Task Force 4: Refuelling Growth: Clean Energy and Green Transitions.

Abstract

Steel is a major contributor to global emissions, and the industry is only expected to grow, owing to demand by emerging economies. This increase in demand and production necessitates the urgent transition to green steel production pathways. International finance institutions (IFIs) such as multilateral development banks (MDBs) can play a catalytic role in ensuring that developing and emerging economies benefit from and are included in this transition. As the G20 sets out the mandates of IFIs and international climate finance, its member states have the opportunity to be key players in rolling out low-carbon steel production globally. Based on interviews with IFIs, this Policy Brief offers five recommendations to nurture collaboration between the G20 and IFIs to build the necessary knowledge, support, and infrastructure for a rapid transition to ‘green steel’ in developing and emerging economies.

1. The Challenge

The steel industry accounts for 11 percent of CO2 emissions and 7 percent of total greenhouse gas emissions.[1] The steel sector must therefore reach net-zero emissions if the global community seeks to achieve the goals of the Paris Agreement.

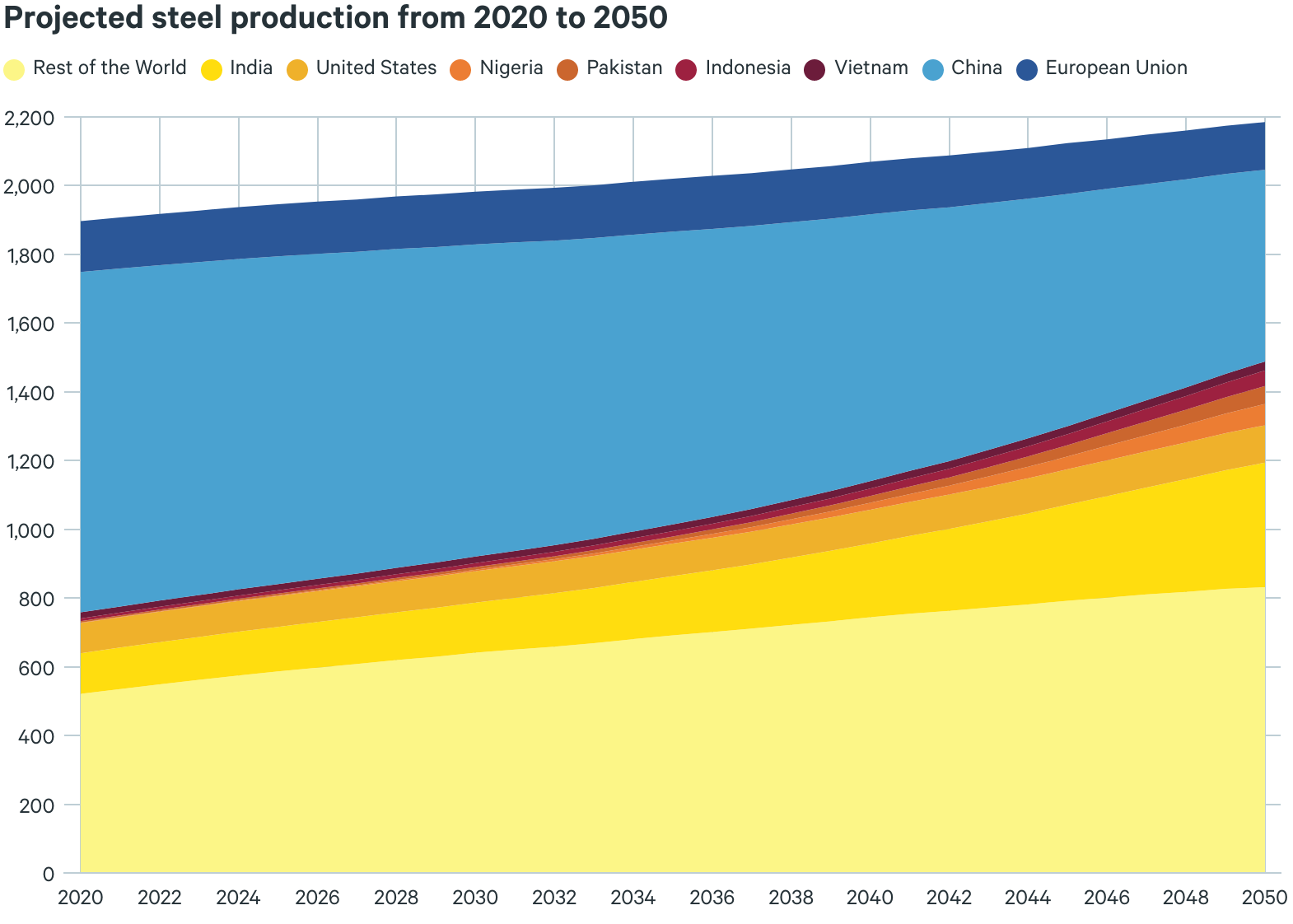

Most steel production is concentrated in Asia, with 54 percent of global production taking place in China alone.[2] While China is anticipated to produce the largest amount of steel in the coming decades, its overall production will fall, while production in the US and the EU is expected to plateau.[3] During this period, production will likely increase most significantly in India, Nigeria, Pakistan, and Indonesia, marking a geographic shift in global steel production (see Figure 1).[4] This shift is taking place as global demand for steel increases due to population growth, industrialisation, and urbanisation in emerging economies.[5] In a medium-demand scenario, in which countries converge on a demand of 250 kg per capita per year by 2080, global demand is estimated to increase from 1900 million tonnes (Mt) today to 2200 Mt in 2050.[6]

Figure 1: Projected Steel Production (2020–2050) for the Largest Steel-Producing Countries and Rapidly Growing Producers

Source: Adapted from Bataille et al. (2021)

