TF-3: LiFE, Resilience, and Values for Wellbeing

Abstract

The latest Intergovernmental Panel on Climate Change (IPCC) report has warned that climate risks from global warming will overlap with non-climate risks, creating complex, compound, and cascading risks that pose multiple threats to ecosystems and human societies. Investing in climate-resilient infrastructure designed and built to withstand the detrimental impacts of climate change is crucial to better prepare for these risks. Under its G20 presidency, India has established the first working group on Disaster Risk Reduction, which aims to reduce the risks associated with natural disasters and climate change, including the development of climate-resilient infrastructure. Building on existing G20 infrastructure initiatives and collaborative platforms, it opens multiple avenues for G20 countries to marshal global and national consensus to tackle global climate challenges and accelerate climate-resilient infrastructure planning and building at sub-national levels. This Policy Brief proposes solutions for G20 countries and sub-national governments to address the three crucial challenges to scaling up climate-resilient infrastructure: lack of capacity and resources; limited availability of financing; and legal, policy, and regulatory risks.

1. The Challenge

According to the latest IPCC report, climate risks from global warming are changing in their frequency, intensity, extent, and duration.[1] They are also overlapping with non-climate risks, creating complex, compound, and cascading risks that pose multiple threats and unprecedented losses to ecosystems and human societies.[2] There is an urgent need, therefore, to develop climate-resilient infrastructure that can withstand extreme events and adapt to slow-onset climate change impacts.

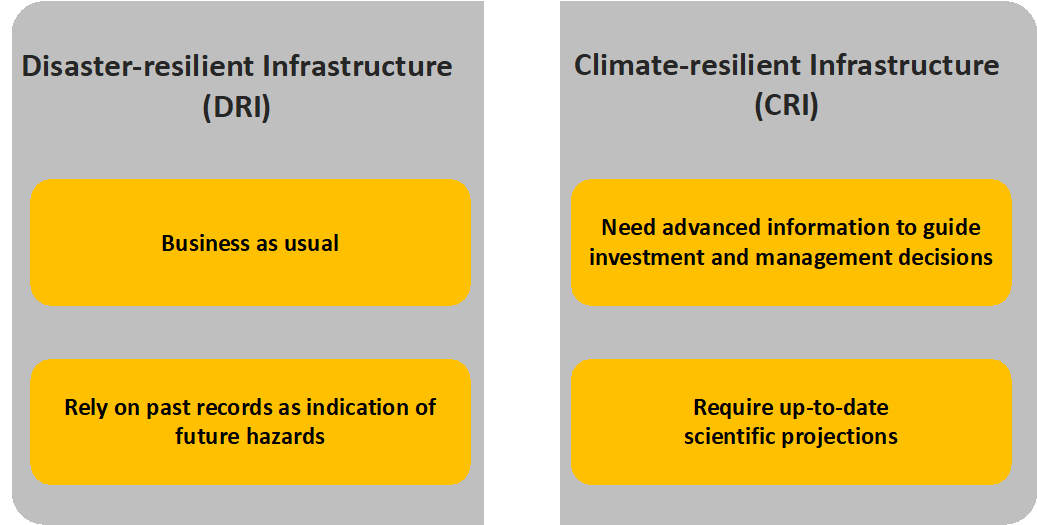

Lifeline infrastructure is the backbone of a country, and climate extremes could jeopardise the sustainable development agenda of a region. The grim climate outlook necessitates infrastructure convergence between the need to support social and economic development and the requirement to safeguard citizens from climatic events. There is international consensus on the need to integrate climate adaptation, i.e., climate change risk management, into national and regional development strategies. Consequently, a series of proposals such as those related to promoting climate-resilient infrastructure (CRI) and disaster-resilient infrastructure (DRI) have been put forth. Both are preventive and deliberative approaches that adhere to Sustainable Development Goal 9 (“build resilient infrastructure, promote sustainable industrialisation, and foster innovation”), the Sendai Framework for Disaster Risk Reduction (“substantially reduce disaster damage to critical infrastructure and disruption of basic services”), and the Principles for Quality Infrastructure Investment of the G20 countries.[3]

The DRI concept, which emphasises systematically reducing risks referenced on historical hazard records, is expanded through CRI. The latter is more proactive in embracing the evolving scientific projections to integrate a wider range of climate change uncertainties and opportunities into the lifecycle of infrastructure.[4]

