteria and bring significant benefits to the public or wider economy. These investments will support adaptation solutions across sectors, ranging from traditional infrastructure projects (e.g., schools, roads, and bridges) that require to be made resilient to climate change; to stand-alone adaptation projects, such as protecting the coast from erosion due to sea rise. Thus, it is difficult to ‘label’ or ‘itemise’ an activity as purely adaptation.

Of the US$46 billion of global adaptation finance identified in 2019–20, only 2 percent came from the private sector.[3] While this certainly underestimates the actual contribution, it indicates that private financing flows are being underutilised.

Box 1: The Need for a Coherent G20 Green Taxonomy

1.2 The untapped opportunity for private investment in adaptation to climate change

1.2 The untapped opportunity for private investment in adaptation to climate change

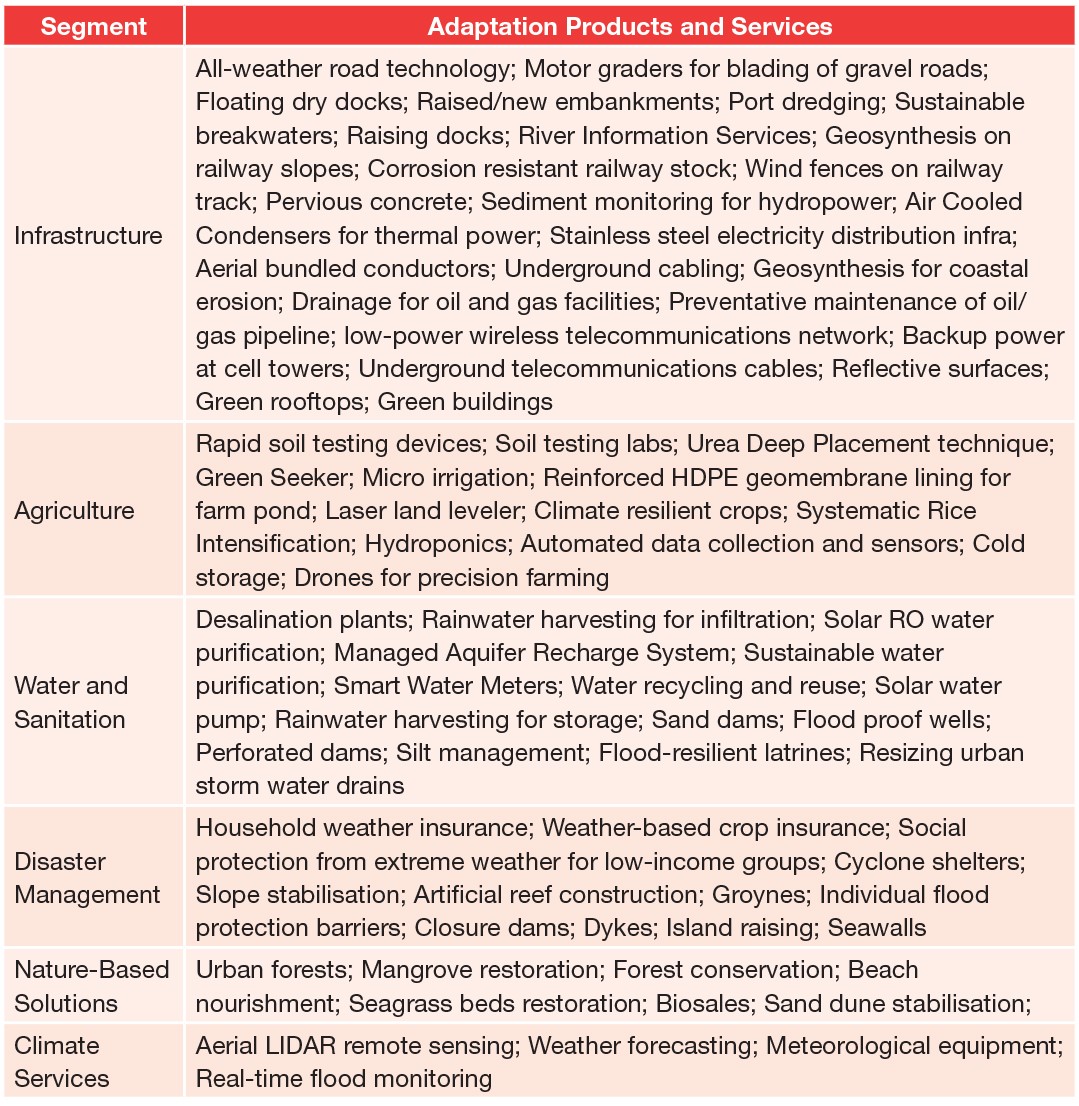