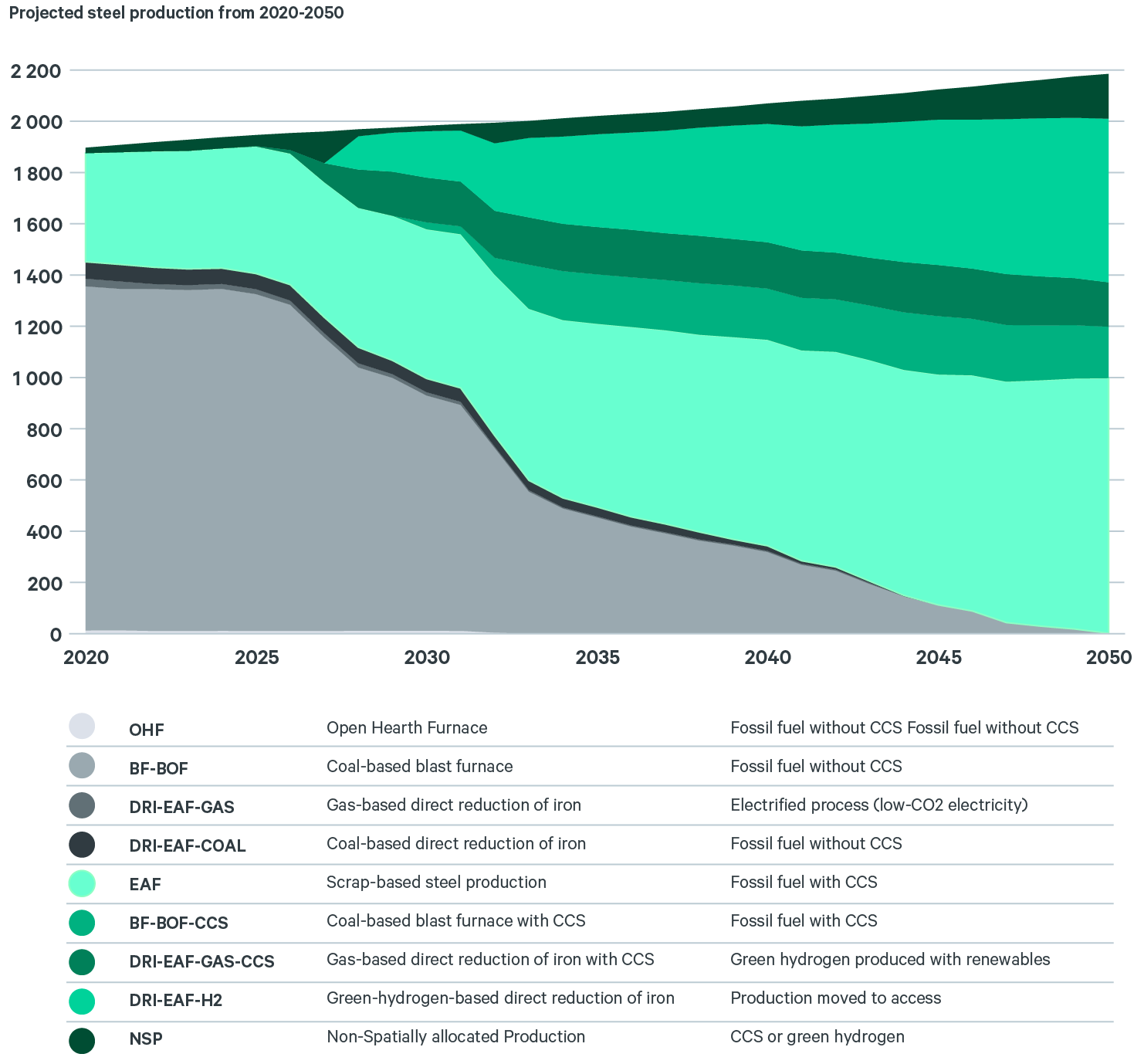

With growing demand for and production of steel in emerging and developing countries, these economies would need to transition to clean production pathways at the earliest. Figure 2 shows what the transition to green steel production methods in a net-zero pathway could look like. This Policy Brief discusses the role of international finance institutions (IFIs) such as multilateral development banks (MDBs), development finance institutions, and international green funds in supporting the shift to low-carbon steel production in emerging and developing economies. Very few IFIs currently have strategies in place to support green steel production, though there is growing global momentum for their development. IFIs can kickstart the transition to green steel, especially in emerging and developing regions, but this potential for promoting green industry, and green steel production in particular, is underexplored.[7]

Figure 2: Global Steel Production by Technology in a Net-Zero Pathway

Source: Adapted from Bataille et al. (2021)