Figure 1: DRI and CRI: Conceptual Overview

Source: Adapted from UNDP, Paving the Way for Climate-Resilient Infrastructure: Guidance for Practitioners and Planners, 2010[5]

Despite its tremendous benefits, G20 countries are facing massive challenges in implementing CRI, including:

- Challenge 1—Lack of capacity and resources: Integrating future climate risk uncertainty into the design and operation of critical local infrastructure is extremely difficult, even in the most advanced G20 countries. Practical challenges exist in determining where and what types of projects should be climate-resilient as well as how much climate risk should be factored into both new and existing projects. This calls for a reliance on scientific progress, such as localising and downscaling global climate prediction models to fit urban planning. Meanwhile, stakeholders such as local governments, development finance institutions, private sector investors, and financiers require methodologies and tools for development strategy setting and impact assessments in order to effectively incorporate climate risk management upstream into local development strategies and major infrastructure decisions, and make CRI truly mainstream.

- Challenge 2—Limited financing: The estimated cost of CRI projects is often higher than traditional infrastructure projects. The Global Infrastructure Facility estimates that, by 2050, the annual investment shortfall for sustainable infrastructure might reach US$3 trillion.[9] Building CRI often requires significant upfront costs, which proves to be challenging to many G20 countries with limited financing.

- Challenge 3—Legal, policy, and regulatory risks: Investing in CRI can be risky due to legal, regulatory, and policy uncertainties. Without access to planning, prioritisation, monitoring, and evaluation information from the government and/or administrations, investing in CRI that does not necessarily follow general engineering codes and standards can be problematic. This will significantly lessen the willingness of private investors to engage in the project, considering that CRI will require a higher upfront investment. Meanwhile, legal, policy, and regulatory frameworks do not currently allow for the exploration of novel designs for CRI. Local financial institutions are unable to create enabling conditions for de-risking, blended finance instruments, and effective partnership models within the private sector due to a lack of knowledge and capacity. Without flexibility in governance, the rigid legal, policy, and regulatory framework would further stifle efforts to put climate-resilient initiatives into action.

2. G20’s Role

The G20 countries play an important role in financing and promoting CRI to prevent damage from disasters that have a global human and economic toll. The G20 region has the highest cumulative damages, the highest number of casualties, and the most frequent occurrence of natural disasters worldwide. According to the international disaster database EM-DAT, from 2000 to the present day, the G20 countries accounted for 50 percent and 45 percent of the top 10 and top 20 countries with the highest cumulative casualties, respectively; and 80 percent and 65 percent of the top 10 and top 20 countries with the highest cumulative economic losses, respectively.[10] The total deaths and damages account for 43.23 percent and 85.68 percent of the global record, respectively.[11] According to the World Risk Report 2022, the G20 countries account for 40 percent and 30 percent of the top 10 and top 20 countries with the highest disaster scores, respectively. Lifeline infrastructure, such as power, water and sanitation, transportation, and telecommunications, are among the most crucial for climate resilience equipment and providing fundamental services for the health and safety and economic security of households.[12]

Climate-resilient infrastructure can protect the G20 countries from the direct impact of climate risks and also prevent related climate risks from spilling over to other countries through trade. Studies show that a 1-degree Celsius increase in average annual temperature in the United States could cause a 0.12-percent ripple effect on global GDP due to decreases in agricultural, energy, and labour productivity, with Canada and China being the most affected.[13] According to the United Nations Commodity Trade Statistics Database, the G20 countries are the most active in global import and export activities, and the top 10 trading flows in global export values all occur between G20 countries. Therefore, for the sake of sustainable economic development and trade security, the G20 countries should rapidly increase their investment in climate-resilient infrastructure to avoid the knock-on effects of both slow-onset disasters and acute events.

