Task Force 3: LiFE, Resilience, and Values for Wellbeing

Abstract

The maritime transport and logistics sector accounts for 80 percent of international traffic involving goods in terms of volume. The slowdown in international trade flows following the global financial crisis, and the disruptions in global value chains (GVCs) brought about by the COVID-19 pandemic and the Russia-Ukraine war, have raised awareness about the need to create new infrastructure models in this sector. These models should combine sustainability strategies and digital tools to help make the mechanisms governing freight traffic more resilient, fluid, and environment-friendly. The Green Ports model has the potential to foster investment in sustainable infrastructure while enhancing maritime transport resilience. Strengthening a coordinated infrastructure investment strategy for the maritime transport sector at the G20 level is crucial to respond to the challenges of increasing geoeconomic fragmentation.

1. The Challenge

GVC Vulnerabilities in a Multi-Crisis Scenario

Substantial vulnerabilities in global supply chains have recently emerged not only as a result of the COVID-19 pandemic and the Russia-Ukraine war, but also because of geopolitical tensions and climate change. Disruption in global production networks has reignited the debate on the reconfiguration of global value chains (GVCs); industrial policy options, such as reshoring or near-shoring, are being increasingly considered as policy tools to secure the supply of critical products.

There is evidence that the pandemic neither spurred significant reconfiguration of international production nor induced firms’ plans to downsize foreign production (Botti et al. 2021, 8-10). Although there is still little evidence of production reshoring in the most advanced economies as a result of the geopolitical fallout of the Russia-Ukraine war,[a] companies are diversifying or duplicating their suppliers and sourcing countries and building inventories to secure their access to key raw materials and intermediate or final products (Work Stream on Open Strategic Autonomy, 2023)

Other signs of an ongoing structural transformation of global supply chains are emerging at the industry level (vertical integration is recovering in specific sectors, such as automotive and batteries) and in foreign direct investment (FDI) flow trends. Greenfield FDIs flowing into China have been nearly halved compared to the mid-2000s (UNCTAD 2022) and multinational staff and imports are shifting from early FDI destinations, especially China, to other Asian countries.

More generally, the resurgence of economic national security as a dominant concept in the political economy of global powers and the resulting fragmentation may affect the functioning of the multilateral system. It could also lead to a subsidy race in critical sectors as well as a growing weaponisation of trade and investment policy (Botti 2022, 6-10).

Regionalisation Trends in Transport Routes and Logistics

Maritime transport has a substantial impact on global trade. According to the United Nations Conference on Trade and Development (UNCTAD), maritime routes account for more than 80 percent of the import-export volume between countries across the world. In 2020, nearly 11 billion tonnes of goods of various types (containers, dry bulk, energy products, Roll on – Roll off[b]) were transported through the world’s ports, impacting the logistics of all countries. These goods were carried by ships of all categories (UNCTAD 2022).

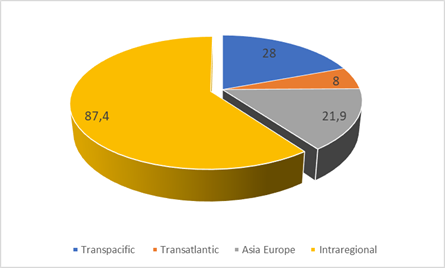

The main container routes, which are a proxy for world manufacturing trade,[c] included the transpacific, transatlantic, Asian-Mediterranean and intraregional ones. Figure 1 shows the distribution of container traffic among the strategic routes.

However, it is essential to note that aspects of the shipping industry may vary across states. For instance, the Logistics Performance Index (LPI) of the World Bank, which measures a country’s logistics efficiency (including maritime logistics efficiency), places three developing countries—India, Bangladesh and Vietnam—at 38, 88 and 43, respectively, in its world rankings, with varying deficiencies. (Germany and the Netherlands are, for example, two developed countries that rank high in logistics performance).[d]

Figure 1: Strategic Global Maritime Routes (Container, Million TEUs, 2022)[e]

Source: SRM on Clarksons

Between 2001 and 2022, container traffic between Europe and Asia grew at an average annual rate of 4.4 percent while that along the transatlantic route increased by 2 percent. Traffic on the transpacific route, which is still the primary one in terms of volume, grew by 4 percent. These figures highlight the growing importance of regional routes for long-distance traffic, particularly in the Mediterranean basin. The significance of the Mediterranean is reinforced by the fact that the Suez Canal witnesses around 12 percent of the world maritime traffic; 27 percent of container liner services and 30 percent of oil traffic pass through it, involving approximately 20,000 ships a year.