An analysis of a sample of adaptation solutions in India highlights some of the barriers that exist in mobilising private sector investment. There is a long list of adaptation solutions that could be offered by the private sector in nearly every segment of the economy and includes a range of investment types. A sample of 77 adaptation goods and services were identified in India as having potential for increased private investment (Table 1). Of these, over 40 percent are infrastructure opportunities, 27 percent are manufacturing, 24 percent are services, and 6 percent involve the provision of resources. Many, though, cut across multiple categories.

Table 1: Adaptation Solutions in India, Viable for Private Investment

Source: Authors’ own

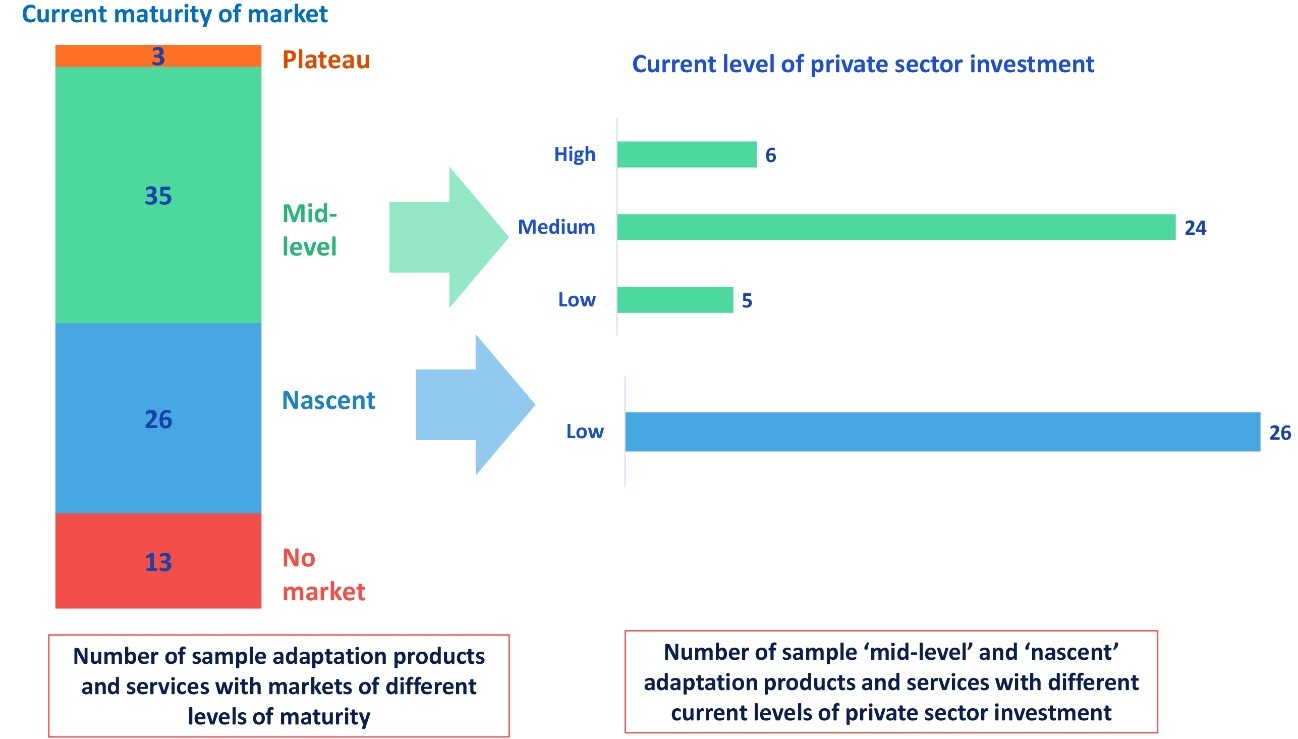

This sample indicates that there is a strong business rationale for investing in adaptation goods and services. An estimated 80 percent of the markets are considered nascent or mid-level markets (meaning high growth is expected) and the current private investment in these adaptation solutions markets is mostly low or medium.