Building CRI is an important tool for the G20 countries to achieve the UN Sustainable Development Goals (SDGs) and their climate commitments under the Paris Agreement. First, providing adaptive and resilient infrastructure more equitably can impact the achievement of all 17 SDGs.[14] In post-COVID recovery, investment in climate-resilient infrastructure can serve as an economic stimulus to bring about long-term resilience, productivity, and improved living standards while also having short-term effects such as job creation and increased economic activity. Second, climate-resilient infrastructure can prevent the G20 countries from falling into a vicious cycle of continuous infrastructure rebuilding after disasters, reducing unnecessary infrastructure construction and operational emissions. Climate-resilient infrastructure is also an important application scenario for low-carbon technologies, such as distributed energy, energy-saving technologies, and nature-based solutions, and is key to facilitating the G20 countries’ achievement of their climate goals.

The G20 has established several global initiatives to facilitate climate-resilient infrastructure financing, including:

- The Global Infrastructure Facility (GIF): Established in 2014, this leverages private investment into quality infrastructure projects through building collaborations among donors, development finance institutions, country governments, private sector investors, and financiers.[15]

- The Global Infrastructure Hub (GI Hub): Created in 2014, this is a knowledge-sharing hub providing a range of resources to support projects, including project preparation tools, data analytics, and market intelligence for investors. It maintains a comprehensive database of infrastructure projects worldwide to fill the data gap and generates guidance and best practices for infrastructure procurement and delivery, including public-private partnerships and project financing.[16]

In 2023, the first G20 working group on Disaster Risk Reduction was established under India’s presidency.[17] This working group was created to facilitate cooperation among G20 countries to reduce the risks associated with natural disasters and climate change, including CRI.

3. Recommendations to the G20

Since the 2019 G20 Japan Summit, the G20 has held in-depth discussions and policy innovation explorations on topics such as the economic effects of infrastructure investment and its financing; infrastructure investment and financing; maintenance and resilient infrastructure; and inclusive, resilient, and greener infrastructure investment and financing. There has long been global consensus on building resilient infrastructure that can withstand climate disasters and long-term climate change impacts.

The extreme climate events that broke historical records in the northern hemisphere in 2022 set a “new normal” for worldwide impacts from climate change and accelerated the construction of infrastructure that can resist both acute and slow-onset climate impacts.

Although the G20 has established international platforms such as the GI Hub and the GIF—which have strengthened policy innovation, method exploration, and pilot practice exchanges among countries in infrastructure construction—CRI construction continues to face many challenges, such as lack of capacity and resourcing; limited financing; and legal, policy, and regulatory risks—as discussed earlier.

This Policy Brief makes the following policy recommendations for the G20 to accelerate sub-national CRI practices.

Policy Options: Challenge 1—Lack of Capacity and Resources

1. Leverage the abilities of G20 and other multilateral development agencies to gear the post-pandemic investment boom and international funds towards climate-resilient infrastructure.

After COVID-19, global foreign direct investment (FDI) flows began to rebound, with significant increases in FDI from and to G20 countries. Infrastructure has become a favoured sector for investors, with the number and value of financing transactions for international projects increasing by 53 percent and 91 percent, respectively, in 2021. To encourage the incorporation of climate resilience concepts in international infrastructure construction projects during this crucial time, the knowledge-sharing and partnership platforms for international infrastructure investment established by the G20 and multilateral development institutions, such as GI Hub and GIF, should be fully utilised. The G20 nations could take the following actions:

- Create an enabling policy environment for CRI investment, such as setting up a national CRI investment fund and fiscal and tax incentive schemes to encourage the flow of international money to CRI projects and pioneering sub-national CRI practices.

- Collaborate with multilateral development agencies to provide tailored technical support for significant infrastructure investment projects, including thorough design, assessment, structuring, and transaction support, to assist in incorporating climate-resilience principles into demonstrative infrastructure.

- The G20 and multilateral development organisations can work with the major infrastructure FDI recipients to direct these inflows towards climate-resilient projects. By jointly investing in CRI construction projects, developing CRI-related technologies, and other means, climate-resilience concepts can be implemented in the new round of infrastructure construction.

2. Encourage sub-national stakeholders to participate in the G20 global infrastructure knowledge and partnership platforms to share data and facilitate local climate-resilient infrastructure practices.

Building on national participation, sub-national stakeholder involvement in the global infrastructure knowledge and partnership platforms will further substantiate data sharing and real-world experience exchange, thus accelerating the mainstream climate-resilience concept for lifeline infrastructures.