Intraregional routes continue to grow significantly, at an average rate of 6.8 percent per year. There is, therefore, an important share of traffic involving short sea shipping, a mode of transport that in itself is more sustainable (a short route means a ship discharges less carbon dioxide) and makes a port system more resilient to traffic delays due to logistic chains getting jammed by any kind of economic shock. According to Eurostat’s data for 2021,[f] the Mediterranean basin was the main area in the EU-27 for maritime traffic pertaining to short sea shipping, with 627.8 million tonnes of goods, accounting for 35.2 percent of the European volume.

This trend in naval traffic is probably one of the components of the so-called ‘globalisation, regionalisation’ phenomenon, i.e. the tendency to increasingly improve economic and trade relations with neighbouring or nearby countries without neglecting those with large markets. However, there is still a structurally crucial freight traffic on which large shipping companies have based a considerable part of their fleet, especially large container ships and those transporting energy supplies (gas and oil tankers).

Recent events have exposed the vulnerabilities of long logistics chains. For example, on 23 March 2021, the Suez Canal was blocked by a giant container ship, Ever Given, causing delays in the arrival of ships into ports and disrupting production cycles after raw materials were stuck in the cargo holds of ships waiting at the canal entrances. According to Bloomberg (Clarke 2021), the logjam corresponded to a blockage of goods worth US$ 9.6 billion a day.

This was in addition to inflationary tensions and difficulties faced by shippers and companies, engaged in international trade, because of a significant growth in ocean freight rates on the long routes. This resulted from the resumption of exports and less space in ships’ holds made available by shipowners, from the second half of 2020 till the end of 2021. The Drewry World Container Index (DWCI) shows the container freight rates on the top eight deep-sea routes and illustrates the high prices during the period mentioned above.[g]

The pandemic also led to significant disruptions in the port logistics systems of many countries. Productivity in port terminals declined as staff got infected with COVID-19, causing delays and port congestion with long waiting times at roadsteads. Multiple economic shocks, such as those caused by the war, energy crisis and the pandemic, have shown that the global port logistics system needs to shift to models that can continue to stimulate short- and medium-haul routes, i.e. routes where ships do not have to cover long distances (e.g. from the Far East to North America or to Northern Europe). This will help orient a part of the economy to a model of regionalisation of traffic to bring certain production chains, identified as strategic, closer together.

Reconciling Efficiency and Environmental Sustainability in Maritime Logistics

The economic shocks (such as those triggered by the war or the pandemic) that have occurred in recent years have raised awareness about the need to focus on increasingly sustainable and green port and logistics models. Indeed, green infrastructure is more resilient to energy crises (brought on by war, for example) because it focuses on energy efficiency and renewable energy. Green infrastructure can also reduce pollution, which in turn can have a positive impact on public health, particularly during pandemics.

Until 2019, investments in ports and related logistics, for the most part, have been strategically oriented to consolidating and strengthening existing infrastructure and have, therefore, been directed towards building new docks, purchasing equipment (cranes and lifting and handling equipment) for spaces where goods can be allocated and building warehouses and car parks to store goods or accommodate vehicles. Disruptions in logistics chains have increased the need for more fluid and sustainable port infrastructure that can reconcile port efficiency with reduction in emissions and improvement in relations between ports and urban centres.

In Italy, for example, the National Recovery and Resilience Plan dictated strategies to create ports that were more energy-efficient, more equipped for rail intermodality, more focused on reducing ship emissions through electrification of docks, and more geared to meeting energy needs through renewable energy. These ports will also provide ships with new fuels that are becoming increasingly ubiquitous, such as liquefied natural gas (LNG), hydrogen, ammonia, lithium and methanol.

By providing infrastructure that uses renewable energies, ports will be less dependent on fossil fuels and therefore, more environment-friendly in their operations. Increasing intermodality, i.e. transfer of goods from sea to rail instead of the all-road mode, will also become strategic. Like ships, rail transport is less polluting and travels on tracks with no traffic and fewer accidents. However, this does not mean bypassing roads, which remain essential, especially for the last mile.

