Task Force 6 – Accelerating SDGs: Exploring New Pathways to the 2030 Agenda

Abstract

This brief discusses one of the most crucial challenges to effective global governance for development: bridging the financing gap for the UN Sustainable Development Goals. It considers the role of the G20 in addressing this gap, and outlines a 10-point action plan for the grouping. The aim is to bolster the financing required to achieve the SDGs in the next six and a half years—serving as an update to the Addis Ababa Action Agenda of 2015 in light of recent global events such as the prolonged COVID-19 pandemic and the Ukraine-Russia conflict.

The Key Challenges

India’s G20 Presidency coincides with the rapidly increasing dangers posed by climate change, rising inequality, and the looming threat of an economic recession. Nonetheless, it offers New Delhi a unique opportunity to shape the post-pandemic development narratives, and to delineate and advance a new global development discourse from the perspective of the Global South.

The Decade of Action is quickly approaching its deadline, as progress towards achieving the Sustainable Development Goals (SDGs) falls perilously behind in many parts of the world. One of the most significant concerns for the countries of the Global South is the massive shortfall in financing required to achieve the goals. It is estimated that developing countries face an annual deficit of US$ 1.7 trillion in SDG financing,[1] while more than US$ 4 trillion accounts for the annual gap in closing the SDGs for the world.[2] It is the least developed countries that face the biggest hurdles. Table 1 illustrates that GDP growth in these countries would need to reach heights—seemingly insurmountable given current trends—to meet the required financial investments for achieving SDG targets 8.1, 1.1, and 9.2 by 2030.

Table 1: Cost and Required Growth for Achieving SDGs in LDCs (2021-2030)

Two major shocks have aggravated the funding gaps and further imperilled the global economy’s ability to achieve the SDGs. The first is the COVID-19 pandemic and its consequent economic fallout. The pandemic caused countries to look inwards and give primacy to domestic issues and outcomes over those of other economies. The second shock is the Russia-Ukraine war, which has disrupted global and regional value chains, created inflationary pressures, drained forex reserves of some smaller economies, and caused macroeconomic insecurity.Furthermore, climate change is increasing the financial demands of countries that are both having to adapt to impacts already being felt, and rapidly transition towards cleaner sources of energy to mitigate further warming. Achieving the SDGs is becoming costlier and more complex, especially for the countries of the Global South which are disproportionately facing the consequences of climate change. New modes of thinking, institutional mechanisms, innovative financing instruments, and mobilisation processes that allow the flow of funds from the Global North to the Global South are urgently needed. The question is, what role can the G20 play in facilitating these changes?

Relevance to the G20

The G20 is a group of the world’s 20 largest economies, which together account for 85 percent of global GDP and 75 percent of world trade.[5] Since its inception, the grouping has acknowledged the importance of the countries of the Global South in creating a sound and stable system of global economic governance. The grouping’s role in sustainable development has changed shape and expanded over time, from the Seoul Development Consensus in 2010 to its current significance in the SDGs.

More specifically, the G20 has contributed to the SDGs by setting concrete targets to enhance global macroeconomic stability, demanding tax transparency, lowering the cost of remittances, and promoting policies to increase female labour force participation.[6] However, meeting the SDGs will require renewed focus and ample financing, and a rigorous upgrade of the Addis Ababa Action Agenda (AAAA)[a] of 2015, which outlined a set of commitments that countries can undertake to finance sustainable development. It is therefore extremely urgent to define specific recommendations to finance the SDGs—one of the most critical challenges of global development governance at this juncture.