The current state of IFIs and green steel

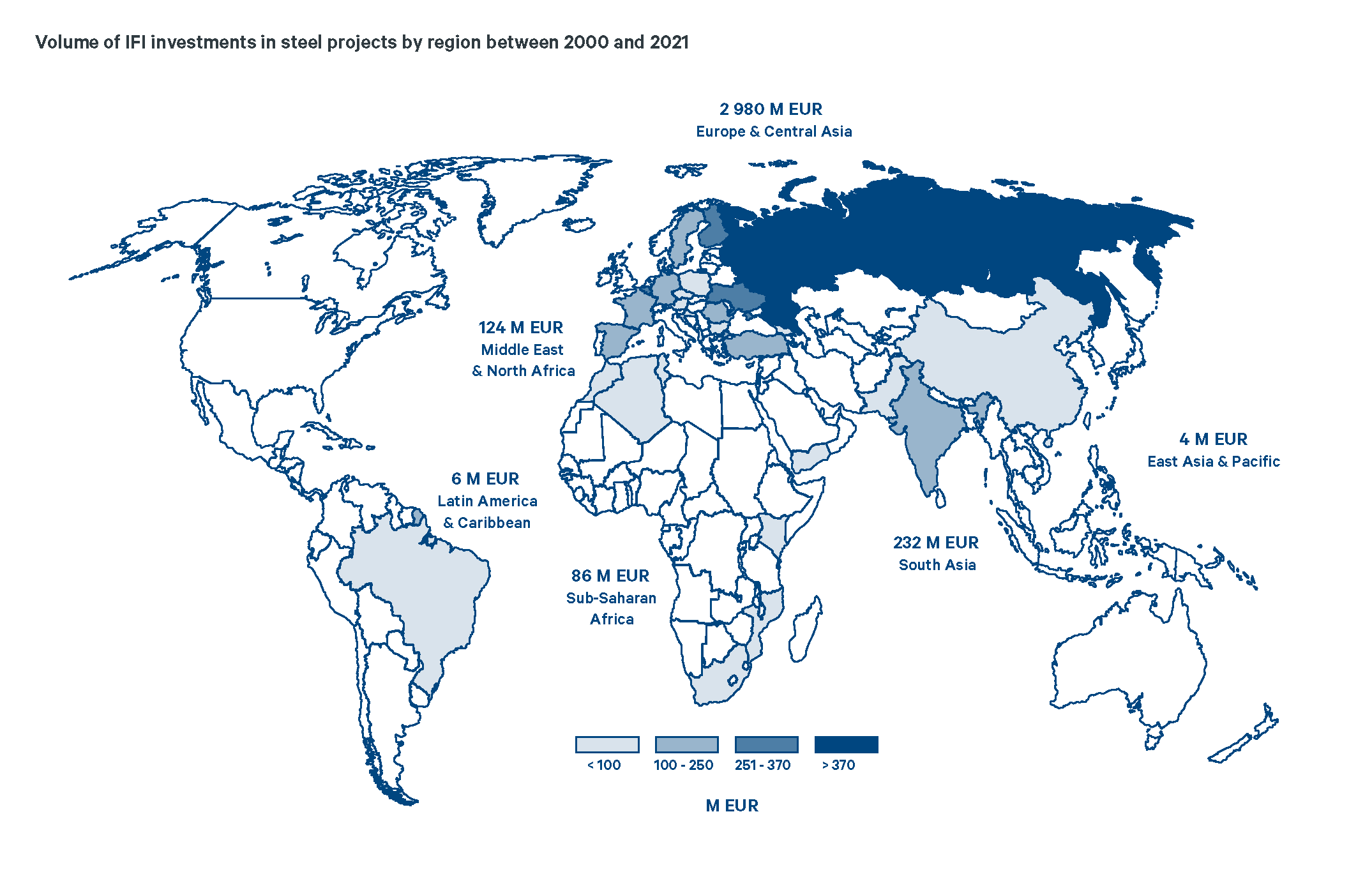

To explore IFIs’ engagement with green steel, the authors of this Brief analysed the project databases of 24 IFIs to assess their current exposures.[8] Figure 3 illustrates these IFIs’ current exposures to the steel sector.

Figure 3: Volume of IFI investments in Steel Projects by Region (2000–2021)