These concepts (use of renewables, intermodality, and sustainability) define the Green Ports model that is already being followed, especially at the ports of Northern Europe. This is a port model for which there is no univocal or unambiguous definition. It is essentially based on six development axes that involve:

- using renewable energy;

- stimulating sustainable investments in related logistics sectors (e.g. warehouses, technical-nautical services and maritime stations);

- investing in electrification of quays and making the quays more resilient to climate change;

- equipping themselves with bunkering terminals for alternative fuels for ships (e.g. LNG and methanol);

- equipping itself with policies to encourage docking of more sustainable ships and vehicles on land; and

- being increasingly connected to the railways.

Aiming for this model and instilling incisive and strong discipline in it can provide the entire world with more fluidity of goods and more sustainability for the transport and logistics system. (Which, indeed, is responsible for about a quarter of the world’s CO2 emissions.)

It is worth reiterating that ports are moving towards a new responsibility that will increase their strategic and geopolitical value; they can become true energy hubs, catalysing investments not only in infrastructure, but also in energy, attracting pipelines and storage depots for new ecological fuels and generators of renewable energy for themselves and for ships. In terms of ecological fuels alone, over 46 percent of the ship fleet in yards are powered by alternative fuels (mostly LNG and methanol).[h]

Norway is one country that stands out for adopting green maritime policies, particularly in terms of the technologies and investments made in the passenger shipping sector with the launch of environment-friendly ferries and development of ships that use alternative fuels.

By diversifying energy services, together with transport services, ports will be able to play the role of a facilitator of logistics chains desired by the global economic system and thus contribute to creating the right balance between globalisation and regionalisation of traffic.

2. The G20’s Role

The G20 members represent a predominant share of the global GDP (around 85 percent), international trade (three-fourths) and world population (about two-thirds). Accordingly, the G20 provides an effective, informal platform for dialogue, exchange of views and preliminary agreements to be adopted and implemented at national and multilateral levels. The G20 Infrastructure Working Group is part of the Finance Track of every presidency, involving each member’s finance ministry and central bank.

The G20 should promote the role of international maritime transportation infrastructure in supporting resilience to shocks and ensuring environmental sustainability and efficient interconnection between increasingly regionalised GVCs.

3. Recommendations to the G20

The role of critical infrastructures in supporting international trade is crucial, as demonstrated by recent events that affected maritime transport, such as the 2020 Beirut port explosion, the 2021 obstruction of the Suez Canal, the congestion of some Asian ports due to the zero-Covid policy and, more recently, the Black Sea blockade due to the Russia-Ukraine war. The role of investment in ports and logistics platforms is also central in the process of value chain restructuring as it may support the adjustment of maritime infrastructure to more regionalised trade routes. Indeed, recent crises have shown not only the fact that 90 percent of global traffic involves sea-borne trade, but have also emphasised that adequate maritime infrastructure and functional logistic links are the key to timely and effective supplies.

The authors recommend to the G20 concrete and relevant actions in the following policy areas:

1. Promote resilient and sustainable ships and logistics through the development of green ports.

A Green Ports model can be developed in two ways.

- The first involves the design of financial instruments and incentives and can be implemented by creating:- public financing instruments that influence infrastructure to make it more sustainable by acting on investments in digitalisation and bunkering terminals for alternative fuels; and- forms of incentives and rewards for companies that use trains to move goods once unloaded from ships or rubber-tyred vehicles that comply with ecological parameters.

- The second can be aimed at creating a set of indicators to measure a port’s level of sustainability, such as:- offering bunkering services (for methanol, LNG and other alternative fuels);- investing in renewable energy and energy efficiency in terminal and port areas;

– implementing active policies to reduce CO2 emissions from ships; and

– having vessel traffic monitoring and control systems to speed up ship embarkation and disembarkation procedures.

2. Foster innovation and digitalisation in maritime logistics and port operations to improve their ability to monitor and manage supply chain risks.

To achieve this, three primary initiatives are proposed.