In this fast changing world, the SDGs are pivotal in creating resilient economies owing to their linkages with various forms of capital: human capital to improve the conditions of the labour market through the promotion of human well-being; social capital, for equitable and strong societies; natural capital, through goals enabling LiFE and the conservation and optimal use of natural resources; and physical capital focusing on markets, innovation, and economic growth. In turn, the effective formation of these capitals will be crucial in enhancing the business climate of the G20 economies.[7]

A 10-Point Agenda for the G20

1. Support South-South cooperation.

South-South cooperation is premised on shared experience, capacity and resource constraints, and mutual respect. The challenges that lower-income economies face are multifaceted and interconnected—from food insecurity to poverty, rising inequality, and corruption. These challenges are often different from those faced by economies of the Global North, and indeed are at times caused by the actions of those countries. For example, the current global economic system is characterised by many multinational corporations headquartered in the Global North that have continued to exploit resources and labour from countries in the South, often with little regard for local environmental and social impacts. This has further perpetuated the economic and social inequalities between these two groups of economies. South-South cooperation can help countries foster alliances with countries in a way that is mutually beneficial rather than exploitative.

The United Nations Office for South-South Cooperation (UNOSSC) envisions that such partnerships can allow greater participation from the Least Developed Countries (LDCs) and the Small Island Developing States (SIDs) in global governance and decision-making. Despite the geopolitical undercurrents between nations, South-South cooperation can enable new sources of development finance, in the form of concessional loans and untied grants, to flow between countries. The aim of the UN-sponsored SDG Fund is for South-South cooperation to transform how knowledge is produced, policy is designed, and funding is secured.[8]

2. Support equitable and just South-North partnerships

To attain the SDGs, the global South and North will need to work as partners. It is crucial, however, that these partnerships are forged on mutual terms and on an equal footing through various cooperation models hinged on a fair division of responsibilities.[9] However, the unjust and exploitative nature of development relationships today must be rectified, and the objectives of development efforts realigned to meet the preferences and needs of lower-income countries.

Moreover, the priorities of multilateral development banks including the International Monetary Fund (IMF) and the World Bank are shaped by majority shareholders of the Global North.[10] These priorities often do not align with the needs or preferences of countries receiving the financing. The African Development Bank has committed to phasing out projects that depend on the use of coal; the European Investment Bank has declared the same about fossil fuel use.[11] The Asian Development Bank, for its part, supports knowledge, capacity-building and SDGs-related dialogues, though these commitments are yet to translate to better living conditions for the 1.2 billion who were living in acute multidimensional poverty in 2022.[12]

3. Facilitate domestic fiscal measures for SDG Budgeting

Domestic fiscal measures to attain SDGs can have two approaches: they might be dedicated to mobilising domestic resources for SDGs or developing fiscal policies that discourage/encourage industries that have a negative/positive impact on achieving the SDGs. The former would concentrate on fiscal reforms—i.e., to strengthen tax administration and reduce tax evasion alongside expenditure rationalisation. The latter, for example, could be concerned with subsidising energy reforms and taxing the use of fossil fuels.[13] Fiscal policy can help nurture a circular economy through upstream resource pricing at the production level (higher prices for harmful resources and lower prices for eco-friendly resources) and downstream taxes on polluting products.[14]

Official Development Assistance (ODA) should ideally go to the most vulnerable communities; this leaves out middle-income countries. High-performing (but developing) economies like India need to plan to secure funds for SDGs from the domestic economy.[15] One way to do so would be to integrate the SDGs with the annual budgets. Each department will have to deliver on certain SDG targets, paving the way for monitoring and evaluating SDG implementation in the G20 countries.[16]

Figure 1: Three Pillars of SDG-Integrated Budgeting

Source: United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP) [17]

4. Incentivise private sector engagement through Creating Shared Value (CSV)

G20 needs to create processes and institutions for incentivising firms towards Creation of Shared Values (CSV). ‘Shared values’ refers to strategies that improve the competitiveness of firms while promoting the social well-being of the communities where it conducts business.[18] The CSV model rests on the belief that ‘doing well’ and ‘doing good’ are not mutually exclusive,[19] and can make achieving SDGs financially sustainable, self-reliant, and scalable. The much-pursued alternative to CSV is Corporate Social Responsibility (CSR) which has a much narrow scope of philanthropy and can therefore gather lower amounts of financing.

Firms can support the CSV model through the following actions:[20] First, redesigning products and markets (creating new products that serve societal needs). Second, rebranding value chain productivity (transform resource use, energy source and employer-employee relations). Third, allowing local cluster development (move away from the practice of gatekeeping technology, support skill-based development and capacity building). In the process, firms create value for themselves and the broader society. The G20 governments would need to provide both financial and non-financial incentives for businesses to move from profit maximisation to value maximisation.