Source: Authors’ own

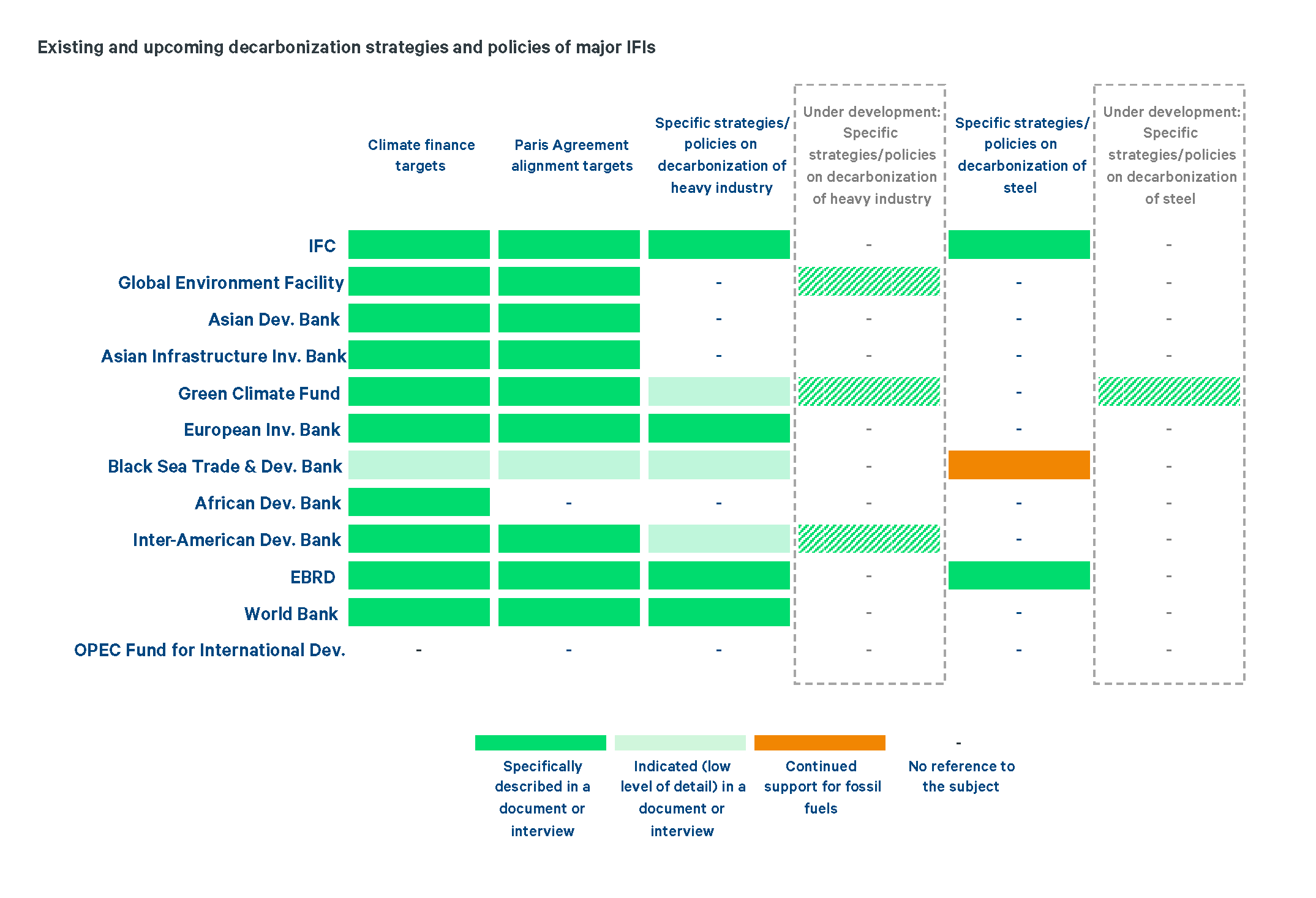

We then selected 12 IFIs to review their policy documents and assess their forward-looking strategies on decarbonising heavy industry, specifically strategies for the steel sector. Of the 12 IFIs, four had published heavy industry decarbonisation strategies at the time of review and only two had steel-related strategies (see Figure 4). Finally, we interviewed a selection of key IFIs,[9] and through these interviews, we identified three more IFIs that intended to publish policies explicitly focused on heavy industry in upcoming strategy documents. One of these forthcoming strategies will address the steel industry specifically. Our research found that even when IFIs do have industry decarbonisation strategies, they often lack detail and only cover industry best practice, energy efficiency, and circularity.[10]

Figure 4: Existing and Upcoming Decarbonisation Strategies and Policies of Major IFIs