- First, drive innovation and digitalisation in maritime logistics and port operations by:- encouraging adoption of digital solutions, such as blockchain, internet of things (IoT) and artificial intelligence (AI), to improve the ability to monitor and manage supply chain risks, streamline port operations and facilitate trade.

- Second, foster collaboration and harmonisation among regional partners and G20 members by:- calling for cooperation among G20 members to establish common standards and interoperability in digital solutions, ensuring a secure flow of data across borders and regions; and- facilitating data-sharing and regulatory harmonisation among regional partners to streamline customs and port operations, ultimately improving overall efficiency.

- Third, improve workforce development and capacity-building in the maritime sector by:- supporting the creation of training programmes and educational initiatives that equip the maritime workforce with the necessary skills to utilise digital technologies and adapt to the evolving industry landscape.

3. Enhance crisis response and contingency planning in the maritime sector.

To achieve this goal, two primary initiatives are proposed.

- First, foster information-sharing and communication among G20 members by:- promoting effective communication and information-sharing among G20 members to enable rapid response and coordinated actions during a crisis.

- Second, develop coordinated intergovernmental crisis response mechanisms for G20 members by:- establishing a unified and intergovernmental crisis response framework for G20 members to mitigate the impact of potential disruptions in maritime transport and logistics on supply chains; and- ensuring timely information-sharing among members and smooth movement of critical goods, which ultimately strengthens the resilience of the global supply chain.

4. Strengthen international cooperation and coordination in the maritime transport sector.

To achieve this objective, two primary initiatives are proposed.

- First, establish a dedicated G20 Maritime Transport Advisory Group (MATAG) to:- support and provide policy recommendations to the relevant G20 Working Groups (i.e. the Infrastructure Working Group and the Trade and Investment Working Group) on maritime transport and logistics-related issues; MATAG can take the form of an informal body, co-chaired by India and other promoting countries, comprising interested G20 members and other international organisations and stakeholders, to facilitate dialogue and cooperation, enhance global maritime safety and security, and promote environmental sustainability.

- Second, promote sharing of best practices and development of common standards in port infrastructure, operations and environmental performance by:- motivating G20 members and international stakeholders to collaborate, exchange best practices, and embrace standardised criteria for port infrastructure, operations and environmental performance.

Attribution: Fulvio Bersanetti et al., “Resilient GVCs Amidst Geopolitical Fragmentation: The Role of Infrastructure Investments in the Maritime Economy,” T20 Policy Brief, May 2023.

Bibliography

Botti, Fabrizio ed. Euro–Mediterranean Economic Cooperation in the Age of Deglobalisation. Rome: IAI, November 2022.

Botti, Fabrizio, Cristina Castelli, and Giulio Giangaspero. “EU Open Strategic Autonomy in a Post-Covid World: An Italian Perspective on the Sustainability of Global Value Chains.” IAI Papers 21/37 (July 2021).

Clarke, Aaron. “Suez Snarl Seen Halting $9.6 Billion a Day of Ship Traffic.” Bloomberg, March 25, 2021.

Di Stefano, Enrica, Giorgia Giovannetti, Michele Mancini, Enrico Marvasi, and Giulio Vannelli. “Reshoring and Plant Closures in Covid-19 Times: Evidence from Italian MNEs.” International Economics 172 (December 2022): 255-277.

Work Stream on Open Strategic Autonomy. “The EU’s Open Strategic Autonomy from a Central Banking Perspective Challenges to the Monetary Policy Landscape from a Changing Geopolitical Environment.” ECB Occasional Paper, no. 2023/311 (March 2023).

UNCTAD. Review of Maritime Transport 2022. New York: United Nations Publications, November 2022.

UNCTAD. World Investment Report 2022 (Annex Table 14: Value of Announced Greenfield FDI Projects, by Destination, 2003-2021). New York: United Nations Publications, June 2022.

[a] OECD countries’ share of manufacturing with regard to GDP is around 13% (2021), a historically low level.

[b] These are ships carrying rubber-tyred vehicles.

[c] Because containers carry finished products.

[d] Logistics Performance Index (LPI), The World Bank.

[e] SRM elaborations on Clarksons Shipping Intelligence Network (2022).

[f] Eurostat, “Short Sea Shipping – Country Level – Gross Weight of Goods Transported to/from Main Ports, by Sea Region of Partner Ports”.