- Enlisting more sub-national participants in the existing G20 international knowledge and partnership initiative will boost the involvement of personnel directly in charge of planning, constructing, operating, and maintaining infrastructure. By learning about CRI experience and best practices in other regions, sub-national actors can strengthen and improve local climate-resilient infrastructure planning and strategies.

- Bringing in a larger number and more diverse stakeholders can further enrich the global infrastructure database, especially for lifeline infrastructures, which are of high significance and wide popularity, bringing in faster efficiency and quality improvement in CRI construction and management.

- By taking a proactive role in the international platform through sharing data and demands, sub-national stakeholders will benefit from fostered collaboration and communication between experts, bridging local demands for CRI with global resources.

3. Build capacities for areas with relatively weak climate-resilient infrastructure knowledge and management capacity but high climate risks.

At present, there is a sizable knowledge and skill gap regarding designing climate-resilient infrastructure at various administrative levels and in various regions. Infrastructure has been built quickly in many locations with low climate-risk expertise and management levels, driven by the rapid urbanisation process. Sub-national governments, especially those with high climate vulnerability, active infrastructure construction, and relatively weak infrastructure management, should proactively seek CRI assistance from the national government and international development agencies in the following aspects:

- Technical assistance tailored to local needs, such as climate-risk review and projection, project planning and design schemes, and financial support, to incorporate the climate-resilience concept into infrastructure implementation and management.

- Technical and financial education, training, and exchange activities with the local workforce to ensure effective infrastructure maintenance and further bolster the climate-resilience concept, technological advancement, and the CRI project pipeline in the region and beyond in the long run.

Policy Options: Challenge 2—Limited Financing

Government finance has been the dominant source of funding for climate-resilient infrastructure.[18] However, during COVID-19, high government spending and low tax revenue squeezed the fiscal space of many countries. To address the issue of limited funding, the G20 countries and sub-national governments can design relevant policies from two perspectives—expanding and increasing public finance support for climate-resilient infrastructure, and better mobilising private investment.

1. Scale up public finance and deploy it more effectively through adjusting budget management, policy planning, and special subsidies.

- Develop long-term budget and development plans for five or ten years for climate-resilient infrastructure at the sub-national level to ensure sustainable public finance support and provide continuous and stable fiscal support for CRI construction and management.

- Optimise project management, for example, by providing special accelerated approval processes, project monitoring, and evaluation for CRI projects to improve project execution efficiency and quality and provide more efficient financial support for CRI construction and management.

- Directly subsidise CRI construction, for example, to bridge the investment gap between CRI and traditional infrastructure in the early stages of investment and help projects reduce investment risks and costs and improve feasibility.

- Encourage local governments, private investors, and enterprises to invest in CRI through preferential interest-rate subsidy policies.

- Establish pilot incentive mechanisms, select outstanding CRI construction cases, and provide financial incentives to encourage more local governments, enterprises, and investors to invest in CRI.

2. Better mobilise private investment to support climate-resilient infrastructure.

Comprehensive research has been conducted on how to better leverage private sector investment for climate resilience and sustainable infrastructure at the national level, whether it be the GIF or multilateral development institutions that are heavily involved in building international infrastructure. Compared to national actors, sub-national stakeholders are better prepared to identify and prioritise projects, because they have a deeper understanding of the local context. They also have more flexibility and adaptability to respond to new and innovative agendas, and they are more willing to try out novel strategies. Based on existing literature, several priority action areas have been identified for G20 sub-national governments to mobilise private investment:

- Develop comprehensive plans that combine CRI planning with concurrent long-term regional and economic development strategies, such as regional and energy transitions, to attract a wider range of investors.

- Engage the private sector in the testing and validation of innovative CRI technologies and financing solutions through local pilot programs and regional scaling-up potential.

- Foster collaboration between sub-national governments, public finance institutions, and the private sector to identify effective and efficient blended finance vehicles, such as public-private partnerships, green bonds, and climate investment funds, that can mobilise private investment to close the financing gap and support climate-resilient infrastructure projects.

- Based on the pilot experience, establish a local and regional climate-resilient infrastructure pipeline to scale-up effective technologies and innovative financing methods for more infrastructure projects.