Figure 2: Creation of Shared Value

Source: Harvard Business School[21]

5. Enable Social Entrepreneurship through instruments like tradeable SDG credits.

‘Social entrepreneurship’ broadly refers to a business that aims to create social value. Social entrepreneurs often follow a two-sided value model where social value is created with the beneficiaries.[22] Globally, SDG-aligned businesses offer market opportunities worth at least US$ 12 trillion.[23] G20 governments can provide incentives for social entrepreneurship and consider creating an SDG Credits framework that allows investment managers to create a well-balanced credit portfolio across various social entrepreneurship industries.

These SDG credits should be tradeable instruments that can be traded in a market framework. While this could divert investor funding to companies with a positive impact on SDGs from those with negative externalities,[24] it may also allow firms with substantial developmental footprint on society to sell credits to those that have low or negative developmental impacts and earn revenues, again parts of which can be reinvested in developmental projects. This will also allow firms that have not been in the developmental space to get involved in social development. To be sure, this market will be operational only if such credit mechanism is mandated by the G20 economies within their national boundaries, and then also extend them across the G20 nations with the necessary regulatory mechanism in place in all cases.

6. Develop innovative financial instruments

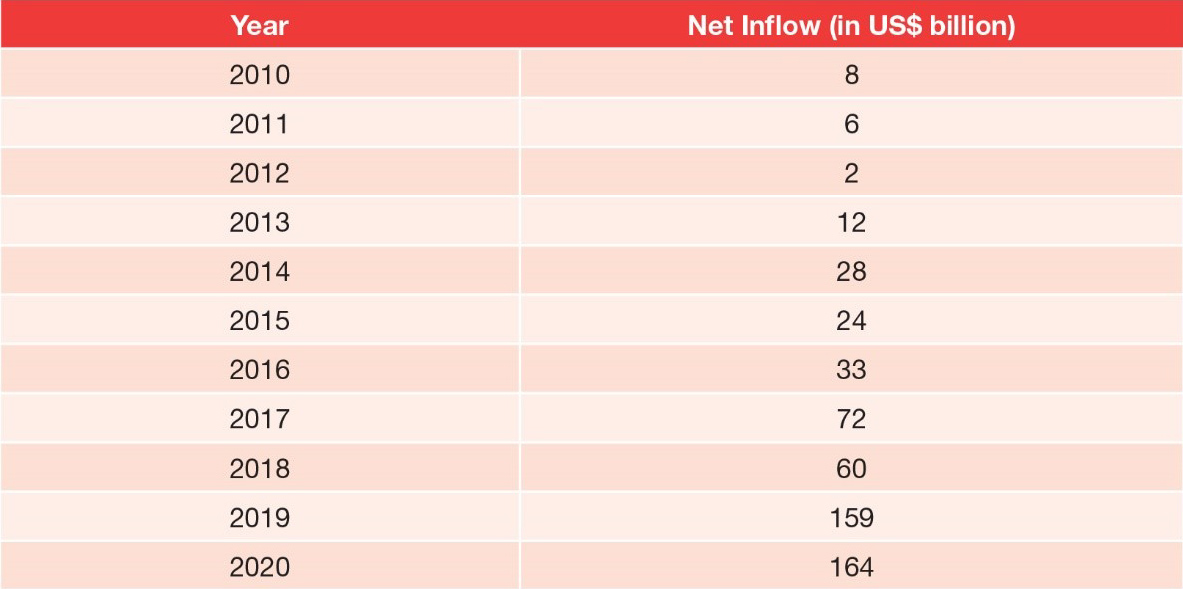

The United Nations Conference on Trade and Development (UNCTAD) asserts that sustainability-related investments have drastically shot up in the last decade and SDG-targeted investing stood at US$ 3.2 trillion in 2020.[25] These investments consist of sustainable funds (US$ 1.7 trillion), green bonds (over US$ 1 trillion), social bonds (US$ 212 billion), and mixed-sustainability bonds (US$ 218 billion).