Figure 1: Rating the Maturity, and Current Private Investment of Sample Adaptation Markets

Source: Authors’ own

The market size and investment potential of seven adaptation solutions are described below.[4]

Construction of solar-powered utility-scale desalination and waste-water-treatment plants (WWTP). Utility-scale desalination and WWTP is a mid-level mature market in India, but the use of solar power at treatment plants is still at the pilot stage. In Tamil Nadu, a desalination plant costing US$175,000 has a capacity of 10,000 litres daily. The market size by 2026 is expected to be US$500 million for solar-powered desalination, and US$1.55 billion for solar-powered WWTP. The approximate ticket size of a utility-scale project is US$130 million, with return expectations of 9–11 percent.

Installation of green technology at ports. ‘Green ports’ use a number of viable technologies to reduce energy use and emissions, increase water and resource efficiency, and reduce the environmental effect of the port. The Government of India is promoting this technology through the upcoming Green Ports Policy (GPP) which is expected to require 50 percent of water to be reused and recycled by 2025. There is a clear revenue stream from the installation of the technology by developers or through engineering, procurement, and construction (EPC) contracts, with various cost recovery mechanisms possible, such as adjustments to the revenue share with the port operator.

A small number of India’s current 13 major ports and 205 non-major ports have the green technology installed, providing an immediate market to service. Each green port technology’s market size varies: for example, on-port sewage waste-water treatment plants have an estimated market size in 2026 of US$67 million. The individual technology ticket size also varies, but the average cost of installing a sewage treatment plant is US$3.4 million (major port) and US$181,800 (non-major port) with return expectations of approximately 14–16 percent.

Manufacturing and installation of rainwater harvesting systems (RHS). RHS technology ranges from simple low-cost to large-scale ones and can be installed in residential homes (55 percent of the market), large buildings, and infrastructure. It collects and stores rainwater for agriculture, domestic or other uses, helping to protect against water scarcity, manage stormwater, and prevent flooding and soil erosion. There is a clear revenue stream based on the market demand for manufacture, installation, and maintenance of RHS. The residential segment has seen CAGR of around 7 percent in recent years and could touch US$0.8 billion to 1 billion by 2026. Currently only 8 percent of rainwater is being harvested and only 18 percent of rural households have tap connection. Depending on the size and the site location, RHS technology costs can vary considerably.

Service providers for a variety of climate and weather data, analytics, and tools. ‘Climate services’ is a broad term to cover a variety of applications, users, and markets, such as weather forecasts, climate analytics, risk modelling, and remote sensing. Private and public sector customers use this weather and climate data and analysis to make decisions that consider the immediate and longer-term risks of climate change. One example of commercial climate service are the private providers of weather forecasting that tailor weather information for both public and private clients.

The overall market size for climate services is difficult to estimate given its diverse scope. The private weather forecasting service was valued at US$100 million in 2019, which, if it follows global market trends of CAGR of 9.9 percent, could touch US$160 million to US$170 million by 2026. A related market, the private sector geospatial market, was valued at US$280 million in 2020.

Manufacture of decentralised solar-powered cold storage systems and solar cooling-as-a-service (CaaS) providers. Decentralised solar-powered cold storage is a nascent technology in India, with an estimated 3,000 units (of 5 tonnes –100 tonnes capacity each) installed. The units are off-grid with a thermal (ice) battery, but can connect to the grid for back-up power. Cold storage in India is a high-growth market, and there is an opportunity for solar-powered systems to fill the US$20 billion opportunity across all chilling segments. India produces more than 400 million tonnes of perishables (horticulture produce, dairy, meat, fish, and such) every year, but it has a cold storage capacity (solar and non-solar) of just 32 million tonnes. The decentralised cold storage market was US$9 million in 2022, and is projected to be US$13 million in 2026, of which 33 percent will be solar (US$4.3 million).