Of the analysed IFIs, EBRD has the most developed decarbonisation strategies in terms of steel, which include financing technologies and infrastructure for clean energy and emissions reduction. EBRD is also working to develop low-carbon pathways with the International Energy Agency. The IFC mentions investments in decarbonising the steel sector as an example of the type of investment they could make through a new fund, run by the venture capital firm The Engine, to scale up global technology solutions in emerging markets.[11] In their 2021 report, the IFC reported a US$20 million investment in this fund. [12]

On the other hand, BSTDB continues to explicitly support projects involving metallurgical coal for steel production.[13] This goes against the trend of major IFIs moving away from financing coal projects over the last decade.[14] At the same time, none of the strategies and policies that were reviewed commented on exposure to coal as a consequence of investments in conventional steelmaking projects.[15]

Most IFIs follow common greenhouse gas accounting frameworks that consider significant embodied emissions (scope 3 emissions) from financed projects. Yet, most IFIs do not define their understanding of ‘significant’, and few have published anything on scope 3 emissions related to heavy industries or the use of heavy-industry products such as cement and steel in areas such as infrastructure projects. A notable exception is the Inter-American Development Bank, which has published methods for calculating greenhouse gas emissions for steel, iron, and cement, as well as a method for calculating embodied emissions (e.g., in buildings and construction).[16]

2. The G20’s Role

The past few years have witnessed increasing debates on reforming multilateral banks,[17] with the key issue being how MDBs can responsibly modify their approaches to risk in order to increase the amount of financing in developing countries. This increased capital could be particularly important to address global challenges such as climate change and biodiversity loss but also to better respond to other crisis situations.

The G20 commissioned an Independent Review of Multilateral Development Banks’ Capital Adequacy Frameworks, which arrived at a number of suggestions on how MDBs could modify their current approaches to risk.[18] As these dialogues with MDBs progress, more assertive MDBs, along with multilateral sources of climate finance, could play a crucial role in advancing investment in climate-critical technologies and projects in the steel sector. This is directly in line with the outcomes of the Energy Transition Ministers’ Meeting in Bali (2022), where the G20 adopted the Bali Energy Transitions Roadmap, calling for industry-specific recommendations in priority sectors such as steel, cement, and metals.[19]

China, the EU, and the US have adopted assertive ‘green industrial policies’ in recent years. These strong support measures in the world’s major economies have set in motion a global race to scale up low-carbon energy and the technologies needed to decarbonise energy-intensive sectors such as steel, cement, chemicals, and transport.[20] Given this shift towards green industrial policy, it is crucial to ask how developing and emerging economies can also participate in this transition. If regions that have the largest expected growth and re-investment in industrial production are not included in the race for green industry, global climate targets will not be met. IFIs can play a catalytic role in ensuring that developing and emerging economies benefit from and are included in the green industrial race.

Investment in low-carbon steel production is exactly the kind of higher-risk investment (but also with a high climate impact) that the reform of MDB practices is concerned with. This Policy Brief makes several proposals for how IFIs can help scale investment in green steel in emerging and developing regions. This is of direct relevance to the G20 member states. The G20 represents the most important shareholders and partners of the major MDBs and other sources of multilateral climate finance and is in a position to provide these IFIs with the mandates they need to play leading roles in realising green steel investments globally.

3. Recommendations to the G20

IFIs that are important sources of development and/or climate finance in developing and emerging regions in which steel production can be expected to expand over the coming decades were interviewed. These interviews allowed a better understanding of the barriers that IFIs face in advancing the transition of the steel sector and the opportunities for IFIs to play a larger role in this transition.[21]

The priorities of both donor countries and recipient countries in the G20 guide IFI-lending practices, help set their strategic focus, and create a clear direction of travel and momentum for the international flow of finance in combination with other bilateral and multilateral efforts. The following recommendations are directed at IFIs that we believe should guide G20 members’ expectations with respect to IFI strategies on green steel.