Table 2: Net Inflow to SDG-Themed Funds (2010-2020)

Source: UNCTAD[26]

Moreover, Sustainability Bonds should be encouraged by global and domestic economies. These should be in the form of fixed-income financial instruments whose proceeds can be exclusively used to finance the SDGs. The problem, however, is that in most cases, households and the private sector are more interested in transacting in financial products that have greater returns, whereas SDG projects have lower economic returns. Fiscal incentives like tax holidays should then be used to motivate the private sector to move to these domains. Furthermore, it is important to look at other innovative derivative instruments like weather derivatives or water index futures or green infrastructure or green freight index to gauge the impacts of specific SDGs.

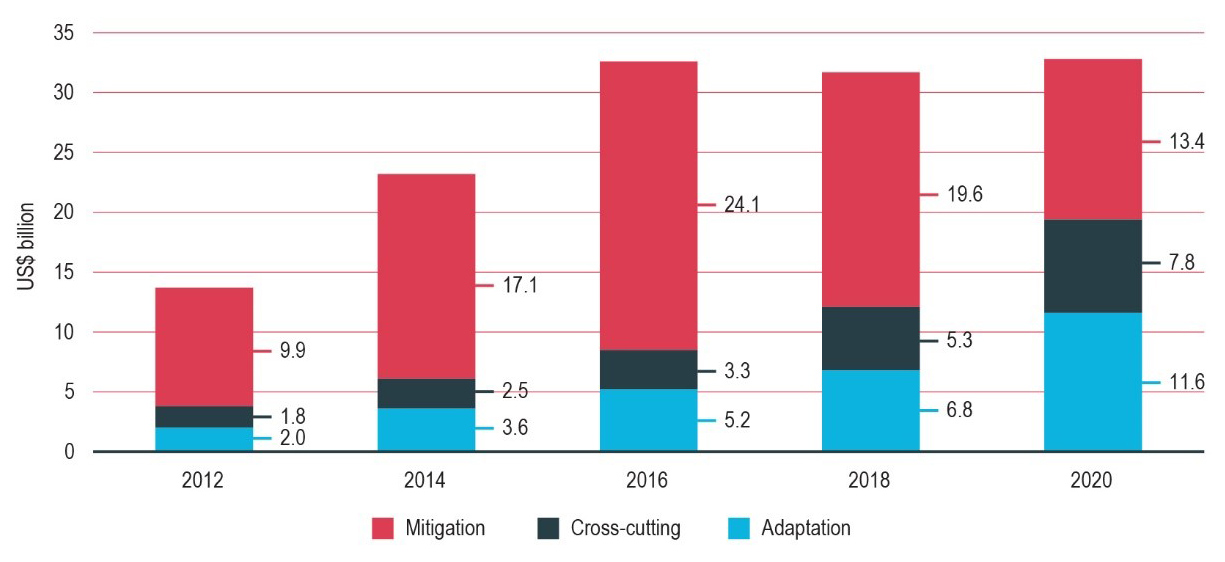

7. Finance climate adaptation measures

Current levels of climate adaptation financing fall drastically short of what is required for countries to adapt to the impacts of climate change.[28] Estimated annual adaptation needs for the decade range from US$ 160 billion to US$ 340 billion; by 2050, the amount could reach US$ 565 billion.[29] In terms of adaptation finance, the primary objective is to hold high-income countries accountable for fulfilling their commitments, with emphasis on directing a greater proportion of mobilised capital towards adaptation rather than mitigation efforts.

Figure 3: Financial Assistance to Developing States from the Developed States[30]

Source: United Nations Environment Programme[31]

8. Promote capacity-building for the SDGs

‘Capacity-building’ refers to the practice of equipping nations and communities with resources and knowledge required to manage transitions and vulnerabilities. It is an opportunity to integrate Agenda 2030 with the national sustainable development frameworks.[33] It can be enhanced through North-South collaboration and knowledge-sharing. In many cases, it is found that many nations in the Global South do not have the wherewithal to understand the needs of the funding agencies for project applications. This is especially true for projects related to climate action. One of the reasons why mitigation projects find funders while adaptation projects often do not qualify—leading to a clear bias towards funding of energy transition projects—is that the applicants are unable to create bankable adaptation projects. This necessitates capacity-building for applicant nations so that the submitted funding proposals align with the expectations and requirements of the funders as well as the applicants. The G20 needs to work towards promoting capacity-building to align needs.