Manufacture of decentralised solar-enabled desalination and waste-water-treatment plants (WWTP). Decentralised solar-enabled desalination and WWTP is less energy intensive and more sustainable than utility scale systems. However, the technology has not yet been demonstrated in India beyond small-scale pilots. The market for this technology is expected to be industrial clusters, governments in rural and remote areas, large residential associations, and the like.

It is estimated that by 2026, just eight commercially viable installations will be feasible for both solar-enabled desalination and WWTP, valued between US$2 million and US$4 million. Each unit is assumed to cost US$262,000 based on pilots done for a throughput of 10,000 litres daily. In the future, if each technology provides 1 percent of freshwater demand projected for 2030, the total market size would be US$7 billion–US$8 billion.

Establishment and operation of large-scale solar-powered hydroponics farms. Hydroponics is a method of growing crops in a controlled environment, without soil, in nutrition-rich water solution. This uses up to 90 percent less water than traditional agriculture practices and is therefore more resilient to temperature and rainfall changes. It requires less land and can be used in urban settings. Hydroponics can provide health benefits by not requiring as much pesticide use as in traditional agriculture practices. The hydroponics market is nascent in India; in 2019 the market size was 3,100 tonnes and valued at US$4.5 million. However, it is expected to grow by 26 percent annually to reach 10,500 tonnes by 2023 and by 13 percent till 2028. Hydroponic start-ups in India have received seed funding of US$125,000 and Series A funding of US$5.5 million.

1.2 Barriers to private investment in adaptation

Analysis of the barriers to mobilising increased investment in adaptation solutions reveal some of the critical problems that the G20 needs to consider.

Policy and regulatory barriers are fundamental for those markets where currently the adaptation solution is being provided by the public sector and the private sector is dependent on government contracts or public–private partnerships. For example, public procurement for converting overhead to underground cables and constructing new cable lines.

The wider regulatory environment is still important for markets in which one company is producing or providing a service to another company or to private citizens; for example, the manufacturing of geosynthesis to prevent coastal erosion in infrastructure projects. This includes setting standards, consumer incentives, and removing barriers such as in land acquisition.

Access to finance is one of the main challenges faced by both buyers and providers of adaptation solutions. These markets require access to capital flows to scale up promising technologies and services. 46 percent of the adaptation solutions sampled in India highlighted ‘financial barriers’ as a key reason for delayed market- entry. Finance problems should be temporary for viable markets offering reliable returns. However, in the short term, financial markets may be slow to respond to new opportunities, overestimating risks in new technologies or services.

Incomplete or asymmetric information occurs as actors—be it investors, farmers, or businesses—are unaware of the scale of climate risks and the measures available to mitigate them. This is a fundamental demand-side challenge for half of adaptation goods and services sampled in India. For example, solutions targeted at small-scale farmers (e.g. urea deep placement technology) face a highly fragmented consumer base who may not yet be aware of the risks from current practices, and the opportunities from this new technology.

Technological or skill limitations arise when a technology remains nascent or unproven. For example, geosynthesis and its application in India in different sectors and local conditions is still developing, and the relevant technical manufacturing and engineering expertise is limited. In some cases, the technology is not easily available at low cost, for example, rapid soil testing devices in India.

2. The G20’s Role

The G20’s Sustainable Development Roadmap sets out the important role for the G20 in scaling up sustainable finance. As the Sustainable Finance Working Group implements these priorities, it should give more attention to private sector finance for adaptation solutions, as the barriers to mobilising such investment are significantly different than those of mitigation solutions. In particular:

- The market for adaptation solutions tends to be smaller than mitigation solutions. In the sample from India, the largest adaptation investment opportunity (which also provides mitigation benefits) was solar-powered utility scale WWTP (estimated market size of US$1.55 billion in 2026). In contrast, the equivalent estimated market size for electrolysers required to produce green hydrogen is US$32 billion.