-

Act as knowledge partners for governments

IFIs can act as knowledge partners to support countries in further developing their priorities. In this way, IFIs can support the first steps towards green industry strategies with lower levels of funding. Financing large industrial actors in the steel sector may not make sense for some IFIs, but directing financing towards feasibility studies and the development of policy frameworks can be a critical step for building capacity.[22]

-

Support roadmaps for hydrogen

New industrial technologies, such as hydrogen-based steel production, appear to be ready for commercialisation soon.[23] As such, there is a clear climate impact case for IFIs to engage with green steel production. IFIs can support related emerging technologies, particularly hydrogen production from renewable electricity. As hydrogen has a role to play in the green transition of several sectors, IFI engagement can simultaneously support multiple transition pathways. As a first step, IFIs can help facilitate country roadmaps for hydrogen in collaboration with both the government and industry. This type of roadmapping and planning sends clear signals to market actors on the directions that countries are taking.[24]

-

De-risk and finance first-movers in industrial production, and small and medium-sized enterprises in green value chains

By financing early adopters of low-carbon production technologies and practices, IFIs can help de-risk investments and mobilise other sources of private capital, help projects access other sources of official climate finance, and deliver credible due diligence to projects that can help attract other investors. Adopting this approach would contribute to the Bali Compact that came out of the G20 Energy Transitions Ministers’ Meeting in 2022 and called for mobilising all sources of finance for an inclusive energy transition.[25]

IFIs can also play a role in financing innovative small and medium-sized enterprises that are part of green value chains for industrial production. For some IFIs, this may be a more suitable approach than working with large established corporates. Hydrogen production and transport are good examples of potential IFI niches in the green steel value chain. Establishing new hydrogen value chains involves trying to mobilise demand signals, production capacity, and needed infrastructure simultaneously. Balancing these elements of market formation involves clear market risks, and IFIs can play an important role in providing financing terms that moderate these risks. Opportunities could also be found in value chains in scrap-based steel production. In addition, IFIs should continue to support the deployment of utility scale renewables needed for the electrification of industrial processes.[26]

-

Support demand through procurement strategies in own operations

On the demand side, IFIs can support governments in developing standards and green public procurement frameworks or roadmaps. IFIs can also develop their own green procurement standards which, given their role in financing basic infrastructure, can be important for developing lead markets. There are demand-side challenges for IFIs, as green steel is not currently available. At the same time, developing strategies and standards for defining green materials and products would send important market signals, and IFIs can potentially play a key leadership role in laying out the way forward on green procurement.[27]

-

Support secondary steel production and circular business models

The volume of steel produced based on scrap must increase dramatically, doubling from a quarter of total global production to half. Scrap-based production in particular can be important in the developing regions that IFIs are engaged with. Our own research and interview responses suggest that this form of steel production can fit well with IFI priorities and financing given its clear climate benefits and the scale and location of projects.[28] In addition, many IFIs are placing growing emphasis on circular business models, and historically, the only greenfield projects financed by IFIs have been for secondary steel. EBRD funded one mini-mill project in Georgia in 2008 and one in Russia in 2007.[29]

Attribution: Aaron Maltais et al., “Promoting G20 Collaboration With International Financial Institutions to Support ‘Green Steel’ Production,” T20 Policy Brief, May 2023.

[1] Caitlin Swalec and Christine Shearer, “Pedal to the Metal,” Global Energy Monitor, 2021.

[2] Chris Bataille, Seton Stiebert, and Francis G. N. Li, “Global Facility Level Net-Zero Steel Pathways,” Institute for Sustainable Development and International Relations, 2021.

[3] Bataille, Stiebert, and Li, “Global Facility Level Net-Zero Pathways”

[4] Bataille, Stiebert, and Li, “Global Facility Level Net-Zero Pathways”

[5] International Energy Agency (IEA), “Industry: Sectoral Overview,” accessed May 16, 2023.