9. Leverage data

Data has correctly been hailed as ‘the new oil’; it is instrumental to identifying needs and challenges, monitoring progress, informing resource allocation and for evidence-based policymaking. Delivering progress in critical areas such as education and health is impeded by the absence of data. Many countries are still struggling with data collection.

Data availability for the Global South is crucial for securing international donor-led investments and for accurately targeting SDGs in the domestic economy. The World Bank provides three pillars for developing states to improve data availability.[34] First, to integrate traditional sources of data collection (civil registration, administrative data, and household surveys) with modern technologies (satellite imagery, geospatial data, data from social media and mobile device data). Second, new innovative practices of data collection would require strengthening data protection norms to prevent political abuse and leakages. Third, working with data along all aspects of the data value chain—from collection to management to curation and analysis.

10. Support a new global SDG financing framework: Developing a G20 DFI

In the past few decades, developing economies and LDCs have borne the brunt of global economic shocks.[35] Enhanced connectivity and communication in the 21st century have led economies to be more connected with and dependent on one another than ever before. Consequently, the outcomes of an economic shock are felt the world over. Smaller economies with lower economic resilience and constrained resources are unable to bounce back following a global shock, dealing with poverty and unemployment for years after. This was the case during the Asian currency crisis in 1997, the 2007-2008 subprime mortgage crisis, the European debt crisis (2009-10), the COVID-19 pandemic beginning in early 2020, and even during the ongoing Ukraine-Russia conflict.

To facilitate collaboration and help economies develop financing frameworks, there is a need to develop a Development Financial Institution (DFI) under the G20. The experiences of the last two decades reveal the need to safeguard SDGs in the face of a global shock. The DFI will be instrumental in reinforcing South-North partnerships; Global North expertise is instrumental in helping design Global South financing mechanisms. A single organising body will also ensure that geopolitical conditions do not blind the process of forwarding aid to less developed countries.

The objective of the DFI will be two-fold: first, it will help bridge the SDG financing gap by mobilising funds from various sources through use of innovative instruments and ensure that funds are channelled to the Global South and the most vulnerable regions of the world; second, it will also help in refuelling the growth forces of the global economy whenever there is a crisis situation, as has been seen multiple times over the last 25 years since the Southeast Asian Crisis.

Conclusion

This brief outlined actionable ideas for the G20 for bridging the critical financing gap for the SDGs. The objective of the G20 is addressing issues of the global economy and ensuring sound governance. This is reflected in its goals with policy interventions in international financial stability, climate change mitigation, and sustainable development. By addressing the SDGs through better financing mechanisms, the G20 will also help in establishing a more equitable and just global economic governance framework that reflects and responds to the urgent challenges of our time, and the needs and preferences of countries of the Global South.

The authors thank Terri B. Chapman, Fellow, The George Washington Institute of Public Policy, for her comments on an early draft of this Policy Brief.

Endnotes

[a] A global framework adopted at the United Nations’ Third International Conference on Financing for Development, held in Addis Ababa, Ethiopia in July 2015 to achieve the SDGs.

[1] OECD, “COVID-19 Crisis Threatens Sustainable Development Goals Financing,” Newsroom, The Organization for Economic Cooperation and Development.

[3] UNCTAD, “Reversing the trends that leave LDCs behind,” News, UNCTAD, September 23, 2022.

[4] D’Souza and Jain, “Bridging the SDGs Financing Gap in Least Developed Countries: A Roadmap for the G20”.

[5] “G20 countries account for 85% of global GDP, 75% of world trade,” The Times of India, June 12, 2015.

[6] OECD/UNDP, “G20 Contribution to the 2030 Agenda: Progress and Way Forward,” OECD Publishing, Paris (2020).