- The ticket size for adaptation investment opportunities, particularly the non-infrastructure ones, tends to be smaller. This is partly because adaptation solutions have to be tightly defined and clearly separated from the ‘development’ investment that are being made more difficult (to avoid ‘green washing’). This makes mobilising finance harder and more costly.

As a result, the G20’s approach to mobilising private investment in adaptation solutions must be carefully considered, depending on the maturity of the market, potential for growth, and ticket size of potential investments.

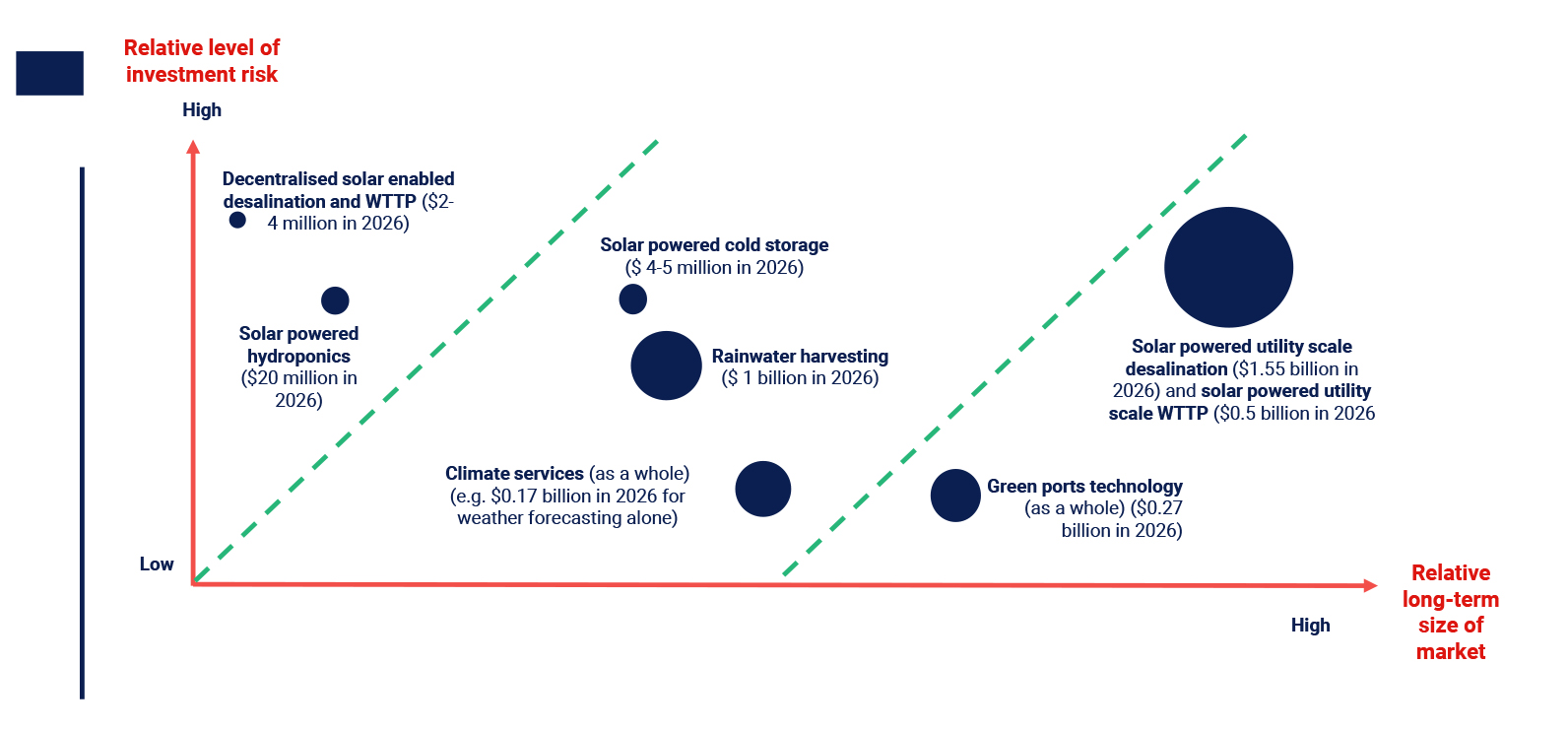

Figure 2 maps the seven adaptation investment opportunities in India against three dimensions: the relative estimated market size in 2026 (indicated by size of bubble); long-term market size (up to 2050); and level of investment risks.[5] They can be divided into three groups:

- Ready for (relatively) large sums of investment (right side): In adaptation solutions with a large market potential, investment risk is low, and provides for relatively large individual ticket size for investments.

- Ready for limited sums of investment (middle): For adaptation solutions with a medium market-size potential, individual ticket size and level of investment risks matter.

- Requires pro-market support (left side): For adaptation solutions with a small market potential, individual ticket size and level of investment risks become important.

Figure 2: Adaptation Investment Opportunities Vs. Market Size and Investment Risk

Source: Authors’ own

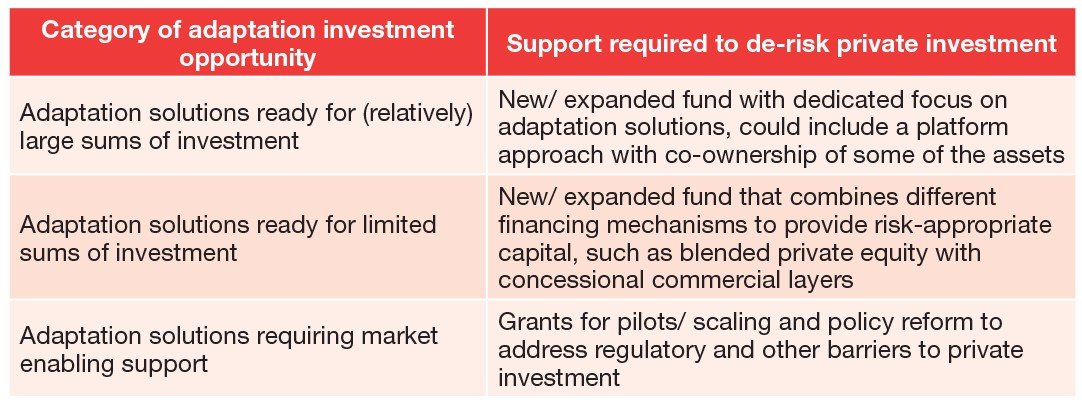

The G20 must identify and support innovative methods of de-risking private investment in such adaptation solutions. Table 2 summarises some examples of how to do this for each category of adaptation investment opportunity.