[6] Bataille, Stiebert, and Li, “Global Facility Level Net-Zero Steel Pathways”

[7] Aaron Maltais et al., “The Role of International Finance Institutions in the Transition to Low-Carbon Steel Production,” Leadership Group for Industry Transition, 2022.

[8] The institutions included in this analysis were the African Development Bank (AfDB), the Arab Fund for Economic and Social Development (AFESD), the Asian Development Bank (ADB), the Asian Infrastructure Investment Bank (AIIB), the Black Sea Trade and Development Bank (BSTDB), the Caribbean Development Bank (CDB), the Climate Investment Funds (CIF), the Council of Europe Development Bank (CEB), the Development Bank of Latin America (CAF), the Eurasian Development Bank (EDB), the European Bank for Reconstruction & Development (EBRD), the European Financing Partners (EFP), the European Investment Bank (EIB), the Global Environment Facility (GEF), the Green Climate Fund (GCF), the International Finance Corporation (IFC), the Inter-American Development Bank (IADB), the Islamic Development Bank (IsDB), the New Development Bank (NDB), the Nordic Investment Bank (NIB), the North American Development Bank (NADB), the OPEC Fund for International Development (OFID), the Organization of American States (OAS), and the World Bank.

[9] The IFIs operating in emerging and developing countries that we were able to secure interviews with were the IFC, GEF, ADB, AIIB, GCF, IDB, and EBRD.

[10] Maltais et al., “The Role of International Finance Institutions in the Transition to Low-Carbon Steel Production”

[11] Maltais et al., “The Role of International Finance Institutions in the Transition to Low-Carbon Steel Production”

[12] International Finance Corporation (IFC), IFC Annual Report 2021: Meeting the Moment, 2021.

[13] Black Sea Trade & Development Bank (BSTDB), “BSTDB Climate Change Strategy,” 2021.

[14] International Institute for Sustainable Development (IISD), “Fossil Finance from Multilateral Development Banks Reached USD 3 Billion in 2020, but Coal Excluded for the First Time Ever,” March 30, 2021.

[15] Maltais et al., “The Role of International Finance Institutions in the Transition to Low-Carbon Steel Production”

[16] Maltais et al., “The Role of International Finance Institutions in the Transition to Low-Carbon Steel Production”

[17] Johannes F. Linn, “Expand Multilateral Development Bank Financing, but Do It the Right Way,” Brookings, November 29, 2022.

[18] Overseas Development Institute (ODI), “Reforming Capital Adequacy at MDBs: How to Prudently Unlock More Financial Resources to Face the World’s Development Challenges,” September 28, 2022.

[19] G20, “Decade of Actions: Bali Energy Transitions Roadmap,” September 2, 2022.

[20] Noah Kaufman, “Economists Can Be Helpful in the Era of Green Industrial Policy,” Center on Global Energy Policy at Columbia University, March 7, 2023.

[21] Maltais et al., “The Role of International Finance Institutions in the Transition to Low-Carbon Steel Production”

[22] Maltais et al., “The Role of International Finance Institutions in the Transition to Low-Carbon Steel Production”

[23] Leadership Group for Industry Transition, “Green Steel Tracker,” accessed May 16, 2023.

[24] Maltais et al., “The Role of International Finance Institutions in the Transition to Low-Carbon Steel Production”

[25] G20, “Bali Compact,” September 2, 2022, http://www.g20.utoronto.ca/2022/220902-bali-compact.html.

[26] Maltais et al., “The Role of International Finance Institutions in the Transition to Low-Carbon Steel Production”

[27] Maltais et al., “The Role of International Finance Institutions in the Transition to Low-Carbon Steel Production”

[28] Maltais et al., “The Role of International Finance Institutions in the Transition to Low-Carbon Steel Production”

[29] European Bank for Reconstruction and Development (EBRD), “CHTPZ Steel”.; European Bank for Reconstruction and Development, “Geo Steel”.