[7] Nilanjan Ghosh et al., “SDG Index and Ease of Doing Business in India: A Sub-National Study,” ORF Occasional Paper No. 199, June 2019.

[8] Sustainable Development Goals Fund, “South South Cooperation,” Sustainable Development Goals Fund, July 5, 2017.

[9] OECD, “The SDGs Call for a Revitalised Global Partnership: What Should We Do Differently This Time?,” The Organization for Economic Cooperation and Development.

[10] Bjarne Steffen et al., “A quantitative analysis of 10 multilateral development banks’ investment in conventional and renewable power-generation technologies from 2006 to 2015,” Nature Energy 4, no. 1 (2019): 75-82.

[11] Asian Development Bank, “Financing the Sustainable Development Goals: The Contributions of the Multilateral Development Banks,” Documents, Asian Development Bank.

[12] UN, “2022 Global Multidimensional Poverty Index (MPI) | Human Development Reports,” United Nations, October 17, 2022.

[13] Green Fiscal Policy Network, “UNEP Policy Brief on Fiscal Policies and the SDGs,” Policy brief, Green Fiscal Policy Network, May 27, 2016.

[14] Green Fiscal Policy Network, “UNEP Policy Brief on Fiscal Policies and the SDGs”.

[15] UNDP Bangkok Regional Hub, “Mainstreaming the SDGs into National Budgets,” UNDP Bangkok Regional Hub.

[16] Mahesti Okitasari and Richa Kandpal, “Budgeting for the SDGs: Lessons from the 2021 Voluntary National Reviews,” Policy Brief, United Nations University Institute for the Advanced Study of Sustainability, 2022.

[17] UNDP Bangkok Regional Hub, “Mainstreaming the SDGs into National Budgets”.

[18] Joan Magretta, “Understanding Michael Porter: The essential guide to competition and strategy,” Harvard Business Press (2011).

[19] Marga Hoek, “CSR v CSV: The Difference and Why It Matters,” Sustainable Brands, July 14, 2020.

[20] Shared Value Project, “What Is Shared Value?,” Shared Value Project.

[21] Harvard Business School, “CSV Explained,” Institute For Strategy And Competitiveness, HBS.

[22] Rob Lubberink, “Social entrepreneurship and sustainable development,” Encyclopedia of the UN sustainable development goals. Springer, Cham (2019).

[23] UNDP, “Business and the SDGs | United Nations Development Programme,” United Nations Development Programme.

[24] David Burrows, “What Have We Learned about SDG Credit Investing?,” Expert Investor, August 4, 2021.

[25] UNCTAD, “Chapter 5 – Capital Markets and Sustainable Finance,” World Investment Report, United Nations Conference on Trade and Development.

[26] UNCTAD, “Chapter 5 – Capital Markets and Sustainable Finance”.

[27] Department of Economic and Social Affairs, United Nations, “The Sustainable Development Goals Report 2021 | United Nations iLibrary,” The Sustainable Development Goals Report 2021, United Nations iLibrary, August 3, 2021.

[28] OP Manuamorn et al., “What makes internationally-financed climate change adaptation projects focus on local communities? A configurational analysis of 30 Adaptation Fund projects,” Global Environmental Change 61 (2020): 102035.

[29] UN, “Adaptation Gap Report 2022,” UNEP – UN Environment Programme, November 1, 2022.

[30] Samina Sabir et al., “Institutions and FDI: Evidence from developed and developing countries,” Financial Innovation 5, no. 1 (2019): 1-20.

[31] UN, “Adaptation Gap Report 2022”.

[32] Nilanjan Ghosh, “Between Growth-fetishism and Green Recovery,” Ecology, Economy and Society–the INSEE Journal 5 (2): 5-13(2022).

[33] UN, “Capacity-Building,” Academic Impact, United Nations.

[34] World Bank, “Data for Development Impact: Why We Need to Invest in Data, People and Ideas,” World Bank Blogs, February 13, 2019.

[35] OECD, “Developing Countries and Development Co-Operation: What Is at Stake?,” The Organization for Economic Cooperation and Development, April 28, 2020.