Table 2: Examples of Support to Catalyse Increased Private Investment

Source: Authors’ own

3. Recommendations to the G20

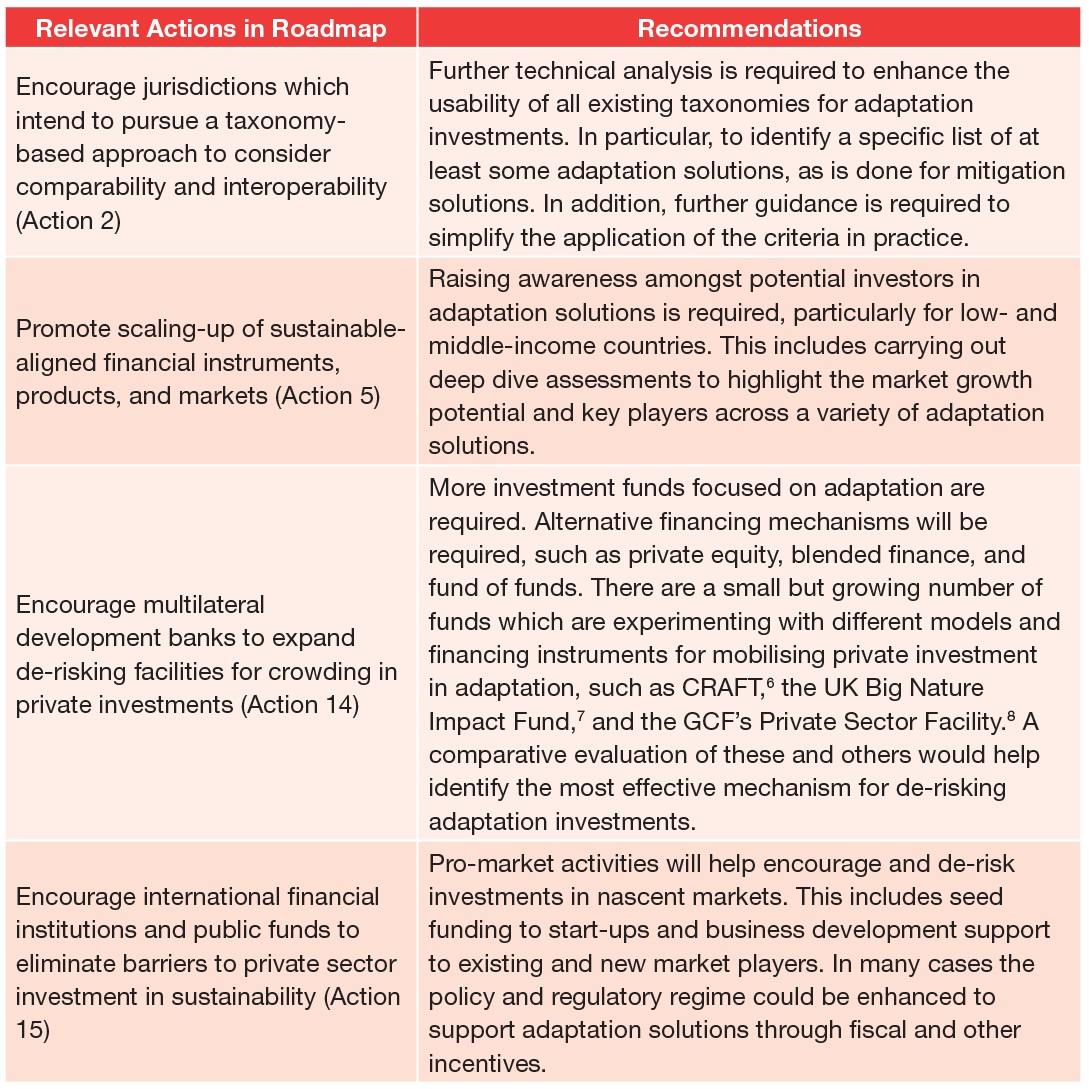

The G2O’s Sustainable Finance Roadmap provides comprehensive actions required to scale-up sustainable finance. Four focus areas of the roadmap can help deal with the challenge of mobilising private investment in adaptation. An increased focus on adaptation finance in the roadmap would also signal the G20’s recognition of developing countries’ particular vulnerability to climate change. Table 3 summarises the additional actions required.

Table 3: Recommendations for G20 Sustainable Finance Roadmap

Source: Authors’ own

Attribution: Elizabeth Gogoi, Rishika Das Roy, and Arun Krishnan, “Mobilising Private Investment for Adaptation to Climate Change,” T20 Policy Brief, July 2023.

This brief draws on analysis prepared under the Green Growth Equity Fund (GGEF) Technical Cooperation Facility including the contribution of Phil Marker, Sunit Kumar Arya, Sandeep Mohanty, Avdhoot Bane, Rushikesh Bhakra and others.

Endnotes

[1] United Nations Environment Programme (UNEP), “Adaptation Gap Report 2022,” (Nairobi: UNEP, 2022)

[2] IPCC, “2022 Annex II: Glossary”.

[3] Climate Policy Initiative (CPI), “Global Landscape of Climate Finance 2021,” (London: Climate Policy Initiative (CPI), 2021).

[4] Due to the page limits for this Policy Brief, the sources for this section could not be provided. For the extended version of the paper please download from.

[5]The investment risk is an approximate rating, given maturity of the market, technology penetration, policy enabling environment etc.