Policy Options: Challenge 3—Legal, Policy, and Regulatory Risks

To advance sustainable infrastructure investment and climate resilience, the G20 established the Infrastructure Working Group (IWG), the Sustainable Finance Working Group (SFWWG), and the Green Finance Study Group (GFSG). These organisations have also created principles and toolkits to increase the transparency, consistency, and comparability of climate-related financial disclosures. The planning, designing, and implementing of CRI still involves major legal, policy, and regulatory risks; therefore, the advancement of sustainable and resilient infrastructure on global and national scales has not yet fully permeated the sub-national level. In order to overcome this problem, it is recommended that the G20 sub-national governments create an enabling environment for climate-resilient infrastructure implementation through the following actions:

- Establish sub-national long-term plans for climate-resilient infrastructure based on existing international best practices and local conditions. These plans should tie infrastructure to national commitments on sustainable development and climate change, fostering an environment that is conducive to the development of climate-resilient infrastructure and encouraging investment from development agencies, financial institutions, and other stakeholders, with local governments taking the lead.

- Provide infrastructure development aids for the region, including climate risk maps and a historical climate disaster damage database, to ensure that infrastructure investment decisions are climate-informed. Climate risks are mainstreamed into infrastructure-planning decisions, beginning with upstream macroeconomic analysis and extending through risk screening, environmental and social impact assessments, budgeting, permitting, and project design. The private sector is provided with tools to quantify the costs and benefits of investing in resilience and track progress.

- Establish cooperative relationships with institutions and groups familiar with the climate-resilient infrastructure development process. Through training, knowledge-sharing, technical assistance, joint development, and other means, jointly promote the CRI concept among local practitioners and build up the local CRI workforce.

Attribution: Li Fang et al., “Capacity, Resources, Regulation: Overcoming the Obstacles to Climate-Resilient Sub-National Infrastructure in G20 Countries,” T20 Policy Brief, May 2023.

[1] IPCC, Climate Change 2022: Impacts, Adaptation and Vulnerability, Summary for Policymakers (Cambridge, UK and New York, USA: Cambridge University Press, 2022).

[2] IPCC, Climate Change 2022: Impacts, Adaptation and Vulnerability, Summary for Policymakers (Cambridge, UK and New York, USA: Cambridge University Press, 2022).

[3] Asian Development Bank, “Disaster-Resilient Infrastructure: Unlocking Opportunities for Asia and the Pacific,” Asian Development Bank, April 2022.

[4] United Nations Development Programme, “Paving the Way for Climate-Resilient Infrastructure: Guidance for Practitioners and Planners,” 2010.

[5] United Nations Development Programme, ‘Paving the Way for Climate-Resilient Infrastructure: Guidance for Practitioners and Planners’ (New York: United Nations Development Programme, 2010).

[6] OECD, ‘Climate-Resilient Infrastructure: Policy Perspective’ (OECD, 2018).

[7] Global Commission on Adaptation, “Adapt Now: A Global Call for Leadership on Climate Resilience,” 2019.

[8] Center for Climate and Energy Solutions, “Investing in Resilience,” 2019.

[9] Global Infrastructure Facility and World Bank, “Stocktake of Approaches That Leverage Private Sector Investment in Sustainable Infrastructure,” 2022.

[10] Data downloaded from EM-DAT, CRED / UCLouvain, Brussels, Belgium – www.emdat.be, and curated by WRI

[11] Data downloaded from EM-DAT, CRED / UCLouvain, Brussels, Belgium – www.emdat.be, and curated by WRI

[12] Stephane Hallegatte, June Rentschler, and Julie Rozenberg, Lifelines: The Resilient Infrastructure Opportunity, Sustainable Infrastructure Series, World Bank Group, 2019.

[13] Zhengtao Zhang et al., “Analysis of the Economic Ripple Effect of the United States on the World Due to Future Climate Change,” Earth’s Future 6, no. 6 (June 2018): 828–40.

[14] Patrick Verkooijen, “Delivering Climate Resilient Infrastructure Through the Private Sector,” World Bank, October 27, 2021.

[15] “About GIF,” Global Infrastructure Facility, accessed April 5, 2023.

[16] “About GI Hub,” Global Infrastructure Hub, accessed April 5, 2023.

[17] “First Disaster Risk Reduction Working Group Meeting in Gandhinagar,” G20, 2023.

[18] Global Commission on Adaptation, “Adapt Now: A Global Call for Leadership on Climate Resilience”.